Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Lazy Financial Strategy | Focus on Berachain, Raising Reslov Airdrop Expectations (March 31)

New Opportunities

Falcon Public Release, Points Program Details Confirmed

On April 30, the stablecoin protocol Falcon Finance, incubated by DWF Labs (Portal: https://app.falcon.finance), officially announced its public release. From now on, users no longer need to apply for a whitelist and can directly mint or exchange USDf on the platform.

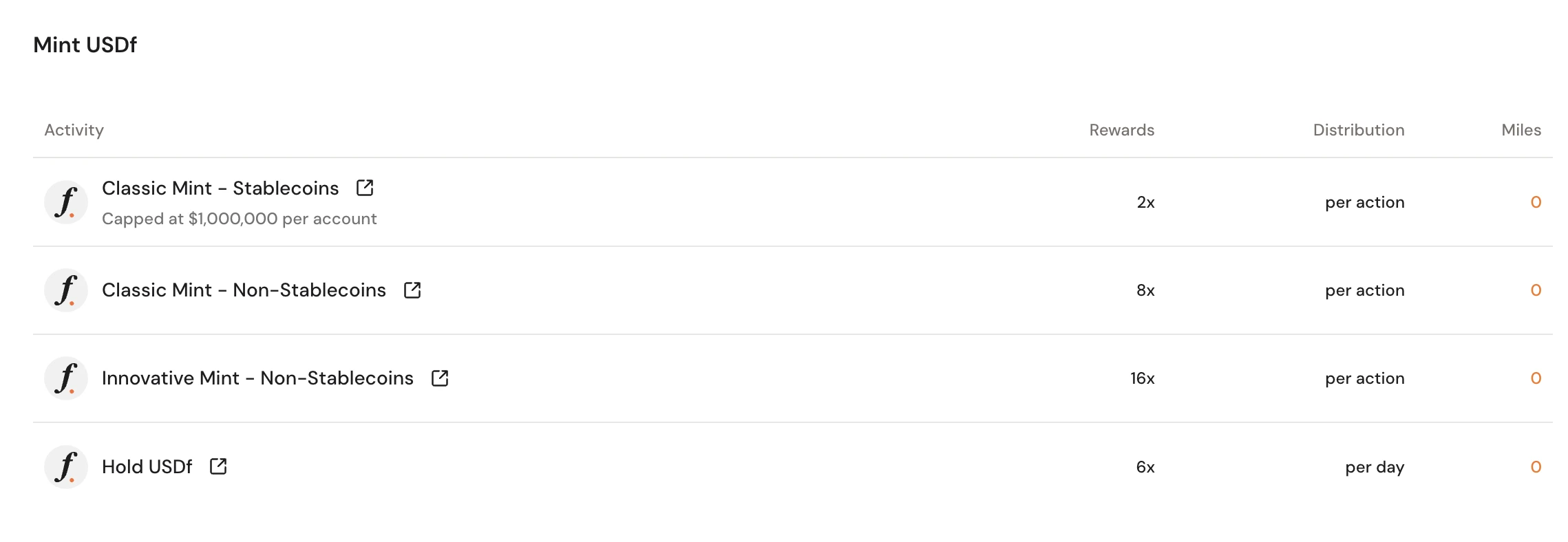

