Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

In this cycle, ETH's performance has significantly lagged behind the overall market. Some attribute this to "heavy burdens," while others criticize the Ethereum Foundation (EF) for being "unworthy of its position." Recently, Layer2 has once again become the target of community criticism.

On February 9, the DeFi god of the last cycle and current co-founder of Sonic, Andre Cronje (AC), posted on X, angrily criticizing Layer2 for profiting immensely through continuous selling of sequencer earnings, becoming a parasite on Ethereum.

Become Layer2 ➡️ Run a centralized sequencer ➡️ Collect $120 million in fees ➡️ Pay $10 million to Ethereum for DA and security ➡️ Then sell off $110 million for profit ➡️ And still claim to be part of the "Ethereum Alliance" … I don't understand how the Ethereum community convinces itself to accept this logic. Layer2 has become the main reason for Ethereum's inflation again.

Layer2 Sequencer Earnings

The controversy over Layer2 sequencer earnings has long been a hot topic.

Sequencers are an essential role in Layer2, primarily serving to: 1) collect user transactions and package them into batches in a specific order; 2) provide instant transaction confirmation to users before the transactions are finally on-chain; 3) compress transaction data and submit it to Layer1, reducing gas costs.

In the decentralized vision of Layer2, the decentralization of sequencer operations is a necessary step, but the reality is that almost all Layer2 sequencers are operated by development teams, which has been one of the biggest criticisms surrounding Layer2 for a long time.

Why has Layer2 been unable to achieve sequencer decentralization? While there are certainly technical and operational reasons, another significant reason cannot be ignored — in a real-world environment, running a sequencer is a very "profitable" business.

