Original Title: Stablecoin B2B Payment is all about Workflows, not Payment itself

Original Author: @DeFi_Cheetah

Original Translation: zhouzhou, BlockBeats

Editor's Note: This article emphasizes that the main obstacles to cross-border B2B payments lie not in the payment itself, but in incomplete workflows, including issues related to data management, regulatory complexity, taxation, and approval chains. While stablecoins can improve payment execution, they cannot resolve complex workflows on their own. Truly successful projects should integrate stablecoins through automated processes, optimizing workflows, enhancing transparency, reducing errors, and achieving efficient and compliant global payments. This comprehensive approach will drive the development of global payment businesses and create significant market opportunities.

The following is the original content (reorganized for readability):

B2B payment systems are often seen as simply pressing the "send" button to transfer funds from one entity to another. Many stablecoin projects adopt this perspective, focusing on improving transaction channels—such as checks, wire transfers, or digital transfers—while neglecting the critical, domain-specific processes before and after the transfer. In reality:

B2B payments are the end result of extensive workflows, most of which focus on data validation, compliance or regulatory steps, and multi-party approvals before funds can be transferred.

The gap between the notion of "we just need to pay someone" and the reality of "we must first confirm multiple contracts and operational details" becomes particularly evident in cross-border transactions, where unique legal frameworks, local tax regulations, and exchange rate fluctuations complicate operations. In fact, the increasing relevance of digital assets—especially stablecoins (e.g., @hadickM)—has begun to intersect with these workflows, and when combined with robust workflow automation, it can provide a potential streamlined path for the flow of funds.

This article argues that the introduction of stablecoins should not merely be viewed as an efficiency improvement at the "payment execution" level; rather, it must be integrated into a workflow-centric solution to unlock the trillion-dollar opportunity, as stated by @PanteraCapital. I believe the most valuable layer in the stablecoin payment stack is the orchestration layer, which, as @robbiepetersen_ mentioned, can simplify complex workflows and cover as many regions as possible.

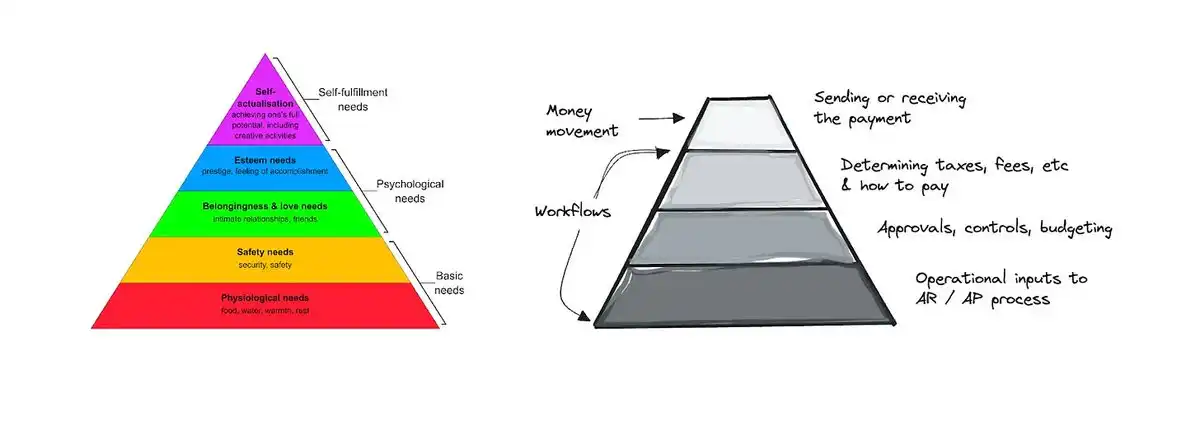

Hierarchy of Needs in B2B Payments

A useful conceptual tool is to view B2B payments as a layered "hierarchy of needs." These layers include:

Data collection and invoice management

B2B transactions often involve gathering supplier information, parsing invoices, and reconciling them with purchase orders or delivery records.Compliance and regulatory checks

Companies must verify that suppliers comply with local or international regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.Tax reconciliation

Determining the correct local and cross-border tax obligations—such as withholding tax or VAT—can be very complex, especially when transporting goods internationally.Approval and auditing

Many organizations require multi-tiered approval chains. The audit trail of approvals and real-time visibility further complicate workflows.Payment execution

The final transfer of funds—traditionally via checks, ACH, wire transfers, or other channels—sits at the top of this structure.

