1. Bitcoin Market and Mining Data

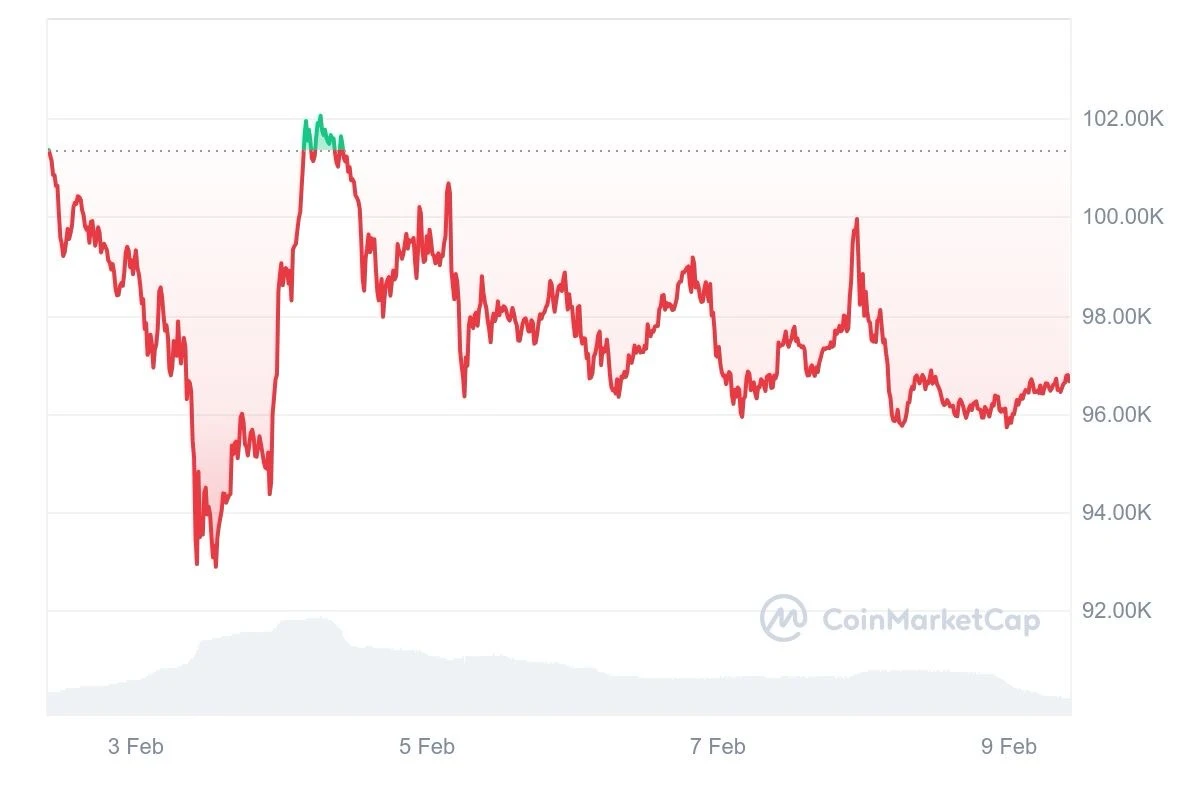

From February 3 to February 9, 2025, the price trend of Bitcoin was as follows:

From February 3 to February 4, Bitcoin continued to decline after opening, with the price fluctuating down from $101,350 to a low of $92,935.16. After 22:00, market sentiment warmed, and the price quickly rebounded, reaching an intraday high of $102,052.28 on February 4. It was then met with resistance and fell back, with a minimum adjustment to $97,963.3.

From the evening of February 4 to the morning of February 5, Bitcoin entered a narrow consolidation phase, maintaining a price range of $98,000 to $100,000. At 3:35 AM on February 5, bulls made a brief push, driving the price up to $100,677.01, but it quickly fell back to $96,344.45 and rebounded slightly.

From February 6 to 7, the market overall showed a range-bound trend, with Bitcoin's price fluctuating between $95,850 and $99,210. Near the close on the 7th, bulls attempted to break through, briefly pushing the price up to $99,952.94, but it could not hold and quickly fell back to around $95,747.76.

