One of the most renowned investment companies in the U.S., ARK Invest, has listed stablecoin protocols as one of the most important trends in the coming years in its latest forward-looking report, "Big Ideas 2025." This prediction highlights a powerful example of rapid development today: Web3 projects have pushed the market size of non-fully-collateralized stablecoin protocols to $6 billion within just 12 months, and ARK Invest has categorized it as a "significant trend for 2025." But is this experiment a breakthrough for innovators, or the beginning of another leveraged game?

In this article, let’s delve into ARK's predictions regarding the future impact of stablecoin protocols.

The Rise of Stablecoin Protocols

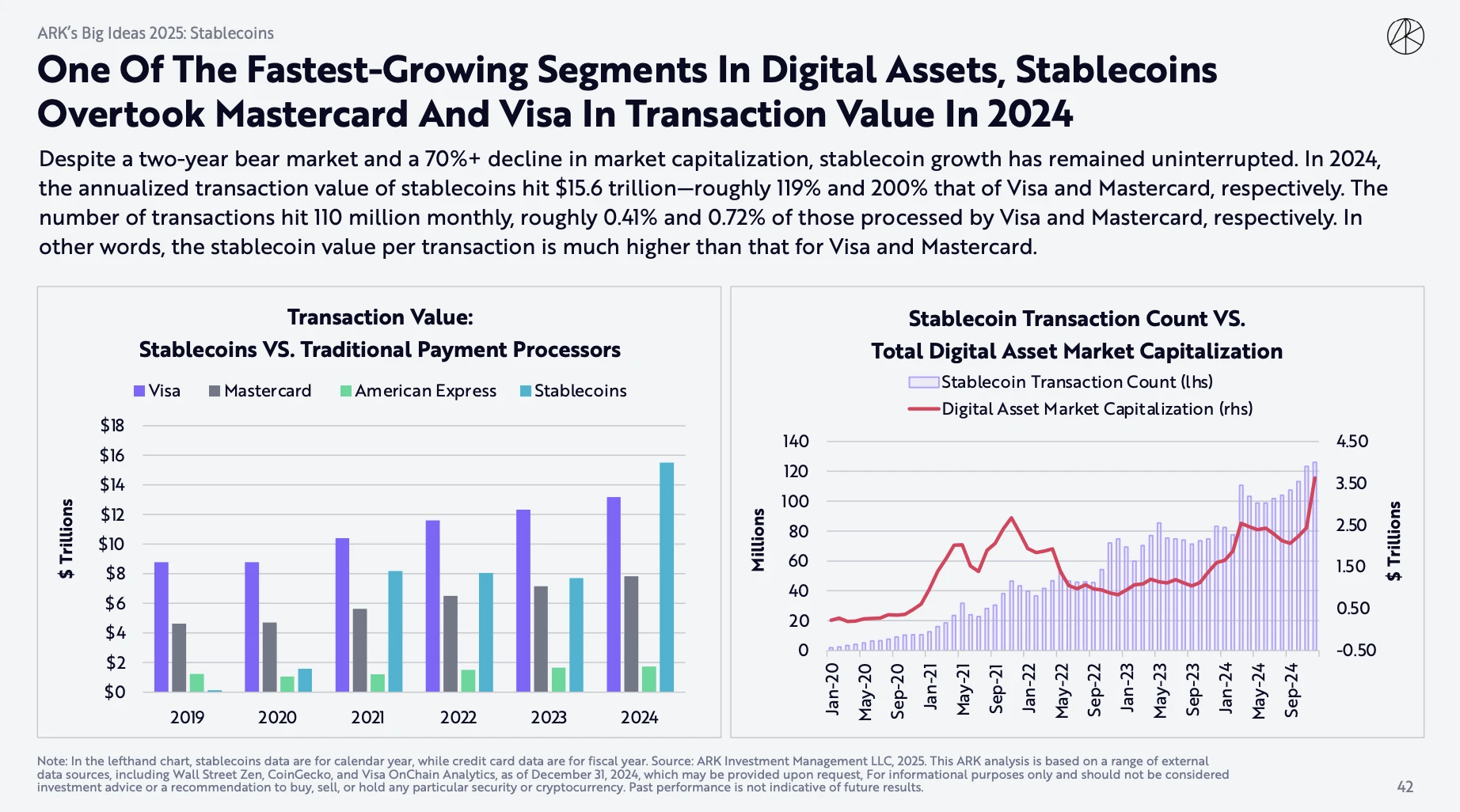

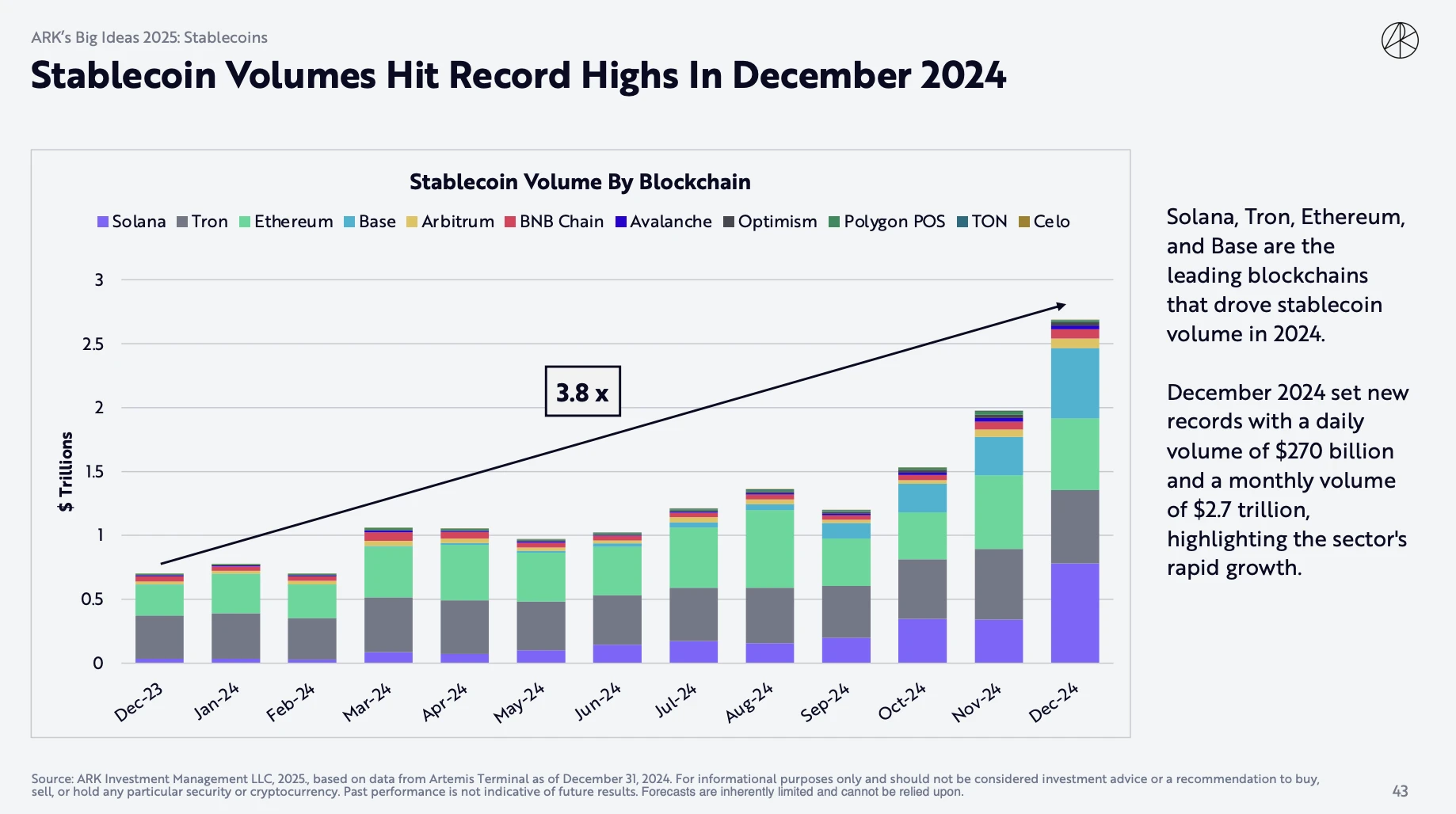

According to the report, the annualized trading value of stablecoins reached an impressive $15.6 trillion in 2024, surpassing the annualized trading values of Visa and Mastercard by 119% and 200%, respectively. Even more astonishing, in December 2024, the daily trading volume of stablecoins hit $270 billion, with monthly trading volume soaring to $2.7 trillion. These figures strongly demonstrate the rapid expansion of stablecoin protocols in the global payment and trading sectors, as well as their significant risk resistance capabilities in responding to market volatility.

