This report is authored by Tiger Research, studying the South Korean Web3 market in the first quarter of 2025, analyzing its evolution from liquidity export to a structured industrial ecosystem, and highlighting key regulatory developments and global project initiatives.

Key Summary

From liquidity export to industrial ecosystem: In the first quarter of 2025, the South Korean Web3 market reached a turning point. This market, once viewed as a "liquidity export" for global projects, is transforming into a structured self-sustaining industrial ecosystem.

Impact of relaxed corporate account regulations: As part of the Financial Services Commission's roadmap, institutional entities are gradually being allowed to trade cryptocurrencies through corporate accounts.

Ecosystem building led by global projects: Projects such as Avalanche, TON, Ripple, and Solana are actively establishing a long-term foundation in South Korea. Their activities have gone beyond marketing to focus on developer community building and hosting hackathons.

1. The South Korean Web3 Market in Q1 2025: Still Just a Liquidity Export?

Despite active retail participation and ample liquidity, the institutional infrastructure development in the South Korean Web3 market has made limited progress. Regulatory efforts prioritize investor protection over ecosystem development, delaying broader industry growth.

Two major obstacles are: 1) restrictions on the association between corporate accounts and cryptocurrency exchanges; 2) high entry barriers for obtaining a Virtual Asset Service Provider (VASP) license. Corporations are unable to connect their company accounts to local exchanges, making it legally unfeasible to convert cryptocurrencies obtained through operations into fiat currency via South Korean financial institutions. While some companies have turned to overseas entities as a stopgap, this approach carries regulatory risks and does not provide a sustainable long-term solution.

The high entry barriers for VASP registration have also become a major constraint on market development. Although small-scale operations can technically operate without registration, large projects consistently face legal and regulatory uncertainties.

These institutional constraints, combined with investor activities that far exceed the maturity of the local ecosystem, have led some projects to view South Korea primarily as a customer acquisition channel. In this context, the external perception of the South Korean market as merely a "liquidity export" becomes difficult to refute.

The market development in Q1 2025 indicates that South Korea has the potential to shift from a speculation-driven market to an industry revitalization-oriented market. Recent regulatory improvements (such as allowing corporate accounts to trade cryptocurrencies) mark substantial progress in structural reform. Beneath the surface, global projects are steadily building a local ecosystem with the support of an expanding builder community and emerging new initiatives.

The South Korean Web3 market is at a critical turning point. As the ecosystem matures beyond an investor-driven development model, supported by institutional readiness and sustained investment interest, it is expected to generate greater long-term value.

2. Institutional Progress: Allowing Corporate Accounts to Trade Cryptocurrencies

In South Korea, restrictions on cryptocurrency trading by corporate entities began with the "Park Sang-ki Ban" in 2017. This policy, led by then-Minister of Justice Park Sang-ki, effectively prohibited financial institutions and corporations from participating in cryptocurrency trading. Although the guidelines have expired, this practice has continued, creating a dual-track system where individuals can trade within the regulatory framework while corporate entities face restrictions on investment and financing activities.

