Theory Analysis of Patterns

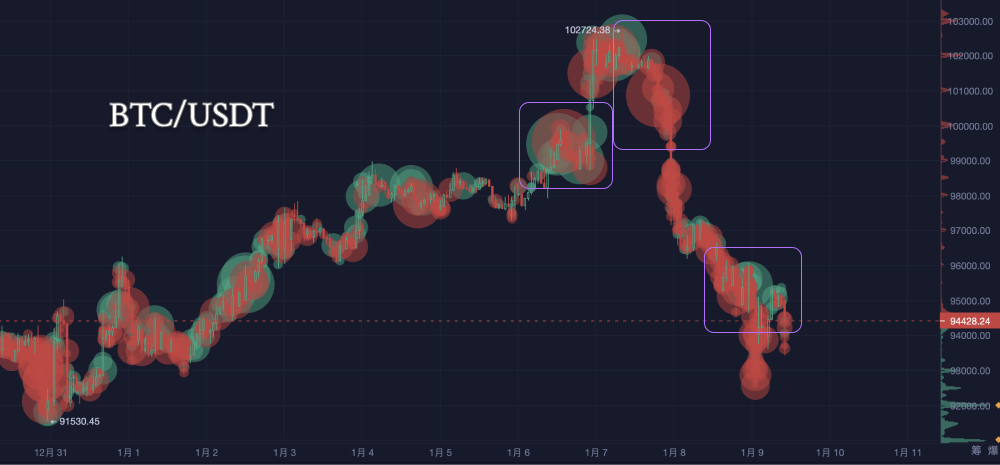

Top Reversal Pattern: From January 3 to January 8, the price of Bitcoin rapidly surged to about 102,724.38, forming a top but failed to break through further, subsequently falling to create a pattern similar to a "double top." This pattern is a top reversal signal, indicating a depletion of bullish momentum.

Downward Channel:

- Price Rhythm: Since January 8, the price has entered a rapid downward mode, forming consecutive large bearish candles, indicating strong bearish momentum.

- Slope Observation: The current trend shows a clear downward channel slope, indicating a bearish market sentiment and strong selling pressure.

- Lower Support: The current lower support of the downward channel is around 91,500.

Bullish Defense Zone:

- Short-term Support: The current price around 95,000 has been touched multiple times, indicating strong short-term support in this area, with bulls attempting to fight back.

- Long-term Support: If 95,000 is breached, the price may further test the important support area of 91,500 from the end of last year.

Support & Resistance Analysis

Key Support Levels:

- 92,500 (Current Support): An important defensive level in the short term; if breached, the market may further decline.

- 91,500 (Strong Support): An important support area from the end of last year, likely to attract more buying interest.

Key Resistance Levels:

- 96,076 (Neckline): An important resistance area for the current rebound; if the rebound cannot stabilize here, the trend remains bearish.

- 100,000 (Psychological Barrier): A significant dividing line for bullish and bearish sentiment; a breakthrough indicates short covering and bullish dominance.

Technical Indicator Analysis

Volume:

- Volume Characteristics: From the volume distribution in the chart, the current price is close to the main trading volume concentration area (94,500 to 96,000), indicating that this area is the core battleground of the market.

- Volume-Price Divergence: The decline has not been accompanied by significant volume increase, indicating that while selling pressure is strong, panic selling is limited.

MACD: Both DIF and DEA are below the zero axis, and the MACD histogram is positive, indicating a weakening of bearish strength, but still in a weak state.

RSI: The RSI14 value is 38.3, close to the oversold range, indicating a potential rebound demand in the short term.

EMA: The current price is below EMA7, EMA30, and EMA120, indicating an overall bearish trend. EMA7 (94,776) and EMA30 (95,680) form resistance levels.

Bollinger Bands Analysis

Current Status

Bollinger Band Contraction and Expansion:

- Recent Expansion: At the beginning of January, the Bollinger Bands experienced a significant expansion, indicating that the market had large fluctuations in the short term, with prices rapidly breaking upward and then sharply retreating.

- Current Contraction: The upper and lower bands of the Bollinger Bands are gradually contracting, reflecting a decrease in market volatility, suggesting that the market may enter a brief consolidation phase.

Price Position within the Bollinger Bands:

- The price is currently close to the middle band (around 95,000 USD), indicating that the market is attempting to restore balance after a sharp decline.

- Downward Test: Between January 8 and 9, the price quickly fell below the lower band but then quickly rebounded back within the band, indicating effective support near the lower band.

