The weekend homework is still very easy to submit. The price trend of BTC has not deviated from the previous prediction range. After reaching $98,000, it started to enter a narrow range of fluctuations. In tonight's tweet, I also mentioned that if this trend continues tomorrow, I will prepare to make short-term trades between $98,500 and $97,500. After all, I have some chips in hand, and if I can lower the cost a bit, that would be a good thing. However, I still have great expectations for the trend in Q1 2025.

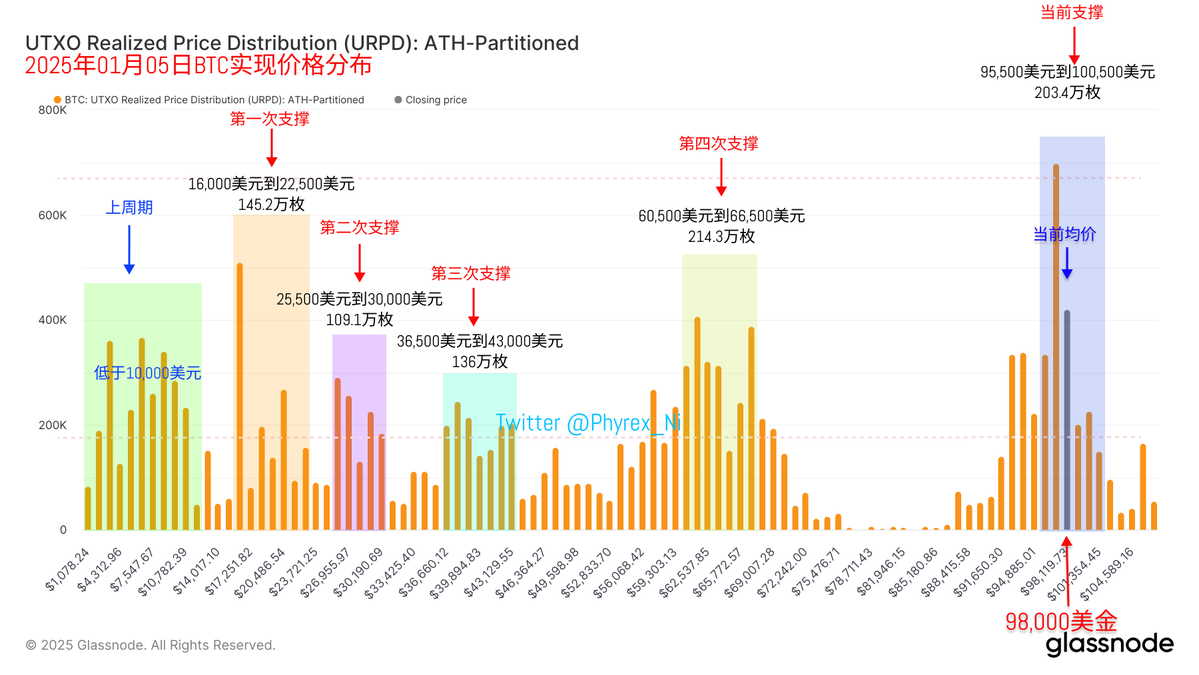

After two days of the weekend, I expect liquidity to gradually recover with the return of investors, and at that time, the price trend will become clearer. Right now, it’s a game among retail investors under low liquidity, so it’s hard to say whether the current price can be maintained next week. However, from the chip structure, at most, it will just shift from a narrow range of fluctuations to a wide range of fluctuations. The central point of $95,000 has not shown any issues for now.

Today, I also discussed grid trading with my friends. I am indeed quite worried that a one-sided upward trend might lead to being sold off, so I basically only use manual trading. After all, this allows for better judgment and a more detailed grasp of the range. As I mentioned earlier, the essential goal is not to sell the #BTC in hand, but to lower the cost as much as possible.

Let’s not mention the weekend liquidity; the turnover rate has dropped to the lowest point in recent times. Both trading volume and turnover have decreased, indicating that on-chain investors have lost motivation. Among the few trades, it can still be seen that with the price increase, short-term profit investors are the main sellers, mostly starting to exit around $96,000. Meanwhile, earlier investors have begun a phase of dormancy.

As for support, as we have been saying over the past week, although it seems that the support level is trending downward, this part consists of short-term chips. As long as the price of #Bitcoin rises, these chips are likely to move again. Currently, this is indeed the case, and the adjustment of the support level will be postponed until after next week.

Looking at the current trend, it’s either grid trading or holding still until next week when a new bullish or bearish direction appears.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。