This Week's Macro and Economic Focus - Analysis of Morning Downturn Possibilities

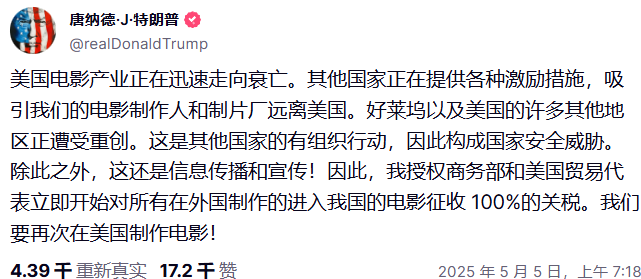

Early this morning, I noticed that U.S. stock futures were down, and almost simultaneously, $BTC also followed suit. I checked the market information and did not find any strong negative news. The S&P 500 and Nasdaq futures were down more than 0.7% in the morning but are now gradually recovering. This was after Trump announced a 100% tariff on foreign films introduced to the U.S.

This issue itself does not have a significant impact on the U.S. economy. I checked the data, and foreign films usually account for less than 10% of box office revenue in U.S. theaters, and the film industry contributes less than 1.5% to the U.S. GDP. The impact of imported films is more significant on platforms like Netflix and Amazon Prime.

Additionally, the current driving force behind the U.S. stock market is mainly in the technology and AI sectors, so the likelihood of a downturn caused by film tariffs is low. Personally, I speculate that the downturn is mainly due to two reasons.

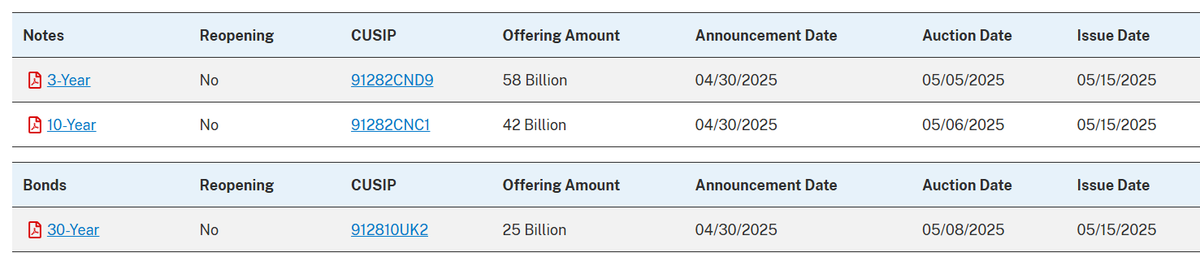

- This week, auctions for 3-year, 10-year, and 30-year U.S. Treasury bonds will begin. The total amount is $125 billion, and in the current high-interest-rate environment, there is a high probability that liquidity will be withdrawn from the market.

Of course, I don't think this is a major negative factor, as the bond sales have long been anticipated by the market. However, while the bond sales themselves may not be a significant negative, the success of the bond purchases will impact the market.

In simple terms, if the demand is strong and the interest rates are moderate, the market's short-term volatility will be limited. But if demand is insufficient or the auction interest rates soar, it indicates a lack of confidence in the sustainability of U.S. debt or the future interest rate environment.

To put it plainly, if the auction results in soaring interest rates or insufficient demand, it could trigger a collapse in the bond market, compress stock valuations, pressure the crypto market, increase dollar volatility, and even raise systemic liquidity concerns, prompting expectations of Federal Reserve intervention. This is a typical "long-end interest rate suddenly out of control" risk window.

To simplify further, it means a stock market downturn. Of course, this refers to an unfavorable auction scenario. However, recent U.S. Treasury auctions have shown overall stable performance, especially the 10-year Treasury bonds (April auction) which demonstrated strong market demand. The decline in foreign investor participation in short-term bonds may indicate market concerns about the short-term economic outlook.