By recognizing that payment execution relies on various underlying components, solution providers can design comprehensive systems that handle all stages, thereby avoiding failures or delays caused by insufficient data tracking, compliance issues, or incomplete approval chains.

Cross-Border Payment Workflows: Some Real Bottlenecks

Cross-border B2B payments amplify the challenges present in domestic payment environments:

Regulatory complexity

Each jurisdiction has unique requirements for foreign exchange transactions, involving not only AML/KYC but often requiring specific documentation related to trade laws and customs.Detailed tax obligations

From import duties to VAT, cross-border transactions require precise tracking, sometimes necessitating the allocation of tax liabilities among multiple parties in different regions.Extended approval hierarchies

Subsidiaries and parent companies often have complex signing procedures. Any mismatch in local compliance, product classification, or documentation can delay payments.

In many cases, these complexities become a greater barrier to timely and accurate payments than the friction of the payment channels themselves.

Industry Examples

Freight and Logistics: Freight Auditing and More

Background: In freight and logistics, multiple carriers charge for transportation, loading, additional fees, and even penalties for early/late arrivals. Fluctuating fuel prices and complex multi-leg transport arrangements can lead to very complicated invoices.

Workflow Pain Points: The core challenge is not just pressing the "pay the trucking company" button, but how to reliably match these charges with agreements, verify that the weight and distance of goods are accurately calculated, and consider potential exceptions.

Why It Matters: B2B payment solutions that focus solely on seamless payment interfaces miss the larger issue of validating invoice details—this step is often still managed by large teams or outsourced business process outsourcing (BPO) companies. A better approach is to integrate with shipping documents, track changes in plans or goods, and identify invoice errors before payment.

Real-World Example: Loop first focuses on auditing and workflow logic before adding payment functionality. Another example could be an AI solution that automatically scans and parses shipping documents, pushing exceptions into a queue, unlocking payment mechanisms only after that.

Construction and Upstream Supply Chain

Background: Construction projects involve multiple layers of suppliers (from lumber and cement to electrical and mechanical subsystems). Tax burdens vary by region and project type.

Workflow Pain Points: Contractors need to not only pay for "50 cubic yards of concrete" but also confirm that the purchase is related to a specific project or permit, apply the correct local taxes, and ensure that the purchase is authorized under the correct work code.

Why It Matters: Tools that merely accelerate transactions—without capturing or automating these approvals—do not address the larger challenge. Automating these checks, integrating with building permits, coordinating with subcontractor budgets, and simplifying partial deliveries in B2B solutions can provide more lasting value to end users.

Real-World Example: Nickel integrates with tax calculation engines to manage the complexity of different tax rates for the same goods, depending on usage, buyer classification, and location. Other vendors may embed material usage forms and generate compliance documents before triggering any payments.

Fuel Cards and Expense Management

Background: Managing fleets of trucks, cars, equipment, or company vehicles involves controlling a large number of operational expenses.

Workflow Pain Points: Fuel is an obvious expense, but drivers can easily spend money on non-categorized items (such as snacks, personal fuel, or company-unapproved items). Therefore, control and visibility are more important than simply "paying for fuel."

Why It Matters: Tools like Wex, Fleetcor, Mudflap, AtoB, and Coast effectively combine purchase transactions with real-time policy controls, allowing supervisors to see if drivers are purchasing items unrelated to the fleet—and optimizing the choice of cheaper gas stations.

Real-World Example: A solution might integrate onboard communication and route optimization software to detect anomalies in mileage or fuel consumption, flagging suspicious purchases, and allowing transactions to flow only after relevant approvals or checks are passed.

Vendor Management and Invoice Approval

Background: Large companies may have thousands of suppliers, with invoices in various formats—some digital, some in PDF, and some even on paper.

Workflow Pain Points: Accounts payable teams must ensure that each invoice is valid, not duplicated, allocated to the correct budget code, and compliant with relevant supplier agreements.

Why It Matters: The "payment" step may be the simplest part—just writing a check or sending an ACH. However, verifying whether a $3500 invoice is correct or whether $100 has been overcharged can consume a significant amount of manual work.

Real-World Example: Solutions like Tipalti, Coupa, or SAP Concur embed invoice reception, expense management, and supplier onboarding processes. They transform chaotic data into standardized entries, allowing for multi-tiered approvals and handling necessary currency conversions, triggering fund releases only afterward.

Sales Commissions for SaaS Platforms

Background: SaaS companies often set complex commission structures for sales teams, with different percentages and bonuses applicable based on product type, region, or subscription level.