Key Observation Points

Bollinger Band Upper Band (96,172 USD):

- If the price can break through the upper band and stabilize, it may indicate that the market is entering a new upward trend.

- However, if the rebound is blocked near the upper band, it may lead to consolidation or a continuation of the downward trend.

Bollinger Band Lower Band (93,791 USD):

- During the previous decline, strong support was observed near the lower band.

- If the price falls below the lower band again, it may trigger larger-scale selling pressure.

Bollinger Band Middle Band (94,981 USD):

- The current price is oscillating near the middle band, indicating that the market is in a short-term equilibrium state.

- If the price can stabilize above the middle band, bulls may attempt further breakthroughs; conversely, it may test the lower band support again.

Bitcoin's current Bollinger Bands show a state of gradually converging volatility, suggesting that the market may be gearing up for the next breakthrough. In the short term, oscillation near the middle band (95,044 USD) may be the main theme, while the upper band (96,191 USD) and lower band (93,897 USD) will become key resistance and support.

Chip Distribution Analysis

Chip Concentration Area (Main Chip Position)

The current main chip concentration area is between 95,000 and 97,000 USD, indicating that this is a region with significant recent trading volume, and also the main support and pressure zone for prices: Support Logic: A large amount of holding chips has accumulated in this range, reflecting a high acceptance of this price by the market, and major funds may be building positions here. Below this position, if the price falls back, major funds may choose to defend the price, providing strong support. Some funds may choose to take profits, and if the price rises to this area, it may encounter selling pressure.

Chip Sparse Area

In the range of 97,000 to 102,000 USD, the chip density significantly decreases, indicating that this area is a rapid decline zone triggered by short-term selling. If the price breaks above 97,000 USD, due to limited selling pressure in this area, the price may enter a "chip vacuum zone," triggering a rapid rise, with target levels possibly looking towards above 102,000 USD. Breakthroughs in sparse chip areas are usually accompanied by increased trading volume and enhanced bullish sentiment.

Dynamic Changes in the Concentrated Chip Area

Currently, a large amount of chips is concentrated in the 95,000 to 97,000 USD range, reflecting signs of control by major funds. If the price retraces below 95,000 USD in the future, attention should be paid to whether the holding volume significantly decreases (chip loosening); if it decreases, it may indicate fund withdrawal and further price declines. If the holding volume remains stable, it indicates that major funds are still defending the price, providing strong support.

Large Transaction Analysis

Current Market Sentiment

- Green (Buying Power): A large number of green circles are clustered around the 95,000 USD area, indicating significant buying support at this price level, primarily manifested by the active participation of institutions or large investors. This also explains why the price temporarily stabilized when it retraced to this level.

- Red (Selling Power): A dense cluster of red circles appears above the 102,000 USD area, indicating strong selling pressure in this region. Combined with chip distribution, this may be due to major funds taking profits at high levels or some institutions adjusting their positions.

Transaction Behavior and Market Structure

- Phase Characteristics: High-level cashing out: When the price approaches 102,000 USD, selling pressure is significant (large amounts of red transactions), leading to weakened market sentiment and triggering a pullback.

- Bottom Buying: When the price falls to around 95,000 USD, a large amount of buying power (green circles) appears, indicating an intention to buy at lower prices.

- Current Transaction Logic: As the price falls to around 95,000 USD, the market gradually enters a game phase, with bearish strength temporarily weakening, but bullish strength not fully dominating.

Market Logic and Background

- Uncertainty in the Federal Reserve's monetary policy and a weak global economic environment have increased market risk aversion, suppressing risk assets (such as Bitcoin).

- Rising yields on 10-year U.S. Treasury bonds have led funds to flow into "safe assets," further pressuring Bitcoin.

