1. Who is Selling Bitcoin?

Recently, the cryptocurrency market has experienced significant turbulence, with mainstream cryptocurrencies like Bitcoin seeing declines. Many may wonder, "Who is selling Bitcoin?" In fact, the reasons behind this are not simple; they are a combination of various factors that have created a "perfect storm."

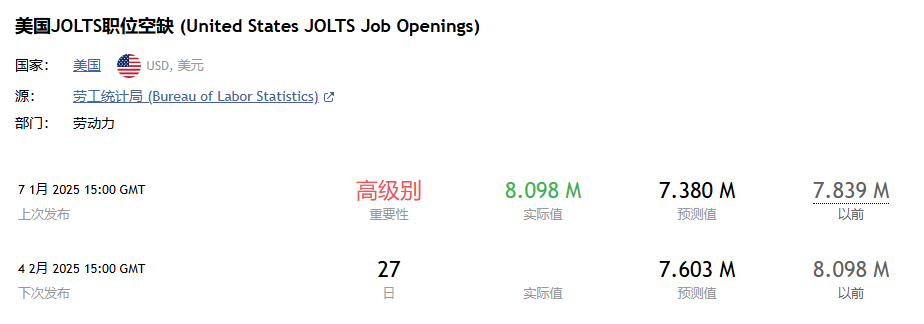

Firstly, economic data has performed better than expected, putting considerable pressure on the market. For instance, the JOLTS job openings data significantly exceeded expectations, reaching 8.098 million, a six-month high. This indicates that the job market remains strong, with the unemployment rate likely to decrease further and job openings increasing accordingly. A thriving job market often drives consumer spending, which in turn propels the overall economy upward. As a result, investors may shift funds from the higher-risk cryptocurrency market to the relatively stable real economy, triggering a wave of selling in Bitcoin and other cryptocurrencies.

Additionally, the ISM Non-Manufacturing PMI data also exceeded expectations, reflecting an expansion in economic activity. As a crucial component of the economy, the rise in the PMI index indicates a strong upward momentum in the economy and a positive outlook for corporate profits. In this context, investors are more inclined to allocate funds to the real economy for stable returns rather than risk investing in the volatile cryptocurrency market.

2. The "Shadow" of Federal Reserve Interest Rate Hike Expectations

In addition to the impact of economic data, the rising expectations of Federal Reserve interest rate hikes are also a significant reason for the decline in the cryptocurrency market. Strong economic data has reduced the likelihood of the Federal Reserve quickly lowering interest rates, with the market expecting that the Fed may only cut rates twice or even less, and there is a possibility of further rate hikes. This expectation increases the cost pressure of funds in the market, heightening investor uncertainty about future economic conditions, which in turn leads to fluctuations in market sentiment.

Particularly, the rise in the 10-year U.S. Treasury yield has exacerbated market tension. The increase in bond yields indicates a growing demand for bonds, and there exists a certain "teeter-totter effect" between bonds and risk assets like cryptocurrencies; when bond yields rise, funds tend to flow from risk assets to the bond market, thereby suppressing the valuation of cryptocurrencies.