From February 8 to 9, Bitcoin's market volatility began to converge, with the price range further narrowing to between $95,710 and $96,920. As of the time of writing, Bitcoin was reported at $96,650. The overall trend continued to show a consolidation pattern, with short-term volatility limited and market sentiment remaining cautious, with no clear short-term direction.

Bitcoin Price Trend (2025/02/03-2025/02/09)

Market Dynamics and Macroeconomic Background

Capital Flow

The Bitcoin market experienced significant volatility, with capital flow showing a cautious attitude. On February 3, Bitcoin saw a sharp decline, triggering over $2 billion in liquidations, leading to a panic sentiment in the market. Additionally, on February 7, approximately $66 million flowed out of the spot Bitcoin ETF, and institutional investors like Strategy paused their purchases after 12 consecutive weeks of buying, indicating a wait-and-see attitude towards current prices. Overall, the outflow of funds and increased market volatility reflect a rise in short-term uncertainty, and investors need to pay attention to subsequent capital movements and market signals to respond to potential changes.

Technical Analysis

The technical outlook shows a wide range of fluctuations, with no clear short-term direction. After forming a temporary low at $92,935, the price rebounded, but $102,052 became a key resistance level, maintaining an overall range of $95,710 to $96,920. Trading volume increased during periods of significant volatility and then fell back, indicating a strengthening wait-and-see sentiment in the market. The RSI rose to neutral levels, and short-term moving averages converged, suggesting the market has entered a consolidation phase, with the 50-day moving average providing some support. The implied volatility of options surged at the beginning of the week before retreating, with funding rates trending towards neutrality, indicating a temporary balance between bulls and bears, while the market still requires new driving factors to break the consolidation pattern.

Market Sentiment

Overall, market sentiment is cautious, with investors increasingly adopting a wait-and-see approach. During periods of sharp price fluctuations, the fear and greed index showed a brief decline, indicating a rise in short-term risk-averse sentiment, which gradually recovered as prices stabilized. Social media and derivatives market sentiment indicators show a clear divergence in bullish and bearish sentiment, with investors lacking a consensus on short-term direction. Trading volume peaks were mainly concentrated during sharp declines and rebounds, indicating that there is still active buying support in the market, but selling pressure remains heavy above. Furthermore, the slowdown in ETF capital inflows suggests that institutional investors have not yet actively increased their positions, keeping the overall market sentiment in a cautious and fluctuating state, awaiting new macro catalysts.

Industry News and Macroeconomic Background

On February 3, the cryptocurrency market experienced significant turbulence, with Bitcoin dropping over 6% in 24 hours and Ethereum plummeting 25%, triggering panic in the market. Additionally, the National Bank of Poland explicitly stated that it would not include Bitcoin in its national reserves due to concerns over security and stability, which also negatively impacted market sentiment.

On February 1, U.S. President Trump signed an executive order imposing a 25% tariff on imported goods from Canada and Mexico and a 10% tariff on goods from China. This move caused global market turbulence, with the cryptocurrency market declining in tandem. Furthermore, on February 4, Trump proposed a potential takeover plan for Gaza, further escalating geopolitical tensions and driving up risk-averse sentiment, with gold prices soaring 9% while Bitcoin's performance remained relatively weak.

Overall, this week, the Bitcoin market exhibited high volatility under the dual influence of industry dynamics and the macroeconomic environment. Investors should closely monitor policy changes and geopolitical events to assess their potential impact on the Bitcoin market.

