Macroeconomic Interpretation: Overnight, Trump made a series of statements at Mar-a-Lago covering various aspects such as the economy, foreign policy, and military issues, which sparked widespread attention and discussion globally. Meanwhile, the global asset markets also exhibited some volatility. We will interpret Trump's statements and the performance of global assets, and delve into how these changes impact the cryptocurrency market.

Trump's remarks touched on multiple areas, including inflation, interest rates, foreign policy, and military actions. He pointed out that inflation is rampant in the U.S. and that interest rates are too high, reflecting the severe challenges currently facing the U.S. economy. The idea proposed by Trump to merge the U.S. and Canada using "economic power," although difficult to implement in practice, demonstrates his tough stance on foreign policy. Additionally, he plans to overturn Biden's offshore drilling ban and is considering controlling the Panama Canal and Greenland, aiming to strengthen U.S. energy security and geopolitical influence. Trump also suggested renaming the Gulf of Mexico to "American Gulf," further reflecting his nationalist position.

Trump's statements had a certain impact on the global asset markets. The three major U.S. stock indices collectively fell after Trump's remarks, with the Nasdaq experiencing the largest drop of 1.89%. Major tech stocks also generally declined, particularly Nvidia, which saw its market value evaporate by over $200 billion overnight. This indicates market uncertainty regarding Trump's policy expectations, as investors weigh potential policy risks against market prospects.

At the same time, global asset performance also showed some volatility. The U.S. dollar index exhibited a V-shaped reversal throughout the day, while spot gold saw a slight increase. Bitcoin futures dropped by over 6%, indicating the cryptocurrency market's sensitive reaction to Trump's statements. These changes reflect shifts in global investors' confidence and expectations across different asset classes.

From our research and analysis perspective, the impact of Trump's statements and policy expectations on the cryptocurrency market is mainly reflected in the following aspects:

Increased Policy Uncertainty: Trump's statements and policy expectations have increased market uncertainty regarding the cryptocurrency industry. Although Trump expressed support for cryptocurrencies during his campaign, the specifics of policy implementation remain uncertain. This uncertainty may lead investors to adopt a wait-and-see attitude, affecting liquidity in the cryptocurrency market.

Changes in Regulatory Environment Expectations: The regulatory environment for the cryptocurrency industry may change under Trump's administration. If the Trump administration adopts a more lenient regulatory policy, it could attract more institutional investors into the market, further promoting the development of the cryptocurrency market. However, if regulatory policies fail to meet market expectations, it could also lead to significant price volatility.

Market Sentiment and Investor Behavior: Trump's statements and policy expectations influence market sentiment and investor behavior. If the market holds an optimistic view of Trump's policies, investors may increase their allocation to cryptocurrencies, driving market prices up. Conversely, if the market has a pessimistic outlook on the policies, investors may choose to reduce their holdings or exit, leading to a decline in market prices.

In summary, Trump's statements and policy expectations have had a certain impact on the cryptocurrency market. These impacts are mainly reflected in increased policy uncertainty, changes in regulatory environment expectations, and shifts in market sentiment and investor behavior. In the future, as Trump's policies become clearer and are implemented, the cryptocurrency market may face more opportunities and challenges. We should closely monitor policy dynamics and market changes, rationally assessing potential risks and opportunities.

BTC Data:

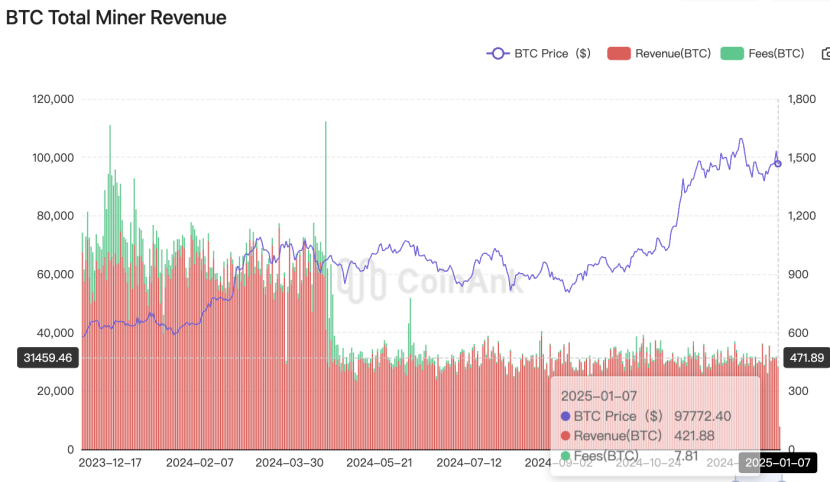

Since last year's Bitcoin mining reward halving, data shows that approximately 450 BTC are mined daily. Recently, entering 2025, ETF purchases often exceed 9,000 BTC daily, which is 20 times the daily output. In addition to ETF funds, institutions like MicroStrategy are also continuously increasing their BTC holdings.

On Friday, January 3, Bitcoin ETF issuers purchased over 9,000 BTC, and on the following Monday, they bought over 9,600 BTC. Since the first approval of Bitcoin ETFs, all 12 issuers have become major holders in the industry, with the amount of BTC they purchased in October equivalent to five times the global mining output, and this figure has now exceeded 20 times, with bearish market signals potentially leading to even greater purchasing volumes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。