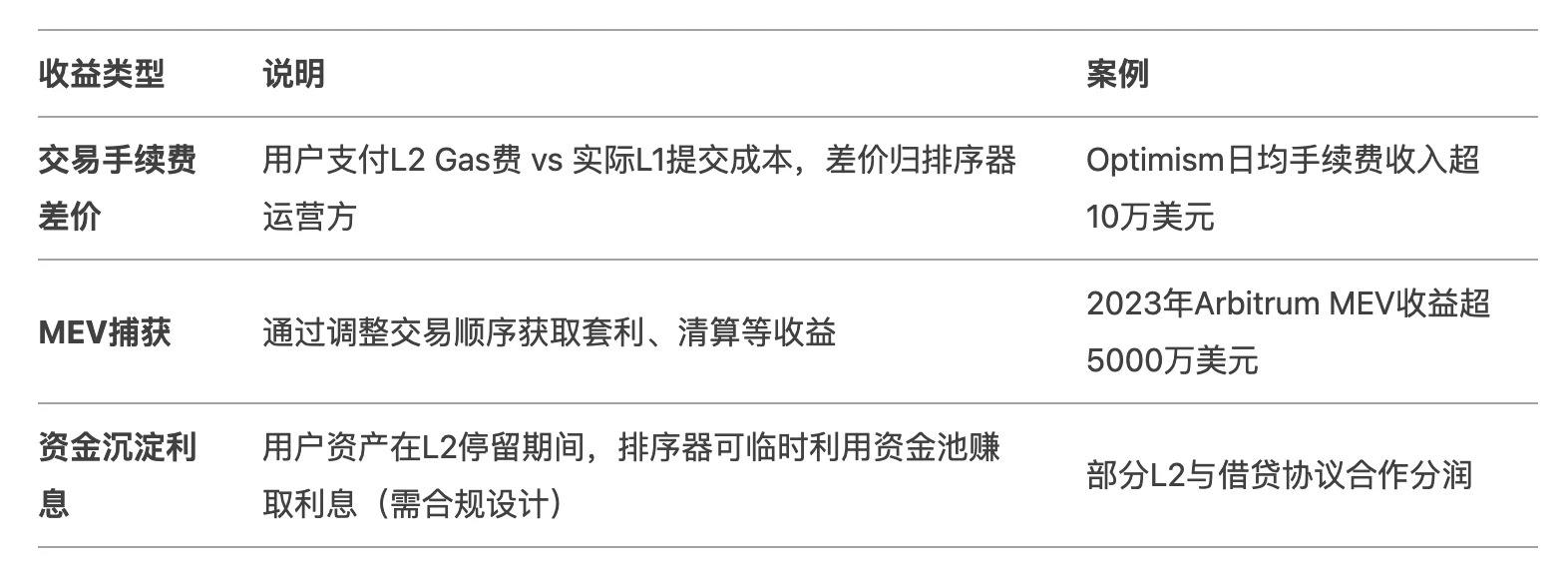

The direct sources of income for sequencer operations mainly include: 1) transaction fee spreads; 2) MEV capture; 3) interest from capital deposits.

Odaily Note: The image is a further explanation by Teacher DeepSeek.

