Industry Overview

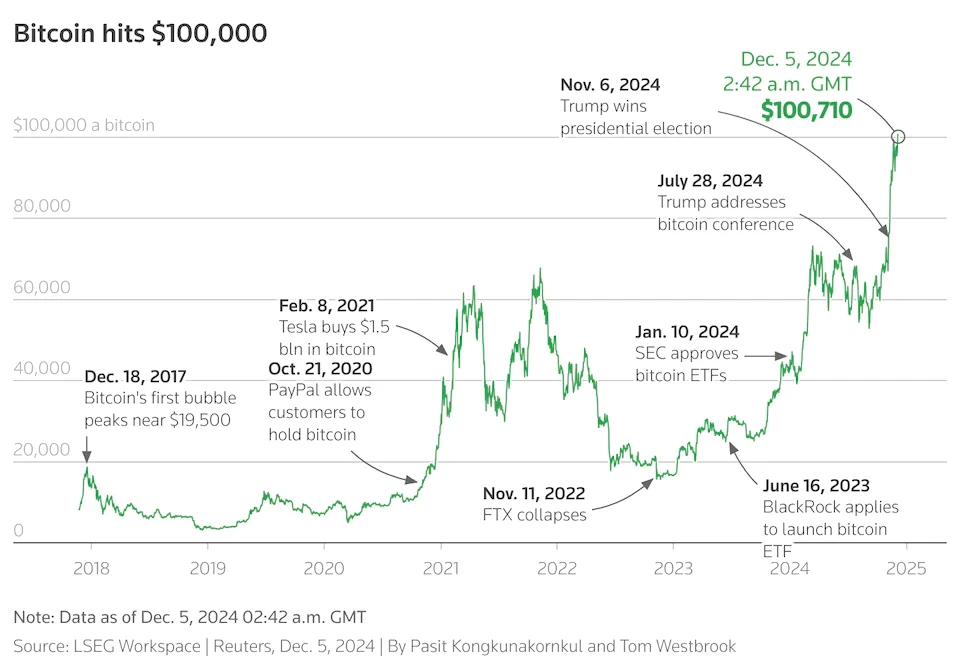

On December 5, Bitcoin broke through the $100,000 mark, creating history as the market had anticipated. At this historic moment, the global financial industry focused its attention on Bitcoin's new high, marking a new milestone in the cryptocurrency space, significantly demonstrating the expanding influence and increasing recognition of the cryptocurrency market, while also indicating tremendous growth potential in the future. This not only marks the realization of ArkStream Capital's long-held beliefs and expectations but also symbolizes the validation of faith in the entire cryptocurrency industry. For the industry, whether in the first market filled with both risks and opportunities, the efficient and diversified secondary market, or the vibrant on-chain activities, the breakthrough of Bitcoin has invigorated the entire market, leading to a strong performance in the fourth quarter.

Bitcoin Price Chart, Source: LSEG Workspace

Bitcoin's successful crossing of the $100,000 threshold is attributed to multiple factors, with the most critical being the macroeconomic environment's expectations of interest rate cuts and Trump's victory in the U.S. presidential election.

The Federal Reserve's two interest rate cuts this quarter had a profound impact on the market, further stirring the market dynamics. On one hand, the rate cuts reduced borrowing costs, stimulating investors to seek higher-yielding assets, leading to more funds flowing into the cryptocurrency market. On the other hand, the rate cuts also improved market liquidity, helping to support asset prices. Additionally, the stablecoin market benefited from the macro rate cuts, with issuance reaching a historic high, significantly increasing market liquidity and reigniting market vitality. ArkStream Capital expects that with the implementation of quantitative easing policies in 2025, liquidity will further enhance, and cryptocurrency assets will experience significant price increases, leading to further market expansion.

During the U.S. presidential campaign, Trump explicitly expressed his support for the development of Bitcoin and the cryptocurrency sector, making a series of positive commitments. Specifically, he proposed establishing a national strategic Bitcoin reserve, planning to incorporate Bitcoin into the national financial strategy framework, and ensuring that the government holds a certain amount of Bitcoin. Furthermore, Trump promised to take proactive measures in regulatory policies and support for startups to promote the healthy development of the crypto sector. After his successful election, Trump took two significant actions to support the development of the cryptocurrency sector: first, he nominated Paul Atkins, an advisor with extensive experience in the cryptocurrency field, to serve as SEC chairman. Second, he established a new position for the White House to oversee artificial intelligence and cryptocurrency affairs, appointing former PayPal executive and expert in big data and cryptocurrency, David Sacks, to this role.

World Liberty Financial (WLFI), a project led by the Trump family, aims to integrate DeFi by merging innovative financial solutions with blockchain technology to provide users with fairer, more efficient, and secure financial services. WLFI is actively investing and collaborating in key areas such as lending, RWA, and stablecoins. The partnership with Aave provides a mature and reliable lending protocol platform and integrates new stablecoin assets like Ethena's sUSDe, which not only broadens the types of collateral assets but also enriches funding sources. Additionally, according to data from Spot On Chain, since November 2024, WLFI's main wallet addresses have significantly purchased mainstream crypto assets such as ETH, cbBTC/wBTC, LINK, AAVE, ENA, and ONDO. This has sparked close market attention to WLFI's asset movements and ignited enthusiasm for buying WLFI's partnered DeFi projects, especially those that yield actual returns through deep collaborations. A notable example is WLFI's collaboration with Ethena in mid-December 2024, which incorporated Ethena's yield-generating stablecoin sUSDe into the collateral asset system of its lending platform, increasing stablecoin deposit sources for WLFI's lending platform. Upon the announcement of the collaboration, the ENA token surged over 10% in a short time, highlighting the market's recognition of WLFI's influence.

