Original | Odaily Planet Daily (@OdailyChina_)

_

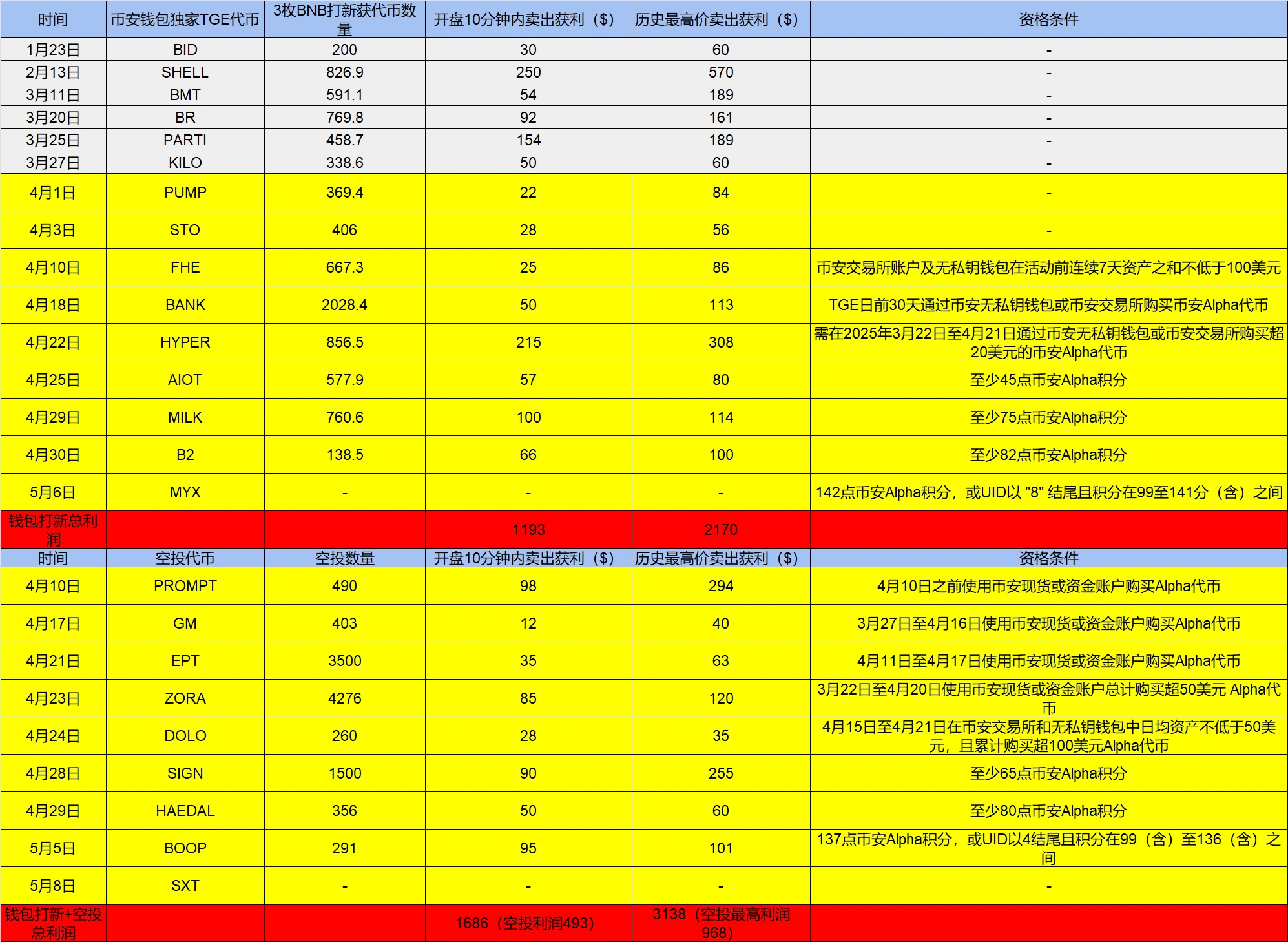

April was the month of Binance airdrops, with frequent wallet launches and direct airdrop activities becoming hot topics of community discussion. Binance Wallet has launched a total of 15 exclusive TGE (Token Generation Event) activities, with 8 of them being launched intensively in April. Additionally, there were 7 direct airdrop activities in April. To make the qualification criteria for participating in TGE or obtaining airdrops more quantifiable, Binance introduced the Alpha Points system on April 25.

Why did Binance's airdrops become so frequent starting in April? In fact, on April 14, He Yi clearly stated in a post that "Binance does not charge listing fees, but there are different types of listing airdrops." Project teams wishing to list on Binance can apply for wallet IDOs, Launchpool, and Mega Airdrops for user airdrops. As a liquidity hub in the crypto market, Binance has a huge attraction for project teams, and it is precisely this advantage that incentivized project teams, leading to the airdrop frenzy in April.

