On January 3, Musk posted on his social platform: "A client purchased $7,000 worth of cumrocket and staked it for 3 months to earn a 6900% return. Then they sold and withdrew the profits to invest in NFTitties, but the developers rug pulled the project, and they only managed to liquidate 10% of the funds. Can the client deduct the gas fees for minting to offset short-term capital gains tax?"

To truly understand what Musk is mocking and why he has repeatedly diss the IRS, BlockBeats consulted professional tax experts from TaxDAO, who have been providing professional financial management software and crypto tax consulting services in the Web3 field since 2023. Recently, they developed a professional crypto asset tax management software, FinTax, aimed at both B2B and B2C markets, using AI Agent to help users address their crypto finance and tax-related needs in one stop.

Through their explanation of U.S. tax law, using the numbers provided in the image as a case study, we can further elaborate on the current state and future of crypto taxation in the U.S.

Image Interpretation: An Unreasonable Tax Story

First, let's interpret the sad story depicted in the image:

This is an example of calculating taxes on cryptocurrency investments, which can be broken down into three stages. The first stage is staking income, which is taxed as ordinary income under personal income tax, with a progressive tax rate ranging from 10% to 37%. The second stage is when the investor mints NFTs using the earned staking rewards, which is considered an investment activity and should incur capital gains tax. The third stage is investment failure, where the project rug pulls, resulting in a 90% loss. In 2023, the IRS issued a memorandum on the taxation of worthless or abandoned crypto assets, stating that if a taxpayer has lost control over the crypto assets (the investor in the image has already sold the depreciated crypto assets), the resulting loss can be used to offset taxes before income, but since this is an investment activity, it can only offset capital gains tax, with a maximum deduction of $3,000 against ordinary income depending on marital status.

Based on the situation in the image, let's assume the client is single, the staking rewards are distributed in a lump sum at the end of the 3-month period, and upon receiving the staking rewards, the client sells all of it to invest in the NFT project, with no other income. The tax implications of this series of transactions can be calculated as follows:

(1) The client purchased $7,000 worth of Cumrocket and staked it for 3 months, earning a 6900% interest. Therefore, the earnings amount to $7,000 * 6900% = $483,000. According to IRS regulations, this income is classified as ordinary income rather than capital gains.

(2) The amount invested in the NFT is $7,000 * 7000% = $490,000.

(3) After investing the crypto asset profits into the NFT project, due to the rug pull, they can only liquidate 10% of the funds, resulting in a 90% loss, which amounts to $490,000 * 90% = $441,000 in losses. Since this amount has been liquidated, the loss is realized and meets the criteria for deductible capital losses.

Capital losses first offset similar capital gains. In this case, there are no capital gains from price increases, so the $441,000 capital loss cannot offset any capital gains. Assuming the client is single, according to IRS regulations, this capital loss can offset a maximum of $3,000 against ordinary income for that year, and the standard deduction for single filers is $13,850. Therefore, the client's taxable ordinary income = $483,000 - $3,000 - $13,850 = $466,150. Based on the progressive ordinary income tax rate table, they need to pay $11,000 * 10% + $33,725 * 12% + $50,650 * 22% + $86,725 * 24% + $49,150 * 32% + ($466,150 - $231,250) * 35% = $1,100 + $4,047 + $11,143 + $20,814 + $15,728 + $82,215 = $135,047.

Thus, from the above calculations, we can see that after a series of financial activities, the investor ultimately only has a surplus of $50,000 (which includes the $7,000 principal), but they need to pay as much as $130,000 in taxes that year. This example accurately satirizes the unreasonable aspects of U.S. crypto tax law, and it’s no wonder Musk has repeatedly diss the IRS's regulations.

Crypto Tax Disputes: Inextricable and Chaotic

Why has Musk long held a dissatisfied attitude towards U.S. crypto taxes? FinTax tax experts analyze the following two reasons:

The complexity of U.S. taxes, with each region having its own regulations and compliance costs that can be nearly 10 times that of China;

Since 2023, the U.S. has introduced targeted tax legislation for the crypto sector, but it has not taken into account the characteristics of the crypto industry, still approaching it from a traditional industry perspective, which may inherently have some unreasonable aspects; even if the legal principles are reasonable, the government’s complete reliance on traditional tax collection methods to manage crypto enterprises makes it difficult for businesses to truly comply.