After Trump's victory, MicroStrategy significantly increased its investment in Bitcoin. According to the latest data, the company purchased nearly 150,000 Bitcoins in Q4 2024, with a total expenditure of nearly $13.5 billion, averaging about $90,000 per Bitcoin. In contrast, the total net asset value of Bitcoin spot ETFs grew from $60 billion at the end of Q3 to nearly $110 billion at the end of Q4, with new capital inflows reaching $50 billion, while MicroStrategy's purchases accounted for nearly 25% of all Bitcoin spot ETF net inflows. Additionally, MicroStrategy plans to propose up to $21 billion in equity financing and $21 billion in bond issuance through a special shareholder meeting to continue investing in Bitcoin. MicroStrategy's CEO Michael Saylor is also actively promoting more traditional giants to invest in Bitcoin, such as Microsoft, although Microsoft shareholders voted against the related proposal. The market is both eager and concerned about MicroStrategy's continued purchasing behavior, on one hand anticipating its collaboration with traditional giants to drive the development of the crypto industry and Bitcoin's new highs, while on the other hand worrying about potential black swan events that could lead to market turmoil.

MicroStrategy's BTC Holdings, Source: https://treasuries.bitbo.io/microstrategy/

Within the cryptocurrency market, the focus had once been on Bitcoin itself and the on-chain speculation of memes, leading value investments focused on infrastructure construction and application landing to nearly fall into a pessimistic trough. However, with the stabilization of the political environment in November, value investments began to see a resurgence. The value of sectors such as DeFi, infrastructure, and emerging public chains is gradually being re-recognized by the market, and steadfast investors are receiving stable returns, bringing value investment back into focus. From specific projects, the popularity of Ethena and Usual reflects the market's increasing preference for RWA and stablecoins, while protocols like Curve, with their low slippage characteristics in stablecoin exchanges, also performed well. Strong fundamental projects that conducted TGE this quarter, such as HypeLiquid and Morpho, as well as projects like Virtuals that insist on product application landing, not only performed strongly in data but also saw their corresponding token prices continuously reach new highs. These trends indicate that value investment is returning, and innovation remains one of the core driving forces for the development of the cryptocurrency industry, with funding attention shifting towards these areas.

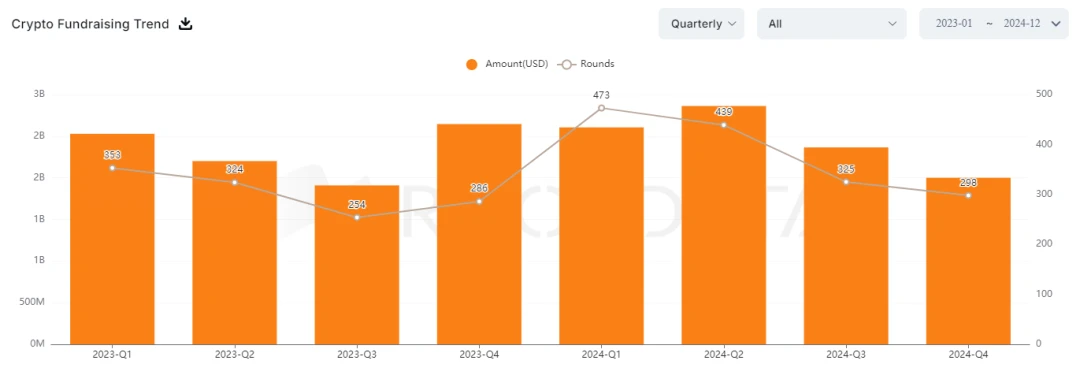

However, everything has two sides; recently, financing activities in the primary market have shown a downward trend in both quantity and amount, creating a disconnect with the secondary market's performance. Moreover, projects that raised funds in the past two years are facing a backlog for listing on first-tier exchanges, while second-tier exchanges continue to experience liquidity shortages. Additionally, the on-chain speculative frenzy at the beginning of Q4 and the heightened anti-traditional venture capital sentiment have adversely affected the pricing of primary market projects post-listing, further compressing investment return space. In the transition to the secondary market, primary market projects not only have to deal with the challenges of liquidity window periods but also face fierce competition within the same track and limited exchange resources. The combination of these factors has led to unprecedented challenges in primary market investment and financing activities.

Quarterly Primary Market Financing, Source: https://www.rootdata.com/

In the secondary market, to pursue returns exceeding Bitcoin's growth, investors typically seek opportunities in the altcoin market. However, in the harsh market environment of Q2 and Q3, although Bitcoin maintained a high price, many fundamentally sound altcoins performed poorly. This indicates that timing is crucial; even if the fundamentals of the target are good, improper timing can lead to unfavorable entry prices or prolonged capital occupation costs. Additionally, the secondary market must also contend with challenges such as position management and risk control, where a slight misstep can lead to capital drawdowns or losses. Therefore, although secondary market trading strategies do not need to consider token listings and liquidity issues, they must face challenges such as target selection and timing choices. Overall, the secondary market has lower strategy certainty, higher risk-reward ratios, and difficulty in scaling capital.

Overall Performance of Altcoins, Source: https://www.tradingview.com/symbols/TOTAL3/

Focus on Sectors

DeFi

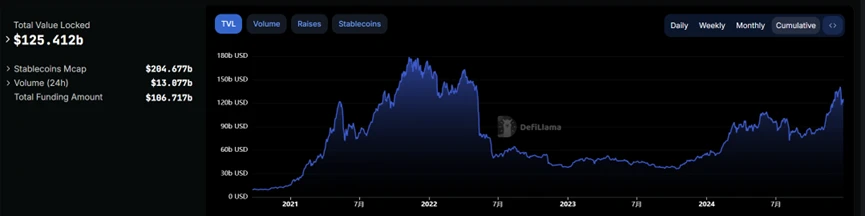

In 2024, the DeFi sector experienced a strong resurgence. As a significant force that disrupted the industry in the previous cycle, DeFi continues to receive widespread recognition within the industry. Meanwhile, with the rise of BTC and altcoin ETFs, along with the potential for large-scale capital inflows from U.S. policy changes, the demand from new users for lending, DEX, and stablecoin trading is continuously growing, providing substantial potential for the robust increase in DeFi's TVL and asset scale.

The market trends following the election have preliminarily validated this. According to DeFiLlama data, from November 6 to December 15, the increase in incremental funds and lending demand brought by new and old investors propelled DeFi's TVL from $87 billion to $130 billion, an increase of over 50%.

