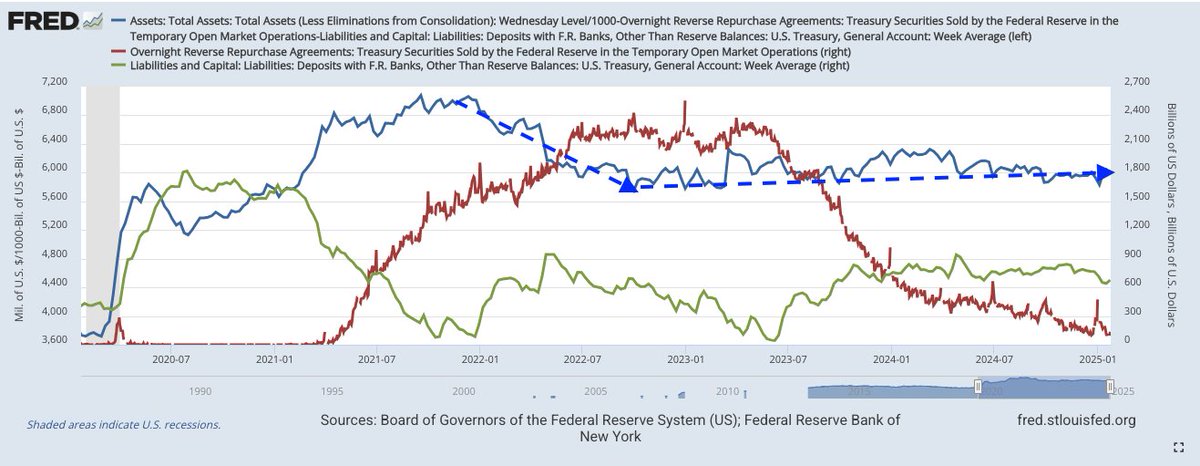

The real QT of the Federal Reserve occurred from the end of 2021 to the end of 2022. From this point, overall liquidity remained relatively stable - the main contribution to this was that onRRP largely offset the decline in the Fed's total assets.

Currently, onRRP has basically reached its limit, but there is still TGA that can be released to continue offsetting the Fed's total assets.

After TGA reaches its limit in the U.S. or after the U.S. debt ceiling is resolved, if the Federal Reserve continues QT, it means that overall market liquidity will decline - this indicates a peak phase.

The next key point is when the Fed will stop QT, which is something to closely monitor in the next FOMC meeting. The current assumption is that this time will not be too soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。