The case depicted in the image is a typical problem where taxpayers have some businesses making money and others losing money, but these profitable and unprofitable businesses cannot offset each other in specific tax scenarios, leading to the awkward situation where one ends up not making any money but still has to pay a lot of taxes. Similar cases include the dispute between the Jarrett couple and the IRS over whether taxes should be paid on staked assets.

Related Articles:

《U.S. Crypto Broker Rules: Bitter Medicine or Deadly Poison?》

《IRS Maintains Stance on Taxing Crypto Asset Staking: Interpretation of Jarrett v. U.S. Case》。

On the other hand, due to the decentralized and anonymous nature of cryptocurrencies, they have also become tools for some individuals to evade taxes, and such cases have become the most common disputes in the crypto field.

Taking the famous "Bitcoin Jesus" case as an example, the protagonist Roger Ver was born in Silicon Valley, USA, in 1979 and began investing in Bitcoin in 2011. Due to his active promotion of Bitcoin's application and value, he played a significant role in its early adoption, accumulating substantial influence in the crypto asset field, earning him the title "Bitcoin Jesus" from the media and crypto community.

In 2014, Roger Ver obtained citizenship in Saint Kitts and Nevis and soon after renounced his U.S. citizenship. According to U.S. tax law, individuals who renounce their citizenship must fully report their global capital gains, including their holdings of Bitcoin and its fair market value. The IRS believes Roger Ver concealed and undervalued his personal asset value before renouncing his citizenship and, after renouncing, obtained and sold approximately 70,000 Bitcoins from his U.S.-based company, generating nearly $240 million in income, thereby evading at least $48 million in taxes owed.

In this regard, the IRS primarily raised two charges: first, Roger Ver did not comply with exit tax regulations; second, Roger Ver violated his tax obligations as a non-U.S. tax resident.

The likelihood of Roger Ver's case succeeding may be influenced by various factors. On the favorable side, his legal team argues that the tax regulations on crypto assets are unclear, providing a basis for defense regarding loopholes in the tax system. They also accused the prosecution of selective enforcement, which, if sufficient evidence is provided, could undermine the legitimacy of the IRS's prosecution. Additionally, it is noteworthy that the Trump administration intended to end the stringent regulation of crypto assets, which could bring a turning point to the case. However, on the unfavorable side, the prosecution has substantial specific evidence, including $48 million in unpaid taxes and a series of tax evasion records, which likely meet the statutory requirements for tax evasion.

The Bitcoin Jesus case has sounded the alarm for tax compliance in the crypto industry, especially for individual investors in crypto assets. Strengthened international cooperation and advancements in technology are continuously narrowing the space for investors to evade taxes. For investors in the crypto industry, tax compliance has become an unavoidable key issue.

Related Articles: 《IRS VS Bitcoin Jesus: Compliance Risks Behind $48 Million Tax Bill》

Wealth Tax: The Sword of Damocles Over the Crypto Industry

In addition, the series of "corporate taxes" and "wealth taxes" introduced during Biden's early presidency has indeed caused Musk to bleed profusely.

After Biden took office in 2020, he initiated multiple rounds of large-scale infrastructure plans to achieve his political ambitions. However, high expenditures must be supported by high taxes, with American corporations and the wealthy class being the first to bear the burden of high taxes to fund this plan, and Musk was undoubtedly targeted by Biden. When announcing the 2023 budget, Biden proposed a new tax scheme targeting the wealthy, imposing a 25% minimum income tax on citizens with a net worth of over $100 million, which includes the annual income from standard taxable amounts and the total value of "tradable assets" (including stocks, bonds, mutual funds, and other securities). According to a report released by ProPublica in 2021, Biden's wealth tax would require tech giants like Musk to pay between $35 billion and $50 billion in taxes. That year, the news that "Musk will pay a $11 billion tax bill" became a hot topic, marking the highest single tax payment by an individual in U.S. history.