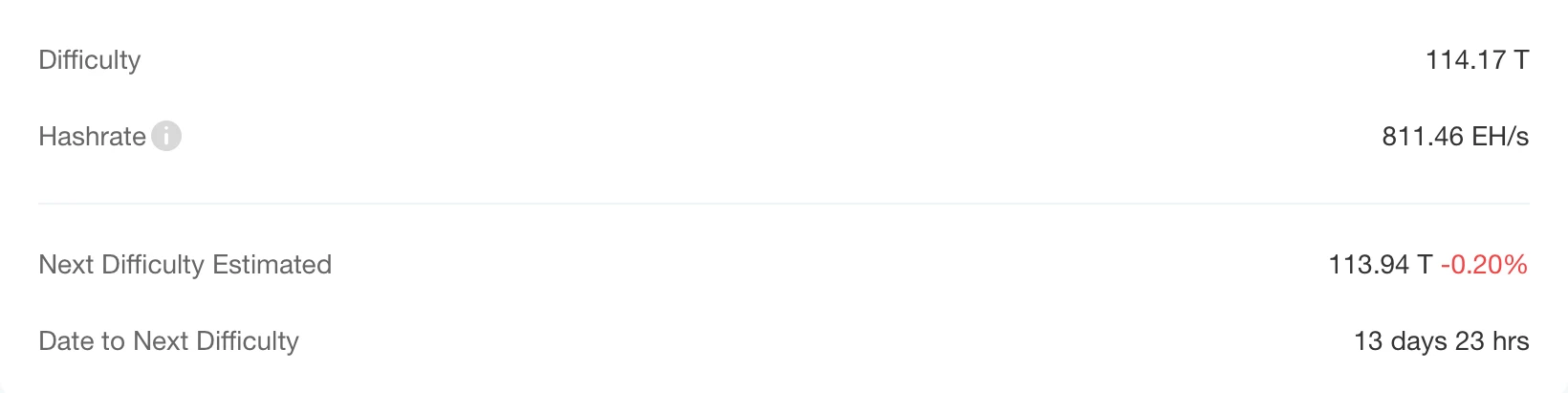

Hash Rate Changes

From February 3 to February 9, 2025, the Bitcoin network hash rate showed significant fluctuations. On February 3, the hash rate fell from the previous day's high of 1008.72 EH/s to a low of 763.32 EH/s, then rebounded slightly to 872.44 EH/s, maintaining an overall range of 760 EH/s to 870 EH/s. From February 4 to 5, the hash rate further declined from 872.91 EH/s to a weekly low of 628.16 EH/s. After February 5, the network hash rate rebounded, climbing to 869.78 EH/s. On February 6, the hash rate fluctuated between 750 EH/s and 870 EH/s. From February 7 to 8, the hash rate further increased, reaching a weekly peak of 1039.65 EH/s, before falling back to around 900 EH/s. On February 9, the hash rate declined slightly, maintaining around 800 EH/s as of the time of writing. Overall, the fluctuations in hash rate may be influenced by miner earnings, mining difficulty adjustments, and changes in the market environment.

Bitcoin Network Hash Rate Data

Mining Revenue

Since reaching an all-time high of approximately $109,000, Bitcoin's price has fallen by about 11.28%, leading to a decline in miner profitability and entering a very low reward zone, facing the risk of surrender. The halving event in April 2024 increased mining difficulty, coupled with a continuous rise in hash rate, intensifying competition among miners and shrinking profit margins. Some miners have begun to actively sell Bitcoin to offset costs, with the flow of miners to exchanges reaching record levels. However, the Puell multiple has remained above 1 since January 13, indicating that miner income is still relatively healthy. To prevent further miner surrender, Bitcoin's price needs to rise and stabilize above $100,000 to ensure sustainable profitability for miners.

Energy Costs and Mining Efficiency

On February 9, 2025, the Bitcoin network hash rate set a new record, surpassing 810 EH/s, reaching 818 EH/s. The Bitcoin network completed a new round of difficulty adjustments, raising the mining difficulty to 114.17T. With the difficulty adjustment, miner operational efficiency was also optimized, affecting overall energy consumption.

According to a research report by Canaccord Genuity, the mining cost for major mining companies is approximately $26,000 to $28,000 per Bitcoin. However, fluctuations in energy prices have a direct impact on mining activities. Recent increases in energy prices may lead to higher mining costs, thereby compressing miners' profit margins. Some mining companies are improving mining efficiency through technological upgrades and operational optimizations. There are significant cost differences within the industry, reflecting the varying levels of mining companies in acquiring cheap electricity, improving operational efficiency, and managing capital. Some mining companies operate with low costs and high profit margins, while others operate on thin margins, making them more susceptible to fluctuations in Bitcoin prices.

