The original text is from Forbes

Translation by|Odaily Planet Daily Moni

Editor’s Note: A major news story has emerged in the stablecoin market—Ripple has made a $4-5 billion acquisition offer to its competitor, stablecoin provider Circle Internet Group, which is in the process of an IPO! Yes, you heard that right, this is Ripple, which just got the U.S. Securities and Exchange Commission to drop its appeal and acknowledge that XRP is not a security. However, this offer was deemed too low and was rejected. It is reported that Ripple remains very interested in Circle but has not yet decided whether to make another offer.

Why would Ripple, a well-known crypto company, attempt to acquire Circle at this point? Will Circle ultimately say “Yes” or “No”? To address these questions, Forbes has published an in-depth analysis of some “insider” information, and Odaily Planet Daily has organized and translated the original text as follows, enjoy~

Why Does Ripple Want to Acquire a Stablecoin Company?

Stablecoins require both scale and speed.

The news of Ripple's acquisition of stablecoin company Circle may not sound like a typical acquisition deal at first, but for those familiar with Ripple's corporate strategy, acquiring Circle is actually “both unexpected and reasonable.”

In early April, Ripple acquired brokerage firm Hidden Road for $1.25 billion and announced that it would use the RLUSD stablecoin as collateral for its main brokerage products, shifting its post-trade activities to the XRP Ledger blockchain. Ripple believes this acquisition has the potential to optimize the cost and liquidity of its cross-border payment service, Ripple Payments, and provide custody services for Hidden Road's clients.

It is worth mentioning that Hidden Road has successfully obtained a brokerage license, which means this acquisition gives Ripple the legitimate right to engage with traditional financial tracks as an institution. XRP and RLUSD could evolve into liquidity bridge assets under institutional trading execution, repo financing, and even sovereign debt swaps, opening doors for tokenized government bonds, central bank digital currencies, and RWAs.

Clearly, Ripple's “ambition” has transcended the crypto track, and its power tentacles are beginning to embed more deeply into traditional financial infrastructure, with stablecoins anchored to fiat currency undoubtedly serving as the best bridge between the crypto and traditional financial worlds.

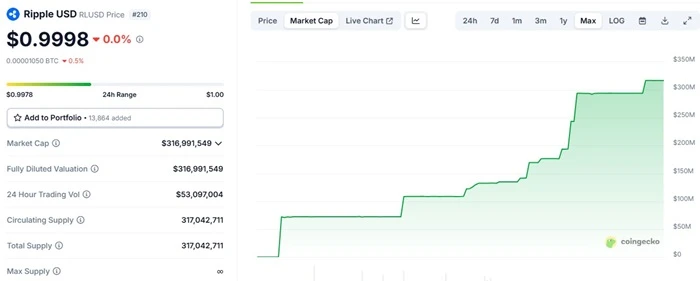

In fact, as early as mid-2024, Ripple CEO Brad Garlinghouse confirmed the stablecoin strategy and announced the launch of the RLUSD stablecoin at the XRP Ledger community summit. After receiving approval from the New York Department of Financial Services (NYDFS), RLUSD officially launched at the end of last year, currently boasting a market cap of approximately $316.9 million, marking a good start.

However, for the current stablecoin market, which has a market cap close to $245 billion, RLUSD's performance has been lukewarm. If a “conservative” strategy is adopted, it seems difficult to keep up with rapidly developing competitors. Not to mention the market cap nearing $149 billion for USDT, approximately $61.5 billion for USDC, and even USD1, which recently surpassed a $2 billion market cap shortly after its launch, RLUSD's advantages are not very apparent.

Therefore, Ripple's acquisition of Circle is not just about expansion; it is also an acceleration strategy that allows Ripple to quickly secure a place in the global stablecoin economy.

Will Circle Say “Yes”?

From Circle's perspective, being acquired is not necessarily a bad thing.