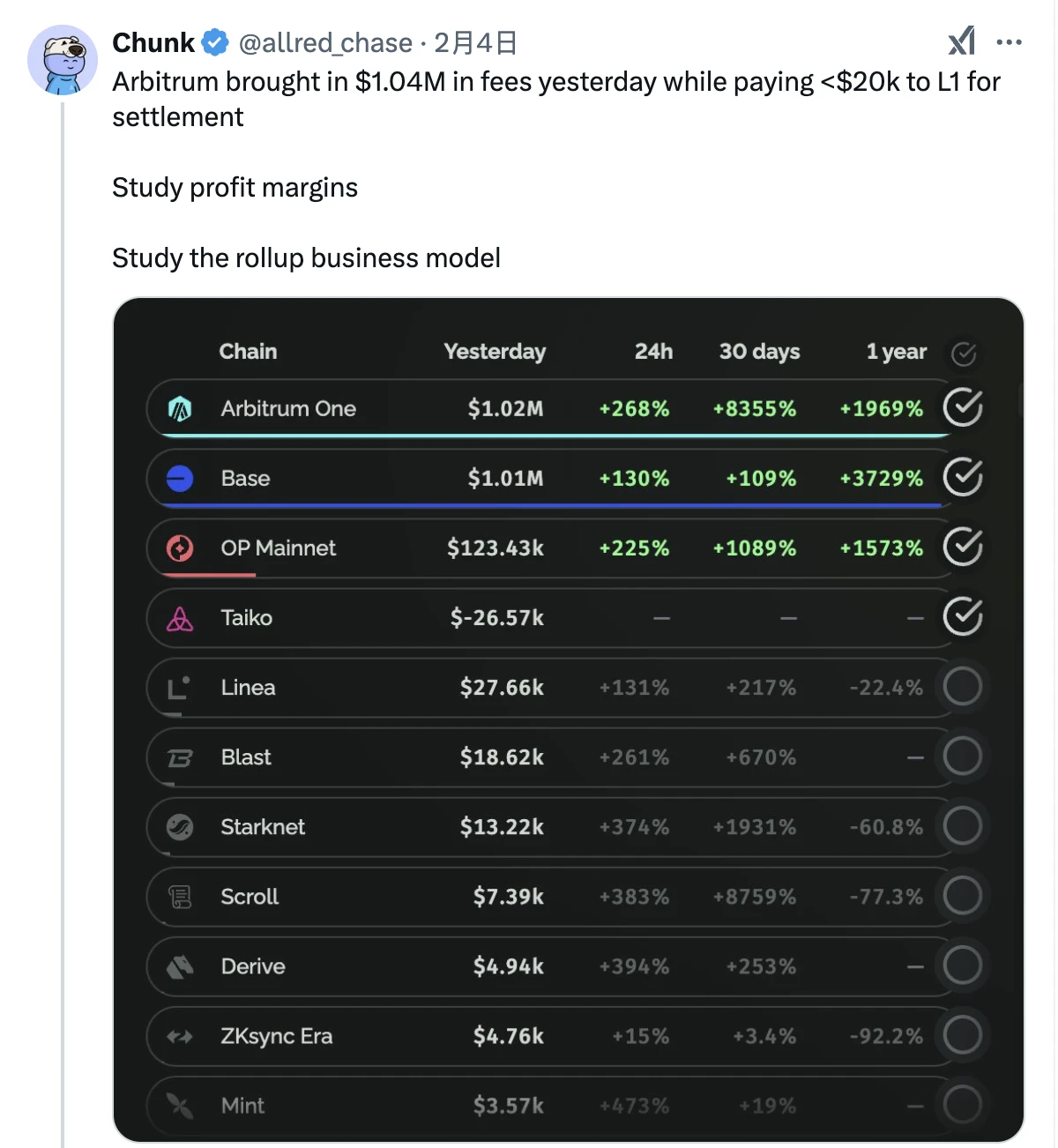

How profitable is this business? We can get a rough glimpse through the data from February 4.

On February 4, due to collective market fluctuations, Arbitrum collected $1.04 million in fees on Layer2 in a single day, while the final settlement cost paid to Layer1 was less than $20,000 — this means that in just one day, the chain earned over a million dollars through transaction fee spreads.

Targeting Base

As the most active Layer2 network in the Ethereum ecosystem, Base has long been at the center of related public opinion. As the debate over Layer2 sequencer earnings intensifies, the community has begun to target Base.