Who benefits from Binance's airdrops?

Binance's airdrops are almost risk-free stable returns. Although each instance may seem like "pork rice," the frequent airdrops have become "large enough to fill the stomach." Even an ordinary Binance user, without having multiple accounts to farm rewards, can achieve total earnings of at least $1,686 from participating in Binance Wallet's new launches and airdrops, with a minimum of $961 earned just in April.

As seen in the image above, the conditions for receiving Binance airdrops are not harsh. The first eight rounds of Binance Wallet's TGE new launch activities had zero entry barriers. Even though subsequent measures were taken to prevent studio flooding by setting certain trading thresholds and Alpha Points requirements, these remain within a reasonable range, allowing a normal user of Binance Alpha trading to enjoy the benefits.

Compared to traditional farming methods where users interact with project teams to obtain airdrops, the cost-effectiveness of receiving project airdrops as a Binance user is much higher.

From the perspective of barriers and costs, users participating in project farming not only face high entry barriers and the need to learn various on-chain operations, but also incur significant time and financial costs. It is common for a project to spend thousands on transaction fees over one to two years without issuing tokens; in contrast, the barriers to qualify for Binance airdrops are much lower, requiring only trading on Binance Alpha, with no additional learning costs and very low transaction fees. With the "integration" of Binance Exchange and Wallet, users can directly buy and sell Binance Alpha's on-chain tokens through their Binance Exchange accounts, further reducing operational difficulty.

However, after the introduction of the points mechanism in Binance Alpha, the transparency of rules and quantification of qualifications have increased enthusiasm among high-usage users. Unfortunately, this has also provided opportunities for unscrupulous farming studios that specialize in Binance airdrops, with optimal point-farming strategies and tutorials proliferating, forcing the threshold for participating in wallet new launches and obtaining airdrops to be raised. But as the saying goes, "You can't have your cake and eat it too." To maintain balance, Binance has also added downward-compatible point rules in later activities, allowing even users with lower usage frequency to have expectations of receiving airdrops.

From a profit perspective, the airdrops obtained by users through farming may, after deducting costs, yield less than the airdrops received from Binance. As shown in the profit comparison below, the returns from the first few project direct airdrops received by Binance users have already exceeded those of the community by 5-7 times, and even in cases where project farming users incur losses, Binance users still enjoy considerable airdrop returns.

Source: Ice Frog (@Ice_Frog666666)

Binance airdrops reward real users while also warning unscrupulous project teams.

Some believe that Binance Wallet's TGE and airdrop activities have directly killed off behaviors like Galxe/project testnet/mainnet interaction farming. The combination of "high frequency + low barriers + no PUA + short cycles + considerable returns" has made traditional farming activities less attractive.

In reality, Binance's actions are causing headaches not for users, but for unscrupulous project teams. Airdrops were originally a way for project teams to give back to the community after achieving results, but in recent years, airdrop chaos has emerged, with project teams using airdrops as bait to attract users and fulfill growth tasks, while the interaction barriers and costs for users have increased. However, when the final airdrop arrives, they often betray the community.

By starting low-barrier airdrops in April, Binance is undoubtedly pulling the veil off some unscrupulous project teams, making users realize that they can receive airdrops simply by engaging in normal trading without experiencing PUA or being "sycophants." If Binance's airdrop activities become normalized, it may also create a "good money drives out bad money" effect in the market, forcing project teams to rethink lowering interaction costs and point thresholds, and further expanding airdrop proportions to regain user recognition.

Binance Alpha: A New Path Combining CEX and On-Chain Business

How CeFi and DeFi can integrate and develop is a theme that leading exchanges are exploring this year. The market is gradually forming two paths: one separates exchanges from on-chain businesses, independently exploring compliance for on-chain operations; the other blurs the boundaries between centralized and decentralized platforms, allowing exchanges and on-chain businesses to develop together. Binance clearly leans towards the latter.

On April 7, Binance co-founder He Yi stated at the 2025 Hong Kong Web3 Carnival that "the exchange and wallet businesses are not completely independent; ordinary users actually use the exchange as a wallet, so for them, the exchange is the wallet." This also means that Binance chooses to prioritize user experience while handling security compliance and on-chain aggregation internally.

Binance Alpha is the culmination of Binance's path of combining CEX and on-chain business, allowing users to directly purchase on-chain assets from the exchange, providing a good experience without additional learning costs. The frequent wallet new launch activities and airdrops that began in April also reflect the advantages of combining CEX and on-chain business. On one hand, airdrops incentivize more users to trade on Binance Alpha, achieving market share and user growth; on the other hand, Binance makes user interactions on CEX "effective," transforming the exchange from a "casino" that people criticize for being unaffordable into a platform that practices Web3 principles, respecting and giving back to the community.

