Current Analysis of K-Line Trends

Main Characteristics of the Recent Market:

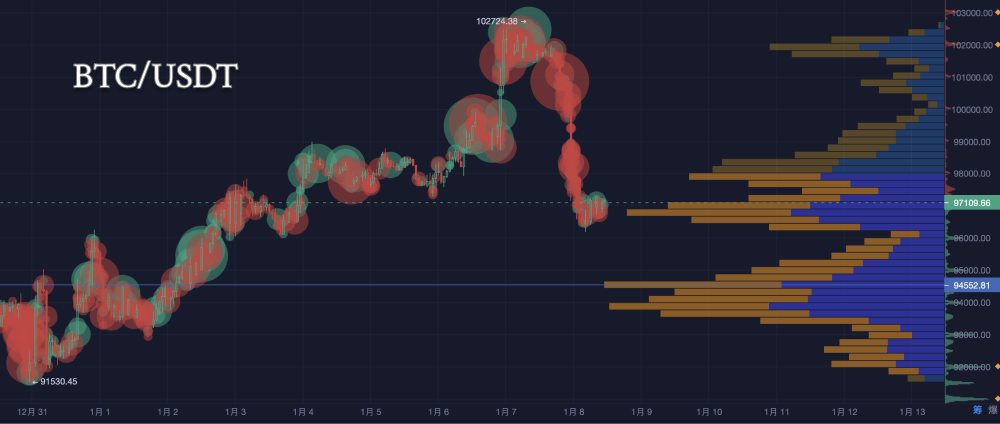

From the AICoin data chart, the market experienced a rise and peaked around 102,724 on January 7, but then quickly retreated, currently sitting at 97,065, a pullback of about 5.5%. This segment of the trend shows characteristics of a high-level retreat, accompanied by long bearish candles, indicating a significant weakening of bullish momentum and a shift towards bearish dominance.

Support and Resistance Levels:

- Support Level: The recent strong support is in the range of 96,000-96,500, corresponding to the dense trading area from January 4 to January 6 (the larger volume bars on the right side of the chart). A stronger support level below is around 91,500, which is the local low from December 31.

- Resistance Level: The recent resistance above is at 98,000, which corresponds to the pullback rebound area of previous highs. Stronger resistance is at the psychological level of 100,000 and the previous high of 102,724.

Interpretation of Pattern Theory

Based on pattern theory, the following features can be observed:

- Preliminary Signs of a Head and Shoulders Pattern: From the recent trend, a "head and shoulders" pattern may have formed from January 3 to January 7:

- Left Shoulder: High point on January 4 (around 100,000)

- Head: High point on January 7 (102,724)

- Right Shoulder: Secondary rebound high point on January 7 (99,000)

If the price cannot stabilize above 96,000 today, the head and shoulders pattern will be confirmed, and it may further test 91,500.

- Confirmation of Downward Trend: Observing the chart, the highs are gradually declining (from 102,724 to 99,000), and the lows are also moving down, forming a short-term descending channel, indicating that the bearish trend is dominating the market.

Bollinger Bands Analysis

- Bollinger Bands Opening: After the price rapidly retreated from the high of 102,724, the opening of the Bollinger Bands has significantly widened, indicating increased market volatility recently. The current lower band (LB) is clearly diverging downwards, the middle band is starting to tilt downwards, and the upper band is slightly flattening, showing that the market is entering a correction or downward trend.

- Price Position: The current price (96,977) is located between the middle band and the lower band, and is close to the lower band area (around 94,652). This indicates that bearish momentum is dominant, but there may be a technical rebound demand as the price approaches the lower band.

- Middle Band Changes: The middle band (98,914) is turning downwards, indicating that the market's short-term trend has shifted from upward to downward. If the price continues to operate below the middle band, the downward trend will be further confirmed.

Technical Indicators Analysis

MACD: The hourly MACD is in the negative territory, with both DIF and DEA diverging downwards, indicating short-term downward pressure. The daily MACD also shows a death cross, with a bearish trend.

RSI: The hourly RSI hovers around 30, close to the oversold area but has not yet entered it; the daily RSI has quickly retreated from the overbought area and is currently in the neutral zone, indicating a cautious market sentiment.

