Original Title: The People are Tired (of losing)

Original Author: francescoweb3, Head of Castle Labs

Original Compilation: zhouzhou, BlockBeats

Editor's Note: This article deeply explores the changes in the crypto market, particularly the fatigue felt by retail users. It is not difficult to see the shift from a venture capital-led market to a meme coin frenzy starting in early 2024. While meme coins once provided a fairer opportunity for retail, they ultimately became overly speculative, leading to a deterioration in market conditions. Retail users are tired of losses, the market has become fast-paced and competitive, emphasizing the importance of finding a new balance, and calling for more attention to projects with real applications and fair distribution mechanisms.

The following is the original content (reorganized for better readability):

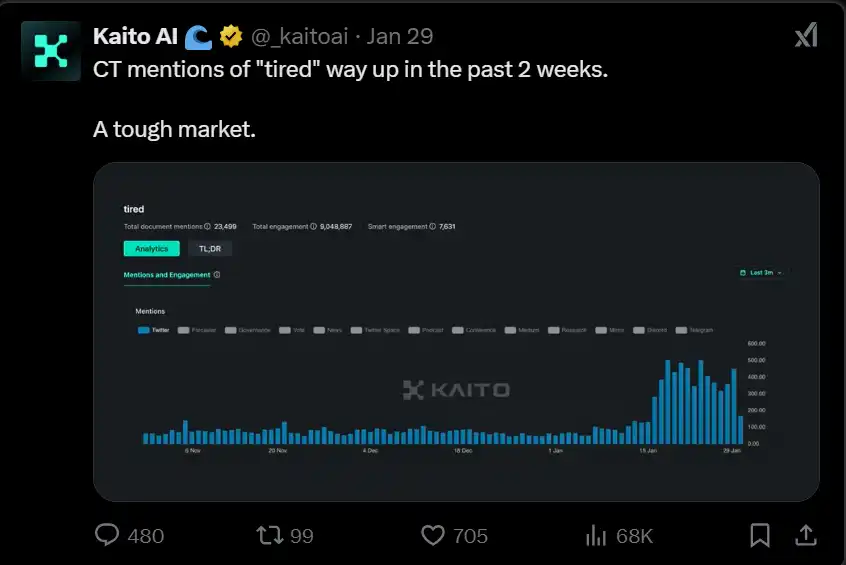

As Kaitoai emphasized, in the last two weeks of January 2025, the mention of the word "tired" increased on crypto Twitter.

This cycle is different from others, more challenging, and even surprising for traders who have experienced two or three cycles. The market is changing: the speed of narrative shifts is faster, and attention has become the scarcest currency. Last but not least, increasing regulatory scrutiny and political intervention in the crypto space have introduced new variables.

Why do people feel tired?

Retail investors have missed opportunities for too long; every time it seems the goal is within reach, the market dynamics change faster than before. In the 2021 cycle, we saw venture capitalists achieve exponential returns compared to retail investors who had no access to private investment opportunities.

This continued until around 2023, when projects like TIA and DYM launched, marking the end of retail investors' disillusionment with these venture capital extraction techniques.

What might be the most rational consequence of this? A movement seeking to change the power dynamics.

The long-known narrative of "meme coins" gained increasing attention as venture capitalists no longer had private chips to sell to ignorant buyers in the market. This was beneficial for retail investors, who managed to find a fair competitive environment. Until the narrative became overhyped and saturated, further shortening users' attention spans. Let's look at how the market landscape has evolved and where we might be heading, attempting to explain why people feel tired.

Stage One (Early 2024) - From VC Coins to Meme Coins

It almost feels like a long time ago, before the AI craze and meme coin frenzy, there was a period when the mainstream play for retail investors was airdrops. This play was initiated by Arbitrum and other Layer 2 airdrops. Retail users saw the potential for airdrops by trying new protocols and chains, and airdrops became a business, leading to the emergence of airdrop-as-a-service companies.

