Black Tuesday, the crypto market faces another bloodbath! Bitcoin retraces over 6%, ETH plunges 10%, the entire market drops 7%, with a total market cap evaporating over $260 billion!

AICoin (aicoin.com) liquidation data shows that in the past 24 hours, a large number of long positions were liquidated, with the total liquidation amount in the futures market reaching $512 million. Among them, ETH liquidation topped the list at $112 million, followed by BTC with a total liquidation of $96.5 million. According to tracking, liquidations were concentrated around 1 AM today, with the largest single liquidation amount reaching $17.74 million, which was a Binance ETH/USDT perpetual long position, with a liquidation price of $3400.54.

According to AICoin analysis, the behind-the-scenes culprits of this sharp decline are:

Surge in U.S. Treasury yields, rising inflation expectations;

Large holders dumping, exacerbating panic selling.

Culprit One: Out-of-control U.S. Treasury yields, inflation worries resurface

As Trump's official inauguration as U.S. President approaches, concerns in the bond market about inflation prospects are beginning to rise. Data shows that the 30-year U.S. Treasury yield has reached a 14-month high of 4.919%, nearing the 5% mark; the 10-year U.S. Treasury yield has climbed to 4.695%, marking a new high since April of last year. (💡 AICoin editor's note: Rising U.S. Treasury yields are typically accompanied by rising inflation expectations or expectations of tighter monetary policy, as such expectations prompt investors to demand higher yields to compensate for the risk of future currency depreciation, leading to the selling of existing bonds and thus pushing up yields.)

Additionally, according to the ISM Non-Manufacturing Price Index, costs in the U.S. service sector unexpectedly surged, recording 64.4% in December, the highest level since early 2023. (💡 AICoin editor's note: The service sector dominates the U.S. economy, and rising costs in this sector can lead to higher service prices, which in turn indirectly increases consumer spending (the principle is similar to rising consumption levels), thereby pushing up inflation.)

The surge in U.S. Treasury yields, unexpected macro data, and potential inflation effects following Trump's inauguration have reignited market concerns about stubborn inflation and sparked investor doubts about the possibility of the Federal Reserve cutting interest rates in 2025. CME FedWatch data indicates that the current interest rate market generally believes the Federal Reserve will pause rate cuts at the end of the month, betting on maintaining rates in March and May, with the possibility of a 25 basis point cut only in June.