In addition to the substantial growth in trading volume, the number of active users of stablecoin protocols has also reached a historic high. The report indicates that the number of active stablecoin addresses has reached 23 million, and the application scope of stablecoin protocols has far exceeded the realm of cryptocurrency trading, beginning to penetrate broader financial fields and attracting more ordinary users to participate. Meanwhile, the total supply of stablecoins has reached $203 billion, equivalent to 0.97% of the U.S. M2 money supply. Although this ratio may seem low, considering that the stablecoin protocol market is still in its early development stage and its global application potential, this figure suggests that stablecoin protocols may have a profound impact on the global financial system in the future.

In terms of market share, USDT and USDC continue to dominate, together accounting for over 90% of the market share. However, the flourishing multi-chain ecosystem has also brought new growth momentum. Blockchains such as Solana, Tron, Ethereum, and Base have become the main forces driving the growth of stablecoin protocol trading volume.

$200 Billion Prediction

ARK Invest boldly predicts that by 2025, the market size of stablecoin protocols will exceed $200 billion.

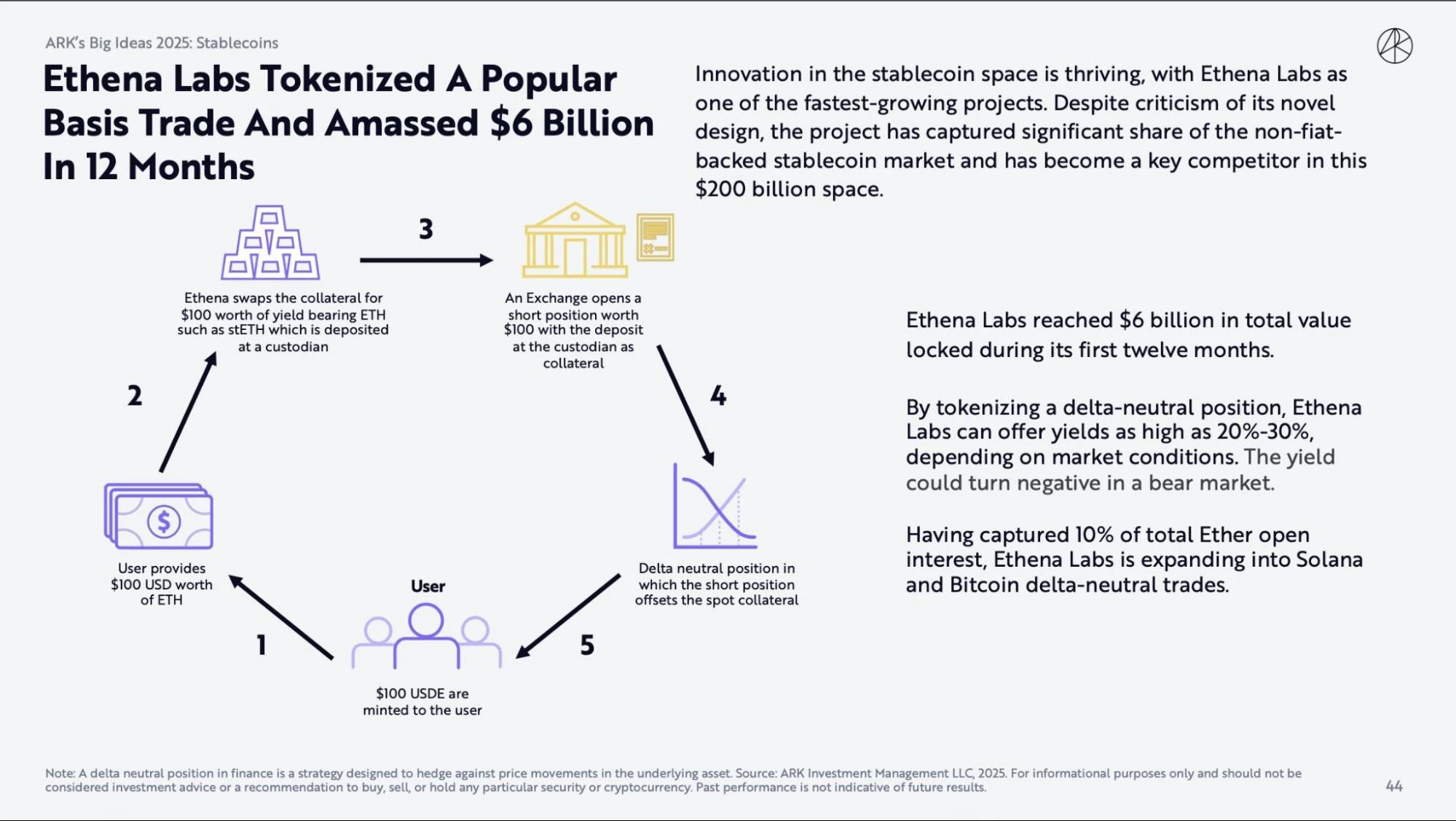

The report mentions the rise of Ethena Labs as a strong testament to ARK Invest's prophecy.

