Original | Odaily Planet Daily (@OdailyChina)

Trump not only changed the rules of the Meme coin game, triggering a wave of political, economic, and internet industry celebrities to issue personal Meme coins, but also altered the fate trajectories of some participants. In the world of Memes, players generally fantasize about getting rich from a single coin, but very few can truly seize opportunities and achieve a leap in wealth.

CryptoD, with keen insight and unique strategies, earned tens of millions of dollars from TRUMP. Who would have thought that he entered the Meme coin market at the end of 2023 with just 1 SOL (about $30) as capital, ultimately achieving an astonishing growth of over $20 million in assets? Was his success merely a coincidence?

In this exclusive interview with Odaily Planet Daily, CryptoD publicly shares for the first time his journey from being a novice in the crypto space to becoming a leader in the Meme coin field, as well as how he seized a series of "golden dog" projects like TRUMP and Moodeng. Next, let’s step into CryptoD's world and uncover the secrets behind his success.

Focusing on Secondary Trading, Entering Meme with 1 SOL at the End of 2023 to Upgrade to A9

Odaily Planet Daily: What prompted you to enter the crypto market?

CryptoD: Actually, I entered this space back in 2016 while I was still in college. Through a friend's introduction, I was first exposed to cryptocurrencies when BTC was around $300.

Although I knew nothing about the field at that time, I naively bought a few bitcoins. When the price doubled, I happily sold them, not realizing that this was just the beginning of a future story.

After graduating and completing my military service, I deeply felt that blockchain could be a significant development opportunity in the next 10 years, so I decided to invest in the Web3-related industry. During my work, I held various roles including Marketing at an exchange, VC researcher, VC trader, and exchange BD, accumulating some industry experience.

By the end of 2023, I resigned from my job and began focusing on managing my own community.

Odaily Planet Daily: How did you make your first pot of gold in the crypto market?

CryptoD: My first pot of gold in the crypto space can be traced back to the last bull market when I focused on the secondary market, and my assets peaked at several million dollars. However, during the bear market, I lost most of my gains, and this experience made me fully understand the importance of asset allocation and risk diversification.

Odaily Planet Daily: How much did you initially invest in trading Meme coins, and what is your current asset level?

CryptoD: At the end of 2023, I entered the Meme space with 1 SOL, and now my assets have exceeded $20 million, which, in RMB, is at the level referred to as "A9 (Assets 9)."

Odaily Planet Daily: Why did you choose to enter the Meme track at the end of 2023?

CryptoD: At the end of 2023, I noticed that on-chain tools were gradually maturing, and more and more bots were entering the market. In the past, DEXs were relatively quiet, mainly due to poor trading experiences, but the emergence of bots effectively addressed this pain point. Because of this, I started to engage in this field. As profits gradually accumulated, I became more convinced that the track I chose was correct, which also provided me with more confidence and motivation for my future direction.

Seizing TRUMP Was Not Luck, Persisting with Small Bets for Big Gains

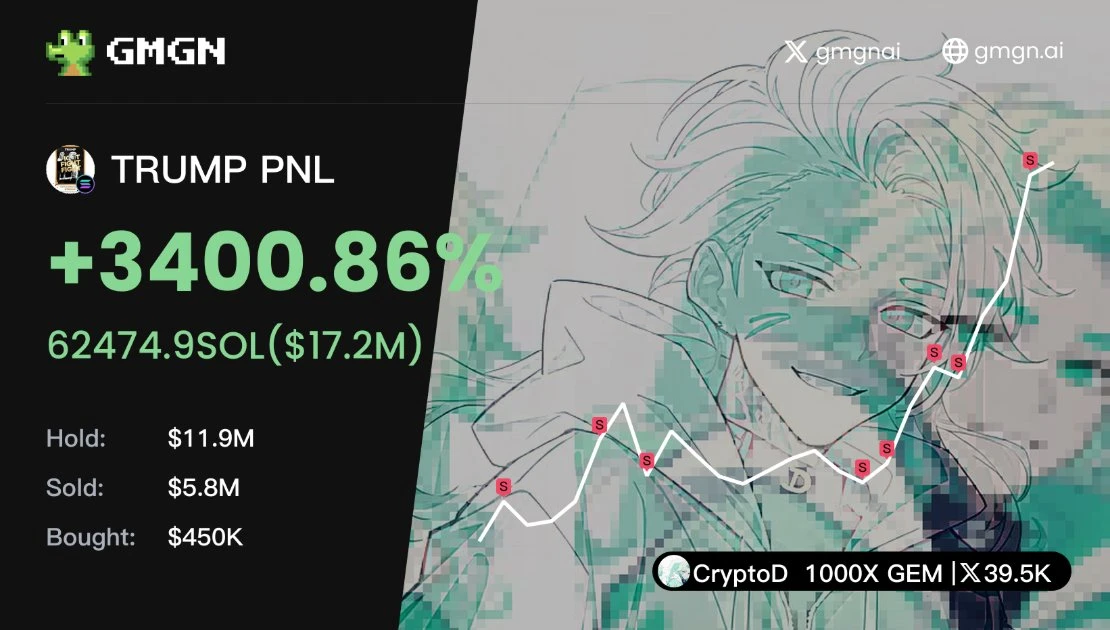

Odaily Planet Daily: GMGN data shows that you made $17.2 million on TRUMP, approximately 123 million RMB, with a buying cost of $450,000, yielding a 38-fold return. Can you share your thought process in investing in TRUMP, why you dared to invest $450,000 at once, and what key trading decisions were involved?

