Brief Overview

Key Events: This week will see the release of several important data points, such as U.S. non-farm employment, Eurozone inflation rates, and the Federal Reserve meeting minutes, all of which are crucial for the sentiment in the crypto market.

Central Bank Dynamics: Inflation and employment market data will directly influence the policy decisions of the European Central Bank and the Federal Reserve, potentially leading to significant volatility in crypto prices.

Global Perspective: Geopolitical risks, changes in regulatory policies, and fluctuations in energy prices complicate the market further, especially with the potential impacts of Elon Musk's X-Money plan and China's GDP growth.

As we enter the second week of 2025, a series of important economic data is set to be released. These data points will not only have a broad impact on global markets but are also significant for the rapidly evolving crypto market. From inflation trends to the latest dynamics in the employment market, these indicators will provide key insights for interpreting market trends, liquidity changes, and central bank policies.

Why is Week 2 Crucial for Crypto Traders?

With the new year just beginning, market attention on inflation, employment data, and central bank decisions is intensifying. For crypto traders, the focus remains on how macroeconomic changes will influence the price direction of digital assets in a volatile environment.

Review of Week 1

The first week of 2025 provided some preliminary signals regarding global economic trends:

China: The manufacturing PMI released by the National Bureau of Statistics slightly fell to 50.1, indicating that despite ongoing policy support, the economic recovery process still faces challenges.

Germany: The unemployment rate rose slightly, highlighting the pressures faced by Europe’s largest economy.

United States: The ISM manufacturing PMI climbed to 49.3, suggesting that after several months of sluggishness, U.S. manufacturing may be stabilizing.

These data points set a cautiously optimistic tone for the start of the new year. Traders are closely monitoring upcoming data releases and policy dynamics to formulate more precise investment strategies.

Table of Contents

Overview of important economic data from January 6 to January 10

Macroeconomic Drivers: Inflation, Consumer Behavior, and Employment Market Resilience

Central Bank Policies and Their Impact on the Crypto Market

U.S. Non-Farm Employment Data

Eurozone Inflation Rate

Federal Reserve Meeting Minutes

U.S. ISM Services PMI

Focus on Key Economic Indicators

Flexibly Respond to Market Sentiment Changes

Wisely Manage Volatility Risks

Global Risks and Opportunities

Geopolitical Risks: How They Affect the Market

X-Money Plan and the Future of Bitcoin

Regulatory Dynamics and the Rise of Central Bank Digital Currencies (CBDCs)

Impact of Energy Price Fluctuations on Crypto Mining

Highlights of This Week

This week will see the release of several important economic data points that could significantly impact market trends. For crypto traders, understanding these trends in advance is key to formulating trading strategies.