First, the massive funding is highly attractive. Ripple's $5 billion acquisition offer is very appealing, and such an injection of capital could significantly accelerate Circle's global expansion. Additional funds could also drive deeper R&D and expand Circle's partnerships, especially in markets where infrastructure and access are still developing.

Second, the synergy between Ripple and Circle could yield “Win-Win” potential. Ripple brings rich experience in navigating complex global regulations and a proven blockchain network, while Circle already has extensive experience in stablecoin operations. Combining the two could spark the creation of entirely new financial products, such as tokenized payment systems, cross-border settlement innovations, and hybrid DeFi/TradFi solutions.

We must not overlook the geographical advantage; Ripple has a well-established international footprint. Its network extends far beyond U.S. borders, with strong relationships in Asia, Latin America, and Europe. Ninety percent of Ripple's business is conducted outside the U.S., and this influence could help USDC enter rapidly growing markets where stablecoin adoption is still in its infancy.

Will Circle Say “No”?

Although Ripple may reiterate its acquisition offer, Circle has temporarily rejected it on the grounds that the offer is too low. From the latest developments, Circle's decision may involve three reasons: valuation, vision, and regulation.

In terms of valuation, USDC's market cap is currently close to $62 billion, and with Circle's IPO plans in full swing, Ripple's acquisition offer at this time seems more like “speculation.” Circle is not a company seeking an exit but is moving towards a broader future in the stablecoin market. The $5 billion acquisition may not only underestimate Circle's financial status but also the strategic importance of USDC in the evolving digital dollar landscape.

Secondly, Circle has a clear vision, and merging with a direct competitor could create friction. While Ripple and Circle both operate in the stablecoin space, RLUSD and USDC do not fully align in governance models, market strategies, etc. An acquisition could lead to a realignment of priorities, potentially undermining Circle's mission-driven approach to an open financial system.

Thirdly, the regulatory perspective cannot be ignored. The merger of two heavyweight companies in the crypto ecosystem would trigger stricter scrutiny from global regulators. Especially in the current environment—where U.S. lawmakers are actively defining the digital asset framework—this move could lead to severe operational slowdowns, legal complexities, and even resistance from certain jurisdictions.

What Does Circle's Decision Mean for the Market and Stablecoins?

Circle's rejection of Ripple's acquisition is not just a story about price; it is a signal of belief—that Circle believes its independent strategy is stronger than a quick acquisition. As the IPO progresses, Circle aims to establish USDC as the global standard for dollar-backed stablecoins, doubling down on its reputation for transparency, compliance, and innovation.

At the same time, Ripple will not give up on the “big cake” of the stablecoin market. RLUSD is currently in the early stages of its lifecycle, but Ripple's actions indicate a long-term strategy aimed at integrating blockchain infrastructure with traditional finance. Whether through additional acquisitions, deeper ecosystem investments, or policy collaborations, Ripple will persist and fight for victory.

It can be said that stablecoins are no longer a simple crypto tool but are rapidly becoming a digital conduit for global capital flows, a coveted power play—whoever controls the stablecoin standards, access, and integration points can shape the future of cross-border payments, institutional-level DeFi, and programmable finance.

The Power Play—Larger than Circle and Ripple

For leaders in fintech, digital assets, and global payments: merely relying on market share will not win the future; “winning” is about ecosystem coverage, interoperability, and trust. The stablecoin race is far from over, and the true winners will be those who can innovate boldly while maintaining enough resilience to cope with regulation, market volatility, and global demand. Stablecoins are becoming a core pillar of the cryptocurrency ecosystem, and in the coming years, the integration, competition, and regulatory battles surrounding “compliant stablecoins + payment networks” will become the main theme.

Ripple's acquisition offer to Circle may seem like a mere acquisition deal, but it reflects the maturity of the stablecoin ecosystem and the blurred lines between crypto-native innovation and institutional adoption of stablecoins, further reflecting the importance of strategic alignment when traditional finance meets crypto finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。