Important News on February 6:

- JPMorgan survey: 71% of institutional traders have no plans to trade cryptocurrencies this year

- Jupiter has regained control of its X account and is conducting a security review

- Tether CEO: Tether has no intention of launching its own blockchain network

- VanEck predicts SOL will rise to $520 by the end of the year, with a market cap of $250 billion

- The cryptocurrency fear and greed index has dropped to 49, with market sentiment returning to neutral levels

Conveying the way of trading, enjoying a wise life.

Yesterday we talked about Bitcoin, which is currently in a consolidation range between $110,000 above and $90,000 below. If it breaks above $110,000 or drops to $90,000, you can buy high and sell low.

The narrow consolidation range is between $96,000 and $100,000 on the 4-hour chart. Yesterday, it also retraced to $96,100, so if you bought in, you can buy high and sell low at $100,000.

Today, we will focus on Ethereum. We plan to interpret Ethereum using two video sessions. Today, we will focus on the dynamics of Ethereum's on-chain data, including the recent market crash, which is not unrelated to the on-chain data.

In this market crash, we are focusing on two accounts. These two accounts are whales that have returned after being dormant for 6 years. The first whale transferred 57,813 Ethereum to the exchange in the early hours of February 3, with a value of $171.6 million at that time.

The second whale deposited 77,736 Ethereum into the exchange, valued at $227.4 million. If both of these whales were to sell, it would make sense that the price dropped to $2,100. In total, there was a sale of 130,000 Ethereum.

Of course, it is not certain that both whales sold at the same time; it could also be a diversion. First, let's look at the first whale, which deposited 57,000 Ethereum. What was the cost of this whale?

Six years ago, on January 5, 2019, this whale bought Ethereum at a price of $153.6, with a cost of $8.88 million. What is its current value? The current price is $171.6 million, so you can see how much it has earned: $162.7 million. This whale's cost is very low.

Similarly, the other whale has the same cost as the first whale, which is also $153.6, and the time is the same, with both withdrawing this amount on the same day. Is there a connection between these two whales? It is very possible that they are two accounts of the same institution.

Regardless, the actions of these two whales have caused market turmoil. After both deposited into the exchange, we know there is a possibility of a downward sale.

First, let's look at the whale that deposited 57,813 Ethereum. After transferring to the exchange, it only has a balance of 0.01 Ethereum left, indicating that its tokens are either still in the exchange or have already been sold.

Now, looking at the second whale, it is quite strange. On the same day, it transferred a large amount to the exchange, but you will notice an issue: 12 to 13 hours ago, it transferred back over 70,000 Ethereum from the exchange to this address, indicating that this whale seems not to have sold these 70,000 Ethereum, while the other whale has significant suspicion. This suggests that on-chain data could also be a form of misdirection.

However, regardless of the situation, the price indeed dropped to a very low level, hitting $2,100, effectively clearing out all the bulls. Currently, this whale still has a balance of 77,740 Ethereum; it merely transferred assets back and forth with the exchange. We can keep an eye on this whale to see when it transfers back to the exchange, which may indicate the start of a trend reversal.

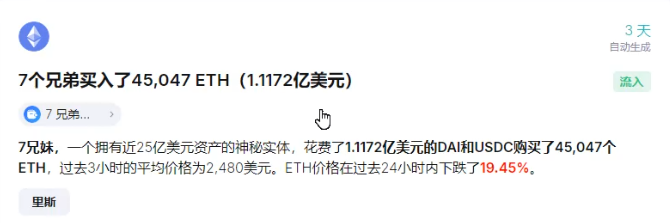

After these whales awakened, there is another whale called "Seven Brothers." During the downward crash of Ethereum, this whale bought $111 million worth, which is 45,000 Ethereum.

This whale is also quite impressive. It bought Ethereum at a price of $2,480, totaling $111 million. This whale is very smart; not only did it buy Ethereum during the significant drop, but it also bought Ethereum during the market crashes on August 5 and October 3, 2024.

This whale's trading strategy is very effective; it only buys Ethereum when the market experiences a crash-like decline.

We can see that on the last occasion, on August 5, it bought Ethereum at a price of $2,305, acquiring 56,000 Ethereum. This whale has assets totaling $2.2 billion.

So, the whale "Seven Brothers" has a very large volume, and we can monitor its movements. If it buys, we can also take action.

On August 5, Ethereum was also in a crash state. The price hit $2,100, which was during a sharp decline, making it a perfect time to buy.

When it dropped below $2,800 and returned to $2,100, this time of action coincidentally also hit $2,100, indicating that this whale is very optimistic about Ethereum's future price trend.

Next, we will focus on discussing how Ethereum's future trend will unfold, why its performance after a crash is stronger than Bitcoin, what its future price resistance levels will be, and where the opportunities for retail investors lie. In the next session, we will interpret the opportunities and risks that Ethereum brings us from another perspective.

For more information, you can follow our Binance media account [Seven Crypto Academy] or contact our assistant to join the VIP group.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。