Table of Contents:

Large Token Unlock Data for This Week;

Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows by Sector;

Inflow and Outflow of Spot ETF Funds;

Changes in BTC Reserve Balances on CEX;

Key Macroeconomic Events and Economic Data Forecast for This Week.

1. Large Token Unlock Data for This Week;

This week, tokens such as CHEEL, CONX, and SAND will experience significant unlocks, with the largest single unlock being CHEEL, valued at approximately $169 million. Among them:

Cheelee (CHEEL) will unlock approximately 20.8 million tokens at 8:00 AM on February 13, valued at about $169 million;

Connex (CONX) will unlock approximately 4.33 million tokens at 8:00 AM on February 15, representing 376.3% of the current circulating supply, valued at about $87.8 million;

The Sandbox (SAND) will unlock approximately 205.59 million tokens at 8:00 AM on February 14, representing 8.41% of the current circulating supply, valued at about $80.2 million;

Berachain (BERA) will unlock approximately 12.98 million tokens at 9:00 PM on February 10, representing 12.08% of the current circulating supply, valued at about $75.9 million;

Aptos (APT) will unlock approximately 11.31 million tokens at 8:00 PM on February 10, representing 1.97% of the current circulating supply, valued at about $66.7 million;

Avalanche (AVAX) will unlock approximately 1.67 million tokens at 8:00 AM on February 16, representing 0.40% of the current circulating supply, valued at about $41.7 million;

Polyhedra Network (ZKJ) will unlock approximately 17.22 million tokens at 8:00 AM on February 12, representing 28.52% of the current circulating supply, valued at about $35.1 million;

Aethir (ATH) will unlock approximately 630 million tokens at 6:00 PM on February 12, representing 10.21% of the current circulating supply, valued at about $24.5 million;

Starknet (STRK) will unlock approximately 64 million tokens at 8:00 AM on February 15, representing 2.48% of the current circulating supply, valued at about $15.7 million.

Sei (SEI) will unlock approximately 55.56 million tokens at 8:00 PM on February 15, representing 1.25% of the current circulating supply, valued at about $12.7 million.

The above times are in UTC+8. This week, pay attention to the negative effects brought by the unlocking of these tokens, avoid spot trading, and seek shorting opportunities in contracts. Among them, CHEEL, CONX, and SAND have a large proportion and scale of unlocked circulating supply, warranting extra attention.

2. Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows by Sector

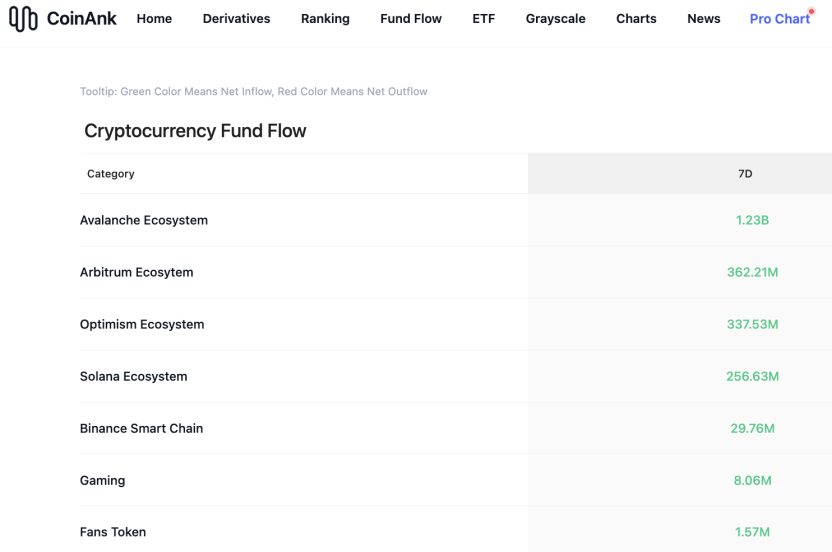

Data shows that in the past week, net fund inflows in the crypto market, categorized by concept sectors, were concentrated in the Avalanche ecosystem, Arbitrum ecosystem, Optimism ecosystem, Solana ecosystem, Binance Smart Chain, gaming, and fan token sectors. Additionally, several tokens experienced rotational increases over the past week. The following are the top 500 by market capitalization, with tokens such as BNX, PROM, GMX, XNO, KMNO, and STPT showing relatively high increases, which can continue to be prioritized for trading opportunities in strong tokens.

3. Inflow and Outflow of Spot ETF Funds.

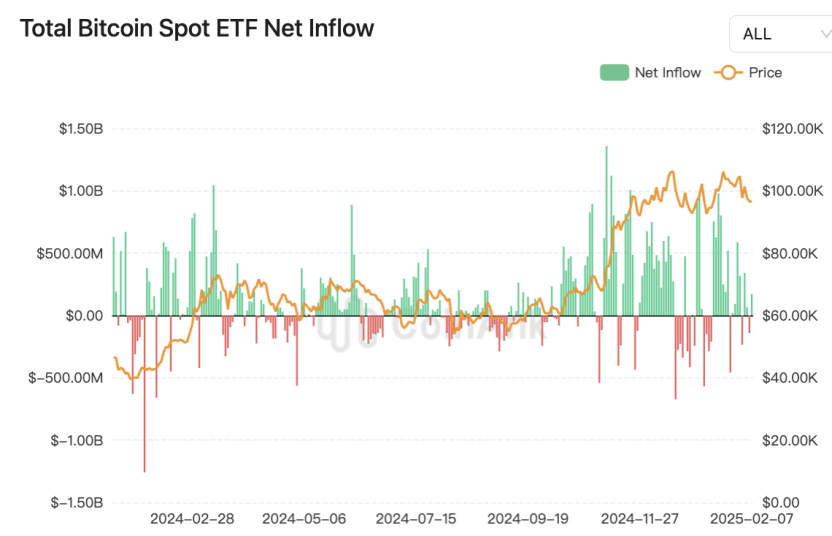

Data shows that in the past week, the net inflow into U.S. Bitcoin spot ETFs was $193 million, with a trading volume of $17 billion, including: - BlackRock inflow of $305 million; - Ark Invest inflow of $64 million; - Bitwise inflow of $21 million; - Fidelity outflow of $218 million.

