It's really not a good idea to write long articles at night. The state data from yesterday and today's Coin financial report were both started in the evening, and it took several hours to write. In between, I mixed in a few news items, and by the time I started my homework, it was already 5 AM. By the time I finished, it was probably dawn. I definitely need to change this habit, but sometimes I just can't help it; when I see a topic I want to write about, I can't stop.

Today's market is still quite good, mainly for a few reasons. One is that Trump is assisting in ending the Russia-Ukraine conflict, which could lower inflation. If a ceasefire can be achieved before April 1, it could almost offset the effects of the real tariff increases, making inflation not so pessimistic.

Secondly, a large amount of data was released in the 13F filings, including information about the Abu Dhabi sovereign fund Mubadala investing approximately $460 million in a #Bitcoin spot ETF. This data was a major reason for BTC's price rising above $98,000. Although it has come down a bit now, it still has a positive stimulating effect on the market, as it represents sovereign nations starting to make indirect investments in cryptocurrencies, especially wealthy nations.

Additionally, State Street Bank and Citibank announced that they can accept cryptocurrency custody. Specific details have not been released yet, but it seems likely that Bitcoin will be the starting point. With custody accepted, collateralized lending based on banks should also be coming soon. This means that the #BTCFi brought by banks will have significant development space. Furthermore, the SEC's understanding of the POS staking system is also news today, which directly benefits #ETH and #SOL. Overall, the recent policy environment is still quite good.

The biggest challenge still comes from the macroeconomic side, and there are no solutions in the short term. We'll just take it slow for now.

Looking at the data for #BTC itself, short-term investors are still the main force in trading, and there is a lot of information today, so volatility has increased a bit. Investor sentiment is also high, with many bottom-fishing investors leaving the market, likely believing that this sentiment won't last long. However, it is indeed true that BTC's price has dropped, and relying solely on emotional FOMO is not enough. Now is a good time for grid trading.

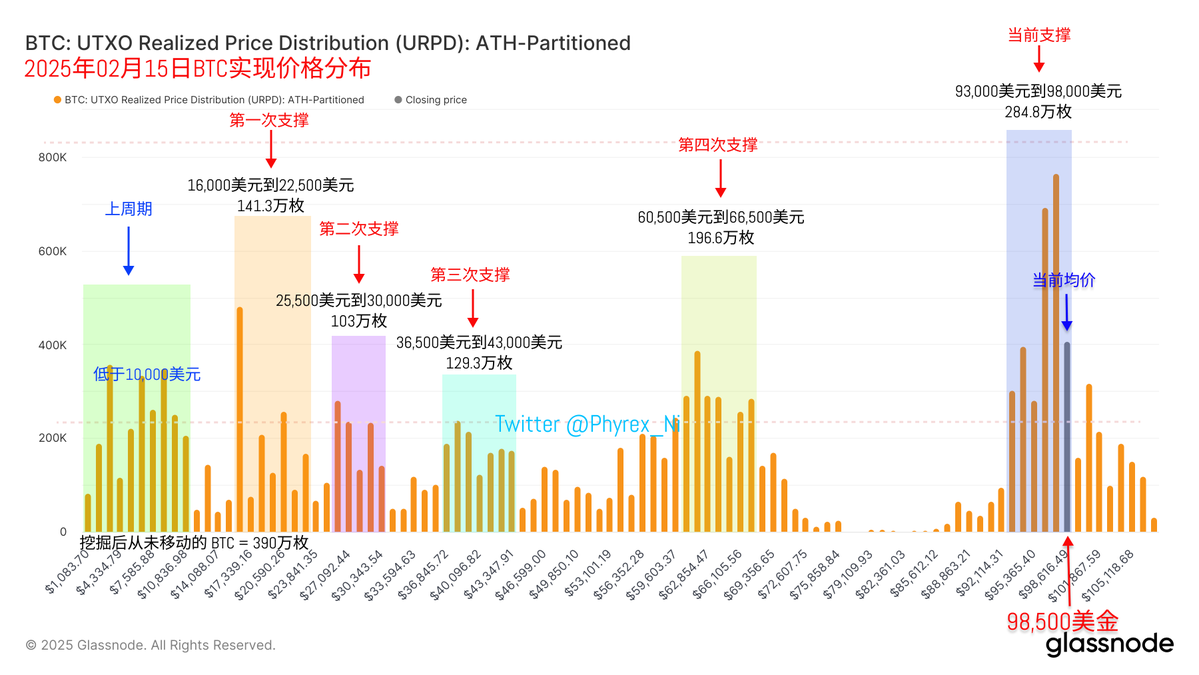

Although volatility has increased a bit, support remains strong. The range of $93,000 to $98,000 is still very solid, and this portion of chips continues to increase, remaining within a safe line for now.

The next two days will be the weekend, entering the "garbage time" of garbage. However, Friday's sentiment is still good, and there shouldn't be too many surprises over the weekend. If, and I mean if, there is a chance to rise to $100,000 over the weekend, I will start doing short trades; otherwise, I will just continue to watch.

PS: I just realized I haven't even taken a shower yet; it turns out I shouldn't go out at night. I spent a lot of time going out, a lot of time on the long article, and now I have to squeeze in time for replies. My bad.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。