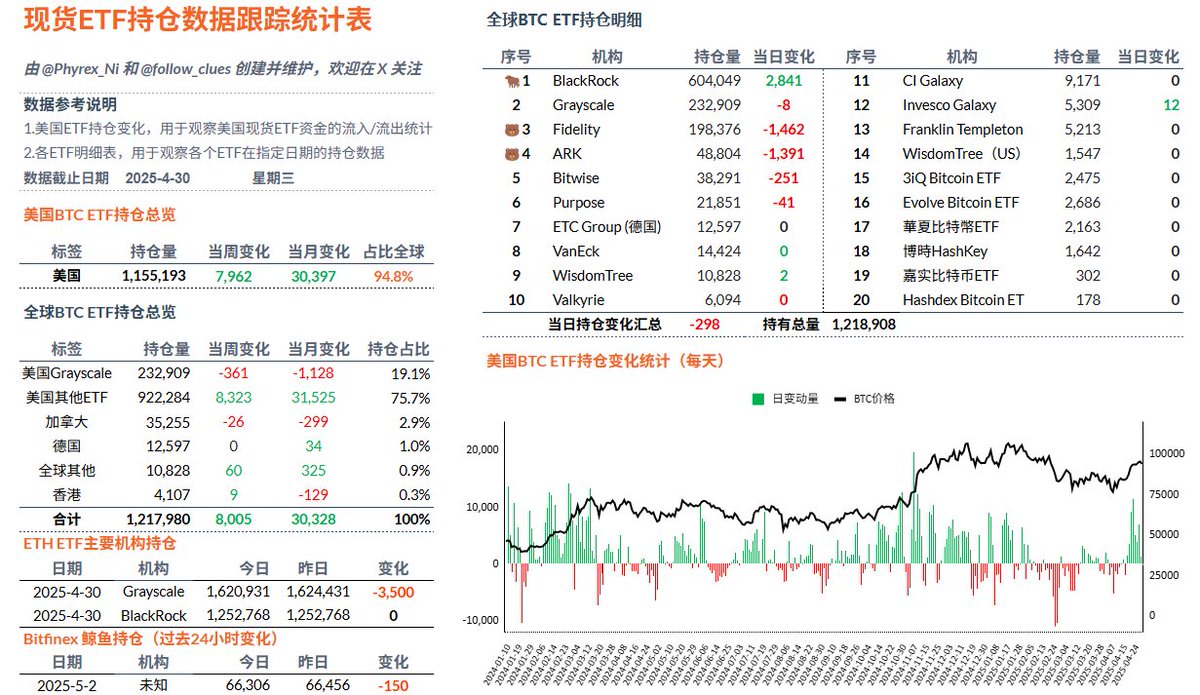

On Wednesday, the data for the $BTC spot ETF showed that it was the first net outflow for U.S. investors in the last nine working days, although the outflow was not significant, just over 200 Bitcoin. This is understandable, as Wednesday's GDP report was indeed shocking. Many investors were concerned about an economic recession upon seeing the negative GDP figures. However, after gradually interpreting the data, investors have come to understand the divergence between domestic demand and imports, and the resilience of the U.S. economy remains quite good, leading to a market rebound in the early hours.

Even so, BlackRock's investors continued to buy, marking 12 consecutive working days of purchases. The net outflow for price-sensitive users from Fidelity and ARK did not exceed 3,000 BTC, indicating that investor sentiment remains very stable, and this time Grayscale saw almost no investors leaving.

Next up is Friday's non-farm payroll data. Although expectations for an economic recession have decreased, it is important to note that the GDP data only goes up to the end of March, and it is still uncertain how April will turn out. Additionally, the strong domestic demand could be partly attributed to tariffs, while the unemployment rate is a good standard to consider. Let's take a look at the unemployment rate first.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。