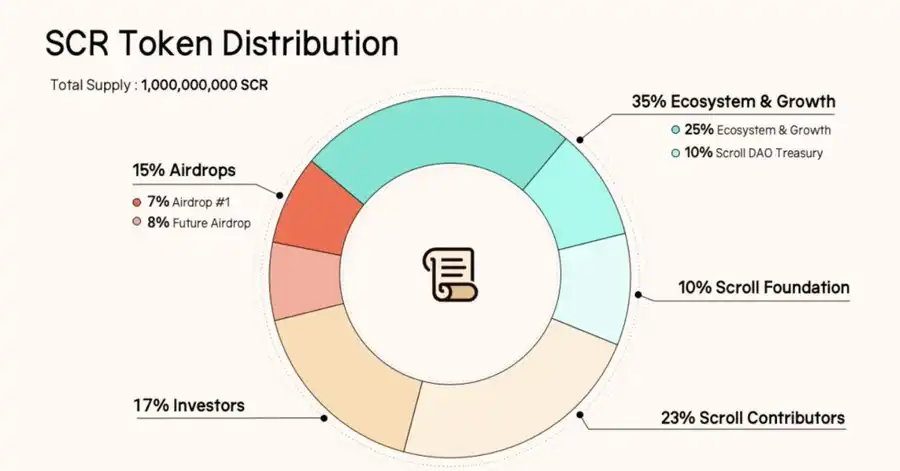

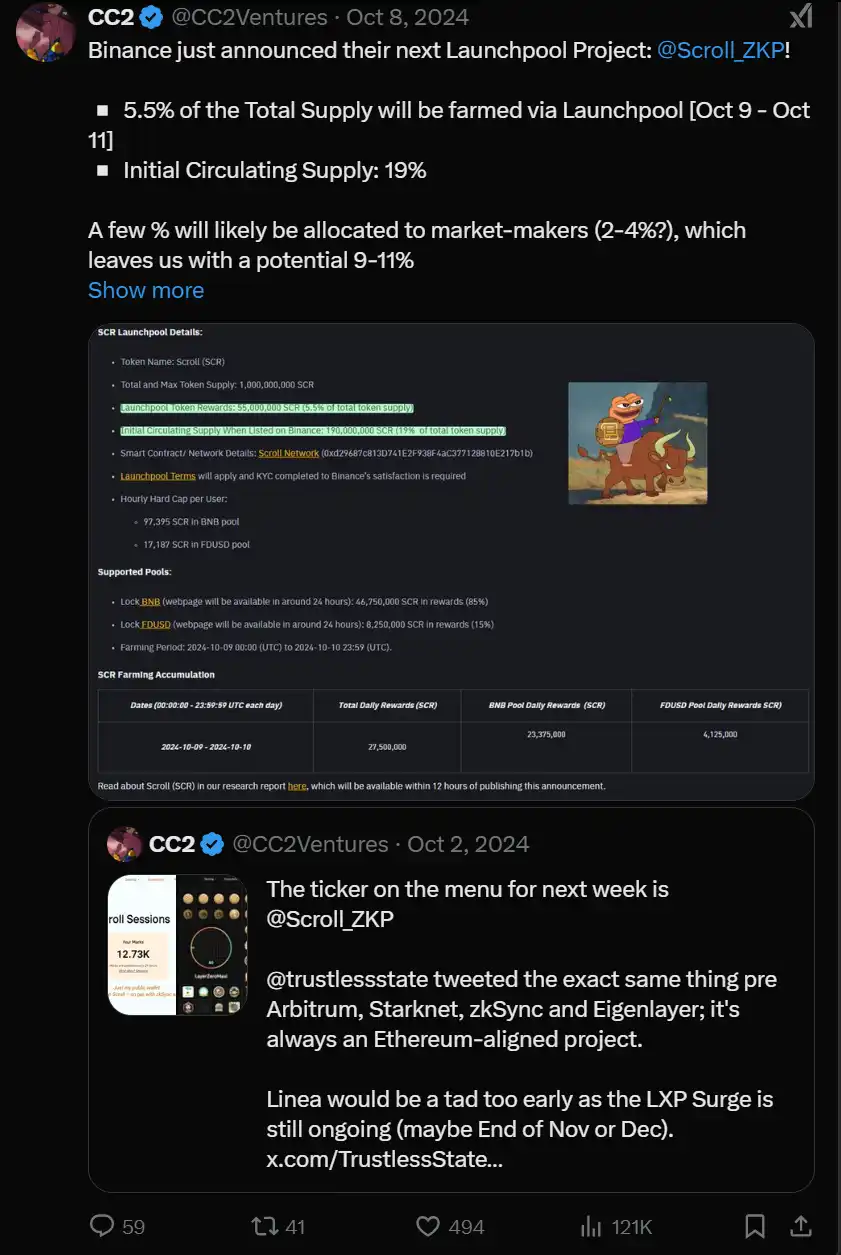

However, the dream turned into a nightmare when these coins began to release and disclose their tokenomics, leaving users very disappointed: all the effort resulted in almost nothing from the airdrops? One of the most controversial releases was Scroll, a ZK-EVM L2.

After over a year of ecosystem promotion, Scroll's airdrop was disappointing, raising questions about why 5.5% of the SCR supply was allocated to Binance instead of the community.

