The weekend homework is still a bit simpler. Recently, the market has gradually lost its temper under the effect of Trump. The best news in the past two days is the decline in core PCE, which at least indicates that inflation trends are showing results without tariff interference. Of course, the interest rate cut in March is already inevitable, and tariffs will also be implemented in March, so the current core PCE is just for observation; the Federal Reserve will not take action lightly.

Another piece of good news is that on March 7 (with the background time being early March 8), Trump will hold a White House cryptocurrency summit. Attendees will include well-known figures from the cryptocurrency industry. This should be the first public exposure of the White House and the president's combination with cryptocurrency. After the news broke, the market responded positively, and with lower liquidity over the weekend, Bitcoin's price returned to around $85,000.

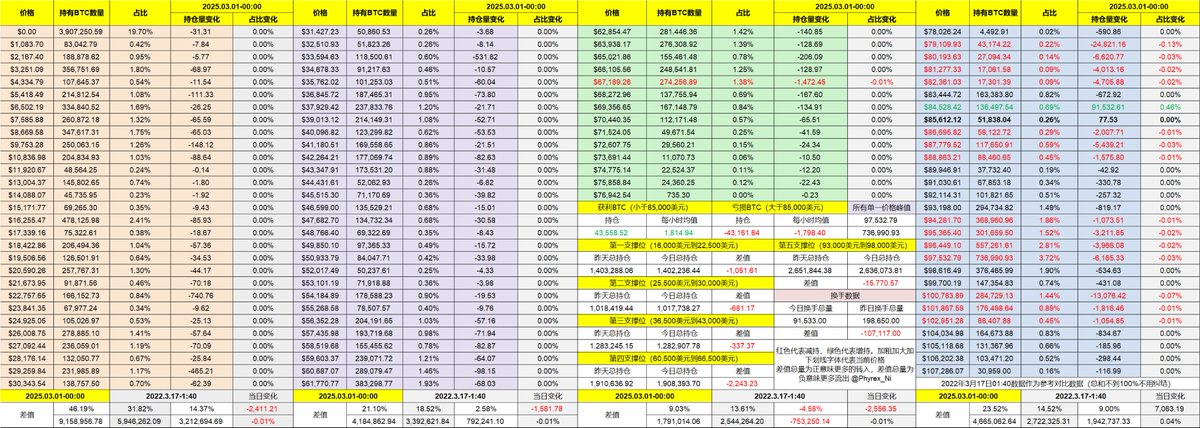

Although there is still some panic sentiment, which can be seen in the turnover data, there has been a significant decline in data. More investors, whether due to the arrival of the weekend or expectations for the crypto summit, have stabilized their emotions; otherwise, the weekend could have been difficult.

For the current market, many investors are already worried about whether we are in a bear market. After all, not only is #BTC declining, but even #ETH has dropped back to 2021 levels, not to mention most other altcoins. March should be the dividing line between bulls and bears in the short term. What will be said at this crypto summit is uncertain, but based on recent policy levels, it is highly likely to focus on stablecoins and strategic reserves.

In particular, stablecoins may take the lead. The hard peg of stablecoins is definitely a key focus of the current U.S. cryptocurrency landscape. After all, only when stablecoins are fully compliant can the U.S. dollar maintain its hegemony through blockchain and cryptocurrency.

Therefore, whether this meeting will involve strategic reserves or release some favorable news for the cryptocurrency industry may be the focus of everyone's attention. However, in reality, the market has become somewhat immune to purely positive news. If it is still just verbal information, it is estimated that it will not have a significant effect. But honestly, I can't think of what else the president could realistically do.

However, as long as there is no hardline stance, it is highly likely that market sentiment will warm up. Moreover, the meeting is after the non-farm payroll data, and if the non-farm data is relatively good, it is even possible for the price to return to $90,000 during the meeting. But don't get too excited; two weeks after the meeting is the Federal Reserve's March interest rate meeting, along with the dot plot. Those who plan to enter this industry before December 2024 already know how powerful the dot plot can be.

The March dot plot may be the dividing line between bulls and bears for the next quarter. If the dot plot shows a rate cut of 2 in 2025, the market may experience slight disappointment but can still accept it, especially with the pressure of tariffs. If it is greater than 2, I think market sentiment is very likely to be stirred up, and if it is less than 2, it may be uncomfortable.

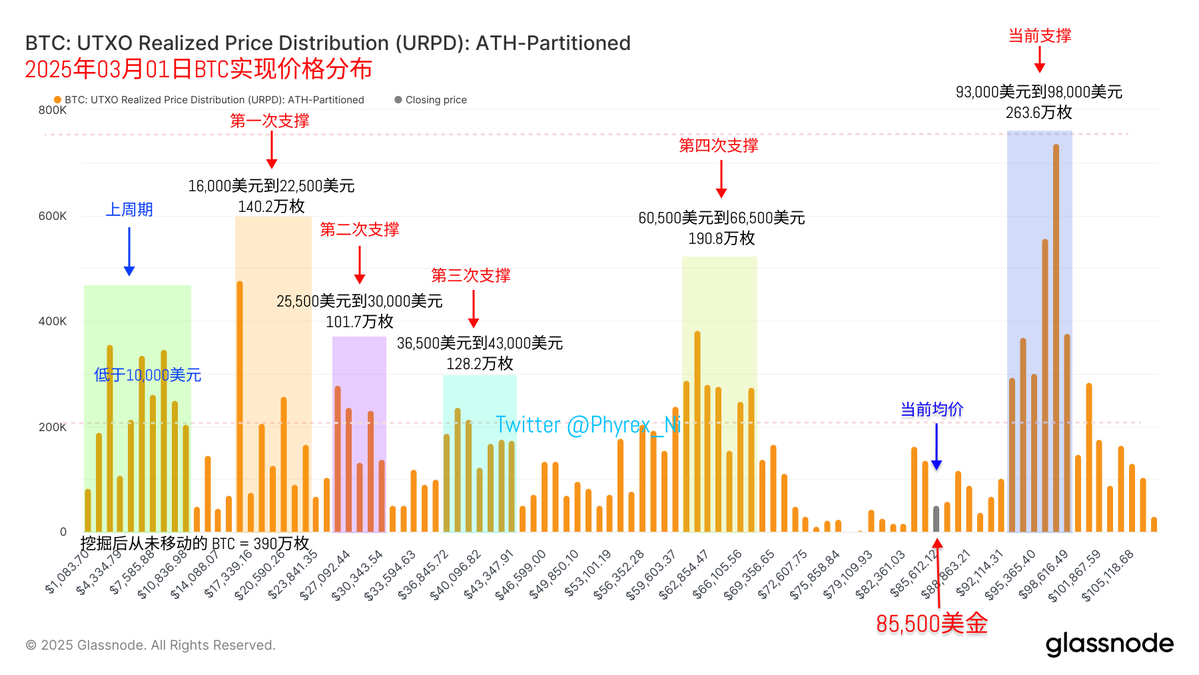

Currently, Bitcoin's support remains quite solid, with chips between $93,000 and $98,000 not continuing to expand panic. A large number of investors have not shown signs of exiting, so in the short term, we have not seen too terrifying emotions. However, the CME gap has not been fully filled, and the URPD gap is still missing two candles.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。