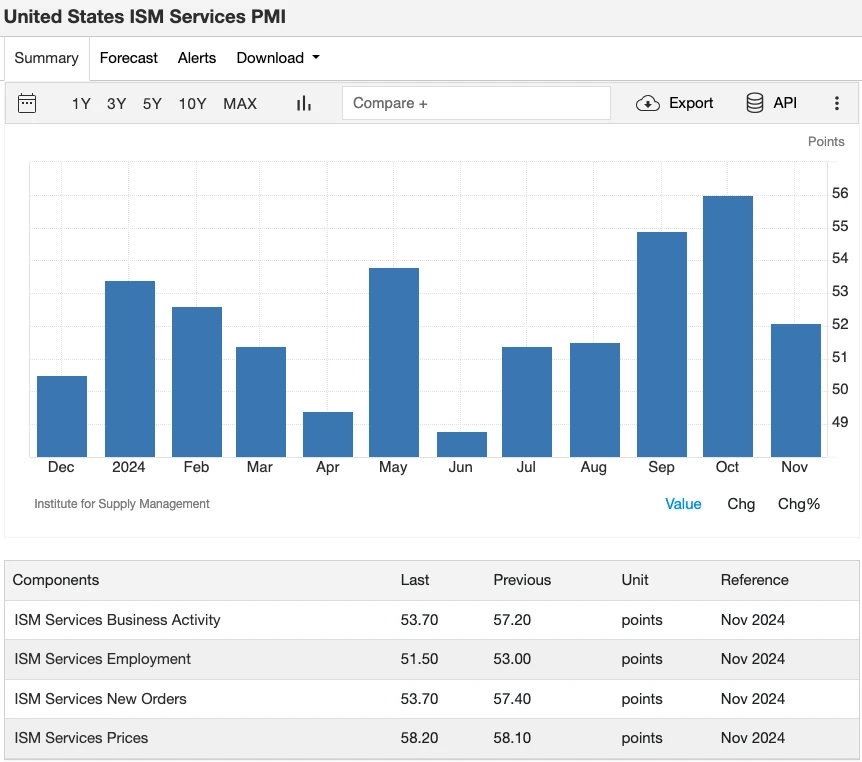

Overview of Important Economic Data from January 6 to January 10

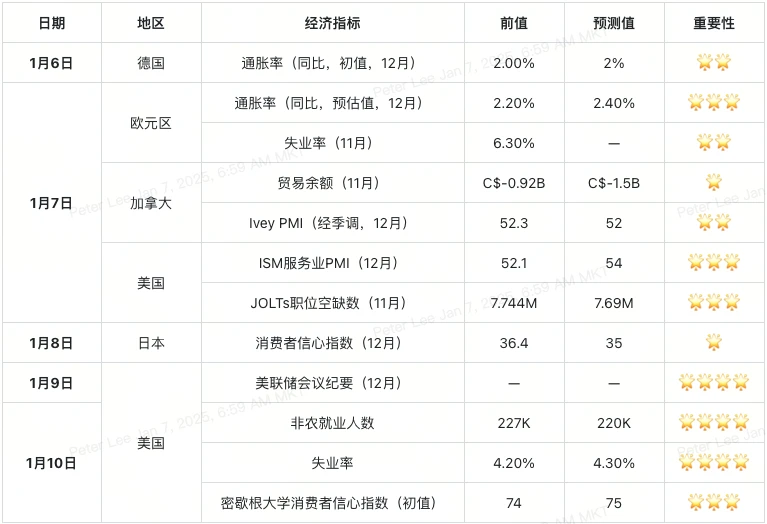

Here are some important data points to watch this week and their potential market impacts:

Macroeconomic Drivers

Inflation: A Key to Central Bank Decisions

Europe: Inflation data from Germany and the Eurozone will provide important clues for the European Central Bank's future monetary policy. If inflation remains high, it may trigger more tightening measures, affecting market risk appetite, and the crypto market will not be immune.

United States: The Producer Price Index (PPI) and core inflation data will determine market expectations for the Federal Reserve's next policy move. If inflation slows, it may encourage the market to invest more in risk assets, including cryptocurrencies.

Consumer Spending and Confidence

- United States: The ISM Services PMI and the University of Michigan Consumer Sentiment Index are important indicators for assessing economic resilience and consumer capacity. Strong data may indicate ongoing economic stability but could also reduce the likelihood of the Federal Reserve easing policies. For the crypto market, this could present both opportunities and pressures.

Employment Market Dynamics

- The non-farm employment data released this Friday is the focus of global market attention. If the data falls short of expectations, it may indicate a cooling labor market, increasing the likelihood of the Federal Reserve shifting to an easing policy, which would be favorable for the crypto market.

Central Bank Signals

Federal Reserve Meeting Minutes (Thursday): The minutes will provide detailed information on the discussions within the Federal Reserve during the December meeting, and traders will look for signals regarding interest rate cuts or policy shifts. If the content leans towards easing, the crypto market may be boosted; conversely, hawkish remarks could dampen market enthusiasm.

European Central Bank: Inflation pressures in the Eurozone remain a significant challenge for market confidence. If there are further signs of tightening, it may affect trading activities of Euro-denominated stablecoins and related crypto assets.