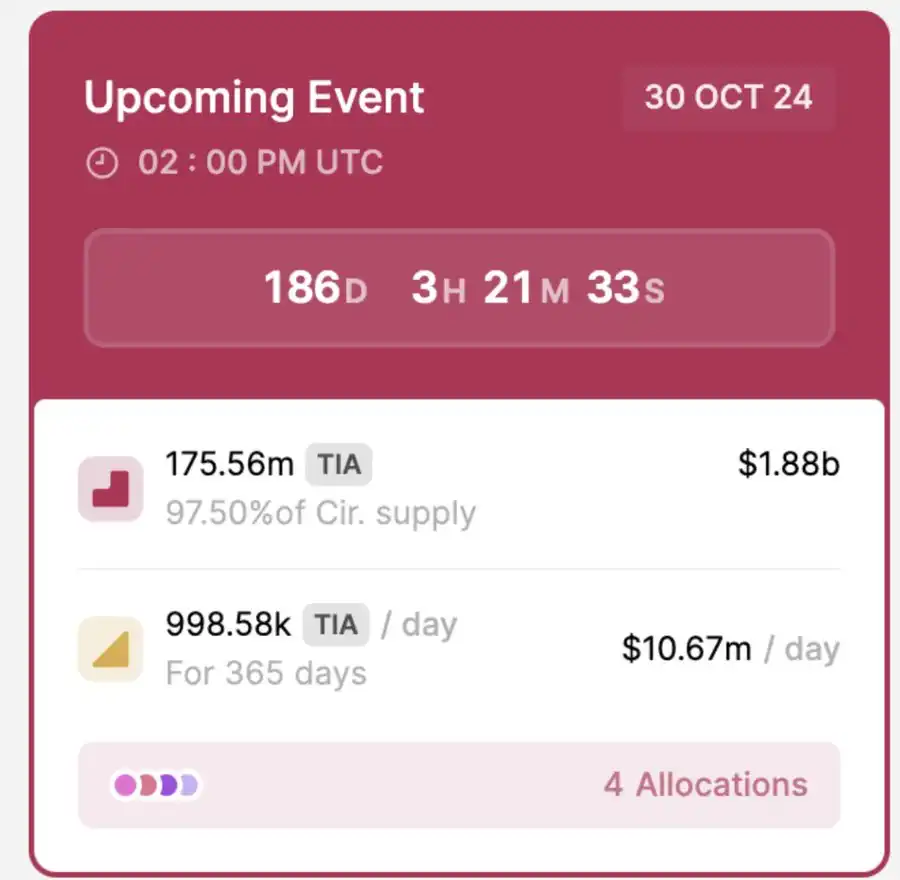

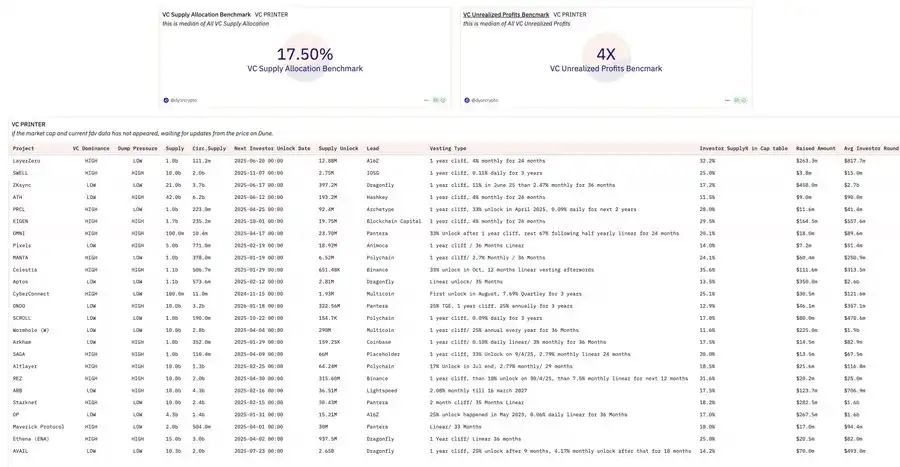

Moreover, most of these tokens had very low circulating supply (circulating supply/total supply), with a large portion allocated to VCs. Another topic of discussion is TIA and DYM, which at one point had narratives on crypto Twitter surrounding staking them in exchange for expectations of future ecosystem project airdrops.

You guessed it: those airdrops never happened, and the price trends of the tokens only went down (below is the chart for DYM).

Here’s an overview of the different rounds and investor unlocks for TIA:

In the first unlock, over 97.5% of TIA's circulating supply was unlocked, valued at over $1.88, with daily unlock amounts reaching $10 million.

