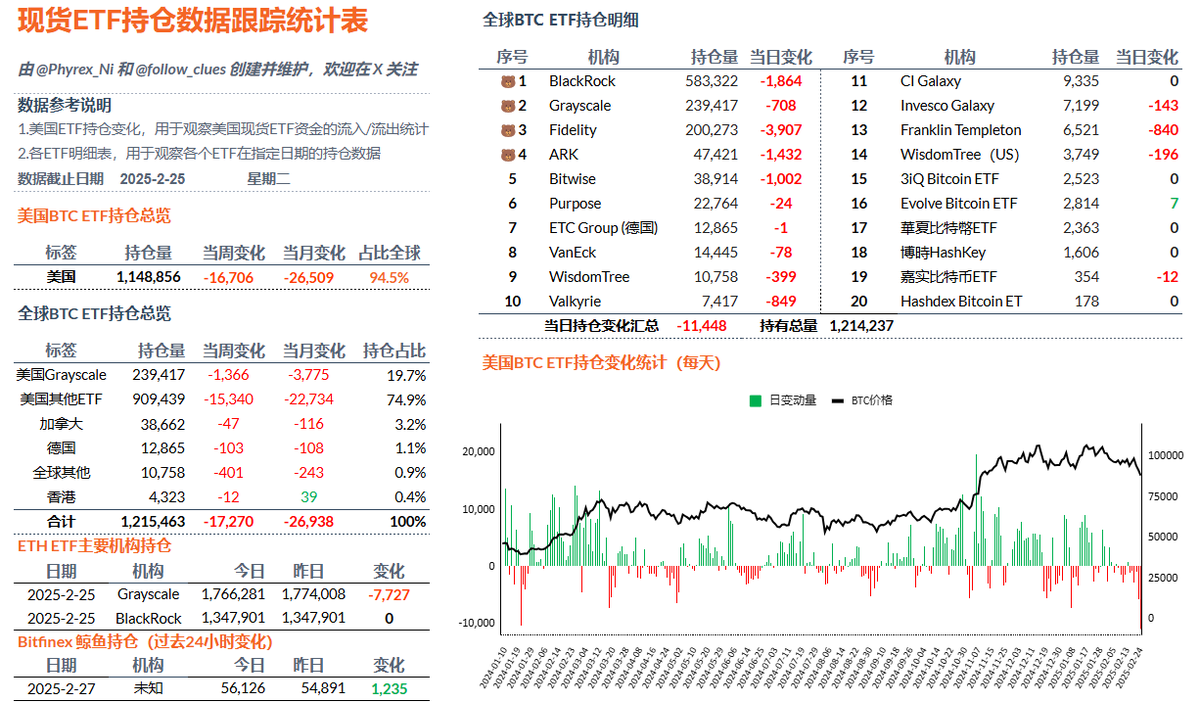

The largest BTC spot ETF sell-off in history has occurred. Many friends may have already seen the funding data, but looking at the actual sell-off data might feel different. In the last working day, there was a net outflow of 11,019 #BTC, with 11 out of 12 spot ETF institutions experiencing net outflows, and only one remaining at zero.

Institutions like BlackRock, Fidelity, ARK, and Bitwise all saw four-digit reductions, with Fidelity having the largest sell-off. Although over 11,000 BTC may not have all been directly dumped into the market, investor sentiment is clearly visible. Whether it's institutional investors engaging in arbitrage or retail investors' expectations, signs of exit are beginning to appear.

The sell-off yesterday accounted for 1% of the total amount held by U.S. investors, and this form of sell-off is quite alarming. The most frustrating part is that there is currently no clear negative information. Even regarding tariff issues, there are not completely unsolvable problems, and even if it starts, it will only begin on April 1. It can only be said that a large number of investors have already begun to enter a state of panic.

The main reason for the panic is still the U.S. monetary policy. If these are difficult times now, it can only be said that the coming times will be even tougher.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。