How much higher can Bitcoin go? Analyzing the rebound of $BTC from the potential of the US stock market

Recently, many friends have been asking how high the price of $BTC can go even if it rebounds. This question is actually quite difficult to answer, as it is still event-driven and the influence of macroeconomic factors and policies has not diminished at all. The recent rise is largely stimulated by tariff compromises and the fact that the economy has not entered a recession.

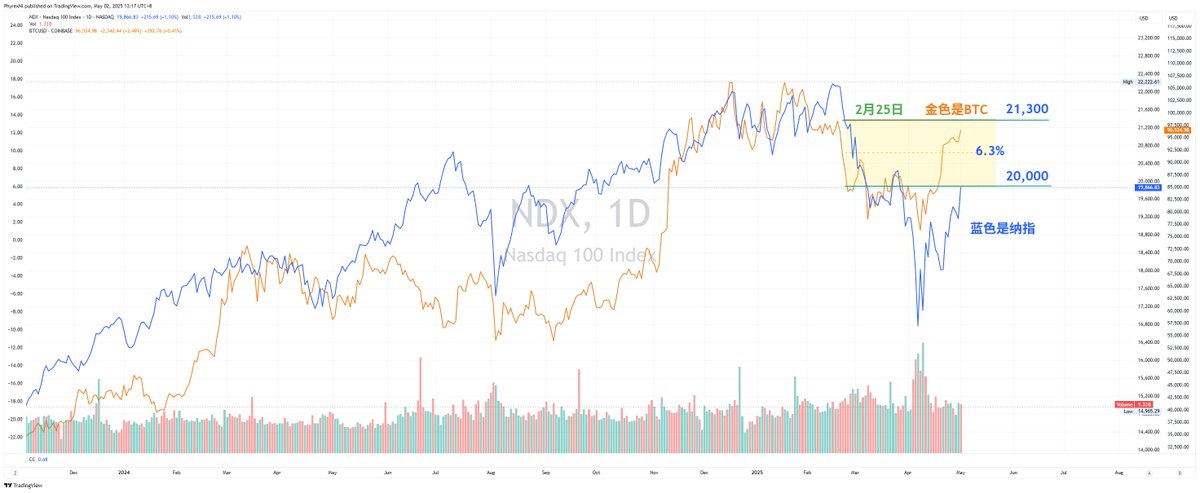

However, it can be observed that the price of BTC has returned to the high point before the tariff incident on February 25. Earlier, I also tweeted that BTC has a strong correlation with the S&P 500, https://x.com/Phyrex_Ni/status/1912593397694755302. Since BTC can return to the high point of February 25, it is also possible for the US stock market, especially the S&P, to return to that position.

Therefore, based on this correlation, there is a high probability that BTC can move up further. I looked at the current level of the S&P 500, and there is still a 6.3% space to the February 25 level. This space has also dropped due to tariff issues. If there are no negative macroeconomic factors in the near term, and Trump does not create any trouble, there may be an opportunity.

If we consider a 6% upward space for Bitcoin, based on the current price of $BTC, it could reach around $103,000. Of course, this is not a certainty, but if the US stock market can recover from the losses caused by tariffs, then BTC has a chance to return to $100,000.

I also looked at the Nasdaq, which has a similar range of about 6.3%. Therefore, the synchronization among US stocks is quite high, especially since the main drivers of this rise are technology stocks. Thus, the Nasdaq and S&P have a high degree of consistency, and $BTC itself also has a strong correlation with tech stocks.

Additionally, a 6% rise in the US stock market does not necessarily mean Bitcoin will rise by 6%. Historically, Bitcoin's increase is often greater than that of the stock market, and it is also possible that BTC leads the way, causing subsequent weakness. Therefore, overall, if the US stock market can return to February 25, a 3% to 8% increase in BTC is relatively normal.

The corresponding price should be around $100,000 to $106,000. If there are new positive factors driving the US stock market to continue rising, BTC can naturally increase as well. More importantly, Arizona's BTC strategic reserve may have results soon, and if approved, it will continue to stimulate the rise of BTC.

The key is to observe the current macro sentiment, the Federal Reserve's attitude, and Trump's tariff and tax reduction strategies.

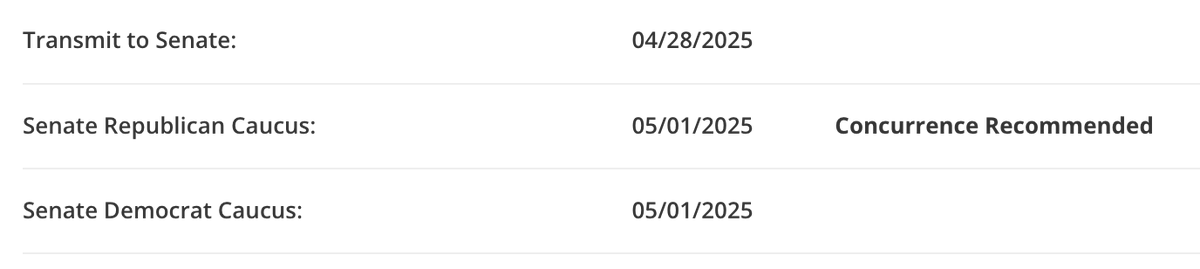

PS: SB 373 has not yet reached the governor's desk, and some content needs to be modified. The Republicans have agreed, and we are still waiting for the Democrats' decision, but SB1025 has already been delivered, and we should know by Tuesday at the latest.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。