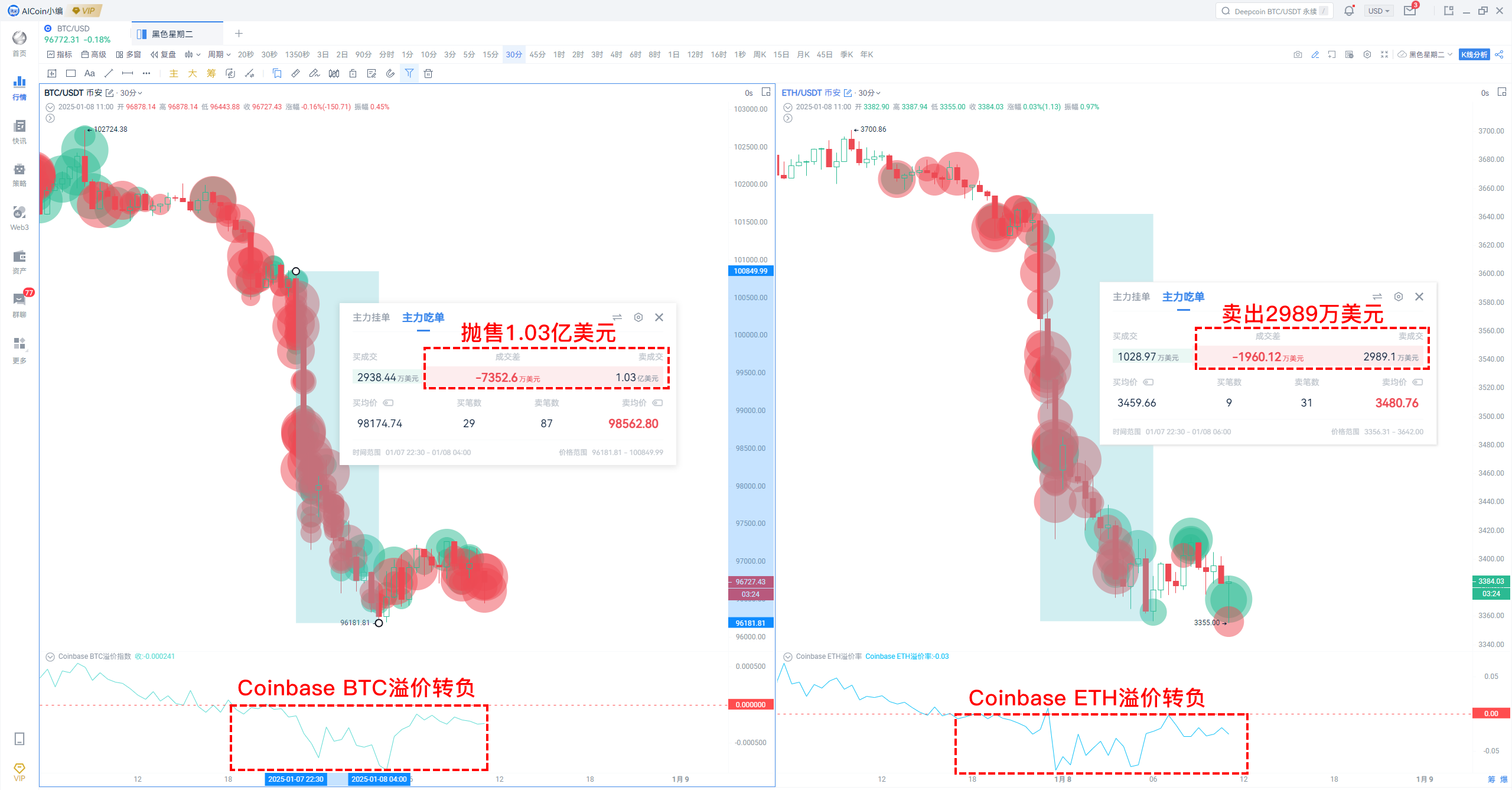

Culprit Two: Large holders dumping, Coinbase premium turns negative

AICoin's large transaction indicators tracked that after the U.S. stock market opened last night, large spot holders in Asia began to dump at market prices, with Binance large holders selling $103 million in BTC and $29.89 million in ETH; OKX's main players offloaded $22.08 million in BTC and $37.93 million in ETH.

Large transactions: Tracking the main market price transaction situation, when large market sell orders appear densely, it can be seen as a signal of main players dumping, for details see: https://www.aicoin.com/vip

Large transactions: Tracking the main market price transaction situation, when large market sell orders appear densely, it can be seen as a signal of main players dumping, for details see: https://www.aicoin.com/vip

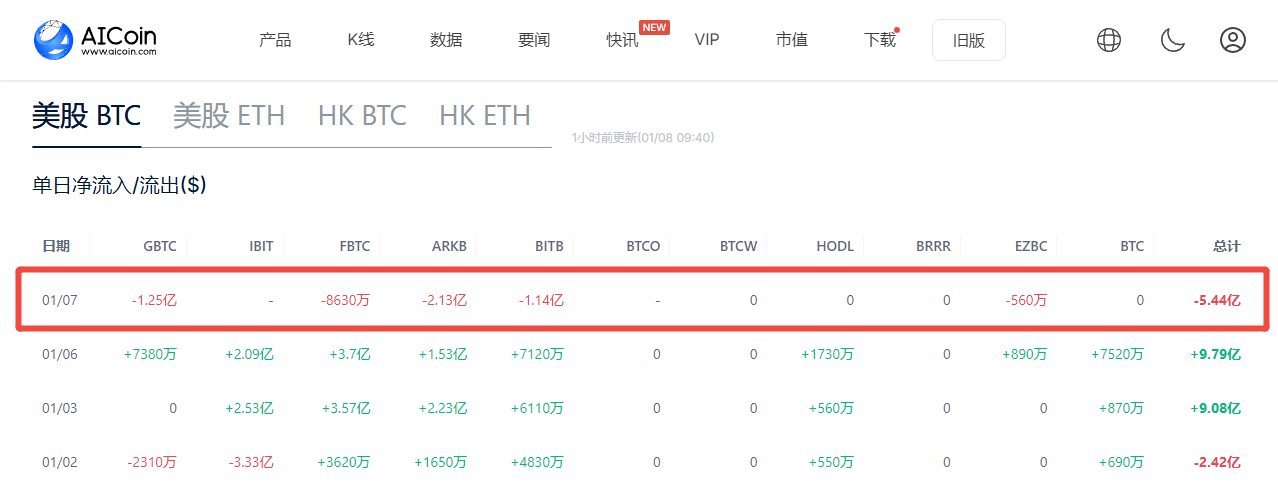

Moreover, the premium for BTC and ETH on Coinbase has turned negative, with increased selling pressure from the main players in the U.S. Additionally, according to data obtained at the time of publication, there was a net outflow of over $540 million from U.S. spot Bitcoin ETFs last night, with GBTC and BITB each seeing outflows of over $110 million, and ARKB experiencing a $213 million outflow.

ETF data tracking: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

Currently, the bulls' resistance is starting to take effect, with BTC temporarily holding the $96,000 support, but on the daily level, it has already fallen below the MA20. Key levels to watch:

• Resistance levels: $97,750, $99,995

• Support levels: $94,220, $92,020

Special reminder: This Friday at 21:30 (Singapore time), the U.S. Labor Department will release non-farm payroll data, with a focus on the number of new non-farm jobs and the Fed's interest rate expectations following the data release. It is almost certain that there will be no rate cut in January, with the focus on expectations for rate cuts in March and May.

Recommended Reading:

“Editor’s Share: Coinbase Premium, Small Data, Big Use!”

“Market Dump or Limit Order Conspiracy? Unveiling the Truth Behind BTC's Main Player Manipulation”

Content is for sharing only, for reference only, and does not constitute any investment advice!

If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。