Ultimately, retail investors grew tired of these types of tokens, meaning that the issuance price of most tokens only fell, eventually even dropping below their last financing valuation.

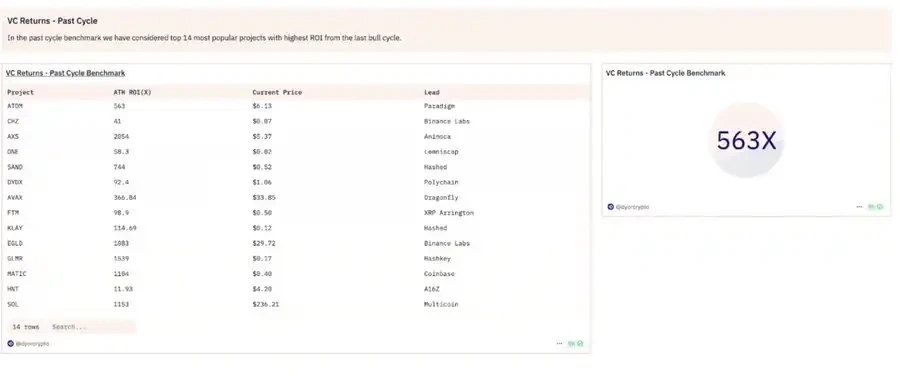

This is evident when we look at the dashboard provided below:

This dashboard considers the investment returns of each VC's best-performing investments in the data sample.

Returns for venture capital in the last cycle:

Returns for venture capital in this cycle:

The end of the venture capital era is so evident that even Hayes accurately pointed this out in his December 2024 article, where retail investors saw a glimmer of hope at the end of the dark tunnel: meme coins.

Tired of the venture capital-led schemes, retail investors finally had the chance to enter the permissionless market that blockchain was supposed to open up for them.

This must be the direction of the future, right?