Key Data Analysis

U.S. Non-Farm Employment Data (January 10, Friday)

Why It Matters: As a core indicator of U.S. economic health, the performance of non-farm employment data has a direct impact on the market. Strong data typically boosts the dollar and weakens the performance of risk assets (including cryptocurrencies); conversely, if the data falls short of expectations, it may lead investors to bet on the Federal Reserve easing policies, benefiting the crypto market.

Forecast: The number of new jobs is expected to be 220,000 (previous value: 227,000).

Potential Impact: If the data exceeds expectations, the market may experience a brief pullback; while results below expectations could stimulate a rebound in cryptocurrency prices, especially if investors anticipate a more accommodative policy from the Federal Reserve.

Image Credit: Trading Economics

Eurozone Inflation Rate (January 7, Tuesday)

Why It Matters: Inflation data is an important reference for the European Central Bank's policy decisions. High inflation typically means that tightening policies will continue, while a slowdown in inflation may lead the market to expect a shift towards easing policies.

Forecast: Year-on-year increase of 2.4% (previous value: 2.2%).

Potential Impact: If the data exceeds expectations, the market may become more cautious towards risk assets (including Euro-denominated stablecoins and crypto assets); while inflation below expectations could release more risk appetite, benefiting the crypto market.

Image Credit: Trading Economics

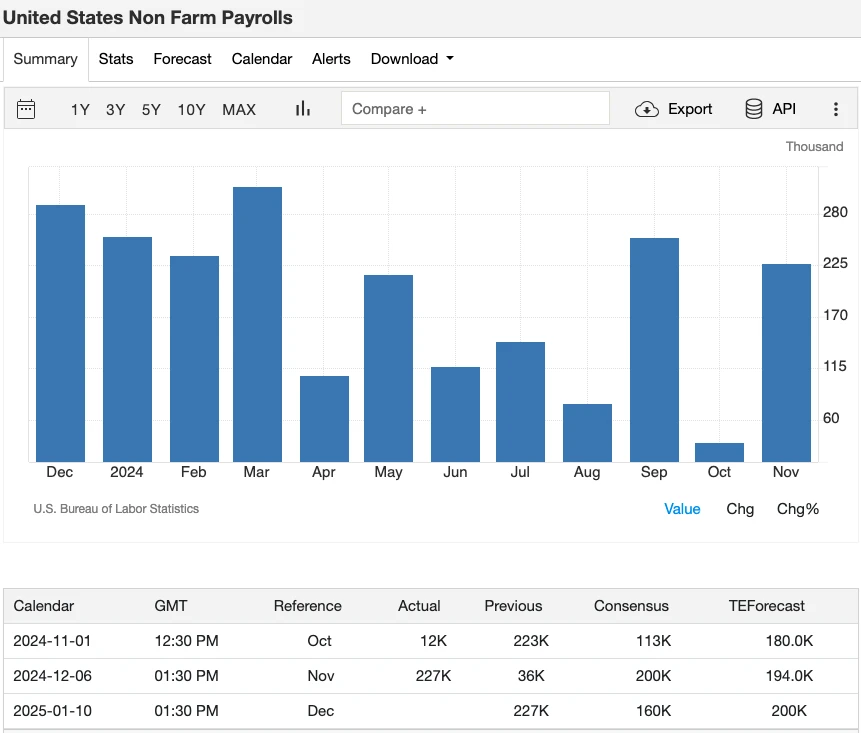

Federal Reserve Meeting Minutes (January 9, Thursday)

Why It Matters: The meeting minutes will provide details on the Federal Reserve's internal discussions regarding December's policy, serving as an important window for observing the direction of monetary policy in 2025.

Potential Impact: Easing signals may raise market expectations for Federal Reserve interest rate cuts, thereby boosting crypto market sentiment; while hawkish content may make investors more cautious, suppressing the prices of risk assets.