Workflow Pain Points: Calculating and verifying each commission can be more complex than simply paying salespeople their bonus checks. Discrepancies can lead to disputes and dissatisfaction.

Why It Matters: Automating a correct and transparent commission structure requires a robust system that integrates with CRM data, tracks subscription usage or expansions, and considers allocations among multiple sales representatives.

Real-World Example: Platforms like CaptivateIQ or Spiff focus on solving the data and workflow issues of commission calculations. Before payment preparation is complete, the system has already optimized large amounts of data and automatically handled exceptions, avoiding error-prone spreadsheets.

Integrating Stablecoin Payments into Workflows for Efficiency

While traditional payment methods (such as checks, ACH, SWIFT) can be slow and costly, especially in cross-border payments, stablecoins have emerged as a powerful alternative for settling digital payments. Here are some key considerations (as mentioned by @proofofnathan):

Reducing Settlement Time

Stablecoins can provide near-instant settlement, bypassing the multiple intermediary banks typically involved in cross-border remittances. This feature is particularly beneficial in workflows where all operational conditions have been met and approvals completed, helping to prevent unnecessary payment delays.

Automating Compliance Checks

Workflow platforms that integrate stablecoin transfers can be designed to initiate on-chain payments only when specific smart contract conditions are met—such as supplier identity verification, compliance document clearance, or proof of delivery. This automated compliance process reduces manual intervention and errors.

Transparent Foreign Exchange Management

In many stablecoin arrangements, assets are often pegged to major currencies (like the US dollar), reducing the impact of exchange rate fluctuations. This transparency can simplify payment reconciliation and accounting. Additionally, integrating stablecoin payment channels with advanced workflows can automatically convert stablecoins into local currency for the final recipient, thereby reducing the complexity of manual financial management.

Micro Transaction Cost Savings

If B2B transactions involve small periodic cross-border payments—such as paying overseas contractors for micro-invoices—stablecoins can reduce fixed transaction fees. A workflow-based approach can bundle or schedule these payments to optimize gas fees or network costs on certain blockchain infrastructures.

Expanded Value-Added Services

Once a company integrates stablecoins into its payment workflows, new opportunities become feasible. For example, features such as instant financing, real-time invoice discounting, or embedded dynamic discounts can be encoded into the workflow. Stablecoin-based systems can facilitate these functions with minimal friction.

Advantages of Workflow Priority Strategies in Cross-Border Payments

Increased Transparency and Auditability

By emphasizing documented automated approvals, organizations ensure that every step, from KYC and AML checks to contract matching, is thoroughly tracked. This process reduces disputes and compliance risks.

Minimized Human Touchpoints

Human oversight at each stage can lead to delays and errors. Adopting an end-to-end workflow approach—where the final stage may be settled via stablecoins—automates and simplifies interactions, significantly shortening overall cycle times.

Scalable Solutions for Global Expansion

Companies relying on ad-hoc cross-border payment methods often struggle to scale their operations. In contrast, workflow platforms that integrate stablecoin payment channels and dynamic compliance management can enter new markets more quickly and at a lower cost.

Bundled Value Proposition

Companies that merely offer "payment" functionality have limited differentiation. Those that can handle documentation, compliance burdens, and payment flows within a single integrated platform will become indispensable partners for customers, ensuring more stable and profitable business relationships.

Conclusion

While traditional views primarily see B2B payments as an issue of efficient fund transfer, the real barriers to cross-border payment efficiency lie in incomplete or imperfect workflows.

These limitations stem from fragmented data management, complex regulatory requirements, extended approval chains, and uncertain tax obligations. Although many stablecoin projects aim to improve existing payment channels, stablecoins alone cannot resolve these multifaceted workflow issues.

While these stablecoin projects position themselves at the payment execution layer, I believe that projects adopting a systematic, workflow-first mindset to address these foundational issues and achieve faster, more transparent, and less error-prone global payments will be the winners capturing the largest market share in the payment space.

These projects need to build robust tools embedded in thoughtful automation processes to verify supplier qualifications, reconcile invoices, manage taxes, and execute multi-tiered approvals.

The trillion-dollar opportunity belongs to those projects that take a holistic approach—optimizing workflow orchestration and leveraging the efficiency of stablecoins. They can not only provide faster and more economical international payment services but also seamlessly integrate compliance, tax, and documentation requirements.

This synergy not only enhances daily payment operations but also enables companies to explore emerging markets, launch new financial products, and create lasting competitive differentiation in the global B2B finance landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。