DeFi's TVL, Source: https://defillama.com/

The lending sector, as a pillar of the DeFi field, performed particularly well in Q4 2024. The total value locked (TVL) in the decentralized lending market reached $55 billion, surpassing the previous cycle's peak of $51.2 billion. AAVE maintained its leading position in the market this quarter, capturing over 40% of the market share and controlling nearly 70% of the DeFi lending market, with active loan management ranging between $7-8 billion. The growth of Aave's TVL can be attributed to several factors: first, the improvement in market conditions following the U.S. elections prompted investors to seek higher yields, leading to increased loan demand; second, in a "easy money" market, investors' interest in leveraged trading intensified, further driving lending activities. Data shows that ETH, as a core lending asset, saw its supply annual percentage yield (Supply APY) rise from 1.8% at the beginning of September to 2.5% by mid-December, while the supply APY for stablecoins USDT and USDC increased from 3% and 4% to a maximum of 15% and 17%, respectively, indicating a significant rise in market demand for high-yield assets. At the same time, the loan-to-value (LTV) ratio increased from $7.5 billion at the beginning of September to $16 billion by mid-December, demonstrating a substantial expansion in borrowing scale. Currently, AAVE's TVL has reached approximately $21 billion, surpassing the previous cycle's peak of $19 billion by about 11%; the token price has risen to $370, leaving approximately 80% room for growth compared to the previous cycle's high of $665. Expectations of lower U.S. bank lending rates in the future may further drive capital inflows into the DeFi lending market, enhancing Aave's TVL.

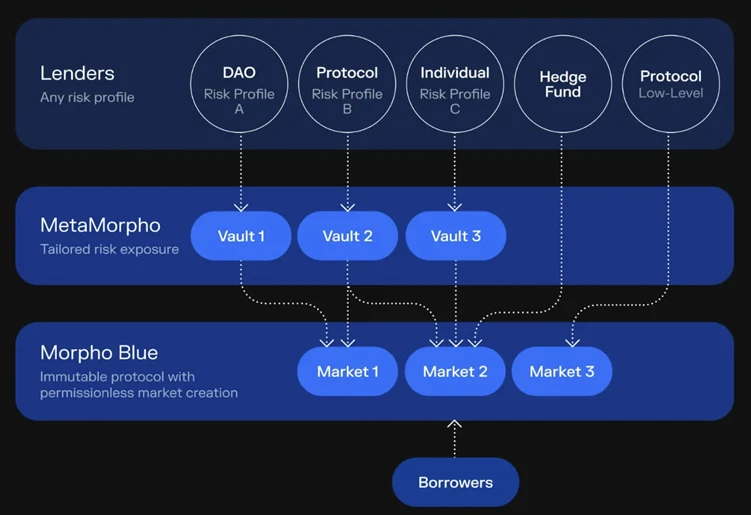

As a new listing project in Q4 2024, Morpho inherits the advantages of leading lending protocols in terms of security and credibility, quickly attracting significant liquidity as the market sees a resurgence in lending demand. Morpho Blue is Morpho's lending layer, allowing the creation of independent markets without permission, catering to the diverse risk preferences and use case demands in the market. MetaMorpho, designed based on the Morpho Blue protocol, allows different types of lenders to create vaults without permission, customizing risk exposure and allocating deposits to one or more Morpho Blue markets.

Morpho Architecture, Source: https://docs.morpho.org/

The design of Morpho provides efficient yield solutions for whale holders of stablecoins and quasi-stablecoins, meeting their demand for safe and high-yield investments. At the same time, Morpho offers Morpho tokens as incentives for lenders, raising the net annual percentage yield (Net APY) to 110%-120% of the base APY. Morpho integrates rewards from emerging stablecoin protocols such as Usual and ENA, further enhancing the platform's appeal and providing users with more diverse yield opportunities. At the time of its token generation event (TGE), Morpho's market capitalization was only $50 million. However, as the market gradually recognized the excellence of its products, investors showed strong confidence in Morpho in the secondary market, driving its market capitalization up to $460 million in Q4. As of now, Morpho's TVL has reached $3.2 billion, and considering the ongoing demand for DeFi lending and Morpho's ability to continue innovating and optimizing its products in a competitive market, its growth trend is expected to persist in the future. The case of Morpho illustrates that even in a mature DeFi sector, protocol-level innovations based on user demand still have significant growth potential.

In terms of trading and liquidity services, decentralized exchanges (DEX) remain an important pillar of the DeFi ecosystem. Curve's main value lies in providing ultra-low slippage exchange depth for stable assets, meeting the rapid and low-cost exchange needs among a large number of stablecoins. However, the founder of Curve previously used CRV for high-leverage operations but had to be liquidated due to a drop in token prices, leading to a temporary decline in its market capitalization and an undervaluation of its value. According to DefiLlama data, at the beginning of Q4 2024, Curve's TVL was only $2 billion, growing to $2.5 billion by the end of the quarter, a relatively limited increase. However, the stablecoin market remained active during this quarter, with Tether alone issuing an additional $3 billion USDT between October 30 and November 14. The addition of emerging stablecoins such as sUSDe, USDe, and USD0, which are popular real-world assets (RWA) and stablecoin protocols, significantly increased trading volume. This is reflected in the fees and revenue, with Curve's monthly fee income around $1.5 million, which, compared to the historical high of $11.5 million in January 2022, still has considerable growth potential, although it has improved from earlier periods. Its token price rebounded from a low of $0.23 in September-October 2024 to about $1, a 330% increase, but still has room for growth compared to the previous cycle's peak of $6.4.

Hyperliquid is an innovative decentralized platform focused on efficient perpetual contract trading, utilizing an order book trading mechanism. It offers perpetual contracts and spot trading, achieving a low-latency and high-throughput trading environment on Layer 1 chains. The platform consists of a consensus layer, HyperBFT, and an execution layer, RustVM. HyperBFT is a consensus algorithm modified from LibraBFT, capable of supporting up to 2 million transactions per second (TPS). After continuous optimization, Hyperliquid can now provide a trading experience comparable to centralized exchanges. Its HIP-1 mechanism allows for the deployment of native tokens and on-chain spot order books, thereby reducing risk and latency; the HIP-2 mechanism (permanent liquidity commitment) differs from traditional AMM models by dynamically adjusting liquidity based on market conditions rather than using a fixed xy=k formula. Additionally, with no KYC required and low fees, it has become an ideal choice for arbitrage traders. Unlike GMX, which relies on Chainlink oracles, Hyperliquid does not have to worry about oracle data being manipulated or encountering issues; compared to dYdX, which also uses an order book, Hyperliquid is not constrained by performance, avoiding slippage caused by network congestion and transaction confirmation times. Furthermore, Hyperliquid incentivizes community participation through the airdrop of HYPE tokens, enhancing community confidence and enthusiasm for its ongoing development.