Image Credit: Trading Economics

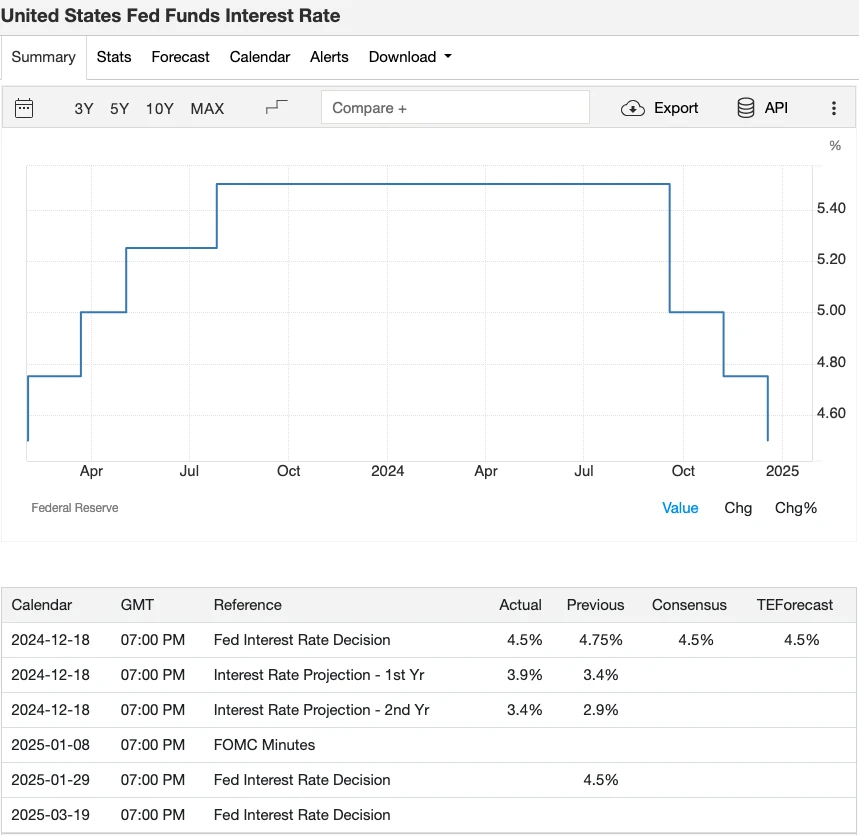

U.S. ISM Services PMI (January 7, Tuesday)

Why It Matters: This data reflects the overall health of the U.S. services sector and is an important indicator for assessing economic resilience.

Forecast: 54.0 (previous value: 52.1).

Potential Impact: If the data is strong, it may reinforce market confidence in U.S. economic stability, but this could also reduce the likelihood of the Federal Reserve easing policies, putting some pressure on the crypto market. Conversely, data below expectations may stimulate more risk appetite, providing support for crypto asset prices.

Image Credit: Trading Economics

Trader Strategy Guide

Keep a Close Eye on Key Economic Data

This week's U.S. non-farm employment data and ISM Services PMI are the top priorities. These data not only reveal the labor market and economic vitality but also directly influence the price trends in the crypto market.

Don't overlook the Eurozone's inflation data, as it may affect the European Central Bank's policy direction and indirectly impact trading of Euro-related crypto assets and stablecoins.

Flexibly Respond to Market Sentiment

As the Federal Reserve meeting minutes and Eurozone economic data are released, market sentiment may fluctuate rapidly. Hawkish signals could put pressure on risk assets, while dovish signals may stimulate a rise in cryptocurrency prices.

Stay sharp and adjust strategies in a timely manner to respond to emotional fluctuations triggered by policy expectations or data performance.

Wisely Manage Market Volatility

High-impact events (such as non-farm data and Federal Reserve meeting minutes) often exacerbate market volatility. During these critical moments, protecting positions through stop-loss orders or appropriate hedging can reduce risk exposure.