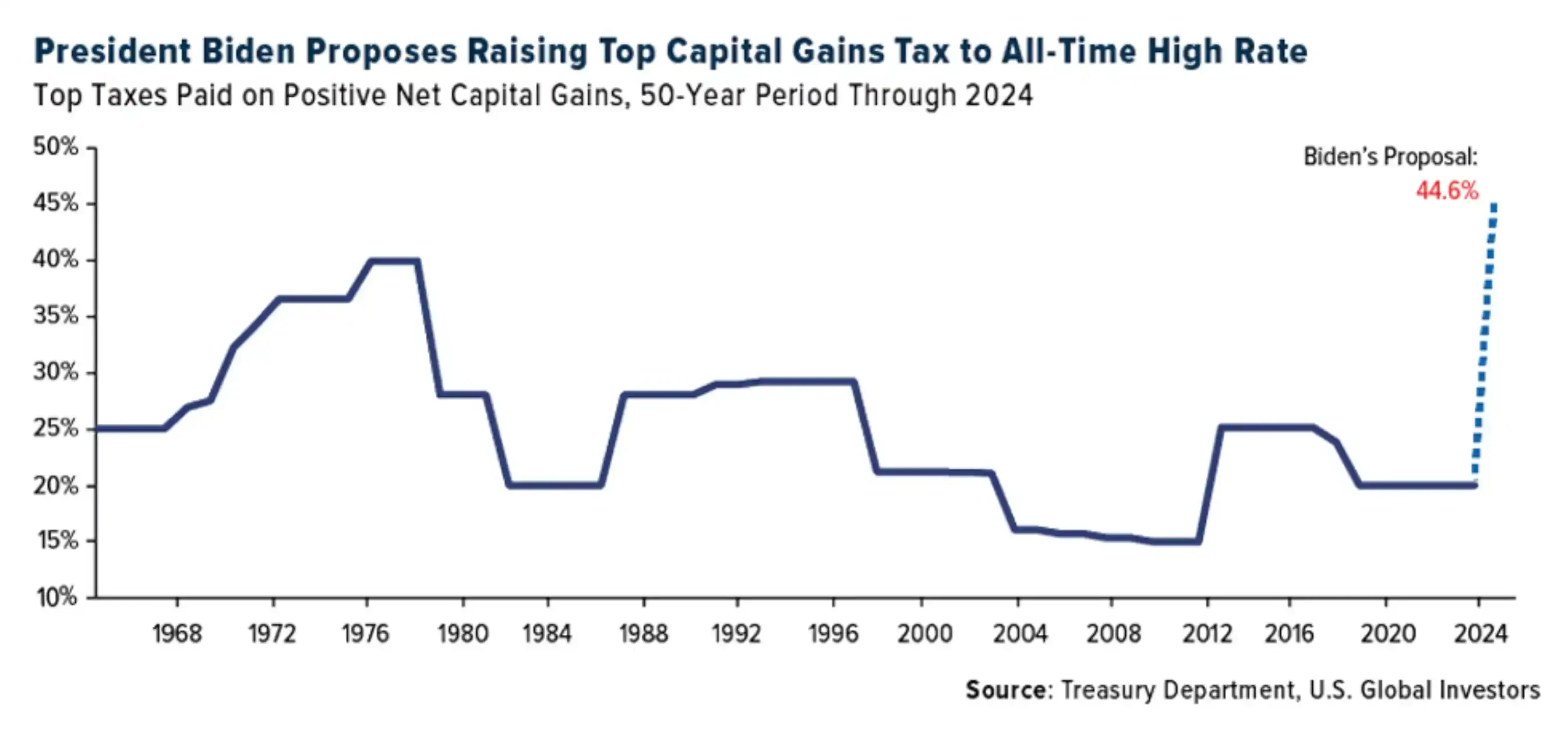

Under the new regulations, U.S. capital gains tax will reach a historic high, with the image source from the U.S. Department of the Treasury.

After raising the fiscal year 2025 budget to $7.3 trillion, Biden has once again proposed a tax on unrealized gains, planning to tax unrealized gains of trusts, corporations, and other non-corporate entities that have not had a realization event in the past 90 years. Taxing unrealized gains means that even if individuals or businesses (with a net worth over $100 million) hold stocks, bonds, and other tradable assets without selling them, they will still need to pay a minimum income tax of 25% when their value increases.

