Important News on February 8:

- Trump plans to announce reciprocal tariff policy as early as Friday

- BlackRock's IBIT pre-market trading volume reached $106 million today, with 37% being active buy orders

- FTX: Creditors in the initial distribution will receive compensation assets within 1-3 business days

- Tether CEO: Not worried about USDT's competitors and will continue to expand coverage

- If Bitcoin recovers to $100,000, the cumulative short liquidation intensity on mainstream CEXs will reach $266 million

Conveying the way of trading, enjoying a wise life.

We will first review our strategy regarding the recent sharp decline in Bitcoin and Ethereum. On February 3, we mentioned that Bitcoin's decline this time was not sufficient, meaning it fell from $104,000 to around $91,000 and then began to rebound quickly, resulting in an overall decline of 6%-7%.

However, Ethereum is different; it dropped directly from a high of $3,400 to $2,100, which is a significant decline, reaching a low point on August 5, 2024.

We mentioned that for Bitcoin and Ethereum, if Ethereum rebounds to $2,700 and then to $2,800, there may be a second bottoming out. As for Bitcoin, if it rebounds to around $100,000, there may be another downward adjustment.

At the same time, after the release of the U.S. non-farm payroll data for January yesterday, which showed an increase of 143,000 people, lower than market expectations, and the unemployment rate also dropped to 4%, below previous and expected values.

Overall, this indicates that the Federal Reserve will be more determined not to rush into interest rate cuts. Therefore, it is very likely that the Federal Reserve will not cut rates again in the first half of the year, and March is basically a done deal for no rate cuts.

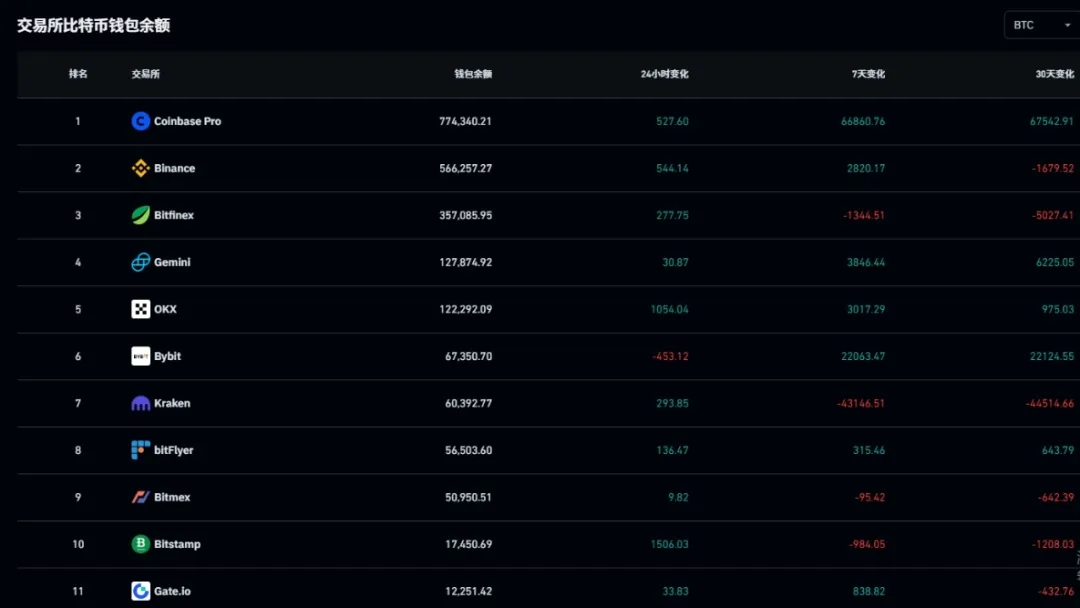

The impact on the cryptocurrency market at this time is self-evident. So, everyone should be mentally prepared for the medium to long term. Let's look at another fundamental piece of news. Returning to the issue of Bitcoin wallet balances on exchanges, we have recently noticed a phenomenon where mainstream exchanges have started to deposit Bitcoin, meaning the balances on exchanges are increasing.