Hyperliquid maintains a large open interest (OI) through its HIP-1 and HIP-2 mechanisms, with major trading pairs including ETH-USD, BTC-USD, and SOL-USD. Currently, Hyperliquid's trading volume in the perpetual contract DEX has exceeded 50%, placing it in an absolute leading position. According to data from Coinalyze and CVI.Finance, its open interest is about 10% of Binance's. In December 2024, Hyperliquid generated approximately $30 million in USDC revenue, with an annualized income exceeding $360 million, second only to Ethereum, Solana, and Tron. The price of the HYPE token has surged from $3 at launch to over $30, with a nearly tenfold increase within a month, further solidifying its position as a market leader. Although Hyperliquid's market capitalization is still lower than that of other L1 and L2 platforms, its annualized income-to-circulating market cap ratio is significantly ahead.

Hyperliquid's Revenue, Source: https://defillama.com/protocol/hyperliquid?tvl=false&fees=true&groupBy=daily

Overall, the resurgence of the DeFi sector in Q4 2024 was primarily driven by products that provide real yields, with product usability and security becoming key competitive advantages. For example, Aave and Morpho attracted a large number of users by offering reliable and efficient services in the lending sector. Curve continued to play an important role in stablecoin exchanges, meeting the market's demand for fast and low-cost transactions. Additionally, emerging decentralized exchanges like Hyperliquid rapidly rose in the derivatives trading space, further enriching the DeFi ecosystem. Large exchanges' Web3 wallets also continued to attract users into the DeFi ecosystem, driving growth in the sector. Overall, DeFi is steadily expanding through the interaction of lending, DEX, and stablecoins, and its future large-scale explosion will benefit from policy support and ongoing innovation.

RWA and Stablecoins

RWA encompasses a wide range of asset classes, including stablecoins, private credit, U.S. Treasury bonds, commodities, and stocks. Among these assets, stablecoins, due to their uniqueness and importance, can be viewed as an independent sector. For non-stablecoin RWA, the complexity of asset standardization and the inadequacy of policies and regulations result in a relatively small scale, so we will focus on the stablecoin sector.

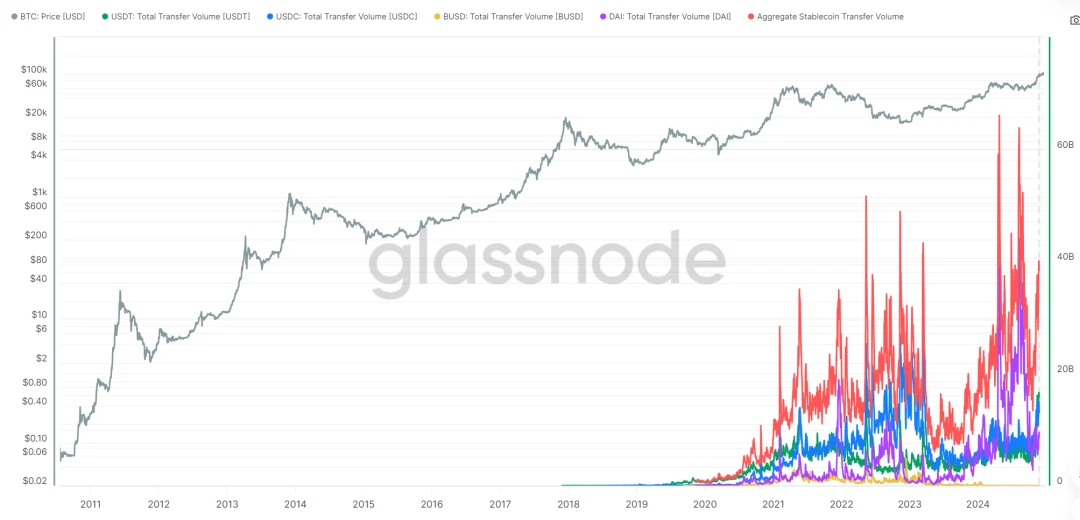

In the cryptocurrency market, since 2018, dollar-pegged stablecoins have played a crucial role. They not only serve as the benchmark currency unit for transactions but also act as shadow dollar assets, active in various scenarios such as transfer payments. As of December 1, 2024, the total market capitalization of stablecoins has increased to $193 billion, a year-on-year growth of 48%. For example, the average daily on-chain transfer volume currently stabilizes in the high range of $25 billion to $30 billion, and even during market downturns, this figure has not fallen below $10 billion. In terms of trading volume, according to industry data from CoinMarketCap, the monthly trading volume in November reached $6 trillion, meaning stablecoins accounted for 30% of the centralized trading volume in the industry. This ratio does not even include on-chain stablecoin trading volume, indicating that its actual share may be even higher. In addition to issuance, trading volume, and transfer volume as the three core indicators, stablecoins also provide stable and sustainable yields by introducing underlying assets such as U.S. Treasury bonds, bringing positive externalities to the industry and further promoting the connection and integration of Web3 with reality.