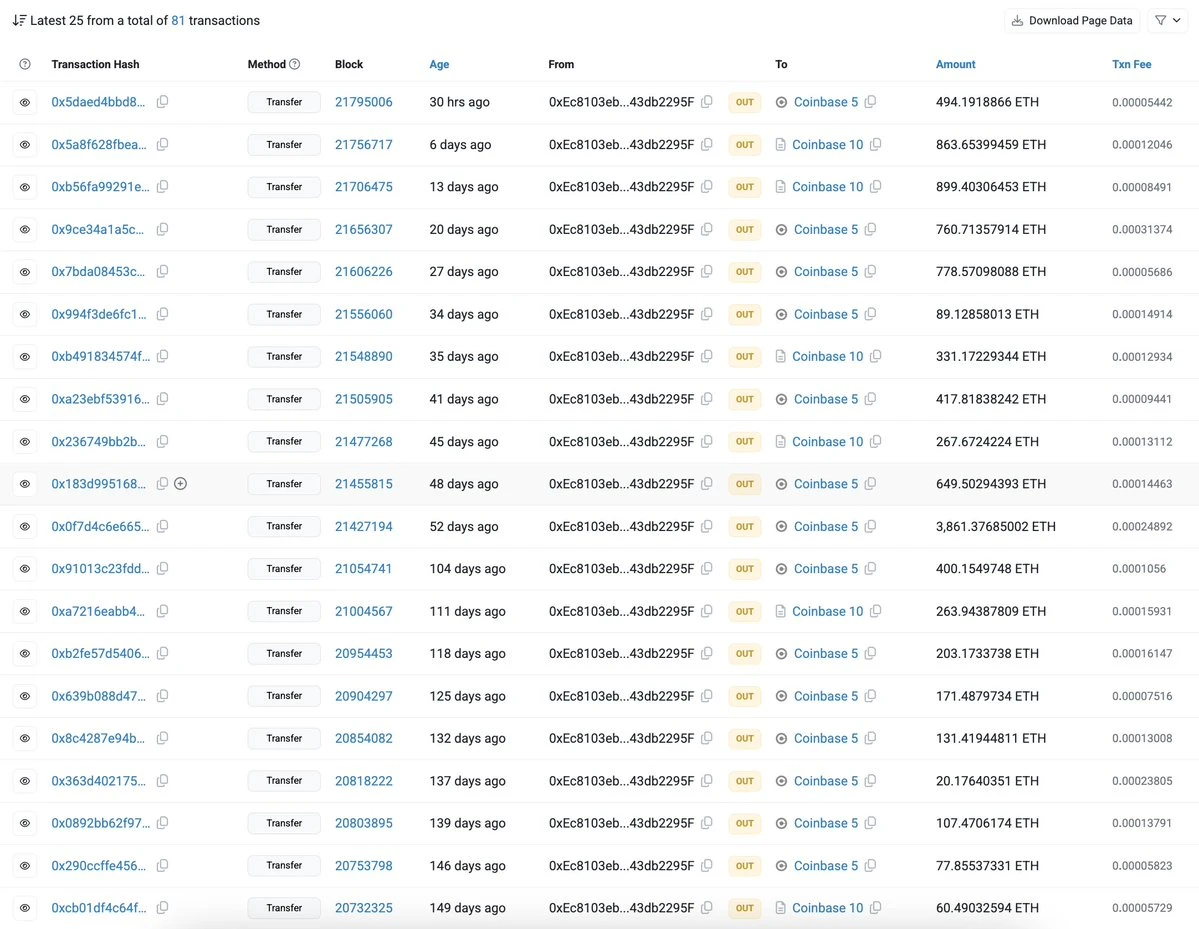

Lucidity CIOSantisa was the first to fire shots on X, accusing Base of transferring all sequencer earnings to Coinbase since its mainnet launch, raising suspicions that these ETH have been sold off.

Since its launch, BASE has been transferring sequencer fees to Coinbase. We don't know if they have sold them, but we know they haven't deployed these funds on Base or kept them on-chain. Due to the lack of further transparency, we can reasonably assume they have sold them. Their stance is not consistent with Ethereum.

Odaily Note: The image shows the Base sequencer income address (0xEc8103eb573150cB92f8AF612e0072843db2295F).

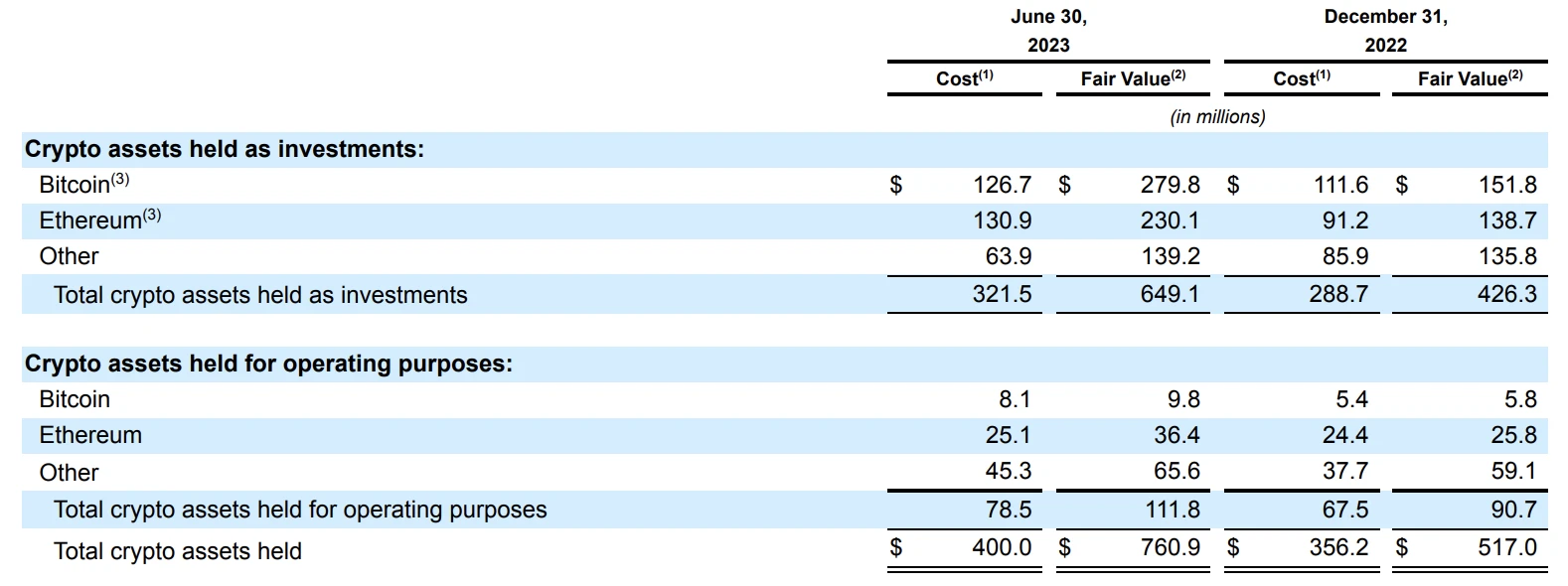

Subsequently, Sonic team member The Assistant further took over, analyzing whether Base has sold these ETH based on Coinbase's financial report data.

