"If only we could establish a position before the ME launch…" Such exclamations are everywhere in the crypto market. When a high-quality project officially launches, the best entry point is often missed.

Today, PVP in the crypto market is ubiquitous, and early positioning often means greater profit potential. Data shows that star projects like ME and HYPE have already demonstrated astonishing growth potential in the pre-market, bringing considerable returns to early participants. This strong demand for early positioning in quality projects has given rise to the innovative market form of pre-market trading.

A deep analysis of the underlying logic behind the rise of pre-market trading reveals three key driving factors: First, early investors and project parties need a liquidity outlet to realize their investment returns; second, new investors are eager to participate in the project's early stages to share in future growth dividends; and most importantly, the market urgently needs an effective price discovery mechanism to provide a valuation anchor for the official token issuance.

The Evolution and Reconstruction of the Pre-Market

The development of the pre-market trading market is essentially a process of continuous optimization of market structure. This process reflects the changing demands of market participants for trading mechanisms and showcases the ongoing improvement of the crypto market infrastructure. Looking back at the trajectory of pre-market trading, we can clearly see the evolution of three important stages:

Traditional OTC Trading: Mainly relies on intermediaries for matching. Although this model meets the basic needs of early users, issues such as severe information asymmetry and uncontrollable credit risks of intermediaries severely restrict the healthy development of the market.

DEX Pre-Market Trading: DEX platforms represented by AEVO and Whales Market have achieved trustless trading through smart contracts, solving the credit risk problem. However, disadvantages such as fragmented liquidity and complex operations also limit their development space.

Centralized Exchange Pre-Market Trading: Provides better liquidity through a centralized order matching system, and a professional risk control system significantly reduces market risks. The standardized trading process also offers users a better experience.

Although these three models currently coexist, centralized exchanges, with their inherent advantages in market organization efficiency, are becoming the dominant force in the pre-market trading market.

Diverse Centralized Exchange Pre-Market Trading Ecosystem

Currently, the centralized exchange pre-market is showing a trend of scaled development. According to market data, mainstream exchanges have their own characteristics in their layouts, and this differentiated layout reflects the exchanges' different strategic positioning in the pre-market.

By analyzing the pre-market trading numbers of major exchanges, we can observe several key trends:

Increased Project Diversity

The types of projects in the pre-market are becoming increasingly diverse, ranging from Layer 1 to DeFi tools, from on-chain derivatives to re-staking projects, providing investors with a broader selection space. Taking LBank as an example, among its 15+ pre-market projects, there are representative projects from different tracks such as BERA, SOLV, HYPE, and EIGEN. This diversified layout helps to disperse risks and enhance overall market stability.

Differentiated Access Strategies

Binance's pre-market trading is only open to specific users, Bybit chooses to limit pre-market trading permissions to UTA users, while Gate and OKX adopt strict KYC access mechanisms. Although this approach limits the participant group, it helps maintain the stability of brand reputation.

Platforms like LBank have adopted a more inclusive access strategy by removing KYC requirements. This flexible access mechanism not only ensures market safety but also provides opportunities for a broader user base to participate. Different access strategies essentially reflect each exchange's understanding of market positioning and risk management.

Market Strategy Differentiation

Leading exchanges like Binance and Bybit maintain a high entry threshold due to their brand effect and capital advantages, which helps maintain the platform's professional image and market stability. Data shows that Binance has strict standards for listing pre-market assets; as of February 0, it has only listed 2 pre-market assets (SCR, USUAL) and has strictly limited trading volumes, capping the maximum holdings for each token. Bybit is slightly more lenient than the former, listing 32 assets including ZERO, HMSTR, CATI, and HYPE, but controls participation thresholds by requiring both buyers and sellers to stake assets on the platform.

Meanwhile, emerging exchanges demonstrate more flexible competitive thinking, enhancing market share through innovative user incentive mechanisms. For example, LBank's price protection activity launched for the DOGS project is a typical case: by providing users with potential downside protection, it lowers the psychological barrier for user participation. This strategy of exchanging benefits for market presence is significantly attractive in the currently competitive pre-market.

It is worth noting that this price subsidy mechanism actually reflects the second-tier exchanges' focus on user experience and actual returns in the face of market competition, adopting a market competition mindset that sacrifices short-term profits to gain long-term market share.