Daily Trading Volume of Stablecoins, Source: https://studio.glassnode.com/charts/usd-transfer-volume

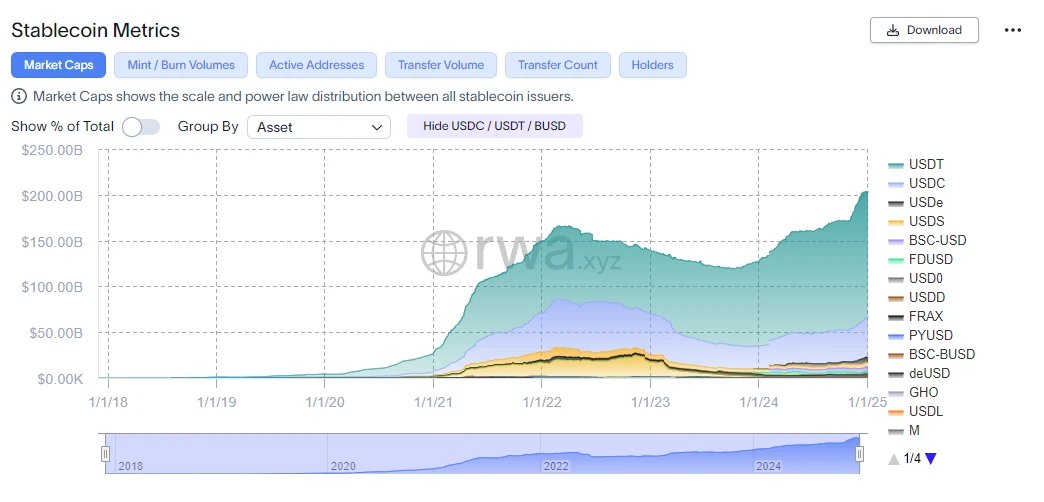

In the stablecoin market, with the increase in market demand, various types of stablecoins have gradually emerged, including fiat-backed stablecoins, decentralized collateralized stablecoins, and algorithmic stablecoins. Among them, fiat-backed stablecoins have already captured a large portion of the market and are continuously growing in scale. However, due to the ever-increasing trading demand in the market, decentralized issued stablecoins are still exploring new paths.

Among them, Ethena has emerged as a leader, with its USDe, a synthetic dollar, occupying a significant position in the DeFi space due to its innovative financial solutions. The key feature of USDe is its use of advanced Delta hedging strategies to maintain its peg to the dollar, which sets it apart from traditional stablecoins. In just over a year, the issuance scale of USDe has steadily grown, successfully withstanding the market downturns in Q2 and Q3, and it has now risen to third place, behind USDT and USDC, entering another phase of rapid development.

Stablecoin Data, Source: https://app.rwa.xyz/stablecoins

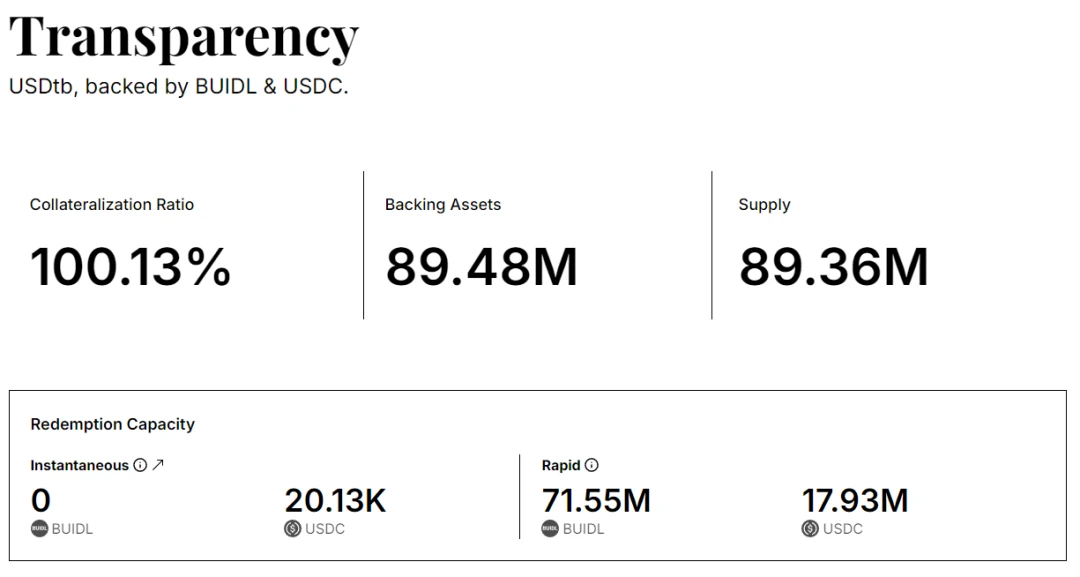

In addition, leveraging the support of BlackRock, the world's largest asset management company, Ethena has launched a new institutional-grade stablecoin, USDtb. As a product independent of USDe, USDtb provides users with a new choice with distinctly different risk characteristics. Its existence allows USDe to respond more effectively to market challenges, especially during periods of negative interest rates, enabling Ethena to close USDe's hedging positions and reallocate assets to USDtb, thereby mitigating related risks and enhancing the overall system's stability and resilience.

USDtb Data, Source: https://usdtb.money/transparency

Aside from Ethena, Usual's USD0 is also noteworthy. This stablecoin integrates RWA as its underlying support, deeply merging the robustness of traditional financial instruments with the transparency, efficiency, and composability of DeFi. USD0, with its permissionless and compliant framework, directly returns real yields from RWA to community users, showcasing the competitiveness of new stablecoins in the market. The emergence of these new stablecoins not only enriches market diversity but also provides users with more choices and investment opportunities.

ArkStream Capital believes that stablecoins can play a crucial role in the crypto industry, traversing market bull and bear cycles. Their growth momentum will not stagnate; in both payment and trading sectors, various metrics for stablecoins will continue to grow. Decentralized stablecoins significantly outperform traditional stablecoins in terms of transparency, decentralization, and yield, making them worthy of long-term attention and investment. Currently, Ethena has shown signs of dominance, while Usual is actively trying to expand its market share. In the future, decentralized stablecoins will not only grow alongside the entire sector but also have the potential to capture more market share from traditional centralized stablecoin markets.