Source: Tiger Research

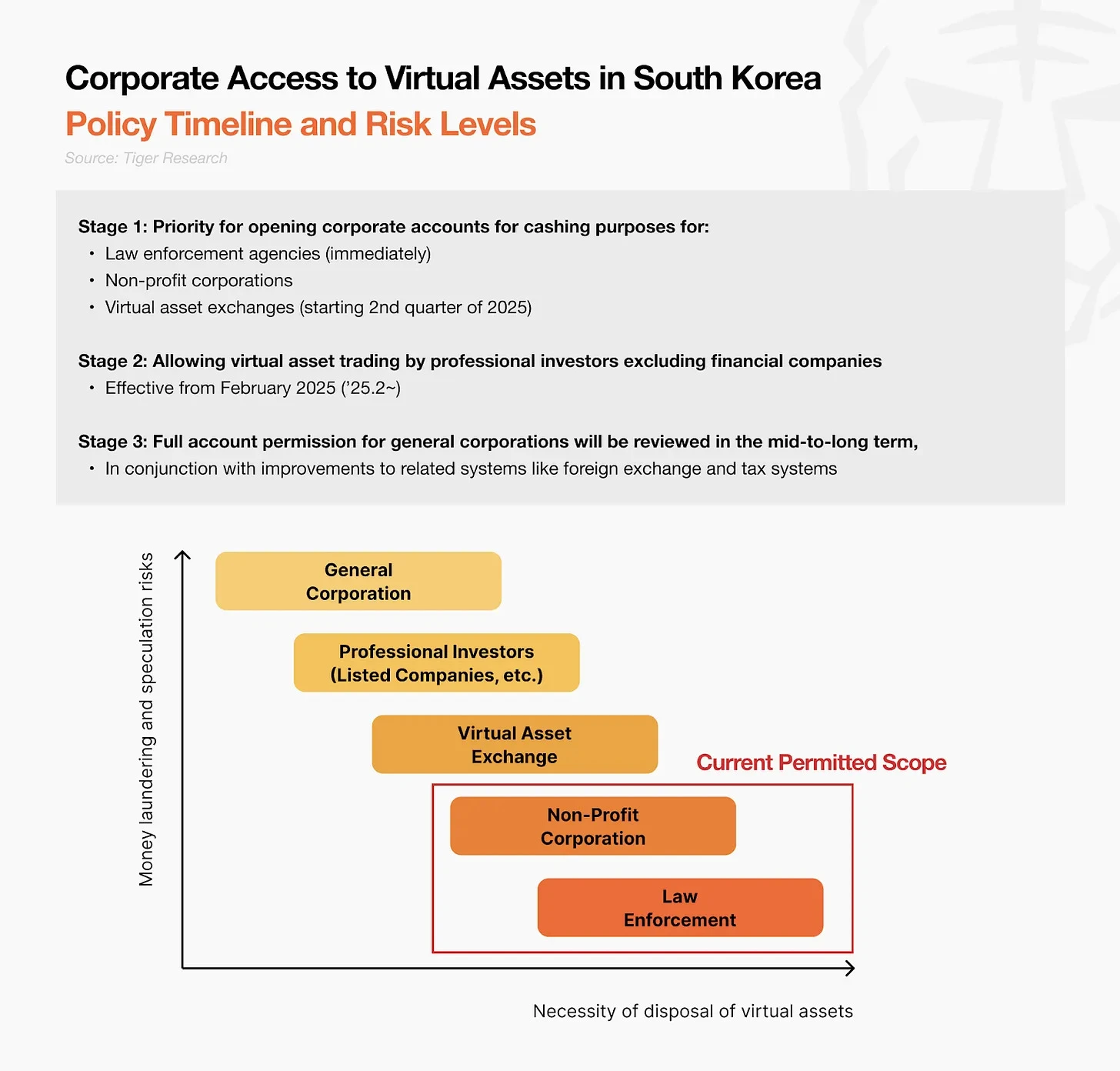

To address these restrictions, the Financial Services Commission (FSC) officially announced the "Roadmap for Corporate Participation in the Cryptocurrency Market" on February 13, 2025. The core highlight of this roadmap is the phased lifting of the seven-year ban on corporate cryptocurrency trading.

Phase 1 (starting Q2 2025): Opening accounts to law enforcement agencies, non-profit organizations, and cryptocurrency exchanges, limited to asset liquidation purposes.

Phase 2 (starting in the second half of 2025): Allowing professional investors such as listed companies and registered investment firms to trade.

Phase 3 (mid to long term): Fully opening the market to ordinary enterprises.

In Phase 1, since November 2024, law enforcement agencies such as prosecutors, tax authorities, and local governments have begun to gain account access for the liquidation of seized cryptocurrencies. Non-profit organizations and exchanges are expected to follow in Q2 2025. Phase 2 marks a more significant shift. Starting in the second half of 2025, listed companies and professional investment firms will be allowed to trade cryptocurrencies for investment and treasury management purposes.

However, most Web3 projects fall under the third phase of ordinary enterprises. To qualify for Phase 2, companies must maintain a financial investment product balance of at least 10 billion KRW (approximately 7 million USD) under the Capital Markets Act, or 5 billion KRW (approximately 3.5 million USD) if audited by an external entity—thresholds that most Web3 companies cannot meet. Therefore, the majority of Web3 projects cannot immediately benefit from the new regulations. Nevertheless, the roadmap still indicates a gradual relaxation of regulatory constraints. As Phase 3 progresses, direct market access for Web3-native enterprises will become increasingly feasible.

2.1 Positive Significance of Allowing Corporate Trading Accounts

Establishing a legal foundation for South Korean companies to engage in Web3 business.

Enhancing market stability through institutional investors with structured risk management and long-term strategies.

Promoting diversification of financial services, including cryptocurrency funds and custody services.

Web3 projects often use native tokens to exchange services and resources. However, in South Korea, companies previously had almost no legal means to liquidate acquired crypto assets. The new policy establishes a critical entry point for compliant corporate operations, facilitating the formal development of crypto-related business activities.

This progress is expected to further expand in the second half of the year, when trading permissions will extend to listed companies and registered institutional investors. Unlike retail investors, corporate investors tend to adopt structured risk management frameworks and long-term investment strategies. Their market entry is expected to reduce volatility and support the sustainable development of the South Korean Web3 ecosystem. Additionally, broader corporate participation may improve the ongoing inefficiencies in the local market—most notably the "kimchi premium."

The increase in institutional participants is also expected to broaden the range of crypto-related financial services. Asset management companies may launch cryptocurrency funds or acquire custody service providers to offer comprehensive solutions. Fintech companies may develop corporate treasury tools that support crypto account management. These developments will help expand the South Korean Web3 industry by strengthening supporting service infrastructure and attracting more traditional financial institutions.

2.2 Potential Risks of Allowing Corporate Crypto Accounts

Phased deregulation may lead to supply-demand imbalances, creating downward pressure on prices.

As listed companies and institutional investors enter the market, government efforts to ensure tax revenue are expected to strengthen.