This bill is akin to declaring war on the venture capital circle, which views valuation growth as the underlying logic of everything. Bill Ackman stated regarding this tax plan that the Democrats should not implement a tax policy "that will destroy the American economy." He added, "If someone invests in your startup at a $1 billion valuation, and you own 50% of the company, you will immediately incur $100 million in taxable income… All American startups will go bankrupt because no one will want to start a business in the U.S." In the latest podcast episode, two founding partners of A16Z expressed the same viewpoint. This bill hangs like a precarious sword of Damocles over startups, with massive taxes potentially delivering a fatal blow, limiting the development of entrepreneurship and investment.

David Sacks remarked at a tech conference earlier this year that this tax could stifle the system of providing stock options to founders and employees in the startup industry, stating, "This is an important reason for Silicon Valley to seriously consider who to vote for." The investment community believes that this tax policy will significantly distort the investment behavior of American investors, especially concerning small-cap stocks and startups. These companies are typically engines of economic growth and innovation, relying on investors willing to take risks for future returns. However, when unrealized gains are also subject to taxation, investors will be less inclined to favor growth-oriented companies, as their valuations tend to be more volatile compared to larger, more mature firms.

Read more: 《Silicon Valley Turns Right: Peter Thiel, A16Z, and the Political Ambitions of Cryptocurrency》

What is the Future of Crypto Tax Law?

Since the birth of the cryptocurrency market, the tax issues surrounding its trading have been a focal point of debate. The core conflict lies in the differing positions of the government and investors: the government seeks to increase fiscal revenue through taxation, while investors worry that excessive tax burdens will reduce investment returns.

Even in the face of high enthusiasm for trading cryptocurrencies, as seen in South Korea, authorities have consistently attempted to regulate the crypto sector through high taxes. This involves not only a tug-of-war between regulatory bodies and the market but also a struggle for discourse power between the Democratic Party and the People Power Party.

The South Korean Democratic Party had long planned to impose a 20% tax on cryptocurrency gains (22% for local taxes), originally set to take effect on January 1, 2022. However, due to strong opposition from investors and the industry, the plan has been postponed twice to January 1, 2025. After a press conference on December 1, 2024, the tax collection was postponed again to 2027. The ruling People Power Party has also proposed delaying the implementation until 2028.

Overall, South Korea has taken a relatively cautious approach to cryptocurrency taxation, not imposing strict regulations on the market. On one hand, this provides the market with time and space for natural development; on the other hand, it offers South Korea a valuable window to observe the policy implementation effects of other countries and global regulatory trends, allowing for the establishment of a more comprehensive tax system based on lessons learned from others.

In contrast, the U.S. attitude towards the crypto market has been increasingly positive since Trump took office. From the SEC chairman to the Treasury Secretary, and the overall coordination of the "crypto team," the Trump administration's "crypto dream team" not only represents significant policy adjustments but also signals a potential major turning point for the U.S. cryptocurrency industry. However, regarding the government's stance on taxation, FinTax tax experts hold a conservative view, believing that while Trump promised many favorable policies for the crypto industry before taking office and will continue to roll out policies afterward, tax regulations will only become stricter. This is because Trump's initial support for the crypto industry stemmed from recognizing its important role in the U.S. financial system and technological development, believing it could bring new growth to the fintech sector, which must be reflected in tax regulations. Therefore, future crypto taxes will become increasingly clear, and tax administration will move towards stricter enforcement.

A satirical image from Musk has sparked a frenzy around a cryptocurrency and left new imaginations for the crypto field. In the U.S. Treasury's announcement of the 2025 crypto tax system, rules related to DeFi and non-custodial wallet providers have been temporarily shelved, indicating the U.S. government's cautious attitude towards formulating crypto tax policies. In the future, whether in terms of the adaptability of tax policies or the regulation of tax evasion and avoidance, U.S. tax law still has a long way to go. We hope that as the crypto industry gallops forward like a runaway horse, there will also be a strong rein guiding it in the right direction.

References:

Overview of U.S. Crypto Tax System;

IRS Regulations: Taxing Staking Income as Ordinary Income;

Ordinary Income Tax Rates and Capital Gains Tax Rates;

Crypto Asset Income Classified as Ordinary Income;

Crypto Asset Transactions Subject to Capital Gains Tax;

《How Crypto Companies Should Respond to SEC Inquiries: Compliance Insights from Bitdeer》

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。