Bitcoin Mining Difficulty Data

2. Policy and Regulatory News

Wu Jiezhuang: Hong Kong Needs to Accelerate Research on the Feasibility of Including Bitcoin in Strategic Reserves

On February 5, Hong Kong Legislative Council member Wu Jiezhuang posted on social media that David Sacks, the "czar" of AI and cryptocurrency in the U.S., held a press conference with Republican representatives on February 4 to announce the formation of a bipartisan working group to develop cryptocurrency regulatory legislation. Wu Jiezhuang pointed out that while Hong Kong has established a three-tier regulatory framework similar to that of the U.S., including a dedicated group for the development of the third generation of the internet, a Legislative Council Web3 and Virtual Asset Development Subcommittee, and a regulatory sandbox for stablecoins by the Monetary Authority, it still needs to accelerate its development pace.

He proposed five major suggestions: first, to expedite research on the feasibility of Bitcoin as a strategic reserve for Hong Kong; second, to expand the permissions of stablecoin companies within the approved sandbox and accelerate their application; third, to seek national support for establishing stablecoin application pilot projects in the Greater Bay Area; fourth, to relax the trading varieties of licensed virtual asset trading platforms; and fifth, to establish a digital asset office dedicated to promoting AI and virtual asset development. Wu Jiezhuang revealed that he has been invited to participate in the Bitcoin America Summit to be held in Las Vegas in May, which will promote cooperation between the cryptocurrency industries of China and the U.S.

Multiple U.S. States Push for Bitcoin Strategic Reserve and Investment Legislation

Between February 6 and February 9, several U.S. states (including New Mexico, Utah, Iowa, Missouri, Kentucky, Maryland, Florida, and Montana) proposed or advanced Bitcoin-related legislation, involving the establishment of strategic Bitcoin reserves, allowing state governments to invest in Bitcoin, and expanding the application of Bitcoin in public finance. Among them, New Mexico proposed to invest 5% of public funds in Bitcoin, Kentucky's legislation allows for investment of up to 10% of state funds, and Montana authorized investment of up to $50 million in Bitcoin.

Czech President Signs New Legislation Exempting Capital Gains Tax on Bitcoin Held for Over 3 Years

On February 6, Bitcoin Magazine reported that the Czech President officially signed legislation exempting capital gains tax on Bitcoin held for more than three years.

German Alternative for Germany Party Seeks to Exit Eurozone and Relax Bitcoin Regulations

On February 7, news emerged that Germany will elect a new parliament on February 23, which could have profound implications for the financial sector of Europe's largest economy. The far-right Alternative for Germany (AfD) party ranks second in polls, but mainstream German parties refuse to cooperate with it in any government, meaning its proposals may never be realized. Nevertheless, their financial policy plans are the most specific and radical. The AfD calls for Germany to exit the Eurozone, supports "extensive deregulation" of Bitcoin, wallets, and trading, and opposes the digital euro, among other things.

3. Mining News

Russia Plans to Establish Mandatory Registration for Cryptocurrency Mining Equipment

On February 3, news reported that the Russian Ministry of Energy announced plans to establish a single registration body for cryptocurrency mining equipment, mandating all cryptocurrency mining operations to register. According to TASS, if the plan is implemented, cryptocurrency mining without registered equipment in the system will be "impossible."

The plan, led by Deputy Minister Yevgeny Grabchak, is part of proposed amendments to existing mining regulations aimed at better identifying domestic mining activities, especially in areas where mining is not permitted.

Mining Company Stronghold Fined $1.4 Million for Violating Electricity Market Rules While Mining Bitcoin

On February 5, it was reported that mining company Stronghold Digital violated energy market rules while prioritizing its Bitcoin mining operations, agreeing to pay over $1.4 million in fines and refunds.

Stronghold had contractual obligations to provide available power to the PJM grid to help ensure the reliability of the grid. However, the Federal Energy Regulatory Commission's enforcement office found that Stronghold failed to fulfill this obligation from June 2021 to May 2022, instead diverting power to its Bitcoin mining operations.

Russia Issues New Regulations for Cryptocurrency Mining, Requiring Miners to Report Income by the 20th of Each Month and Establishing a National Miner Registration System

On February 6, news from Bitcoin.com reported that Russia officially released new regulations for cryptocurrency mining, explicitly requiring miners to report their mining income to the government by the 20th of each month. It also stipulates that only government-approved entities can legally engage in mining operations. Additionally, the Russian government has explicitly prohibited any individuals or companies with financial crime records from participating in cryptocurrency mining to strengthen industry regulation and prevent financial risks.