Stage Two - The Meme Coin Frenzy

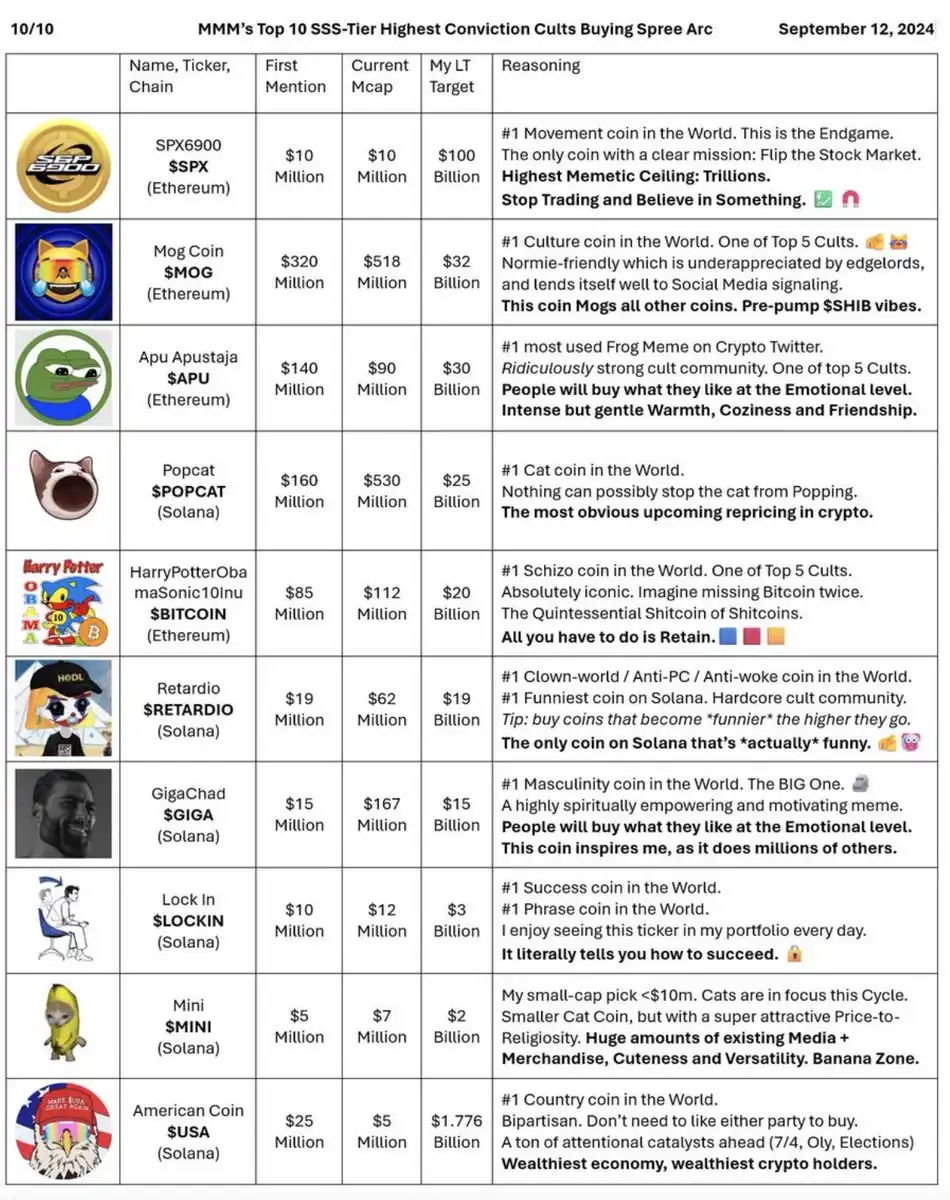

After the end of the venture capital era, users had to find new plays, which they discovered through muststopmurad and his "meme coin supercycle."

For retail investors, meme coins seemed to be the closest thing to having equal opportunities in the market—until they no longer were.

Prices soared, Trump was elected, and we were going to the moon.

But suddenly, the liquidity plug was pulled, market attention shifted elsewhere, and all your meme coins crashed during the market correction.

Meanwhile, all the insiders who had early opportunities to position themselves also had the chance to sell their chips. Perhaps the situation retail investors ultimately faced was even worse than what they experienced with VC coins.

So what remains? A greater inclination towards risk, further shortening attention spans, liquidity becoming more dispersed, while trying to understand past mistakes through more gambling disguised as "trading."

Pumpfun is just a symptom of the direction the market is heading.

jediBlocmates highlighted the net negative issues in this ecosystem.

Among the mentioned reasons, the Pump.Fun team continuously transferred large amounts of fees out. Just last month, they transferred over 880,877 SOL to Kraken, totaling $211,410,480.

