Original | Odaily Planet Daily (@OdailyChina)

As you can see, ai16z's market value skyrocketed 100 times in just two months, and the Eliza framework ranked first in the trend list last December, accumulating 9,703 stars.

I first purchased ai16z at the end of October last year, when the price was in the range of $0.02 to $0.025. In the following days, I gradually transferred SOL from exchanges to ai16z through multiple wallets in this price range. (By the way, the price of ai16z today is $1.77, and I'm glad I'm still on the ride.)

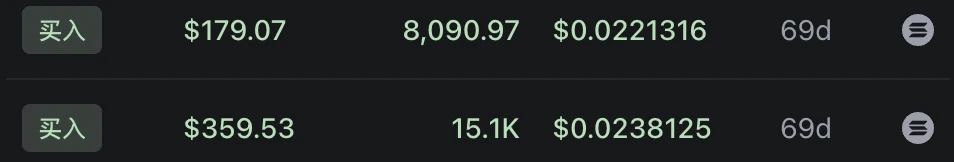

Some purchase records of ai16z holdings

Act One: A Beautiful Misunderstanding

To be honest, my initial choice to invest in ai16z was somewhat of a "misunderstanding." Before November 2024, my main focus was on blockchain games and yield farming, where I manually earned tokens from Pixels, earned RP points from Mocaverse's collaborative projects, and earned rubies from Heroes of Mavia, but ultimately none of these met my expected returns.

During this time, I discovered through browsing X that the on-chain profit effect was significant, especially in the Meme sector. After GOAT, the on-chain AI Meme-related concepts exploded, leading to numerous "get-rich-quick myths," which made me realize that my research focus should shift. I began buying SOL on exchanges and transferring it to wallets, looking for quality AI Meme projects.

One day, I accidentally discovered a project called ai16z, which was endorsed by Marc Andreessen, the founder of a16z. Marc tweeted about it, sharing the concept image of ai16z and the official Twitter link. I thought to myself: an official project from a16z, could it be a potential stock? So I decided to buy ai16z.

Act Two: A Lucky Mistake?

As my position increased, my research on ai16z deepened. Unsurprisingly, I discovered that the ai16z project has no actual connection to a16z. This revelation caught me off guard, but I didn't sell immediately; instead, I decided to continue observing. At that time, ai16z's market value was fluctuating between $20 million and $30 million. Although ai16z was unrelated to a16z, I decided to "take a gamble" (what if those who came in later hadn't discovered it yet?).

On one hand, from the project's fundamentals, ai16z belongs to the AI concept. The AI concept has always been a hot topic in both Web2 and Web3, and its founder Shaw was very active on X, giving the impression that he was quite adept at "stirring things up." On the other hand, from the funding data perspective, I found that many early whitelist addresses had purchased at very low costs and had not sold at the high points after the opening. I also noticed several large GOAT holders continuously reallocating to ai16z, with new wallets worth hundreds of thousands of dollars buying ai16z in single transactions.

Sure enough, the market's enthusiasm truly reached the AI sector, and within a week, ai16z's market value surged from less than $30 million to over $500 million. As ai16z rose, I believed that projects within the ELIZA ecosystem would also be continuously recognized by the market, so I began to reduce my position in ai16z and reallocate to the two projects Shaw mentioned the most: degenai and ELIZA.

Degenai is the first AI agent developed by the ai16z team, which will share alpha information on Twitter and conduct autonomous trading based on that. Degenai is a whitelist project for the ai16z DAO (it will never be sold), and 8% of the profits are used to buy back degenai. ELIZA is an AI agent supported by the ai16z team. At the end of last year, ai16z founder Shaw joined the Eliza project as an advisor. Additionally, Eliza Studios director, ai16z creative Jeff, Nous Research researcher Ropirito, and Ryze Labs founder Matthew also announced their roles as advisors for the Eliza project. In simple terms, if degenai succeeds, it will be a "self-trading AIXBT." ELIZA can be understood as the spiritual totem of the ELIZA framework.

Act Three: To Switch or Not to Switch?

However, the development of the ai16z project has not been smooth sailing. With the popularity of the AI agent sector, many emerging challengers have emerged, among which swarms has garnered the most attention. The core founder behind swarms, Kye Gomez, is hailed as a "genius" in the field of artificial intelligence. Although he dropped out of high school, he developed the multi-agent coordination framework Swarms in just three years and successfully operated 45 million AI agents.

However, due to Shaw's comments about Kye's code plagiarism, swarms' market value plummeted from a high of $25 million to below $13 million on the same day. I felt that regardless of whether Kye had any suspicion of code plagiarism, swarms itself is an AI framework with vast potential, so I continued to buy amid the FUD sentiment.

I met Shaw offline, and chatting with him was very comfortable; he was not a "keyboard warrior." At the end of December last year, when I learned that Shaw would come to Shanghai for an offline Dev Meetup and my company arranged for me to interview him, I was very excited. For my large positions in the three ai16z system projects, I could finally directly ask the project parties about the latest developments.

This face-to-face communication completely dispelled any doubts I had about him and the ai16z team. Shaw was not the "aloof" figure I had imagined; on the contrary, he was very friendly and seemed fully committed to building the ai16z DAO into a more powerful platform. During our conversation, I felt his passion and determination for the ELIZA framework, and I firmly believed that the positions I held would yield even greater returns.

Therefore, I sold swarms and increased my positions in ELIZA and degenai. (Click here to view the interview transcript with Shaw: Full Interview with ai16z Founder Shaw: Eliza Framework, DAO Innovation, and How AI Reshapes the Future of Web3.)

Act Four: Believe and Hold — Fasten Your Seatbelt and Wait for Takeoff

I believe that the prices of the ai16z system projects will reach a new height after the update of ai16z's token economics. Around January 1, the ai16z team initiated a proposal to update the token economics, focusing on the Launchpad phase in the first quarter of 2025, which includes acquiring mature technologies and teams, focusing on innovations in the Eliza framework, and integrating multiple chains, among other value capture mechanisms such as increasing launch fees and staking. With the establishment of the Launchpad platform, it is conceivable that a massive influx of projects will enter the ai16z ecosystem in the first quarter of 2025, significantly increasing the demand for the ai16z token.

Since last weekend, watching the continuous surge of swarms has inevitably caused some fluctuations in my heart, but I still believe in the ai16z system and that ELIZA and degenai are still waiting for value discovery. Currently, over 80% of my on-chain positions are in the three ai16z system projects, with ELIZA accounting for 50%, degenai for 20%, and ai16z for 10%. I look forward to the update of ELIZA's token economics on January 10, the subsequent diversified development; I look forward to degenai's upcoming AI agent surpassing AIXBT; and I look forward to the adjustment of the ai16z token economic model, the launch of the Launchpad, and even the introduction of its own L1 blockchain.

In conclusion, I am optimistic about the Eliza framework and embrace the ai16z system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。