An important aspect of the new regulations is the establishment of a national miner registration system, which will register all miners and may involve collecting personal information and cryptocurrency wallet addresses. In response, the Russian Bitcoin mining community expressed strong concerns. According to Cryptoslate on February 8, Russian lawmaker Anton Gorelkin warned on Telegram that this system could pose serious security risks, especially if miners' wallet addresses are leaked, which could be exploited by geopolitical adversaries, threatening the security of miners' funds. Gorelkin pointed out that given the current international sanctions environment, Russian Bitcoin miners face potential external attack risks, and these new regulations may increase their compliance costs and operational pressures.

Related Images

4. Bitcoin News

Global Corporate and National Bitcoin Holdings (This Week's Statistics):

El Salvador: Holds 6,056.18 BTC, approximately $586 million.

Genius Group: Holds 440 BTC, total value $42 million, average purchase price $95,519 per coin.

Bitcoin Depot: Holds 71.5 BTC, with an addition of 51 BTC this week, and an extra purchase of $5 million in BTC.

Remixpoint: Holds 509.33 BTC, with an addition of 30.83 BTC this week, increasing investment by approximately $3.22 million.

Semler: Holds 871 BTC, total purchase amount $88.5 million, average purchase price $101,616 per coin, with a return of 152%, and a year-to-date return of 22%.

Metaplanet: Holds 1,700 BTC, with the company's stock price reaching an 8-year high.

Canaan Creative: Holds 1,293 BTC.

Semler Scientific: Holds 3,192 BTC, increasing by 871 BTC.

Neptune Digital Assets: Holds 376 BTC, increasing by 20 BTC.

CleanSpark: Increased by 10,556 BTC.

Bank of America: Holds $24 million in Bitcoin ETF, up from $14 million previously.

Strategy (formerly MicroStrategy): Holds 471,107 BTC, with a market value of approximately $46.612 billion, total corporate market value of $84.966 billion, and a stock price increase of 586% over the past year.

Bitfinex: Bitcoin Market Undergoing Structural Change, but Institutional Investors' Continued Accumulation Shows Market Resilience

On February 3, BitfinexAlpha's latest report indicated that the Bitcoin market is undergoing structural changes. Although the BTC price fell below $100,000 due to Trump's tariff policies, the continued accumulation by institutional investors shows market resilience. MicroStrategy increased its holdings by 10,107 BTC for $1.1 billion, bringing its total holdings to 158,400 BTC, and submitted a financing application to the SEC to prepare for future increases; the Japanese listed company Metaplanet completed a $745 million financing to expand its Bitcoin reserves to hedge against yen depreciation risks. In January 2025, BTC recorded a 10% increase, with prices consolidating within a 15% range for nearly 65 days.

On a macro level, Bitcoin's correlation with traditional markets has increased, with a 30-day correlation with the S&P 500 reaching 0.8, a new five-month high. The Federal Reserve maintained interest rates at 4.25%-4.50%, with inflation still above the 2% target, and core PCE year-on-year remaining at 2.8%. Meanwhile, Tether is integrating its $140 billion USDT into the Bitcoin Lightning Network, enhancing network payment efficiency through TaprootAssets technology, promoting Bitcoin's transition from a store of value to a payment network.

Analysts: Sovereign Nations Will Hoard Gold and Bitcoin as Economic Buffers

On February 3, analysts from brokerage firm Bernstein stated in a report to clients: "If tariffs mean a stronger dollar, rising inflation, and a weakened prospect for interest rate cuts in the short term, this implies a decline in global liquidity for risk assets. Over a longer time frame, as governments take on higher debt and deficits, leading to further currency devaluation, Bitcoin has relative value against the dollar, which is evident in Bitcoin's long-term compounded history. However, in the short term, Bitcoin is correlated with risk assets. Therefore, the sell-off in cryptocurrencies is not surprising."