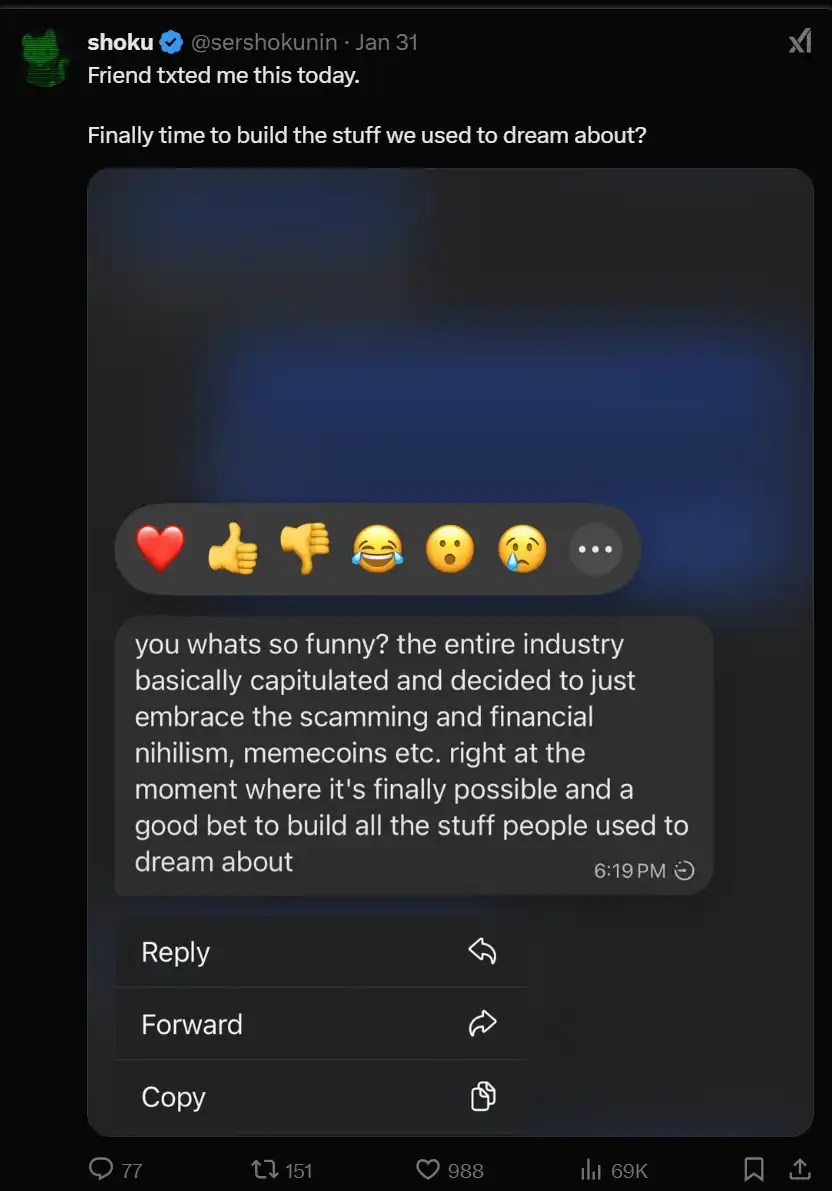

The impact of meme coins and the Pump.Fun frenzy is evident in the market changes they brought: narratives change rapidly, the environment becomes player-to-player, and people no longer believe in anything.

Stage Three - Market Trauma After PTSD: People Feel Tired

After being let down by venture capitalists, users now carry the trauma of the Pump.Fun arena, hoping their next 100x return can make up for previous losses. The market has now changed forever, and the new plays reflect this change.

Market rotations are shorter and faster; in previous cycles, you could hold positions overnight and hold tokens for weeks, but now you can hold them for at most a few days or hours. New projects siphon off all liquidity: attention is scarce, and everyone is playing the same game.

The influence of politics and regulation is increasing: this is particularly evident in the launch of TRUMP, highlighting how external events can have unprecedented impacts on the market.

