After Trump took office, there was no significant policy promotion for the cryptocurrency market. Apart from the family WLFI fund continuously buying coins, there were also some scandals suggesting a "possible collusion with project parties for market making"; Trump's son called for buying ETH, and the fund was "suspected of secretly cutting losses" on ETH. The Trump administration's pressure on the SEC to lower interest rates also had no effect, and the established cryptocurrency committee and other government agencies were all noise without substance.

Related article: Is Trump still favorable for the crypto world?

On the contrary, the Trump administration's macroeconomic policy of a strong dollar and weak U.S. stocks had a huge impact on cryptocurrencies. The imposition of a 25% tariff on Mexico and Canada, followed by a delay in cancellation, caused turmoil in the cryptocurrency market. More critically, when BTC rebounded, altcoins "fell but did not rise," with most altcoins hitting new lows in nearly two years.

Many people are questioning: Is the bull market still on? In this cycle, the current situation has led to the emergence of a wealth myth around the Trump-named meme coin, calling for an "eternal bull market," reminiscent of the wealth myth surrounding SHIB and the Coinbase listing in the last bull market, collectively shouting that the "eternal bull market" has ended, which seems to be a case of "carving a boat to seek a sword." Is the bull market really still on? Will altcoins have a "day to break even"? Let's take a look at traders' views.

Technical Analysis

The liquidity of altcoins has not yet returned; more liquidity from altcoins has exited in favor of BTC liquidity.

The two possible paths previously recognized now seem to have followed the second one.

Around $92,000 is the green area I marked in the chart. This is the lower boundary of the entire range of fluctuations. If the price rebounds here, it can serve as an entry point; if it breaks below, stop loss should be triggered. Currently, this area is in the middle of the range, making it difficult for both bulls and bears, waiting for a suitable entry opportunity.

BTC has completed the plundering eqh. Bears should pay attention to their positions, while bulls should look for buying opportunities on pullbacks.

Bitcoin is in a fluctuating market. The market logic is to seek liquidity: where most people stop loss + where liquidations occur. Bitcoin's daily chart has formed two long-legged doji candles, increasing the likelihood of a rise next week. There is still a possibility of one last dip to around $94,600, and if it recovers above $95,600, then the upward trend will begin. If it rises next week, the target is at least $100,500, with a maximum of $103,000.

Data Analysis

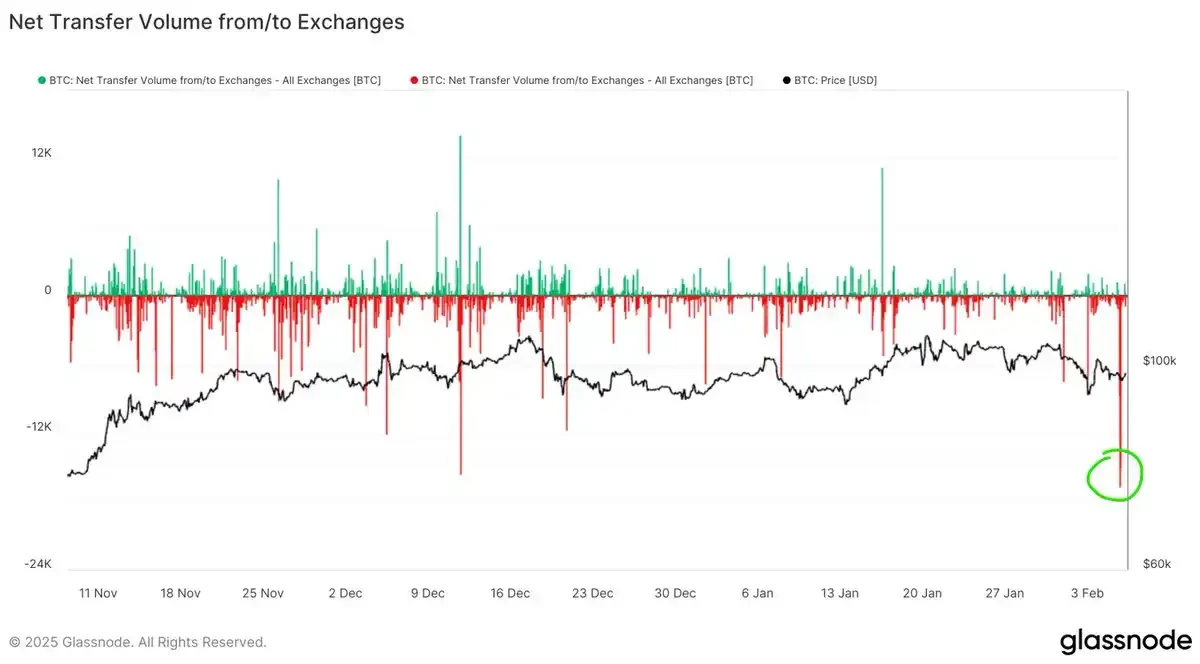

The largest outflow of BTC from exchanges since 2024 has just occurred, with over 17,000 BTC leaving exchanges, of which 15,000 were withdrawn from Coinbase. A large number of whales are buying bottom chips here.

@Phyrex_Ni

The stock of BTC on exchanges has indeed plummeted after the price fell below $100,000, nearing a six-year low, spanning two later periods. This indicates that more investors are choosing to hold their coins after buying.

Macroeconomic Analysis

The non-farm payroll data has just been released. It is basically in line with expectations, with the unemployment rate slightly decreasing to 4%, lower than the previous value. This data is not very good, indicating that the current labor market is still very strong, while the non-farm employment number has decreased significantly, falling well below expectations. This data is still acceptable, and wage growth is also increasing. Overall, the entire labor market has not shown significant cooling, which may not align with the expectations of some Federal Reserve officials. But it also indicates the strength of the U.S. economy.