Conservative risk management by institutional investors may lead to concentrated holdings in Bitcoin, raising concerns about decreased activity in the altcoin market.

The introduction of corporate accounts may have substantial impacts on retail participants. From a market dynamics perspective, phased deregulation may lead to an imbalance of pressure between buyers and sellers. According to the FSC's corporate roadmap, regulators believe that corporate selling activities carry relatively low risk. Therefore, by the end of 2025, there may only be selling-side liquidity entering the market, leading to downward price pressure. Although the expected selling volume may remain moderate relative to the overall market, low liquidity tokens may face greater volatility.

On the regulatory front, once listed companies and institutional investors fully enter the market, government efforts to ensure tax revenue are expected to strengthen. Although cryptocurrency taxation has been postponed until January 1, 2027, the presidential election on June 3, 2025, may change policy direction, warranting close attention.

In terms of investment behavior, corporate capital may concentrate on Bitcoin. As seen with U.S. Strategy (formerly MicroStrategy) and Japan's Metaplanet, institutional investors tend to allocate to large-cap stable assets due to conservative risk management. This may lead to significant capital inflows into Bitcoin or impact the altcoin market—where South Korean retail investors have historically been highly active. Therefore, the altcoin market may face reduced interest and liquidity in the medium to short term.

3. Industrial Transformation: Strategic Layout of Global Web3 Projects

Following the U.S. and China, South Korea has become a core strategic market for global Web3 projects. In response, numerous international teams are actively recruiting South Korean talent and establishing substantial collaborations, demonstrating a strategic shift from superficial marketing to building a sustainable, builder-led local ecosystem. This long-term layout not only supports the growth of individual projects but also enhances the overall competitiveness of the South Korean Web3 industry.

3.1 Project Support: Guiding Industry Direction through Support for Mature Teams

Source: Avalanche Korea X

Avalanche and the TON Foundation are exemplary global projects that support the construction of ecosystems by directly supporting local teams in South Korea. After a successful collaboration with "MapleStory," Avalanche has expanded its cooperation with small and medium-sized projects in South Korea. The team holds demonstration days every quarter to showcase available products and actively attract users, creating a feedback loop that provides substantial value to projects and participants.

The TON Foundation has taken a more structured approach by launching the "TON Society Korea Builder" program. This program includes a formal project database, a systematic support framework, and expanded network access to strengthen the local TON ecosystem in a scalable manner.

These ecosystem support strategies have yielded tangible results that go beyond short-term exposure or participation metrics. Verified local developers have gained a more stable growth foundation, and their success stories provide clear guidance for newcomers. At the same time, these initiatives lay the groundwork for the international expansion of South Korean projects.

3.2 Hackathons: Cultivating Korean Builders and Strengthening Market Potential

The hackathons hosted by XRPL Korea (Ripple) and Superteam Korea (Solana) have transcended the scope of single events, becoming a key turning point for the South Korean Web3 ecosystem. In March, Ripple held a two-day "DE-BUTHON 2025," attracting 24 teams and 203 participants. Superteam Korea, in collaboration with 22 global partners, hosted the "SEOULANA HACKATHON," with over 300 participants.

The scale and success of these events help to reshape the perception of South Korea as a speculation-driven market. The high participation in large hackathons reflects the presence of a strong builder ecosystem. These events have now become strategic launch platforms—providing builders with clear market entry pathways and bridging the gap between prototype development and actual deployment.

As of Q1 2025, driven by globalization-led ecosystem building initiatives (rather than mere capital inflows), the South Korean Web3 industry is beginning to show quantifiable progress. Strengthened collaboration with mature participants, combined with developer support programs, is nurturing a new generation of local builders.

These developments mark a new momentum phase for the South Korean Web3 sector. On this foundation, South Korean projects are expected to deliver substantial innovations to the global stage in the coming years.

4. From Investment-Driven to Industry-Driven: A Turning Point for the South Korean Web3 Market

In Q1 2025, the South Korean Web3 market experienced a critical transformation—from an investment-driven environment to a mature industrial ecosystem. Regulatory progress, including the phased opening of corporate cryptocurrency trading accounts, lays the groundwork for structured market participation. At the same time, the ongoing ecosystem building efforts of global Web3 projects support the long-term growth positioning of the South Korean market.

Another important milestone is the successful completion of the first retail user real-world transaction for South Korea's central bank digital currency (CBDC) "Han River Project." Concurrently, major commercial banks in South Korea began exploring the issuance of a won-pegged stablecoin in early April. The Bank of Korea has also indicated that it will play a more active role in future regulatory legislation.

In terms of infrastructure, ongoing discussions about a "one exchange - multiple banks" system suggest potential structural breakthroughs. Under this model, cryptocurrency exchanges will no longer be limited to a single banking partner and can connect with multiple commercial banks. This move is expected to significantly enhance market flexibility and user access.

Overall, these developments clearly demonstrate the evolution of the South Korean Web3 sector towards a sustainable industrial ecosystem. After years of regulatory constraints and structural inefficiencies, South Korea is entering a new phase characterized by policy synergy, institutional participation, and the emergence of industrial-level growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。