In the past week, the performance of ETH spot ETFs was stronger compared to BTC, with net inflows exceeding $400 million, double that of BTC spot ETFs, with a net increase of 146,541.77 ETH.

On Tuesday of last week, influenced by the SEC's adjustment of ETF plans, market expectations suggested that spot trading and staking mechanisms might be allowed, leading to a single-day net inflow of up to 106,924.01 ETH, setting a record for the largest single-day inflow. However, despite the strong inflow, ETH prices fell instead of rising.

We believe that the fund flows of U.S. crypto spot ETFs in the past week exhibited significant structural differentiation: Bitcoin ETFs had a net inflow of $193 million, but internal institutional strategies were clearly differentiated, with BlackRock dominating with a net inflow of $305 million, while Fidelity experienced an outflow of $218 million, which may reflect some institutions taking profits or adjusting their holdings at high levels. In contrast, Ethereum spot ETFs performed more strongly, with a weekly net inflow of $420 million, twice that of Bitcoin, including a single-day peak inflow of over 100,000 ETH, setting a historical record, mainly driven by expectations that the SEC might allow staking mechanisms for spot ETFs.

It is noteworthy that there is a divergence between Ethereum's fund inflows and price movements. Despite significant fund inflows, ETH prices fell, which may reflect market concerns about selling pressure after staking unlocks, or some funds hedging spot positions through ETFs. Additionally, institutions like BlackRock are optimizing product features through acquisitions of staking service providers, enhancing the attractiveness of Ethereum ETFs, but short-term arbitrage activities in the derivatives market may suppress price elasticity.

In comparison to Bitcoin, the differentiation in its ETF market highlights the dominance of institutions: BlackRock's IBIT has seen total historical inflows exceeding $40.7 billion, becoming a core funding pool, while Fidelity's outflows may resonate with Grayscale's GBTC continuous selling pressure, indicating that the Bitcoin ETF market has entered a stage of stock game. In the future, as expectations for Ethereum's staking mechanism implementation rise, its ETF may further divert traditional institutional funds, but caution is needed regarding regulatory policies' potential phase restrictions on innovative functions.

4. Changes in BTC Reserve Balances on CEX.

According to CoinAnk data, in the past 7 days, CEX has seen a cumulative net inflow of 49,127.3 BTC, with the top three CEXs by inflow as follows:

Coinbase Pro, inflow of 63,466.85 BTC;

Bybit, inflow of 22,411.82 BTC;

Gemini, inflow of 3,956.05 BTC.

In the past 30 days, CEX has seen a cumulative net inflow of 29,962.86 BTC.

We believe that the significant increase in Bitcoin's net inflow on CEX in the past week reflects that market participants may have reduced interest in trading or investment activities. Further observation shows that the cumulative net inflow over the past 30 days is lower than the inflow level of the past 7 days, indicating an acceleration in recent inflow speed. This may suggest a decrease in market demand for Bitcoin or concerns about future price movements, indicating potential selling pressure, which has also affected the recent decline in BTC prices.

5. Key Macroeconomic Events and Economic Data Forecast for This Week.

Recently, global investors have continued to worry about the tariff war, and Trump's erratic policies have further exacerbated market volatility. Meanwhile, the latest non-farm payroll data and the University of Michigan consumer confidence survey have made the outlook for Federal Reserve interest rate cuts more uncertain. In the coming week, Trump is expected to continue attracting significant market attention, with the latest developments in his tariff plans being closely watched. Additionally, U.S. inflation data and Federal Reserve Chairman Powell's testimony in Congress may be key factors influencing expectations for U.S. interest rate cuts. The following are the key points of market focus for the new week:

Monday 22:00, ECB President Lagarde participates in a plenary debate on the ECB's 2023 annual report;

Tuesday 0:00, U.S. January New York Fed 1-Year Inflation Expectations;

Tuesday 21:50, Cleveland Fed President Mester speaks on economic outlook;

Tuesday 23:00, Federal Reserve Chairman Powell attends a Senate hearing and delivers semi-annual monetary policy testimony;

Wednesday 4:30, FOMC permanent voting member, New York Fed President Williams speaks;

Wednesday 21:30, U.S. January CPI, Core CPI;

Wednesday 23:00, Federal Reserve Chairman Powell delivers semi-annual monetary policy testimony before the House Financial Services Committee;

Thursday 1:00, 2027 FOMC voting member, Atlanta Fed President Bostic speaks on economic outlook;

Thursday 21:30, U.S. Initial Jobless Claims for the week ending February 8;

Thursday 21:30, U.S. January PPI Year-on-Year and Month-on-Month;

Friday 21:30, U.S. January Retail Sales Month-on-Month;

Friday 22:15, U.S. January Industrial Production Month-on-Month;

Some Wall Street analysts point out that due to seasonal factors, predicting CPI for January is more challenging, which may increase market volatility risk at the time of data release. According to the Cleveland Fed's inflation Nowcasting indicator, the year-on-year growth rate of overall CPI for January is expected to be 2.85%, and the year-on-year growth rate of core CPI is expected to be 3.13%, slightly slowing compared to the previous month. This may enhance market expectations for the Federal Reserve to maintain stable interest rates at the March meeting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。