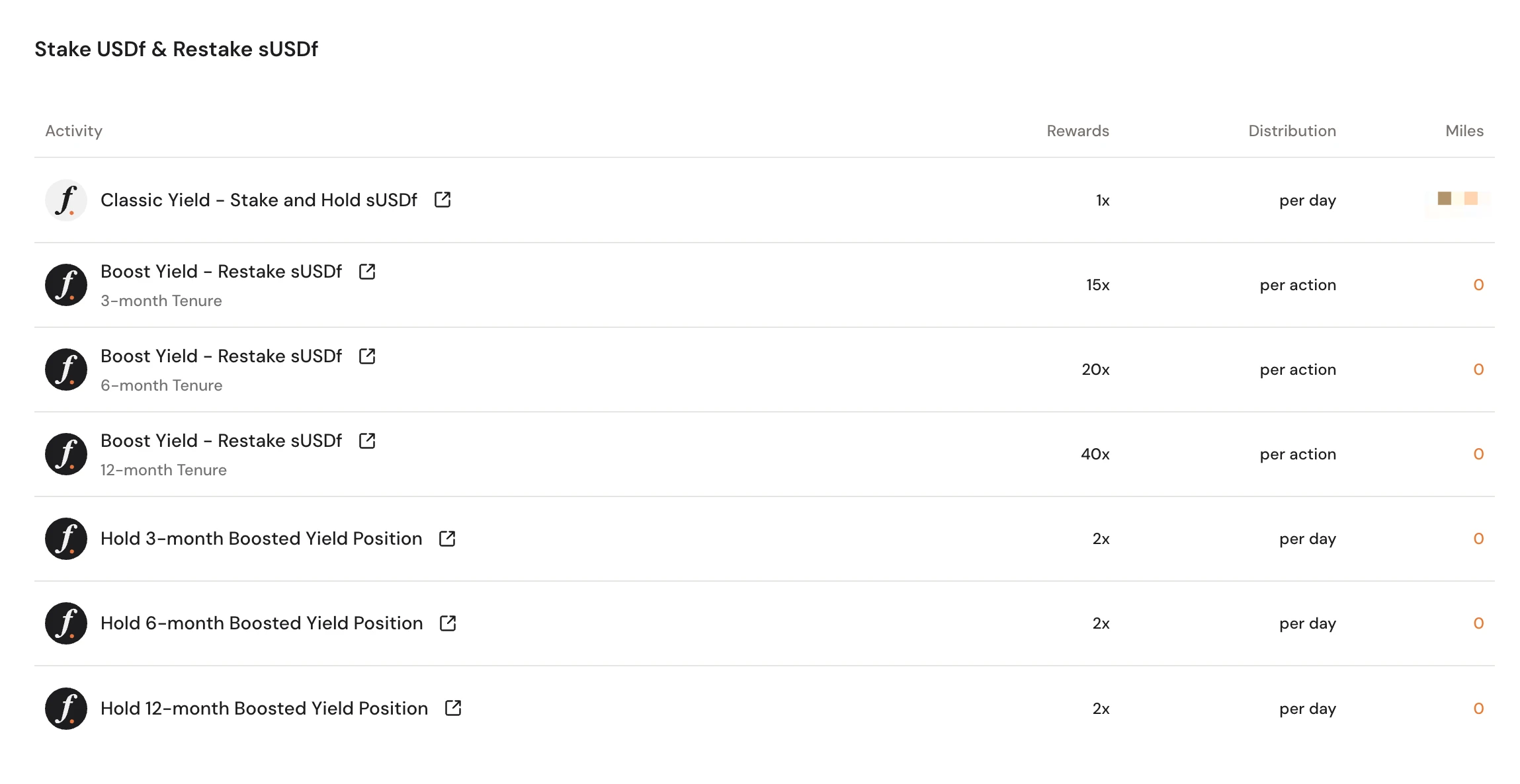

At the same time, Falcon Finance has also officially confirmed the details of its points program (Falcon Miles). Minting, holding, and staking USDf can all accumulate points, with the corresponding points multiplier for each operation as follows — choosing to lock up for 3, 6, or 12 months will yield corresponding APY increases (up to 19.83%) and accelerated points accumulation, allowing users to choose whether to lock up based on their risk preferences.