EMA: The hourly EMA7, EMA30, and EMA120 are all arranged downwards, and the price is below all moving averages, indicating a bearish short-term trend. The daily EMA30 and EMA120 still maintain an upward trend, but EMA7 has turned downwards, requiring attention to whether a larger adjustment will form.

Chip Distribution Analysis

- Current Chip Concentration Area: The range of 96,000-98,000 is the current main chip concentration area. This indicates that both bulls and bears are actively trading in this price range. This price range can be seen as a short-term support area; if the price maintains within this range, a consolidation may occur.

- Upper Pressure Area: The 102,000-103,000 area has a significant concentration of chips, near the previous high price range. This area is a notable pressure zone, and if the price rebounds to this level, it will face significant selling pressure. To break through this pressure zone, it is necessary to observe whether new chips enter and whether buying power can be sustained.

- Lower Support Area: The 93,000-94,000 area has a secondary chip concentration, indicating that this price range may become a strong support level during the downward process.

- Market Risks and Opportunities: The current price (96,999) is close to the lower edge of the main chip concentration area (96,000). If this support area cannot be maintained, it may touch 93,000.

Large Transaction Analysis

- High Point on January 7 (102,724): A large number of red bubbles (large sell orders) appeared near 102,724, indicating that bulls took profits, leading to a rapid market reversal. This large sell order was a significant catalyst for the market decline, showing a notable shift in the balance of power between bulls and bears.

- During the Downtrend (January 8): During the downtrend, there were continuous dense red bubbles, indicating that bearish forces are dominating the market, with sell orders being concentrated. Green bubbles are relatively scarce, indicating weak buying interest and significant selling pressure in the market.

- Near Recent Low Points: A small number of green bubbles appeared near the current low point (around 96,500), indicating that there are attempts to buy, but the trading volume is limited. If the number of green bubbles increases significantly in the future, it may drive a price rebound.

Today's Trend Prediction

- Short-term Downward Trend Dominates: The price is currently at the lower edge of the 96,000-98,000 chip concentration area and may repeatedly test around 96,000 in the short term. If bearish forces continue, the price may break below 96,000 and further approach the 93,000-94,000 chip support area.

- Possible Rebound at Low Levels: Due to the strong chip support in the 93,000-94,000 area, combined with the large selling pressure released at high levels yesterday, bearish forces may temporarily weaken. If buying interest increases at low levels, it may drive a technical rebound in price.

- Limited Upside Potential: The 98,000-102,000 area is a significant pressure zone, with substantial selling pressure still present. Short-term bulls need to break through this area to open up higher rebound potential.

Trading Strategy Suggestions

1. Short-term Strategy (suitable for day traders)

- Attempt to buy near support: Entry position: A light position can be tested for long orders when the price approaches 96,000. If it drops to the 93,000-94,000 area, positions can be added in batches, but position size should be controlled. Stop-loss setting: Below 95,500 to prevent further market declines.

- Sell high near resistance: If the price rebounds close to 98,000-99,000, positions can be gradually reduced to avoid selling pressure from the upper resistance zone. If large sell orders (red bubbles) continue to increase, be cautious about chasing highs.

- Volatility breakout strategy: If the price breaks below 96,000, a light position can follow the bearish trend, targeting around 94,000.

2. Medium-term Strategy (suitable for conservative investors)

- Build positions in batches: Focus on the 93,000-94,000 support area, gradually laying out medium-term long orders. The target price above is in the 98,000-100,000 area, and positions can be added if it stabilizes.

- Defensive position management: Stop-loss point: below 92,500 to prevent the market from entering a deep correction.

3. Risk Management

- The current market is highly volatile; it is recommended to control positions and enter in batches to avoid heavy positions at once.

- Observe whether green bubbles (buy orders) gradually increase and whether the selling pressure (red bubbles) weakens during declines as signals for market reversal.

Summary

- Key Levels: Today, pay attention to 96,500 (support) and 98,000 (resistance).

- Main Direction: The probability of short-term fluctuations is high, and price volatility may be significant.

- Risk Warning: Attention should be paid to the impact of news (such as macroeconomic data) on market sentiment.

Disclaimer: The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。