Bernstein analysts believe that in the long run, the Trump administration views cryptocurrencies as strategically significant for government governance and national finances, aiming to control inflation by reducing deficits, cutting costs in the government efficiency department led by Elon Musk, and increasing energy output. While foreign governments may retaliate against tariffs by selling U.S. Treasury bonds, Bernstein expects sovereign nations to hoard gold and Bitcoin as economic buffers, with the U.S. leading the shift in support for cryptocurrencies, and more countries likely to follow suit.

CryptoQuant Analyst: Suggests Altcoin Investment Should Not Exceed 10%, Bitcoin's Own Volatility Is Sufficient for Significant Returns

On February 5, CryptoQuant community analyst Maartunn pointed out that while Bitcoin only fell by 7%, altcoins exhibited larger declines. He suggested that investors control their altcoin investment ratio to between 5-10% based on their risk tolerance.

Maartunn stated that many investors holding only altcoins without Bitcoin would subject their portfolios to excessive volatility, while Bitcoin's own volatility is sufficient to generate significant returns, especially compared to traditional financial markets.

Standard Chartered Forecasts: Bitcoin Will Rise to $500,000 During Trump's Term

On February 5, Decrypt reported that Standard Chartered predicts Bitcoin will rise to $500,000 during Trump's term, approaching half of gold's market value. BTC is expected to reach $200,000 in 2025, rise to $300,000 in 2026, surpass $400,000 in 2027, and hit $500,000 in 2028, with a total market value of $10.5 trillion. Key driving factors include $39 billion inflow into Bitcoin spot ETFs, improvements in the U.S. regulatory environment, and the Trump administration's consideration of establishing a national digital asset reserve. Standard Chartered believes that as volatility decreases, Bitcoin's share in investment portfolios will increase, attracting more traditional investors and driving long-term growth.

Related Images

Sygnum: Every $1 Billion Strategic Bitcoin Reserve Purchase Could Drive $20 Billion in Market Value Growth

On February 6, Katalin Tischhauser, head of investment research at Swiss crypto bank Sygnum, released a new research report predicting that every $1 billion invested in the U.S. strategic Bitcoin reserve could drive approximately $20 billion in Bitcoin market value growth through a multiplier effect.

The report noted that due to the limited liquidity supply of Bitcoin, new demand would trigger significant upward price shocks, with $19 billion of the growth coming from demand shocks and limited supply squeeze effects. Tischhauser stated that the first and second rounds of $1 billion inflows would mainly absorb existing demand, while the third and fourth rounds of inflows would face a more constrained supply environment, accelerating price increases.

BitRiver Analyst: Bitcoin Will Reach $160,000 by Year-End

On February 7, news reported that BitRiver financial analyst Vladislav Antonov stated that Bitcoin prices are expected to "continue to grow to $130,000 between March and April 2025, and to $160,000 by October to November 2025." This prediction depends on favorable financial and regulatory developments, as well as positive geopolitical developments.

Grayscale Research Director: Despite Weak Employment Data, Bitcoin May Reach New Highs in Q1

On February 8, according to Cointelegraph, despite the U.S. hiring pace being below expectations in January, Grayscale Research Director Zach Pandl stated in an interview that Bitcoin has the potential to reach an all-time high in the first quarter of 2025. On February 7, U.S. officials reported that the country added 143,000 jobs in January, slightly below expectations.

Pandl believes that the latest U.S. employment report may "reinforce expectations that the Federal Reserve will pause interest rate hikes for a while, but is unlikely to lead to a substantial repricing." He stated, "Bitcoin may respond calmly to the latest employment report. Bitcoin and other digital assets are benefiting from various policy-related tailwinds, including progress in stablecoin legislation." Therefore, he expects "the cryptocurrency market to exhibit a bullish bias." He added, "As long as the stock market remains stable, Bitcoin may reach new highs later this quarter."

Tether CEO: Quantum Computing Currently Poses No Threat to Bitcoin's Cryptographic System

On February 9, Tether CEO Paolo Ardoino posted on social media platform X, stating that quantum computing is still far from posing a substantial threat to Bitcoin's cryptographic system. He predicted that before any serious threat arises, Bitcoin will add anti-quantum address functionality. All living individuals who can access their wallets will transfer their Bitcoin to new anti-quantum addresses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。