In the 7-day change, Coinbase increased by 66,860 Bitcoins, and Binance increased by 2,820. Only two exchanges showed negative values in the 7-day change; the rest are positive. Overall, the Bitcoin balance on exchanges is decreasing; turning positive indicates that the Bitcoin balance on exchanges is increasing.

What does this issue indicate? If I deposit coins into an exchange, it should naturally mean selling. Historically, there have been instances where Bitcoin's balance on exchanges decreased as prices rose since 2024.

However, in the past two years, there was suddenly a significant inflow into exchanges. This phenomenon is not necessarily a good thing.

Historically, we also found that in July 2024, there was a significant inflow on July 25. The amount of this inflow far exceeded the previous inflow, which was 47,000 coins; this time, the inflow was 122,000 coins, nearly three times that.

So, when so many Bitcoins flowed into exchanges on July 25, 2024, did it lead to a crash?

From a technical perspective, on July 24-25, after the inflow into exchanges, the price actually rose, reaching around $68,000. However, in the following week, Bitcoin's price fell sharply, dropping from $68,000 to $49,000, resulting in an overall decline of 28%.

This led to what is referred to as a massive volume, marking a temporary bottom. Therefore, in the last downward movement of Bitcoin, my view is that Bitcoin did not drop sufficiently, while Ethereum experienced a significant decline and released a massive volume, but Bitcoin did not release a massive or extraordinary volume. This time's volume is not significantly different from usual.

In December, there was a volume increase, and this volume is basically equivalent to the volume in late January. Therefore, this volume does not have a significant advantage; it can only be said that someone is bottom-fishing at $91,000.

Since Bitcoin did not release a massive volume, does the large amount of Bitcoin flowing into exchanges mean that Bitcoin might crash next?

Do you remember at the beginning when I mentioned that my view is that Bitcoin might not have reached its bottom, based on two levels? The first level is technical. As for the technical aspect, we can see an issue with the 5-day moving average, where the MACD indicator has already shown a bearish divergence at this position. The price has been maintained above $100,000, but this indicator has shown a severe exhaustion of bullish momentum, indicating a 5-day level divergence that has not yet been repaired. There are two scenarios for repair: one is sideways consolidation, and the other is a deeper downward probe.

Is there another basis for a deeper downward probe? Of course, there is. Let's return to the futures trading gap, a topic we have repeatedly mentioned. The lowest price of the futures gap corresponds to the $78,000 position, which is where the futures gap is located.

We know that gaps generally need to be retested and filled. So, is it possible for Bitcoin to drop below $91,000 after reaching $100,000, continuously testing $87,000, $83,000, and $78,000?

Therefore, my view is that we do not rule out this possibility.

From the increase in Bitcoin wallet balances on exchanges and the technical aspect of the 5-day chart showing a bearish divergence, it seems that in the future, the performance in the coming months may not be so ideal.

To summarize, we should still be cautious, maintain a conservative approach, and not blindly bottom-fish. We can only hold a portion of our positions and consider re-entering when it truly wants to undergo a deep correction.

So, the entire first half of the year may be a bottoming process, which is also when we can consider re-entering, and the second half of the year will likely see another explosion.

As for our welfare strategy, from a short-term perspective, on the 4-hour level, Bitcoin's price is actually supported at $96,000. Is it possible for us to consider a long position? It is worth considering. If it closes below $96,000, then we can exit. The fluctuation above $96,000 is $100,000, and it is currently still consolidating in this range.

As for Ethereum, if it drops below $2,600, where is its next support level? Through the Fibonacci retracement levels, we need to pay attention to the 50 line, 382 line, and 618 line. $2,618 is currently being tested, as well as $2,523 and $2,429, which are all major support levels for Ethereum.

This is today's welfare strategy, and our sharing ends here. Don't forget to like, share, and leave comments. Do you think Bitcoin's price has a chance to reach lower levels?

To learn more, you can follow our Binance media account [Crypto Academy No. 7] or contact our assistant to join VIP.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。