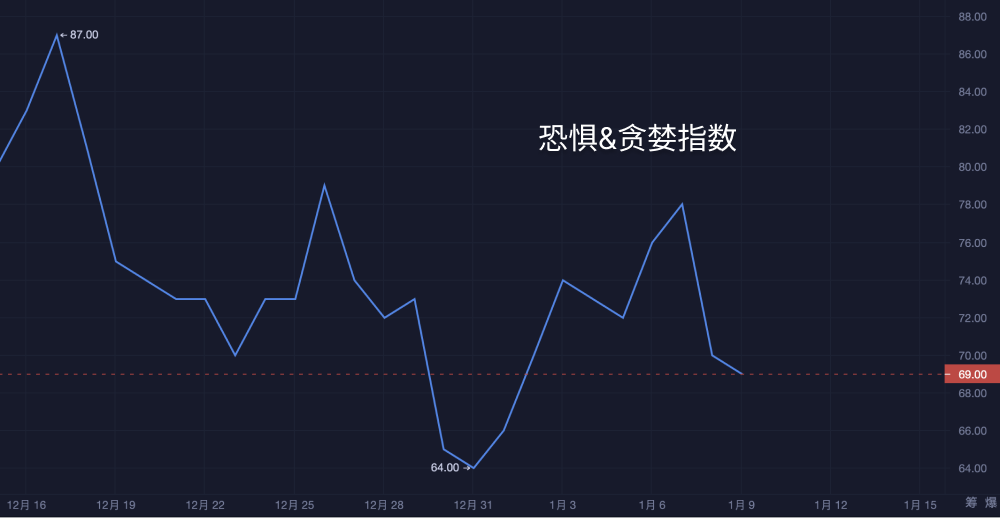

- The Fear and Greed Index has recently been at a low level, indicating insufficient market confidence, with short-term funds more inclined to wait and see or short the market.

Trend Forecast: Intraday and Long-term Outlook

Intraday Trend Forecast

Baseline Prediction: Range-bound consolidation, primarily weak rebounds

- Volatility Range: The price is expected to oscillate between 95,000 and 98,000 USD. Bulls may attempt to push the price up, but face significant resistance.

- Rebound Space: In the short term, a certain rebound momentum may arise due to the RSI being in an oversold state, but the resistance at 98,000 USD is difficult to break, limiting the rebound extent.

Secondary Prediction: Breakdown and test lower support

- Downward Risk: If the price falls below 95,000 USD, it may quickly test the 91,500 USD support area or even lower.

- Market Sentiment: The current market leans towards risk aversion; if accompanied by negative macro data (such as non-farm payrolls, CPI, etc.), the decline may further intensify.

Long-term Trend Forecast

Baseline Scenario: Downward breakout, testing lower support

- Technical Formation: If the price effectively breaks below 95,000 USD, it may confirm a head and shoulders pattern, further testing the 91,500 USD or 85,000 USD support.

- Amplified Momentum: A breakdown may trigger panic selling, forming a new downward trend, leading the market into a deeper adjustment.

Optimistic Scenario: Breakthrough after range-bound consolidation

- Consolidation Range: If the 95,000 USD support holds, the price may form a range-bound consolidation between 91,500 and 98,000 USD.

- Target Level: If sufficient momentum accumulates and breaks through the upper boundary of the range, the price may aim for 105,000 to 108,000 USD. However, a breakthrough requires support from the macro environment and capital inflows.

Pessimistic Scenario: Continued bearish dominance

- Downward Risk: If market sentiment continues to deteriorate, the price may break below the bottom of the range, entering a deeper bear market cycle, with targets potentially moving down to 80,000 USD or even lower.

Trading Strategy

Short-term Trading Strategy

Bullish Strategy

- Entry Range: 94,500 ~ 95,500 USD, suitable for low-buying speculation on rebounds.

- Stop-loss Range: Below 94,000 USD (chip loosening, clear bearish advantage).

- Target Level: 97,000 ~ 102,000 USD, gradually taking profits.

Bearish Strategy

- Entry Range: If the price is blocked near 97,000 USD, consider shorting at high levels, with an entry range of 97,000 ~ 98,000 USD.

- Stop-loss Range: Above 98,500 USD (chip breakthrough confirmation).

- Target Level: Below 95,000 USD.

Range Trading Strategy

- Range Operation: Utilize the upper and lower bands of the Bollinger Bands (93,800 USD ~ 96,200 USD) for high selling and low buying, with stop-loss set outside the bands.

- Target Level: Gradually reduce positions or take profits within the 95,000 ~ 96,000 USD range.

Medium to Long-term Layout Strategy

Medium to Long-term Investor Strategy

- Accumulate on Dips: If the price approaches the 91,500 USD area, consider gradually building positions, waiting for the medium to long-term trend to recover.

- Chip Accumulation: If chips continue to increase in the 95,000 ~ 97,000 USD range, indicating funds are accumulating at the bottom, gradually build positions with a target above 110,000 USD.

Risk Control Recommendations

- Monitor Market Data: Pay close attention to macro data (such as non-farm payrolls, inflation, Federal Reserve meeting minutes) and significant market news to judge market volatility direction.

- Stop-loss Management: Strictly set stop-loss for short-term trades (e.g., below 94,500 or above 98,500 USD) to guard against sudden market risks.

- Breakout Direction Confirmation: Closely monitor the breakout direction of the Bollinger Bands' middle band and combine it with volume changes to prevent losses from false breakouts.

Disclaimer: The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。