AI Agent

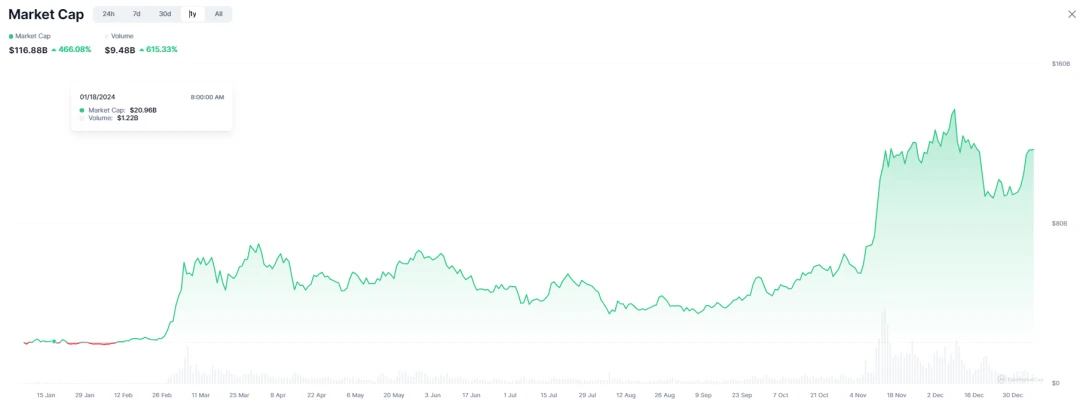

In Q4 2024, the AI Agent sector within the crypto industry has garnered unprecedented attention and rapid growth. AI Agents have evolved from being mere auxiliary functions of traditional AI models to becoming the core driving force of community ecosystems, shedding their singular "tool attribute" positioning. In this quarter, whether it is ai16z and ELIZA on the Solana chain or VIRTUAL and AIXBT on the Base chain, their market capitalizations have achieved several-fold growth alongside market enthusiasm. Meanwhile, the performance of traditional AI Agents in the industry has been relatively lackluster. During this transition, the positioning of AI Agents has changed. In the past, AI Agents in the crypto market were primarily used to assist in the updates and iterations of existing products, such as FET and OLAS, focusing more on the integration of blockchain with AI model training or building practical application scenarios like workflow assistance and emotional companionship (similar to the original intention of humans creating robots to assist in daily life). However, the current development model has shifted from "product-oriented" to "community-oriented," focusing more on the growth of AI Agents themselves and the construction of ecosystems (similar to creating an autonomous community entirely composed of robots).

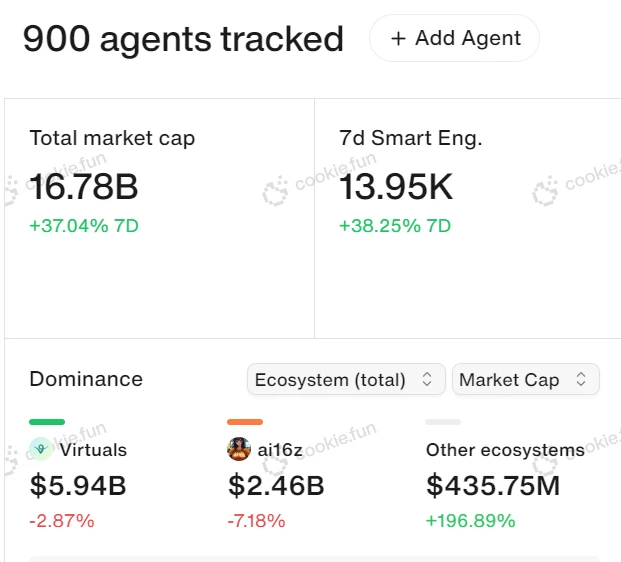

AI Agent Market Capitalization and Share, Source: https://www.cookie.fun/

In the current "community-oriented" development model, ai16z and Virtuals are undoubtedly the two most prominent representative projects. According to the latest data from Cookie.fun, the overall market capitalization of AI Agents has approached $16.7 billion, with a nearly 37% increase in the last week of Q4 2024. The combined market capitalization of ai16z and Virtuals accounts for nearly 50% of the AI Agent market share. ai16z is essentially a decentralized DAO that utilizes AI for investment management. Its core component is the open-source AI agent framework ElizaOS, which is used to create, deploy, and manage AI agents. Within this framework, there are two core applications: ai16z and degenai. ai16z is a governance token that allows holders to participate in voting on investment proposals and the distribution of fund profits. Degenai is a self-trading AI agent chatbot that acts as an AI trader within ai16z, allowing users to interact with degenai and influence its trading decisions.

Similar to the ElizaOS framework, Virtuals Protocol is dedicated to advancing the field of AI agents. Its predecessor was the gaming guild Path DAO, which underwent a strategic transformation and rebranded as Virtuals Protocol in 2023. By launching the fun.virtuals platform, Virtuals Protocol enables users to easily build and deploy their own AI agents, supporting one-click deployment functionality. Virtuals provides a complete AI agent creation and token issuance platform akin to the "Apple system," forming a closed-loop ecosystem. ai16z emphasizes open-source frameworks and decentralized governance, with both having unique characteristics in terms of technical architecture, token economics, and market strategies to meet different user needs.

The source of the wave cannot overlook the two AI Agent memes, GOAT and ACT. Although they have no practical utility, they were the first to break the traditional technical positioning of AI Agents, combining them with meme culture and quickly attracting the attention of users and capital. Subsequently, the market's pursuit of AI Agents shifted from pure memes to infrastructure projects dominated by narrative prospects. Virtuals introduced its unique IAO (Initial Agent Offering) model, combining "AI Agent functionality + Token + Meme" to reach new heights. In the Virtuals ecosystem, these AI Agents not only possess tool functionalities such as virtual humans and value analysis but also play the role of memes. AI Agents in the crypto industry are no longer just service providers; they have become core players in the ecosystem, serving as the main driving force for user interaction and community ecosystem development.

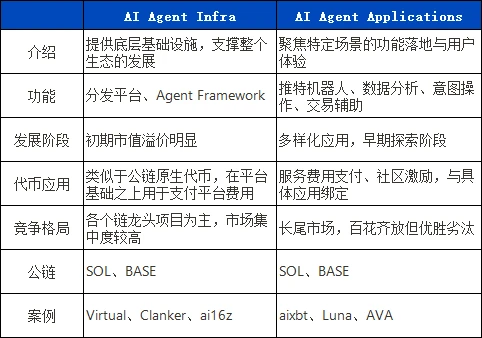

Currently, the AI Agent market is mainly divided into two categories of projects: one is the "technical support layer," focusing on providing underlying technology and infrastructure support for AI Agents; the other is the "application layer," dedicated to applying AI Agents in specific business scenarios to realize their practical application value.

