Macroeconomic Interpretation: Many friends may wonder why BTC had a good upward momentum on Monday, seemingly on the verge of breaking new highs, only to plummet from a high of $102,762 on Tuesday, dropping all the way down to around $92,500?

On December 26, the day after Christmas (Christmas Day in the U.S.), I analyzed in my research report that the resistance level for BTC was around $102,770, with a support level around $92,520. Now, the highest and lowest points of this week's market align perfectly with the predicted resistance and support levels.

This week, the global financial markets and the cryptocurrency market experienced multiple significant events and policy news impacts. These events not only reshaped market trends but also triggered a reassessment of future trends by investors. Below is a summary of this week's hot events and an in-depth analysis of their impact on the crypto market.

1. Rumors of Trump's Tariff Policy Trigger Market Volatility

On Monday, following a report by The Washington Post that Trump's team was exploring a general import tariff plan on key imported goods, the dollar index plummeted, while U.S. stock futures and the crypto market surged. This news reflects the market's high sensitivity to the potential protectionist policies that Trump might adopt. However, Trump's denial on Tuesday reversed market sentiment, leading to declines in both U.S. stocks and Bitcoin (BTC), indicating the market's heightened vigilance regarding policy uncertainty.

2. Delay in Fed Rate Cut Expectations

The market widely expected the Federal Reserve to cut rates earlier this year, but this week, the expectation for the first rate cut was significantly pushed back to June or July. This change led to a reassessment of inflation expectations and Fed rate expectations, putting pressure on dollar-denominated assets like U.S. stocks and BTC, resulting in price declines. This reflects the market's keen attention to the direction of the Fed's monetary policy and its significant impact on asset prices.

3. Trump's Remarks Cause Global Asset Market Turmoil

A series of remarks by Trump regarding inflation, interest rates, foreign policy, and military actions further exacerbated volatility in global asset markets. Trump's idea of merging the U.S. and Canada using "economic power," along with plans to overturn Biden's offshore drilling ban, demonstrates his hardline stance on foreign policy. These remarks negatively impacted the three major U.S. stock indices and the crypto market, leading to a collective market decline.

4. Fed Meeting Minutes Reveal Rate Cut Path

The minutes from the Fed's meeting showed that while a 25 basis point rate cut was decided, the pace of rate cuts is expected to slow significantly by 2025. Market participants remain uncertain about the path of the federal funds rate over the next year, increasing market volatility. The cryptocurrency market, as a high-risk asset, is particularly sensitive to changes in the Fed's monetary policy.

5. U.S. Government Plans to Sell BTC from Silk Road Case

The news that the U.S. government plans to sell BTC seized in the Silk Road case led to a brief drop in BTC. This event highlights the impact of government policy on the cryptocurrency market. Although Trump has stated that he would not sell any BTC after taking office, it remains to be seen whether the government can successfully sell these bitcoins.

6. Non-Farm Payroll and Unemployment Rate Data to be Released

Non-farm payroll and unemployment rate data will be released on Friday evening, and these two data points are crucial for assessing the health of the U.S. economy and will directly influence the Fed's future rate policy. Cryptocurrency market investors need to closely monitor this data, as it may trigger significant market sentiment fluctuations.

Comprehensive Analysis: The hot events of this week indicate that policy news, economic data, and government actions have a significant impact on the crypto market. Rumors of Trump's tariff policy, the delay in Fed rate cut expectations, Trump's hardline remarks, and the government's plan to sell BTC have all intensified market volatility. Additionally, the release of non-farm payroll and unemployment rate data will provide new guidance for the market.

For cryptocurrency market investors, in the face of such a volatile market environment, it is essential to remain calm and rational, closely monitor policy dynamics and changes in economic data, and adjust investment strategies in a timely manner. In the future, as more policies and economic data are released, the crypto market may encounter new opportunities and challenges.

BTC Data Analysis:

In this market, one will notice that when the market is rising, all the news seems positive, while during a downturn, the news often appears negative.