3. The "Butterfly Effect" of Market Sentiment

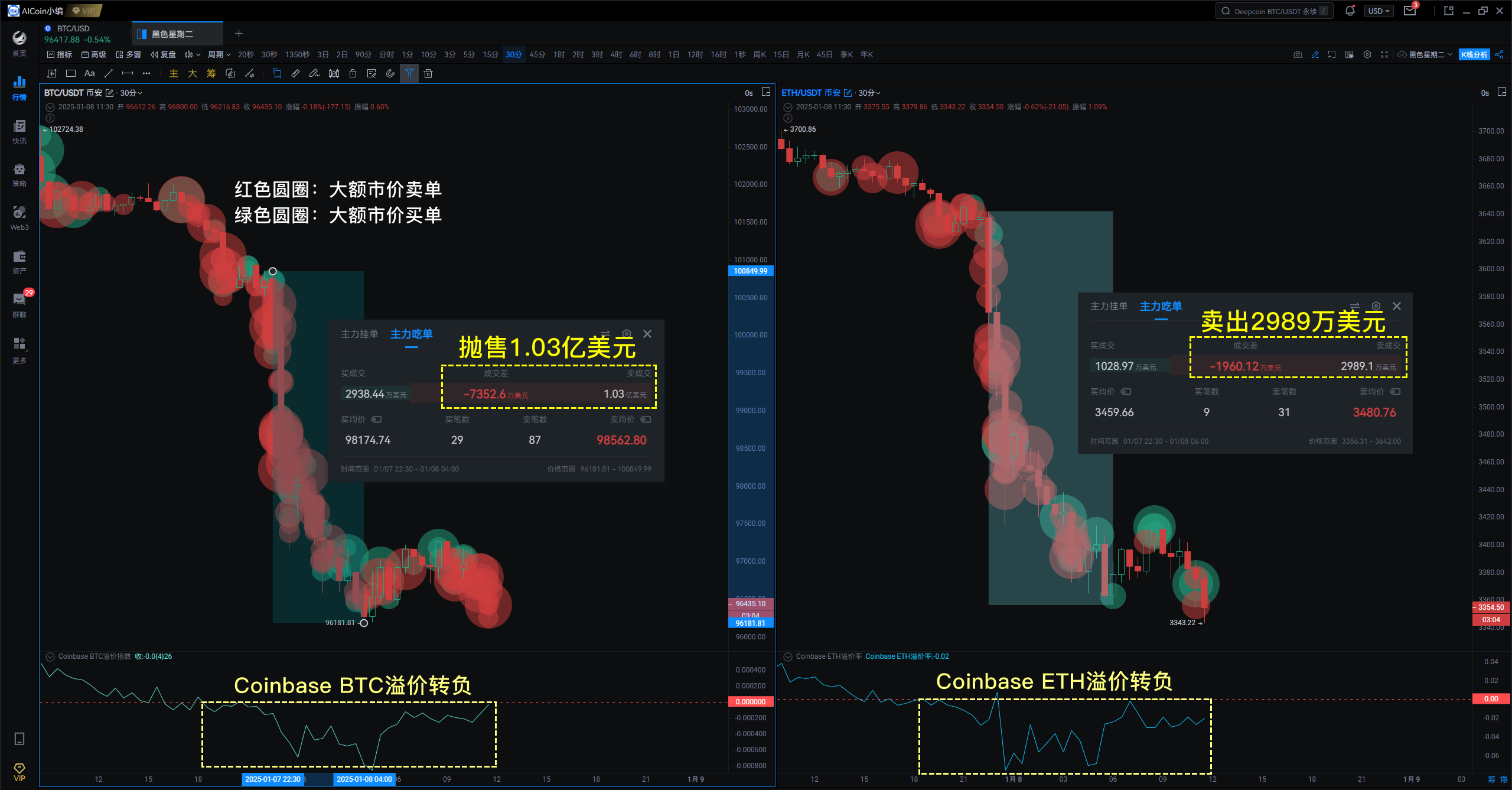

The combination of "overly strong" economic data and rising expectations of Federal Reserve interest rate hikes has triggered significant fluctuations in market sentiment. On one hand, the increased risk of tightening liquidity has led to a decline in investor confidence in holding risk assets like cryptocurrencies, prompting many to sell off to avoid risk, as shown in last night's selling situation:

On the other hand, uncertainty regarding future macro policies (slow rate cuts or the possibility of rate hikes) has heightened risk-averse sentiment, exacerbating market sell-offs and further driving down cryptocurrency prices.

In summary, the core reasons for the overall decline in the cryptocurrency market are the better-than-expected economic data and rising interest rate hike expectations. Although the cryptocurrency market may face some challenges in the short term, in the long run, as the market continues to mature and investors' understanding of cryptocurrencies improves, cryptocurrencies still have broad development prospects. Investors should remain rational in the face of market fluctuations, manage risks effectively, and seize investment opportunities.

The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。