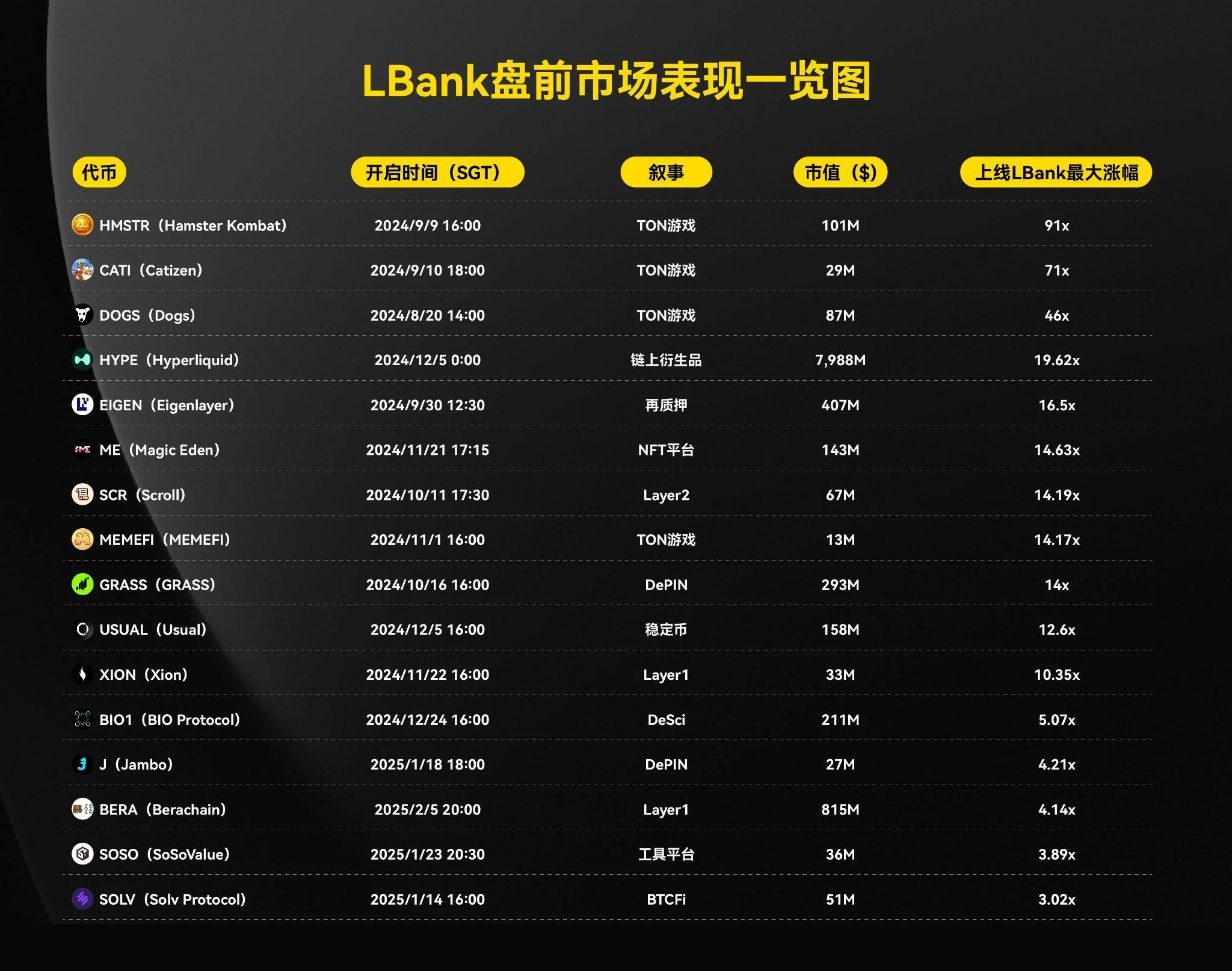

In the practice of these differentiated competitive strategies, multiple pre-market projects launched by LBank have shown good market performance. Data indicates that the platform has successfully positioned several high-growth projects:

HMSTR and CATI in the TON gaming track achieved astonishing increases of 91 times and 71 times, respectively;

The on-chain derivatives project HYPE also achieved an excellent performance of 19.62 times;

The re-staking field's EIGEN reached a growth of 16.49 times.

Additionally, projects like the NFT platform ME (14.625 times) and Layer 2 project SCR (14.18 times) have also shown strong market performance.

In the fierce competition among centralized exchanges, LBank has performed remarkably in recent years, showing a strong growth trend. Especially in the Meme track, at the beginning of 2025, leveraging its keen market sense, LBank successfully positioned itself in popular Meme tokens like TST and TRUMP, which achieved considerable returns of 68.42 times and 56.54 times, respectively, further solidifying the platform's position as the preferred platform for investors to obtain Beta returns. This successful experience in the Meme track has also been replicated in other tracks, maintaining a prudent balance in project structure through strategic layout of diversified pre-market assets, providing users with richer investment choices while effectively dispersing investment risks.

The Evolution of the Pre-Market

As an unconventional trading method, pre-market trading has transcended platform limitations, becoming an important component of the collective psychology of the entire crypto market. Looking ahead, as large institutions gradually intervene and the regulatory environment improves, this market will continue to iterate in terms of transparency, liquidity, and risk management, rapidly developing into a more mature and rational value discovery mechanism.

In this rapidly evolving market, the ability to keenly grasp opportunities is becoming the core competitiveness of centralized exchanges. Recently, following Binance's announcement to launch the Solayer project, LBank quickly responded and took the lead in initiating pre-market trading for the project while launching a price protection limited activity. This rapid market response and strategic layout to seize investment opportunities have established LBank's advantage in the ever-changing crypto market.

It is certain that exchanges like LBank, which focus on user experience, emphasize risk control, and possess market sensitivity, will occupy an important position in future market competition. For investors, maintaining an open perspective, rational judgment, choosing the right platform, and closely tracking structural changes in the market will be key to obtaining excess returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。