Binance Alpha has become the link between Binance Spot and the Community

There is no doubt that Binance's development of its Alpha segment is not a hasty decision; it will not only continue beyond April but also provide more benefits to Alpha users in May and beyond. At the same time, Binance Alpha has become the link between Binance Spot and the community, with a simple indicator being that on-chain tokens with consistently high trading volumes on Binance Alpha have a solid community foundation.

On April 11, Binance announced the results of the second round of voting for new listings, giving higher weight to projects with large trading volumes on Binance Alpha. The projects launched in the second round, ONDO, BIGTIME, and VIRTUAL, ranked first, fourth, and second respectively in trading volume on Binance Alpha.

According to statistics from AB Kuai.Dong data, the frequency of Binance listing Binance Alpha projects is accelerating, with 16 projects being listed on Binance Alpha first, then moving to Binance Futures, and subsequently to Binance Spot.

Therefore, Binance Alpha has become an important observation area for new listings on Binance Spot. Both spot and futures tokens will prioritize observing projects launched on Binance Alpha. The trading volume of projects on Binance Alpha also represents a certain degree of community recognition. On April 25, Binance officially announced the standards for new listings on Spot, focusing on the secondary market performance, price stability, compliance, and unlocking plans of projects already listed on the Futures/Alpha platform.

Therefore, Binance Alpha has become an important observation area for new listings on Binance Spot. Both spot and futures tokens will prioritize observing projects launched on Binance Alpha. The trading volume of projects on Binance Alpha also represents a certain degree of community recognition. On April 25, Binance officially announced the standards for new listings on Spot, focusing on the secondary market performance, price stability, compliance, and unlocking plans of projects already listed on the Futures/Alpha platform.

Promoting Collaborative Development of BNB Chain Ecosystem Projects

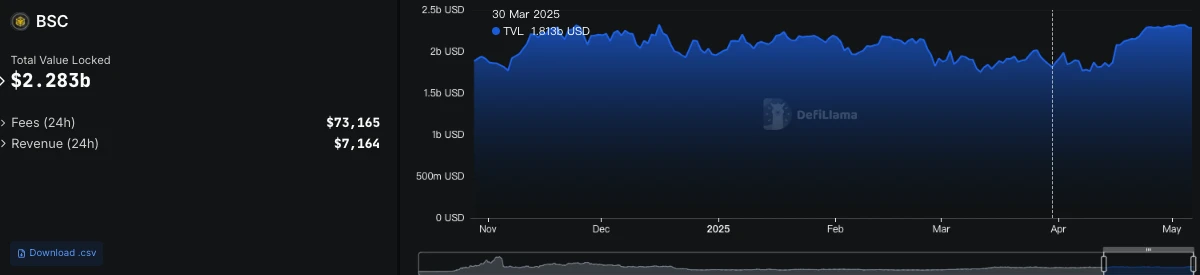

Binance's airdrop frenzy is also creating a ripple effect, promoting the prosperity of BNB Chain ecosystem projects. For example, the lending ecosystem of BNB Chain has seen a surge in short-term lending demand due to the hot new launch activities of Binance Wallet, which not only promotes the growth of existing lending platforms within the ecosystem but also fosters healthy competition, leading to the emergence of new generation lending protocols like Lista Lending.

According to DeFiLlama data, the total TVL of BNB Chain's lending has increased by over $300 million from $1.923 billion at the beginning of April, reaching $2.283 billion.

At the same time, Binance's airdrop activities are also bringing natural traffic to BNB Chain ecosystem projects. According to Binance's official announcement, starting from May 1, Binance launched a limited-time Binance Alpha Points promotional event, where purchasing BSC Alpha tokens will be counted as double trading volume, with the formula being Alpha Volume = 2 * (BSC Alpha token purchases + limit buy orders) + other purchases.

Conclusion

Looking at 2025, the traditional "farming" ecosystem is facing unprecedented challenges. Project teams are attempting to use complex task chains, community "PUA" techniques, and large-scale account farming by studios to turn airdrops into a "sharp weapon" for growth and marketing. In this environment, Binance's continuous airdrops are, in fact, negotiating with project teams using its "liquidity pricing" to retain some benefits for real users on the platform.

Looking ahead, the deep integration of Binance centralized exchange and Binance Alpha may bring more surprises to users. Through the Alpha Points system and the integrated interaction experience of spot and futures, users may easily participate in various on-chain projects on a single platform while enjoying the security and convenience of CEX.

Binance's airdrops will not stop in April, but the influx of point farming and the entry of account farming studios raising point thresholds is an inevitable result of the transparency of Binance Alpha's point rules. The contradiction between defining loyal users and "bot" studios still exists, but Binance has not given up on exploration, continuously striving to push the entire crypto ecosystem towards a more fair, efficient, and user-centric direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。