Ensure sufficient liquidity before and after major data releases to flexibly adjust trading plans during significant market fluctuations.

Global Risks and Opportunities

Geopolitical Risks and Their Market Impact

Geopolitical tensions remain a potential risk that cannot be ignored in the crypto market.

United States: Since Trump's administration, the market has anticipated a potentially more favorable attitude towards cryptocurrencies, which could further mainstream crypto assets.

China: In contrast, China has banned private ownership of Bitcoin and is focusing on promoting the digital yuan. This starkly different policy direction may exacerbate market uncertainty and volatility.

Global Hotspots: The ongoing escalation of the situation in Ukraine and conflicts in the Middle East also add risks to the market. Although Bitcoin is sometimes viewed as a safe-haven asset, its correlation with traditional financial assets is weakening this characteristic.

Image Credit: CSO Online

X-Money Plan and Bitcoin's Outlook

Elon Musk's X-Money plan is expected to be a major breakthrough in the payment sector.

Disrupting the Payment Landscape: According to reports, X-Money will deeply integrate cryptocurrency functionalities, potentially revolutionizing traditional payment methods.

Opportunities for Bitcoin: As the price of Bitcoin gradually approaches $100,000, the market has high hopes for Musk's plan, believing it could attract more institutional participation and accelerate Bitcoin's global adoption.

Image Credit: Tekedia

Regulatory Policies and CBDC (Central Bank Digital Currency) Development

The global regulatory environment for cryptocurrencies is rapidly changing:

United Kingdom: The Financial Conduct Authority (FCA) plans to introduce stricter crypto regulations by 2026, which may have long-term impacts on the market.

Morocco: New cryptocurrency laws are being formulated while exploring the launch of its own central bank digital currency (CBDC).

Bank of England: The decision on the digital pound is still in a wait-and-see phase, which may affect the competitive landscape between cryptocurrencies and CBDCs.

Image Credit: Bitcoinist

Energy Prices and Crypto Mining Costs

Fluctuations in energy prices directly impact Bitcoin mining activities:

High Costs Suppress Production: If energy prices remain high, miners may slow down production, affecting network hash rate and Bitcoin supply.

Low Costs Promote Expansion: If energy prices decrease, miners may expand production, increasing the supply of Bitcoin in the market.

Environmental Pressure: As global attention to sustainability increases, the mining industry faces greater environmental pressures. Particularly, Musk's emphasis on energy efficiency in the X-Money plan may significantly impact future mining methods.

Energy prices not only affect miners but also influence investors' expectations for Bitcoin, introducing new variables to market trends.

Image Credit: Dreamstime

Week 3 and Future Outlook

Upcoming Data and Trends

Week 3 will see the release of several important economic data points, including consumer confidence, inflation rates, and GDP growth. Additionally, U.S. retail sales data will also be released this week, providing important insights into consumption trends.

Key Indicators to Watch (January 13 – January 17)

China GDP Growth

- Why It Matters: China's GDP growth was 4.6% in the third quarter, reflecting dual challenges in the real estate market and domestic demand. The forecast for the fourth quarter is 5.0%, which will reveal whether policy stimulus is beginning to take effect. Strong data could boost global market confidence and inject more funds into crypto assets related to the Asian market.

U.S. Core Inflation Rate

- Why It Matters: The core inflation rate in November was 3.3%, indicating persistent inflationary pressures. The forecast for December is 3.0%, which will directly influence market expectations for Federal Reserve policy. If the data falls below expectations, it may drive up prices of risk assets, including cryptocurrencies.

U.S. Retail Sales Data

- Why It Matters: Retail sales data for December is expected to be released mid-week. This data will reflect holiday consumption performance and directly impact market assessments of economic resilience. Strong consumption data may indicate a robust economy but could also lower expectations for Federal Reserve easing policies, leading to complex reactions in the crypto market.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and more than 40 million user traffic within its ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a rich variety of trading options, including spot trading, margin trading, and futures trading. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。