Unfortunately, once again, retail investors have lost their direction in this game, with many tokens becoming reminiscent of the capital extraction mechanisms they are already very familiar with. In contrast to this trend, the launch of Hyperliquidx has drawn attention to community-led airdrops and distributions. Over 31% of the airdrop was allocated to the community, and the token price has increased more than sevenfold since its release, proving that fair distribution is achievable.

Nevertheless, it must be considered that not every project can replicate this model, as teams like Hyperliquid have incurred tens of millions in expenses to sustain their operations over a long period.

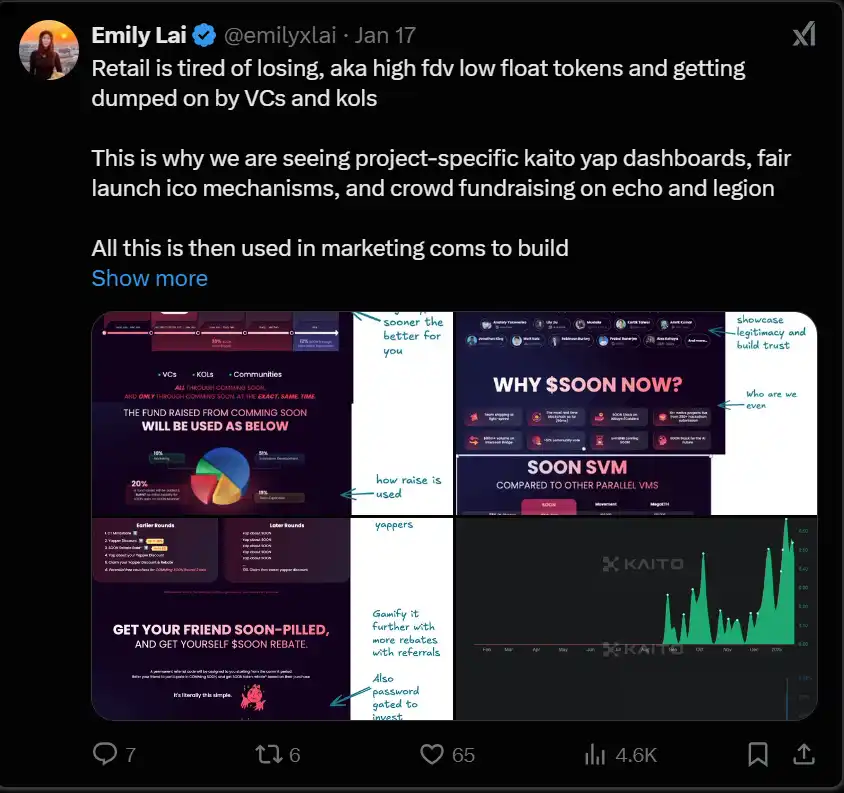

Importantly, the launch of Hyperliquid has brought about a paradigm shift within the industry. Coupled with Kaito's release, the project's approach to launch strategies has also changed.

Where does this leave us?

These stages highlight two extremes:

The power held by venture capitalists is too great: retail investors cannot participate in private rounds and can only serve as exit liquidity.

Unrestricted meme coin acquisition has led to a player-to-player market, worsening overall market conditions.

Both have the same consequence: dissatisfaction among retail investors and a demand for balance and stability.

We leave some possible thoughts to consider what the future might look like: a return to practicality, reducing focus on meme coins, and paying more attention to practical projects.

Reducing the focus on value extraction, emphasizing value creation, and avoiding zero-sum games. A return to fair distribution, inspired by Hyperliquid.

A complete transformation in protocol marketing and token release methods, utilizing tools like Kaito for marketing and growth activities, while valuing the influence of social graphs and communities.

While we all know that price is the best marketing tool and has always been a crucial factor in attracting smart talent and liquidity, it would be a pity to remain focused on value extraction as a supportive regulatory environment is on the horizon.

The growth cycles of emerging markets are often filled with rollercoaster-like ups and downs, but it is essential to have a final goal and outline a viable path for the majority. That is, to build something truly valuable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。