The weekend homework wasn't too difficult to write. Today, aside from the fact that the governor of Arizona rejected the first $BTC state strategic reserve, there was also Buffett's speech. The state strategic reserve was not approved because the governor believes that Bitcoin still carries significant risks and is not suitable for pension fund investments. However, the second strategic reserve should be submitted to the governor after the Democrats pass it next week. The second proposal does not include pension fund purchases, so it's uncertain whether it will be approved. If it is not approved, what will the reason be this time?

There are two key points to focus on regarding Buffett's performance this time. First, cash reserves have reached a historical high, which likely indicates that cautious investors are not very optimistic about the U.S. and U.S. stocks moving forward. The second point is that Buffett believes there may be developments in the U.S. soon, and this dollar bull thinks it might be wise to allocate more to other countries' currencies.

Although it cannot be confirmed, based on Buffett's investment behavior over the past year, he seems to be intentionally reducing his holdings in U.S. stocks. While the U.S. economy appears to be stable, whether it can maintain this stability under high interest rates and sustain it until inflation naturally declines back to 2% is a question that all investors cannot ignore.

Looking back at Bitcoin's data, liquidity and trading volume continue to shrink, and a decline in turnover rate is quite normal. Although Arizona's situation is bearish, as mentioned before, the lack of approval won't elicit a significant reaction, while approval would be an epic event. Investors generally do not have high expectations for the $BTC strategic reserve, but this is also the first time the Democrats and Republicans have jointly agreed on a state-level cryptocurrency strategic reserve.

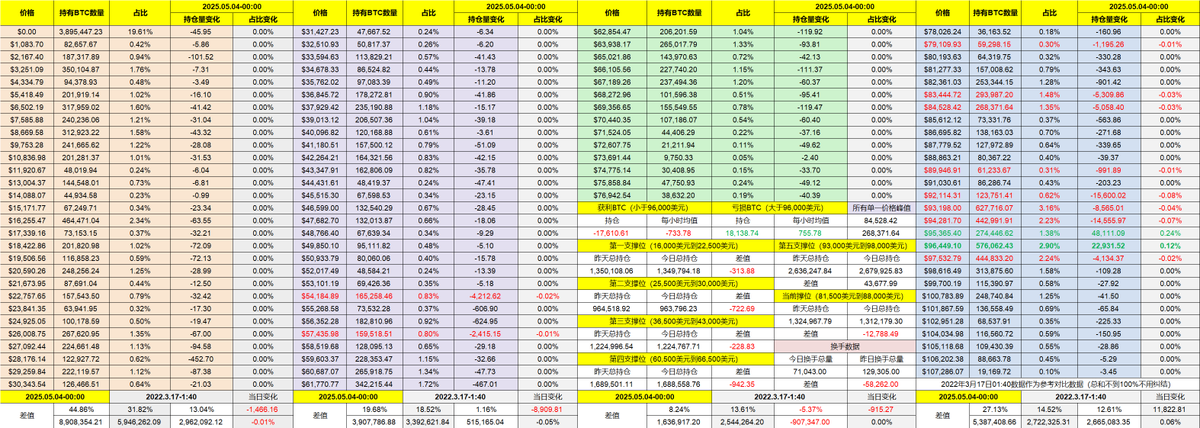

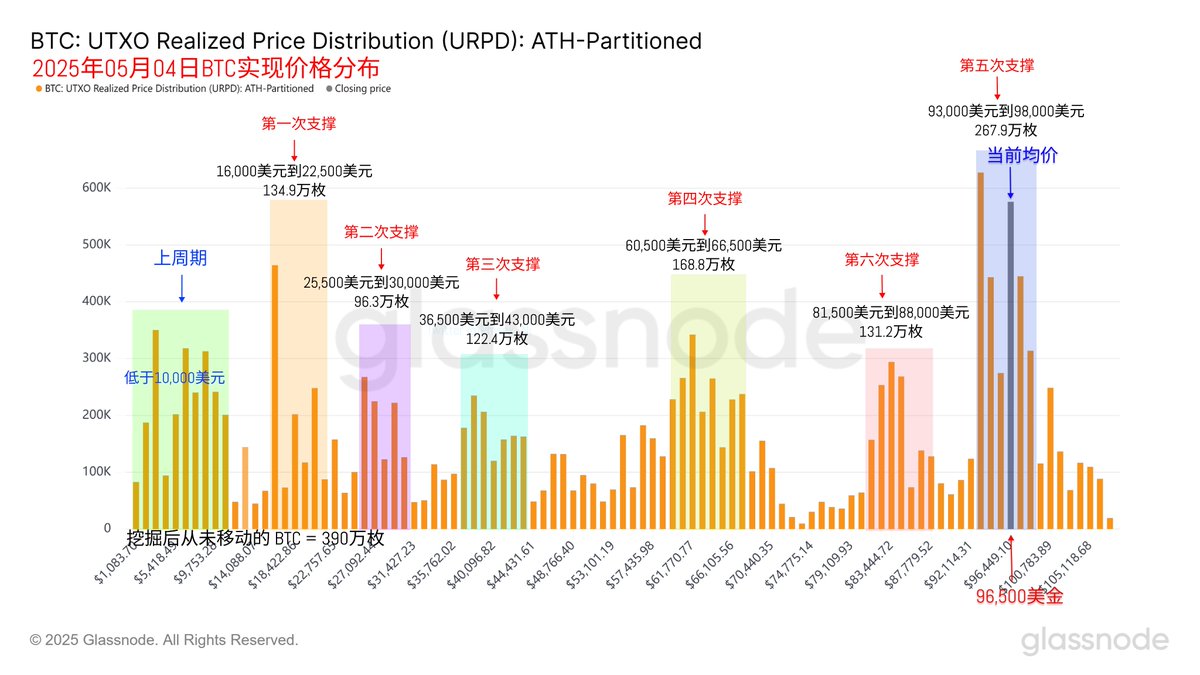

A low turnover rate naturally has little impact on support levels. The support between $93,000 and $98,000 remains very solid, with accumulated chips approaching 2.7 million.

The upcoming market will still be event-driven, and next week's Federal Reserve meeting will be a key focus.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。