In the rapid development and evolution of AI Agents, their trajectory resembles the early boom of the blockchain industry. For example, distribution platforms like Virtuals, vvaifu, Zerebro, and those providing different frameworks like ElizaOS, ARC, and Swarms currently exhibit a competitive landscape similar to the early competition among Layer 1 public chains. According to the time machine theory, it can be inferred that, compared to application-type projects, AI Agent infrastructure projects, due to their strategic importance, receive more attention from mainstream market funds in terms of survival cycles and market capitalization, enjoying a premium due to their scarcity.

As infrastructure matures and approaches saturation, the collaborative development of infrastructure and applications will become the core theme of the next stage, driving the field into a period of deep integration. Unlike traditional project development, AI Agent applications place greater emphasis on pre-validated market demand after the Roadmap and TGE, continuously promoting ecosystem innovation and development through mechanisms such as ecological tokens or associated tokens, achieving several-fold growth in overall market capitalization this quarter. With the emergence of wealth effects, more and more new projects are surfacing, showcasing the immense potential of AI Agents in various subfields, from market analysis and on-chain operations to intent execution. For instance, Aixbt's Twitter bot can answer user questions around the clock and analyze market dynamics in real-time, serving as an AI version of an analytical opinion leader; AVA focuses on the social domain, providing emotional companionship and personalized services through AI virtual humans; CGPT integrates functions such as trading, market analysis, and NFT generation, becoming a comprehensive AI Agent tool.

ArkStream believes that the current enthusiasm in the sector is evident. Driven by FOMO sentiment, various funds are flooding in, attempting to get a piece of the pie. This rapid expansion pattern has led to projects emerging like mushrooms after rain, but currently, no single project has a market capitalization exceeding $10 billion. This stage can be seen as the "primary stage" of the Web3 AI Agent sector, characterized by a time-oriented focus: market participants generally harbor speculative mindsets, competing to enter the sector as quickly as possible.

ArkStream Capital predicts that the "second stage" is about to arrive, with the market's focus shifting to product quality, leading to a major reshuffle where low-quality, opportunistic projects will be swiftly eliminated by mainstream funds. With the continuous iteration and upgrading of traditional AI technologies, ArkStream Capital remains optimistic about the prospects of the entire sector. The current level of enthusiasm is sufficient to indicate its potential development space, and it is expected that the first batch of AI Agent projects with market capitalizations exceeding $10 billion will soon become important milestones in the industry's development.

Meme

In the past three months, Memes have experienced significant growth and evolution, particularly in terms of total market capitalization, trading activity, thematic diversity, and exchange support. From October to early December, the total market capitalization of Meme coins increased significantly, reaching an all-time high, with trading volumes also rising sharply. The market witnessed the emergence of various new Meme coins, including AI Agent Memes (GOAT, ACT), art BAN linked to Sotheby's art auctions, squirrel PNUT related to Trump and Elon Musk, and CHILLGUY, which attracted a large number of TikTok followers. The rise of these emerging Memes not only injected vitality into the market and stimulated on-chain capital liquidity but also attracted a large number of new investors into the market, contributing to the prosperity and development of Memes and the crypto industry.

Compared to emerging Memes, traditional Memes such as DOGE, PEPE, and WIF also performed strongly in the market. In particular, PEPE and WIF successfully landed on Robinhood in November 2024, highlighting the recognition of Memes by compliant exchanges in North America and further expanding the market influence of these established Memes.

Combining relevant data from the past year in the Meme sector, by the end of 2023, the number of Memes in the top 500 by market capitalization was extremely limited, mainly including a few such as DOGE, SHIB, BONK, PEPE, FLOKI, and ELON, while most Memes had relatively low market capitalizations. However, by the end of 2024, the number of Memes in the top 500 by market capitalization significantly increased to 48, accounting for nearly 10%, with a total market capitalization reaching approximately $10.47 billion and a 24-hour trading volume of up to $7.4 billion. These figures indicate that the recognition and market consensus for Memes are continuously breaking through.

Meme Sector Market Capitalization, Source: https://coinmarketcap.com/view/memes/

Particularly in this quarter, Memes became the focus of the cryptocurrency market, attracting significant attention from investors. With the return of value investment trends in November, some funds began to flow out of Memes, but some newly listed popular Memes quickly listed on mainstream exchanges like Binance and Upbit due to their strong market performance and large user bases. Although the lack of relay funds in the market led to significant corrections from the peaks for these Memes, ArkStream Capital believes that this correction is a perfect reflection of the market's attention economy, indicating that the inflow and outflow of funds for Memes will undergo significant changes with fluctuations in market attention. Many Memes rapidly grew to a market capitalization of $100 million or more in a short period, making it reasonable to experience corrections and time validation.

ArkStream believes that the prosperity of Memes in the industry is not just a transient phenomenon; they serve as a bridge connecting Gen Z with the Web3 world, and their characteristics of being easy to understand and participate in are expected to persist and bring emotional and value contributions to the market. Therefore, ArkStream Capital is actively seeking opportunities to position itself in the Meme sector. In particular, it focuses on two types of areas: one is portal platforms that provide token information and trading data, as well as Bot products that offer trading convenience and strategy customization, along with new Meme launch platforms like Pump Fun, which are core infrastructures in the Meme field with actual sustainable revenue; the second is that Memes are gradually becoming a method of asset issuance that embodies fairness, with many projects with real value support attempting to attract users through Meme forms, adopting organic growth concepts and low market capitalization openings, reflecting a relatively healthy growth model and the active exploration and innovation of primary market projects regarding Memes.

Project Investment

Ethena

Project Introduction

Ethena, as an innovator in the DeFi space, is committed to providing a variety of stable and scalable crypto-native currency solutions. Its first stablecoin is the crypto-native synthetic dollar USDe, with the core innovation being the use of Delta hedging strategies to hold various mainstream crypto assets' spot and corresponding short positions to maintain intrinsic stable value. This design does not rely on dollar assets provided by traditional banking infrastructure, allowing USDe to not only match the stability of stablecoins backed by dollar assets (such as USDC and USDT) but also achieve significant improvements in capital efficiency and yield. The second stablecoin, USDtb, was co-developed with the well-known RWA institution Securitize, leveraging BlackRock BUIDL, connecting traditional financial products such as dollars, short-term U.S. Treasury bonds, and repurchase agreements to create a digital dollar supported by stable returns from real-world assets. USDtb not only possesses multiple advantages of high liquidity, low risk, and stable returns but also utilizes Web3 technology to achieve transaction transparency and high efficiency in settlement. Together, USDe and USDtb expand Ethena's footprint in the stablecoin market and enhance the overall robustness and credibility of Ethena's stablecoin solutions through synergies.