Many messages sometimes serve merely to guide market sentiment, and media reports often carry a bias towards either bullish or bearish perspectives, potentially influenced by vested interests. For instance, those holding short positions may promote bearish sentiment, while those holding long positions or seeking to expand profits may promote bullish sentiment. Of course, it is not necessarily the media itself that holds positions; it could be the capital controlling the media that has corresponding holdings.

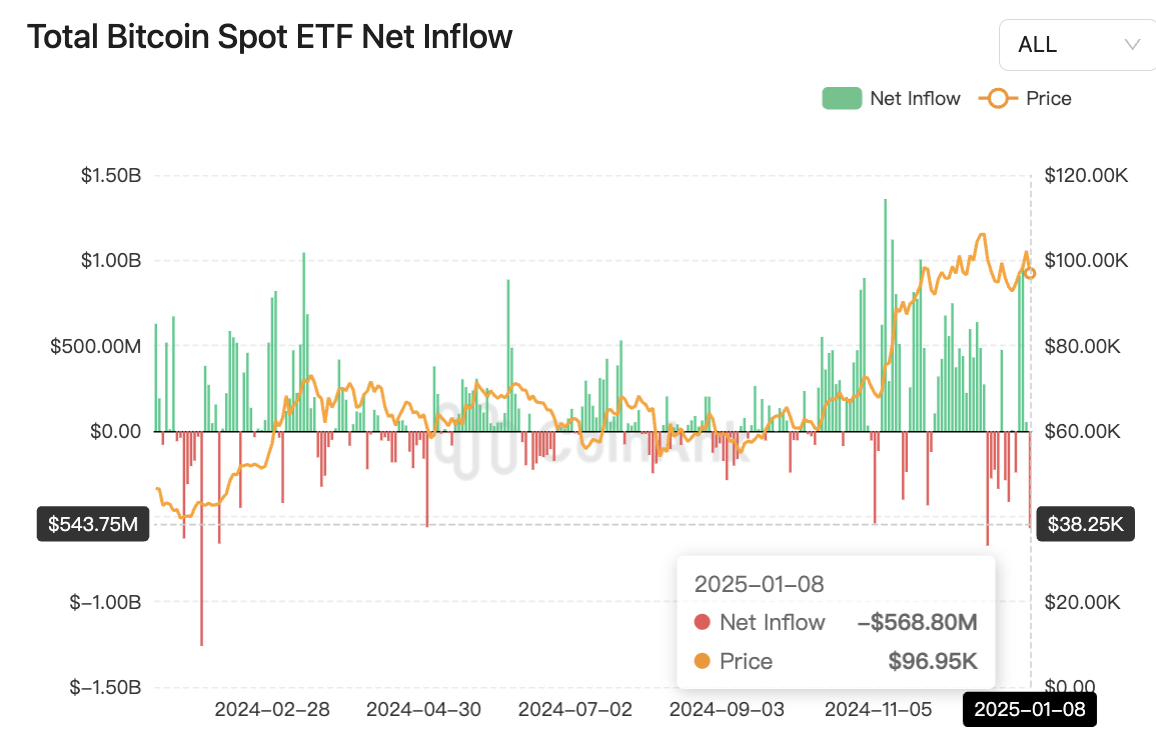

For example, in this round of negative news, #U.S. stocks fell, and there was a significant outflow of funds from the #Bitcoin ETF overnight, with Coinank data showing an outflow of $569 million yesterday, along with the U.S. government's plan to sell #BTC:

U.S. officials confirmed to media DB News today that the Department of Justice has been authorized to liquidate 69,370 BTC (worth approximately $6.5 billion) seized in the Silk Road case. This news led to a brief drop in BTC.

It is reported that the Department of Justice requested permission to sell these assets due to Bitcoin price volatility. When asked about the next steps, a Department of Justice spokesperson stated, "The government will take further action based on the case's ruling."

The progress of this event is "approved for sale," but the Department of Justice cannot currently determine when these bitcoins will be sold. There are only 11 days left until Trump officially takes office on January 20, and Trump has stated that he would not sell a single bitcoin after taking office. Given the efficiency of the U.S. government, it remains to be seen whether the Department of Justice can successfully sell these bitcoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。