CryptoD: I usually maintain over 15 hours of energy using GMGN for on-chain information collection, so when TRUMP came out, I was online.

Initially, a community member posted relevant information in the group. At that time, the market cap was about $250 million, and I immediately checked it out. Trump had first released this news on his social platform TruthSocial, and you could only see the specific contract address by visiting the official website. My first reaction was to think this might be a scam or a hack, as there had been previous cases of fake Trump coins. However, I noticed that some addresses I was monitoring on GMGN were continuously buying TRUMP, which raised my alert.

To further confirm the authenticity of the news, I found that the TRUMP coin's official website allowed Americans to purchase with credit cards, which indicated high compliance requirements. This made me certain that this was likely real.

So, I seized this opportunity and invested all of my $450,000 on-chain into TRUMP, and I am grateful to GMGN for allowing me to buy smoothly during the on-chain congestion. But I did not withdraw more funds from CEX to continue increasing my position because I believed that $450,000 was the maximum risk capital I could accept to lose. The subsequent trend is well-known; TRUMP skyrocketed from a $200 million market cap to $70 billion, and I successfully earned $17.2 million from it.

Odaily Planet Daily: Before TRUMP, what other golden dog projects did you seize? How did the investment costs differ for different Memes?

CryptoD: My fame initially wasn't high, and it only grew significantly after the "Hippopotamus War." At that time, with Moodeng, I nurtured it from a $2 million market cap to a peak of $700 million, which was also when I first gained widespread attention in the circle. "Hippopotamus" was also the first Meme coin where I made over a million dollars in profit.

Subsequently, my community and I continued to discover potential projects, and we managed to capture almost every influential "golden dog" at near-bottom prices, such as arc, Swarms, YNE, Buzz, RIF, URO, etc., with profits of about $3 million before the TRUMP battle.

The average cost I invest in a Meme is somewhat related to the market cap when I discover the coin. Typically, I would take 0.2% to 1% of the total supply of that token. For example, if the market cap at discovery is $1 million, I would invest about $2,000 to $10,000; if the market cap is $10 million, I would invest between $20,000 and $100,000.

The goal is to avoid holding too many chips that could lead to the operator abandoning the project while also achieving a good risk-reward ratio. GMGN's profit and loss calculation function helps me effectively review each trade.

Odaily Planet Daily: People often only see the successful parts of others, while few ask about the hard times. Before TRUMP, did you experience any significant losses? Share the process and the lessons learned.

CryptoD: Indeed, there is no such thing as perpetual profit in the world, but playing Memes has a significant advantage: you can bet small for big gains. Losses are usually limited, as long as you can maintain a long-term strategy of "small losses, big gains" and keep a positive EV, the asset curve can achieve stable growth.

More importantly, never bet big for big gains, and do not go all-in on a single coin due to FOMO; such behavior carries high risks and can lead to substantial losses. Sound capital management and rational decision-making are the keys to long-term success.

As for me personally, I haven't experienced particularly memorable losses, as I always prepare mentally for the possibility of losing everything when purchasing tokens. This mindset allows me to face risks rationally; even if I incur losses or even lose everything, it remains within my control.

Thus, this strategy not only reduces psychological pressure but also allows me to focus more on the long-term investment return goals.

Odaily Planet Daily: Why are you able to continuously seize big Meme opportunities like Moodeng and TRUMP?

CryptoD: Usually, I spend almost all day monitoring GMGN's chain scanning page, conducting detailed research on every coin launched on external exchanges. Meanwhile, community members are doing similar things; those who discover first-hand information usually share it immediately in the community, and everyone conducts research and analysis together, ultimately deciding for themselves whether to invest.

Additionally, I regularly collect some smart wallet addresses and add them to GMGN's address monitoring system. The buying signals from these addresses are also an important way to scan the chain.

Good Community + Good Tools + Good Strategy = Achieving Long-term Returns

Odaily Planet Daily: Your Meme Alpha community 1000X GEM is gradually gaining recognition in the Chinese community. Why did you decide to establish this community?

CryptoD: In the Meme space, information equals money; buying five minutes earlier can yield ten times the profit. This was my initial intention for establishing the community—to create a platform for information exchange, allowing everyone to share valuable insights. However, as the community grew rapidly, the members' strengths began to vary, and some scam groups emerged that exploited community members. To address these issues, I decided to establish an NFT group.

After the community gained recognition, I started receiving various advertising invitations daily, but my response was always, "If your project is strong enough, I will naturally discover and invest in it without needing advertising fees." So if a project truly has strength, it doesn't need to pay me for advertising; instead, I will find it and invest.

