The original text is from Andrey Didovskiy

Translation|Odaily Planet Daily Golem (@web3golem)_

Intelligence is a broad, relative, and highly subjective variable that humanity has yet to fully quantify. Generally speaking, if an organism is "alive" and "autonomous," we classify it as intelligent life. This abstract vagueness is particularly evident in the crypto space.

From degens writing papers on the potential value of Fartcoin, to governments exploring strategic Bitcoin reserves, to scholars developing complex useless technologies, the cryptocurrency industry is a vast, paradoxical Pandora's box.

In this crazy world, there are few winners and many losers. The only simple standard that determines the difference between the two is a single, straightforward intelligence metric measured by portfolio performance.

If you want to win in the crypto game, you must stay away from mediocrity. You are either a Sith Lord with an IQ of 200 (the leader of dark force users in the Star Wars series) or an absolute degenerate ape with an IQ of 20 (a completely brainless speculator); if you fall somewhere in between, you are doomed.

In the crypto world, the greatest insult one can receive is being called "average intelligence" (not to mention the emotional and financial pain that comes with it).

What is the Crypto IQ Curve

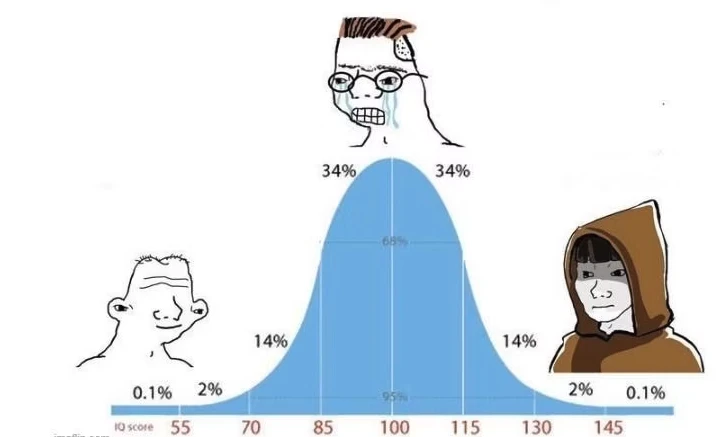

Based on the principle of the "bell curve," the Crypto IQ Curve is a meme used to describe the intelligence distribution of market participants.

Crypto IQ Curve

A very small number of people are at the ends of the curve (winners);

A very small number of people are at the ends of the curve (winners).

This is the essence of the vicious competition and zero-sum game in financial play.

On the left side of the curve are those with IQ 20 "degenerates" (brainless speculators in the crypto industry) who have single-celled brains and almost no self-awareness; on the right side are those with IQ 200 "super brains" who possess almost supernatural mathematical and social psychological understanding; and standing in the middle are the hardworking, emotionally dependent ordinary people.

Further analysis of these groups:

Left Side Curve: IQ 20 - 70

Thinking like single-celled organisms

This group of bold individuals is unafraid of taking risks; they are at the forefront of crypto, constantly trying, failing, and learning, but always full of energy. These beings are often highly paranoid, sometimes even autistic, but they excel at creating memes and "CX supporting" each other.

While their fervent dedication makes it hard to distinguish the line between "degeneracy" and gambling, the same energy also helps them become diamond hands and the elite group of early adopters. Those on the left side of the curve typically lack emotional color; they have a natural tendency to understand human psychology through intuition.

Types of assets involved: Mainly meme coins, but open to all categories

Examples: GOAT, SHIB, SOL, PEPE

Investment philosophy: Less is more, Catcoin Gudcoin, HODL, WAGMI (We will make it)

Return variance: -99% ← → +10,000% (either go to zero or freedom)

Do they ultimately profit?: Sometimes

Middle Curve: IQ 70 - 120

The group treated as liquidity exits

Those in the middle curve heavily rely on technical analysis/charting tools; they are meticulous thinkers but often immersed in false narratives and do not engage in risky experiments. They do not dare to be the first but always believe they won't be the last. This group of emotionally sensitive top buyers and bottom sellers has many other names in the crypto market: bag holders, retail investors, paper hands, token holders, etc.

Their existence is crucial to the industry—without them, there are no profits.

Types of assets involved: Mainly scams and slow-growing assets

Examples: EOS, BTC, HEX

Investment philosophy: Buy high, sell low, panic, blame market manipulation

Return variance: -99% ← → +100% (either go to zero or make a small profit)

Do they ultimately profit?: Almost never

Right Side Curve: IQ 120 and above

Alpha individuals

These people are frontier thinkers, even creators of narratives, who predict and control trends.

To join this group, one needs expertise in knowledge-intensive disciplines such as cryptography, economics, finance, sociology, psychology, computer science, statistics, and others. Those on the right side of the curve are very aware of their emotional states, obsessed with human psychology, and extremely patient. These individuals do not yield to social pressure, are unafraid of losses or admitting mistakes, and are very flexible thinkers.

Types of assets involved: Mainly meme coins, but open to all categories

Examples: SOL, GOAT, PEPE, OM

Investment philosophy: HODL, BUIDL, DCA, no leverage

Return variance: -99% ← → +10,000% (either go to zero or freedom)

Do they ultimately profit?: Always

Intelligence Levels of Different National Populations

The average intelligence levels of different countries in the real world can be understood through the following data:

(The dataset varies due to its sources, so the data below includes the most consistent/persistent information from multiple sources that can be found via search engines)

The global average IQ is about 94 (ranging from 70-110)

The average IQ in the United States is about 97 (varying between states from 95-103)

The average IQ in China is about 104 (106 in Hong Kong)

The average IQ in Russia is about 96 (ranking in the top four among countries with annual incomes below $10,000)

The average IQ in India is about 77 (possibly influenced by culture and population density)

(Please take these data with caution; it is certain that there is some bias in the census methods used to collect and compile this information. If you are moved by this data, congratulations, you are likely positioned in the middle curve; do not feel offended, but be aware of this.)

What kind of person do you want to be?

Choose extreme left or extreme right? (No political pun intended), you can choose your preference. However, due to human nature's arrogance, many will think they are on the far right, while some will not care about this (investors on the left side), but the fact is that the vast majority will ultimately find themselves in the middle position.

"He who chases two rabbits catches none." No matter which side you choose, remember that mediocrity is the only wrong answer.

Understand where you truly stand?

While judging solely by asset types is a strong indicator, accurately quantifying a person's position on the Crypto IQ Curve requires considering multiple factors, including their emotional and psychological state during the decision-making process, logical reasoning (or lack thereof), ability to handle social feedback, and the ultimate outcome of their decisions. Ultimately, it is essential to remain objective, be honest with yourself, understand your risk preferences, and take action.

Step out of your comfort zone; that is where the seeds grow. May peace, love, and absolute abundance come to everyone (no matter where you currently stand on the curve).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。