The core innovation of Ethena Labs lies in tokenizing delta-neutral strategies, essentially transforming unique arbitrage opportunities in the crypto market into the fuel for minting stablecoin protocols: by going long on spot and shorting contracts, it generates returns through the interest rate differential between funding rates and spot prices. This structures the returns, packaging basis returns into interest-bearing assets with annualized yields of 20%-30%, attracting arbitrage capital influx. It automates risk hedging, with collateral achieving real-time hedging of on-chain/off-chain positions through custodians, maintaining a 1:1 peg.

This mechanism no longer relies on fiat reserves but instead transforms market arbitrage opportunities into intrinsic value support for stablecoin protocols. This innovative value anchoring mechanism significantly enhances the capital efficiency of stablecoin protocols and provides broader space for their scale expansion.

Transformation of Stablecoin Protocols

ARK Invest's report points out that the rise of stablecoin protocols will profoundly change the cryptocurrency market, pushing it into a new era of "yield rights revolution." This revolution is not merely a technological innovation but a comprehensive reshaping of the crypto financial system, centered on creating, distributing, and trading yield rights as a new financial asset. This shift is primarily reflected in three key transitions:

Transition One: Yield Rights Securitization - Merging the Essence of DeFi and Traditional Finance

ARK Invest's report emphasizes that Ethena Labs has successfully introduced the structured product thinking from traditional finance into the DeFi space, achieving a remarkable transformation of stablecoin protocols from mere payment tools to yield-generating tools. This marks a shift where stablecoin protocols are no longer just mediums for storing and transferring value but have become financial assets capable of generating continuous returns.

Ethena Labs' USDe stablecoin protocol can essentially be understood as a call option on basis returns. By cleverly utilizing the basis (the price difference between spot prices and perpetual contract prices) and the differences in funding rates in the cryptocurrency derivatives market, USDe can continuously provide returns to its holders. It brings a new financial product design approach to the DeFi space, laying the foundation for future innovations in more complex yield rights products.

Transition Two: Capital Efficiency Upgrade - The Efficiency Advantage of Stablecoin Protocols

Compared to traditional over-collateralized stablecoin protocol models, the delta-neutral strategy adopted by Ethena Labs demonstrates significant capital efficiency advantages.

The traditional over-collateralized model requires holding a large amount of fiat or crypto assets as collateral, which not only increases funding costs but also reduces capital utilization. In contrast, stablecoin protocols can achieve the same level of risk control with lower capital usage by cleverly employing derivative hedging strategies. Ethena Labs leverages its expertise and technological advantages in the derivatives market to accurately hedge market risks, thereby minimizing the need for over-collateralization and achieving a significant improvement in capital efficiency. This higher capital efficiency not only reduces the issuance costs of stablecoin protocols but also provides greater space for their scalable expansion.

Transition Three: Accelerated Institutionalization Process - Stablecoin Protocols Become New Favorites for Institutional Investors

ARK Invest's report predicts that the rise of stablecoin protocols will accelerate the institutionalization process of the cryptocurrency market. As stablecoin protocols can generate stable returns and possess higher capital efficiency, hedge funds and asset management institutions are beginning to incorporate stablecoin protocols into their cash management strategies. This marks a new height in institutional investors' acceptance and participation in the cryptocurrency market.

The large-scale influx of institutional funds will further drive exponential growth in the stablecoin protocol market size, making it an indispensable part of the cryptocurrency ecosystem. This trend of institutionalization not only brings greater financial support to the stablecoin protocol market but also provides stronger stability for its long-term development.

The validation of ARK Invest's predictions is an important experiment in the maturation of the stablecoin protocol market. However, historical experience shows that all financial innovations must undergo a complete bull-bear test. Perhaps only when the next black swan event occurs will we truly see whether this revolution is the cornerstone of reconstructing the financial order or yet another castle in the air.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。