Odaily Planet Daily: You have mentioned GMGN multiple times. Why do you choose GMGN as your commonly used trading tool, and what usage tips can you share?

CryptoD: First of all, for beginners, I recommend starting in a learning environment, regardless of whose group you join; the environment is crucial.

It's like learning English; if you want to improve your English skills rapidly, the best way is to immerse yourself in an English-speaking environment and force yourself to learn actively. The same goes for trading; being in a high-intensity trading environment can greatly enhance your growth.

Next is choosing the right tools. I recommend GMGN, and the reasons are obvious; it has indeed helped me a lot in achieving my current performance. Beginners can start by collecting some "smart money" addresses. Although it may seem confusing at first, you can find resources on Twitter and then add these addresses to GMGN's address monitoring. GMGN's address monitoring is very fast, and with its data analysis features, I can quickly filter projects, see the chip structure of projects, and identify who is participating in buying and selling. After collecting smart money addresses, the next focus is to understand the characteristics of each smart money address and see which tracks they excel in. However, remember not to blindly follow others or buy things you don't understand, as profits and losses stem from the same source; it all comes down to the realization of knowledge.

Finally, there is the training of position control and profit-taking and stop-loss strategies. I suggest that friends who are new to playing Meme on Solana should not try to catch the bottom or think about averaging down their costs. 99% of projects on Solana are one-time flows, and profit-taking strategies should start with doubling your initial investment. GMGN's order placement feature can help achieve this effectively.

Odaily Planet Daily: The huge wealth effect brought by TRUMP has led to more and more secondary players or newcomers in the crypto space joining the primary Meme market. What advice or experiences do you have for new Meme players who want to earn tenfold or hundredfold returns?

CryptoD: For me, the primary market has many similarities with playing poker; both involve uncertainty regarding opponents, developers, exploitative analysis by the house, and the design of long-term strategies that cannot be exploited.

Here are a few similarities I see:

- The biggest risk in the primary market is "becoming the bag holder" or being exploited by other players (such as whales, developers, or the house).

The concept of GTO (Game Theory Optimal) in poker tells us to design a balanced strategy that prevents us from being driven by emotions or overly aggressive behavior in the market, thus avoiding manipulation or exploitation.

For example, do not bet all your funds on a single token; instead, diversify your capital and set rational target prices for gradual profit-taking. During extreme FOMO, a rational GTO strategy will tell you not to blindly chase highs but to make calm decisions based on mathematical probabilities and past market patterns.

- Range balancing vs. market signals and chip management.

In poker's GTO: In every betting action, you balance based on opponent behavior, your own hand range, and possible community cards, combining value betting and bluffing.

In the primary market, range balancing can be likened to how you interpret market signals and manage funds:

Value Bet: Invest in projects you believe have intrinsic potential, such as those supported by active communities or high-certainty projects (similar to having a good hand);

Bluff: For some high-risk, high-reward short-term speculative PVP projects, you can test with small positions, but this portion should be limited to avoid excessive risk.

- Rational profit targets with long-term positive EV.

In poker's GTO: Long-term positive EV is key; not every hand needs to win, but the goal is to maximize overall returns.

The same applies to the primary market, where market volatility is very high. Pursuing maximum returns in every trade may lead to significant losses. In the primary market, you must accept that some projects may fail or be rug pulls, but you can indeed achieve asset growth through disciplined overall strategies. We cannot control the market, but we can control our positions.

Remember, the heavens do not pity those who go all-in; as long as you are alive, there is hope.

The market is not short of opportunities, and I remain optimistic about the development of the Meme market.

Odaily Planet Daily: Some believe that the Meme market after TRUMP is approaching hellish difficulty. What is your view on the future development of the Meme market?

CryptoD: Every time a "big dog" appears in the market, a large number of imitators will follow, and most of these imitators are of a PVP nature.

After the "Hippopotamus War," I reminded everyone on Twitter that if a narrative misses the boat, don't rush. Although there may be one or two successful imitators, if you haven't participated in the breakout, there's no need to engage with the others. It's better to take a break and wait for the next narrative opportunity. As the time since the hot topic is released increases, the difficulty of "dog fighting" will rise exponentially, and the risk of losses will also increase. The market conditions after TRUMP have confirmed this; calmness and patience are key.

However, I still hold a relatively optimistic attitude towards the upcoming Meme market. The success of the Trump narrative has indeed attracted a lot of real outside capital, indicating that the market is not short of money; what is truly lacking are quality projects. I believe that as time goes on, with the accumulation of market sentiment and the flow of funds, there will definitely be other "big dogs" emerging in the future. As long as we seize the opportunities, this market is still full of possibilities.

Odaily Planet Daily: Besides on-chain Memes, what other tracks are you paying attention to, and why?

CryptoD: As long as it can bring wealth effects, successfully break out, or has innovative projects, I will pay attention. But at this stage, only Memes can achieve these.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。