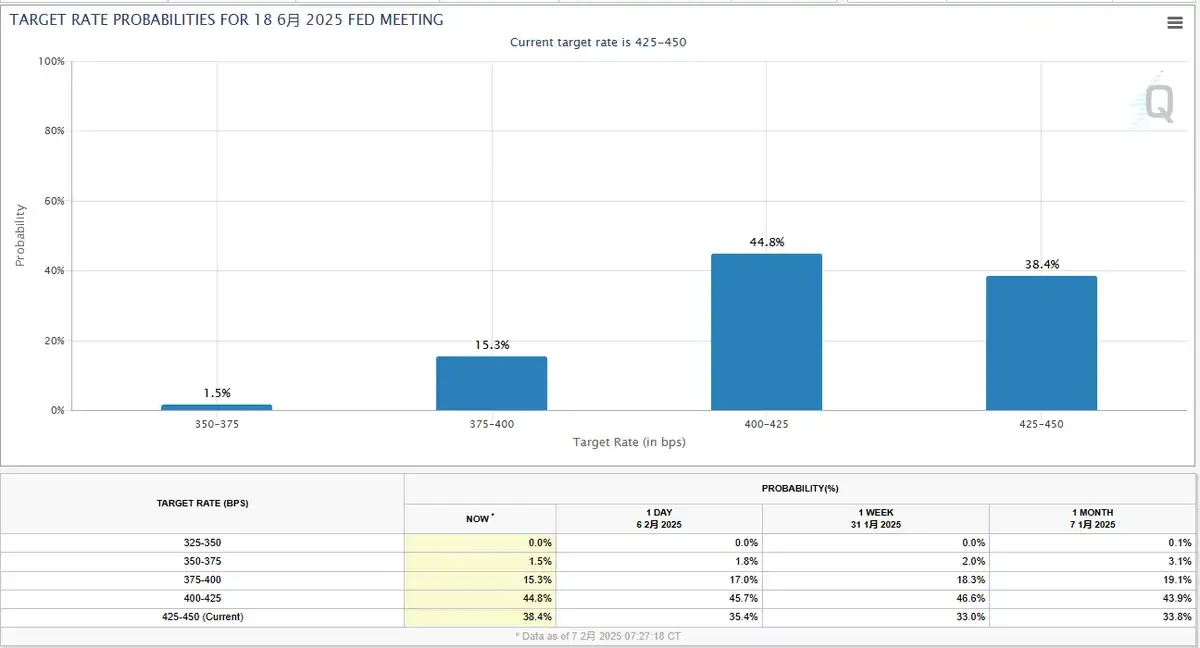

The possibility of a rate cut in March is almost nonexistent, and it was never really there. The current labor data will further reduce the probability of a rate cut in March, which is already within the market's expectations. Let's first look at the dot plot in March; to be honest, the current macro data is of limited help to the market.

After all, Powell himself has said that the focus on the labor market is not very high; it is better to pay more attention to inflation data, especially housing inflation. Overall, today's labor data is favorable for the economy but not beneficial for the Federal Reserve to increase the number of rate cuts.

After the data was released, Federal Reserve's Kashkari made a statement, mainly echoing Powell's views: "If we see good inflation data and the labor market remains strong, then this will prompt me to support further rate cuts." Interestingly, this view is completely different from Logan's statement yesterday, which considered a strong labor market to be a good thing.

The decline in inflation mainly depends on housing inflation. Kashkari said, "If inflation is declining, I see no reason to keep interest rates unchanged." He expects inflation to continue to decline this year, and the Federal Reserve's rate cuts will proceed moderately.

Basically, this has characterized the labor data, especially since the labor data is favorable for the economy, moving further away from recession.

Firstly, after a week, BTC's market value has basically remained unchanged, but the market and #ETH altcoins have shrunk. The change in market share clearly shows that BTC has significantly absorbed the market, with its share now exceeding 58%, approaching 59%. In contrast, ETH's share has directly fallen below 10%, which is quite dismal.

In terms of trading volume, aside from BTC maintaining a certain level of activity, ETH altcoins have seen a continued decline in activity, with poor sentiment.

There has been a significant increase in funds, with an increase of $8.9 billion this week, bringing the total amount of stablecoins in the market to $231.5 billion.

USDT: The official website shows a current market value of $141.355 billion, an increase of $1.951 billion compared to last Sunday. The Asian and European markets have seen a return of inflows this week, with an increase in inflows.

USDC: Data shows an increase of $2.817 billion, with funds in the U.S. also maintaining an inflow.

After the employment data was released, BTC began to rebound alongside U.S. stocks. However, the inflation expectations triggered a decline in the risk market, and this week is likely to end with a drop, with the current price still in a weak zone!

After the employment data was released, although the data was not favorable, given the downward trend this week has basically cleared the negative sentiment, as long as it is not negative, it will allow the market to rebound again.

The market reflected this after the data was released, with BTC's price breaking through the 1-hour/4-hour range.

However, the subsequent Michigan University inflation expectations raised concerns about inflation in the risk market, leading to a decline in U.S. stocks, and BTC followed suit, directly interrupting BTC's rebound momentum, leaving the current BTC price still in a weak zone.

The unemployment rate has decreased, and non-farm payrolls were below expectations. Traders are betting on a recovery rate cut node currently stuck in June this year, and it doesn't seem very stable. This means that there is no need to wait for a rate cut in the first and second quarters; the earliest will be the mid-June meeting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。