Coinshift Points Program

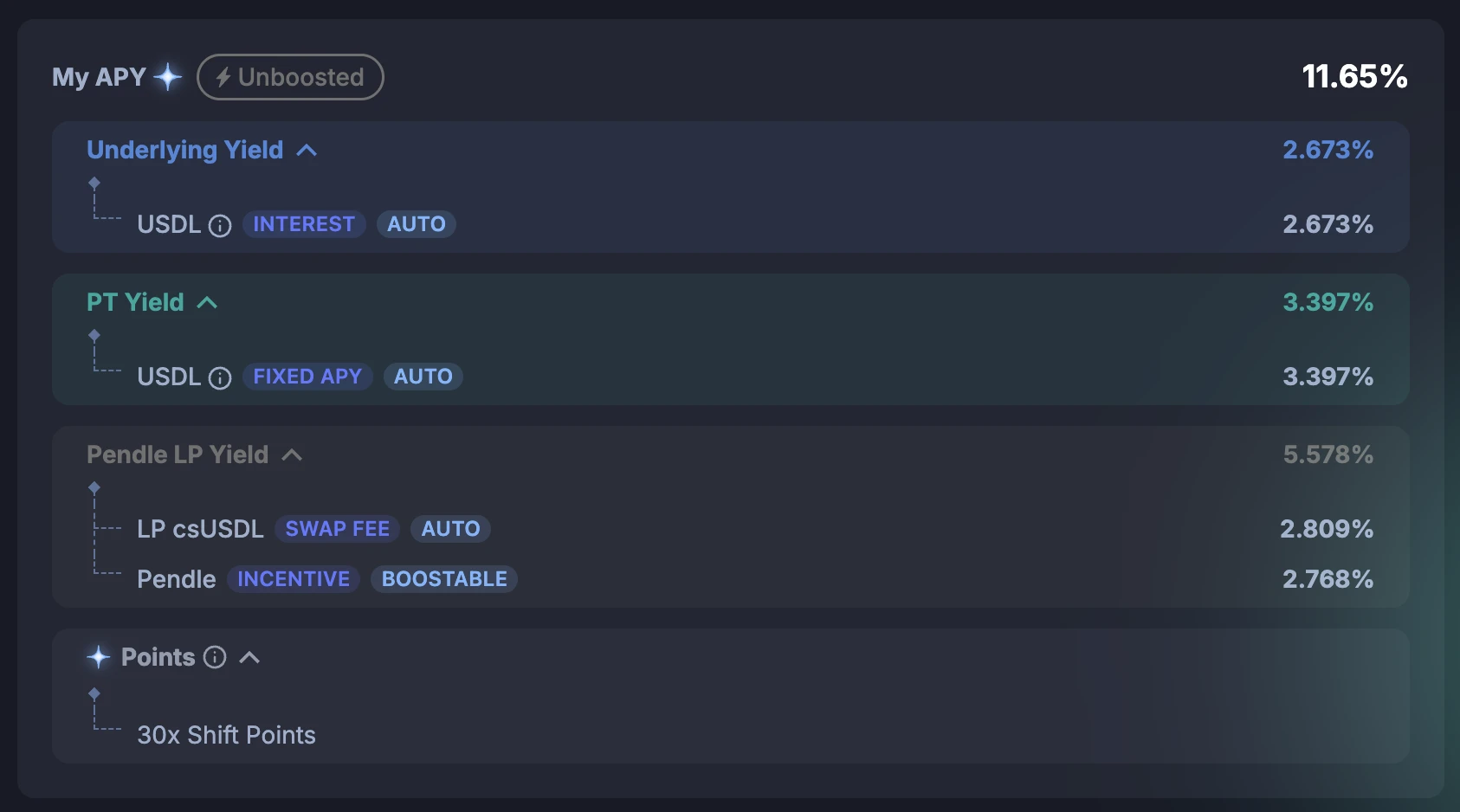

At the end of April, the asset management platform Coinshift, which has received investments from well-known institutions such as Tiger Global, Sequoia Capital India, and Polygon Studios, announced that its stablecoin csUSDL has integrated Pendle.

Currently, users can directly purchase PT expiring on July 31 on Pendle, with an APY yield of 11.5%; if providing liquidity, the APY is 11.65% (which can rise to 17.76% with sufficient PENDLE staked), while also earning 30 times Shift points.

I checked Coinshift's historical updates, and this seems to be the first time the project has mentioned points-related matters. Although the specific plans and utilities are currently unclear, given the base yield is already quite good, it may be worth considering an entry.

Midas TVL Growth Significant

On April 26, my colleague wrote an article about the RWA protocol Midas (see "TVL Breaks $60 Million, Analyzing the Hidden Wealth Opportunities Behind Midas").

Just a few days later, Midas's TVL broke $75 million on May 1, showing clear signs of capital inflow, and users can consider participating based on the previous strategy.

Ethena's Third Season Collection

Last week, the most celebratory event for stablecoin miners was undoubtedly Ethena opening the third season airdrop application, ultimately allocating 3.5% of ENA as this season's airdrop quota.

Due to multiple adjustments in my personal address, it is difficult to calculate the exact yield rate, but a prominent figure on X has calculated that the APR performance of the Pendle USDe pool (with a 50 times points multiplier) is about 11%.

Currently, Ethena's fourth season (Portal: https://app.ethena.fi/join/r0p2g) is ongoing and will last until September 24. Large capital users with liquidity requirements may consider participating.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。