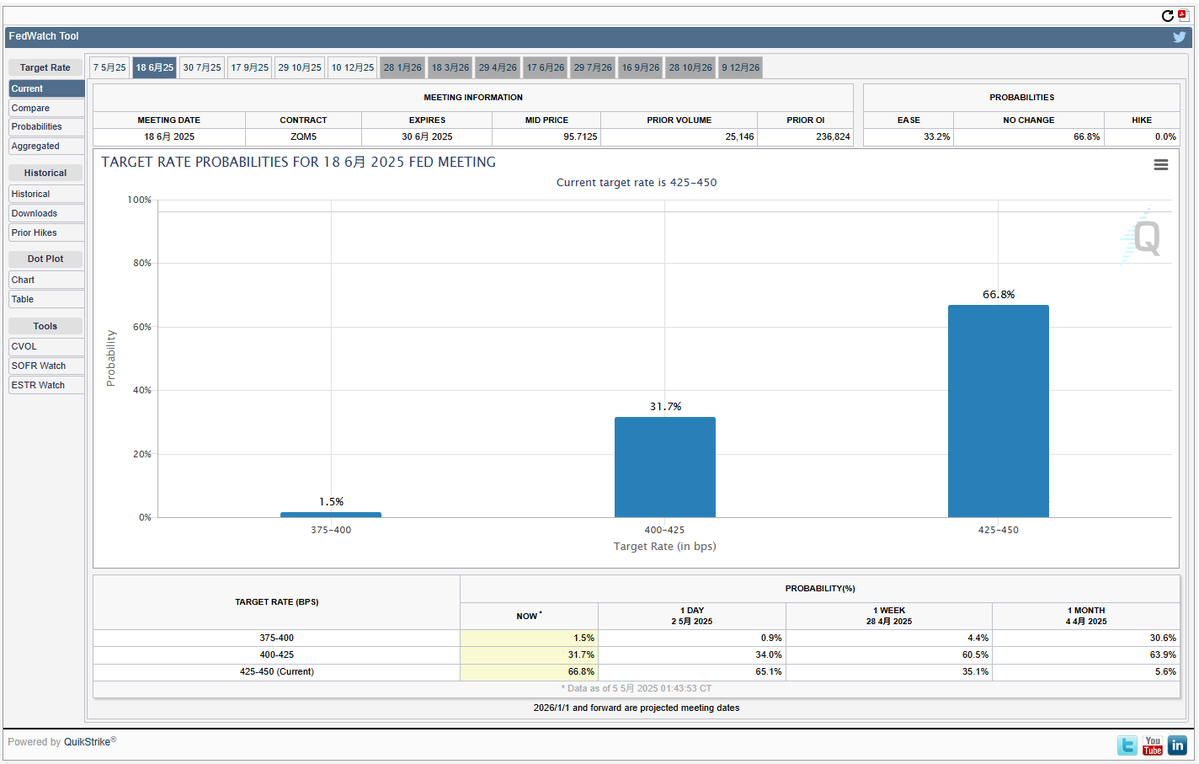

- The Federal Reserve's interest rate meeting early Thursday morning. There should be no doubt that there will be no rate adjustment in May; the focus is on whether there will be adjustments in June and July. According to data from CME, the expectation of no rate cut in June has risen to 66.8%. After the GDP and non-farm payroll data, the market is no longer predicting a rate cut in June.

This has already been anticipated by the market, so not cutting rates is not considered a negative factor. What Powell says during the meeting is what investors are anxious about. This morning, I read an interview with former Federal Reserve official and current Goldman Sachs Chairman Kaplan in the Wall Street Journal, titled "Talking About the Rate Cut Dilemma," so I think everyone knows what the content is likely about.

In the interview, Kaplan even quoted Powell's warning from 2022: "To bring inflation down to 2%, we may have to accept an economic recession." He believes that the main reason the U.S. has not yet entered a recession is that government fiscal spending has remained historically high, with the fiscal deficit accounting for over 6.5% of GDP. However, the U.S. is currently reversing this situation by reducing fiscal spending.

Therefore, Kaplan believes that the probability of economic risks in the U.S. is quite high and stated that if he were still at the Federal Reserve, he would support only two rate cuts by 2025. He also believes that the Federal Reserve will take more reactive measures rather than preemptive ones.

In simple terms, the Federal Reserve will still primarily rely on data, and will only intervene in the market if there are clear signs of potential economic downturn (recession). It is essential to pay close attention to Powell's statements regarding tariff-induced inflation. If he clearly views the inflation caused by increased tariffs as "transitory," it may alleviate market concerns about hawkish policies.

Overall, although there is a lack of clear negative data this week, the instability of long-end interest rates combined with the Federal Reserve's data-dependent environment means that the market will continue to be driven by macro events, with sentiment influenced by information. If positive news decreases, FOMO will gradually cool down. Risk assets (such as BTC and tech stocks) lack clear upward momentum, and unless there is an unexpectedly dovish shift from the Federal Reserve or an oversubscription in the Treasury auction, it is likely to enter a consolidation phase around the support levels of $93,000 to $98,000.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。