Why Invest in Ethena

Ethena's vision is to reshape the cryptocurrency system and establish a bridge between DeFi, CeFi, and TradFi to promote the prosperity of the next generation of internet finance. Its first stablecoin, USDe, has achieved deep integration in several key areas of DeFi, including money markets, collateral for derivatives markets, stablecoin infrastructure, interest rate swap agreements, and spot AMM DEXs. In the exchange sector, Ethena's liquidity pools not only support existing centralized and decentralized trading platforms but also assist emerging exchanges in solving liquidity challenges during their initial launch, becoming a leading provider of depth and over-the-counter liquidity in the market. For TradFi, Ethena's USDe is favored for its unique yield, integrating local actual yields from two billion-dollar scale cryptocurrencies, and its yield is weakly negatively correlated with traditional financial interest rates, with underlying assets held by custodians recognized by TradFi. USDe provides large investors with a convenient way to achieve excess returns in the cryptocurrency market through a single asset.

The ENA token plays a key role in the Ethena ecosystem, serving as a governance token that grants holders the right to participate in key decisions, such as electing risk committee members and shaping policy directions, as well as providing opportunities to stake and become sENA for additional yields. As ENA will be used as a voting tool for the Ethereal derivatives exchange in the future, its importance in Ethena's development blueprint is increasingly highlighted. These functions not only solidify ENA's position as the core of the Ethena protocol but are also crucial for maintaining the protocol's decentralized governance and incentivizing user participation. In terms of liquidity, ENA performs excellently on mainstream exchanges, consistently ranking high in trading volume, which not only proves the market activity of the Ethena protocol but also indicates its broad recognition and acceptance in the market.

Ethena has implemented a series of hedging strategies in collaboration with major exchanges to respond to emergencies in the derivatives market, ensuring the stability and security of USDe. Additionally, the use of USDe as a trading quote currency is gradually being realized, thanks to Ethena's efforts to increase liquidity to mitigate risks. In terms of resources, Ethena collaborates with several top global market makers, who provide liquidity and market depth, further enhancing the market adaptability and resilience of USDe.

ArkStream Capital believes that the competitive landscape in the stablecoin sector is far from settled. While USDT and USDC hold leading positions, emerging competitors are fully capable of challenging their market status. The key lies in selecting stablecoin protocols that possess unique mechanisms, can stabilize anchored value, increase market capitalization, and expand application scenarios. Just as DEX has captured 10% of CEX trading volume, decentralized financial products are rapidly occupying market resources due to their verifiability and convenience. It is expected that by 2025, decentralized stablecoins represented by Ethena will continue to grow in market size, reaching a 10% market share, equivalent to $20 billion. Furthermore, Ethena will become one of the important financial tools for implementing Trump policies. The implementation of Trump policies will also promote Ethena's strategic position in the revival of the U.S. economy and the reshaping of global finance, becoming an important support for domestic and global digital finance in the U.S.

TRex

Project Introduction

TRex is dedicated to building a publisher network focused on gaming and entertainment content projects within the blockchain industry. Its goal is to guide project parties through high-quality, scalable, and sustainable development methods, providing them with support in resource matching, token economic model design, strategic consulting, and marketing. Taking two recently incubated game projects as examples: Legend of Arcadia and Last Odyssey, both have attracted over 100,000 active users. Legend of Arcadia is a multi-chain card game that occupies 7% of the total trading volume on the X Layer; Last Odyssey is an MMOSLG strategy game that occupies 1.2% of the total trading volume on opBNB.

Why Invest in TRex

Leveraging the strong EVG ecosystem, TRex has significant advantages in funding and resources. EVG is one of the most successful Web3 project incubation and investment companies in the Asia-Pacific region, with its invested and incubated projects including well-known enterprises and funds such as Celestia, Wormhole, Berachain, Animoca Brands, The Sandbox, Yuga Labs, and Kraken. Additionally, TRex has established deep cooperative relationships with Animoca Brands. The Sandbox, under Animoca, is a pioneer in the metaverse field and has gained widespread recognition from traditional internet and luxury brands, showcasing Animoca's exceptional capabilities in incubation. Both EVG and Animoca are resource-rich, powerful, and experienced institutions in the Web3 field in the Asia-Pacific region, with many team members coming from traditional financial capital backgrounds in Hong Kong. With these advantages, TRex can adopt high-quality, scalable, and sustainable development strategies to provide comprehensive support to project parties in resource matching, token economic model design, strategic consulting, and marketing promotion.

Additionally, ArkStream Capital has noted that whether it is the Web3 game fund launched by traditional gaming giant Nexon or Sony's plan to launch a Layer 1 blockchain, the ongoing development of games within the Ton ecosystem and the trend of developing entertainment content applications are becoming increasingly evident. From the Web2 game "Black Myth: Wukong" to the popularity of Taptap games on the blockchain, the market's recognition and demand for such applications are continuously growing. It is foreseeable that in the near future, more developers and project parties will actively engage in this field. The one-stop, customizable publishing and incubation services provided by TRex will help project parties develop projects at a lower cost and acquire higher-quality resources, which will undoubtedly provide strong support for their development.

ArkStream believes that TRex, with its outstanding track record and high-quality team background, has garnered support from several senior experts in the Web2 and Web3 gaming and TMT industries. Its planned publisher network platform and gradually expanding ecosystem make TRex a high-quality project with investment value. With the diversification and large-scale development of on-chain applications, the TRex network and its platform token are expected to become an indispensable component in the GameFi sector.

Research Reports

ArkStream Capital: Why We Invested in Ethena After Trump’s Victory

ArkStream Capital: The Meme Craze | A New Battlefield for VCs – Opportunity or Trap?

ArkStream Capital: How PayFi Unlocks a New Chapter in Crypto Payments

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。