The Assistant pointed out that on-chain data can be checked (referencing the address posted by Santisa), Base has earned over $100 million in sequencer earnings in the past 12 months, with a profit margin exceeding 90%. All these fees have been transferred to the exchange via Base ➡️ Ethereum ➡️ Coinbase.

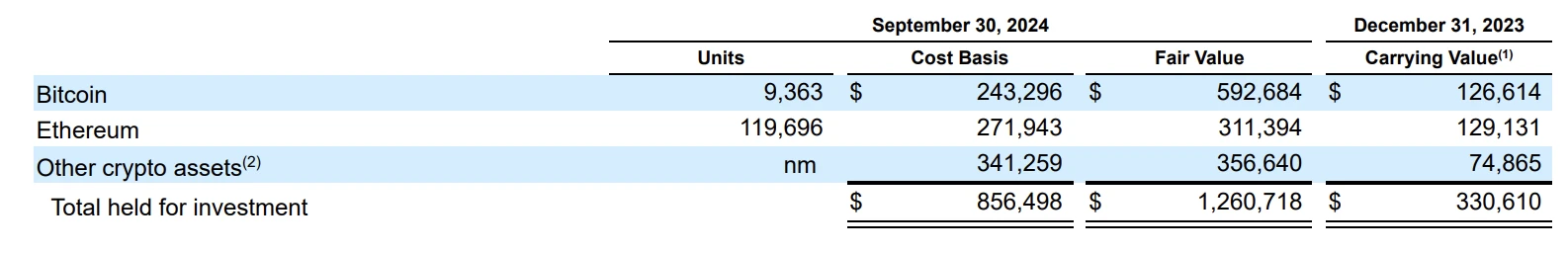

According to Coinbase's public financial report data, as of June 30, 2023 (see Q2 2023 financial report, page 66), Coinbase held approximately $230 million in ETH on its balance sheet, with the ETH price at $1934, meaning Coinbase held 118,924 ETH; as of September 30, 2024 (see Q3 2024 financial report, page 22), Coinbase held 119,696 ETH.

The Assistant finally questioned, since Base's launch, Coinbase has only increased its balance sheet by 772 ETH, so where did the over $100 million in Base sequencer earnings go? The answer seems to be only one…

Some may question that as a (nominally) independent network, Base's income should not be counted in Coinbase's balance sheet. This question is also unreasonable, as Coinbase has highlighted the increase in Base's income in multiple past financial reports.

Building on The Assistant's investigation, AC retweeted and further fired back:

The Ethereum community is proud of their Layer2, but what Layer2 does every day is transfer fee income from Layer2 to Layer1, and then to Coinbase for sale. This is the leader of the Ethereum ecosystem. Ethereum community, wake up.

What is Vitalik's potential stance?

As of the publication, Vitalik has not responded to AC and other community members' accusations, but in a handwritten article on January 24 (“Under public pressure, Vitalik calls on L2: Support ETH again”), we can roughly see that Vitalik is dissatisfied with the current state of Layer2 operations.

In that article, Vitalik mentioned the need to clarify ETH's economic model to ensure that ETH can continue to accumulate value in a Layer2-intensive world. On the execution level, Vitalik encouraged Layer2 to support ETH by contributing a certain percentage of fees, which could be achieved by burning part of the fees, permanently staking, and donating the proceeds to public goods in the Ethereum ecosystem or other schemes.

In simple terms, this statement can be translated as: Layer2 should not be too greedy; it's time to give up some of the cake.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。