Table of Contents:

Industry Headlines;

Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Fluctuations/Fund Flows;

Spot ETF Fund Inflows and Outflows;

Analysis of BTC Balances on Exchanges;

Interpretation of Contract Funding Rates;

Large Token Unlocking Data for This Week.

1. Industry Headlines:

Forbes' predictions for seven major trends in the crypto industry by 2025 reveal potential future directions for the industry. The G7 or BRICS countries may establish strategic Bitcoin reserves, indicating the increasing importance of cryptocurrencies in the global financial system. The market capitalization of stablecoins is expected to double to $400 billion, reflecting the growing demand for stablecoins as a store of value and medium of exchange. The growth of the Bitcoin DeFi ecosystem, particularly through L2 networks, signals innovation and expansion in DeFi. The expansion of crypto ETF products to include Ethereum staking and Solana tracks shows the diversification of crypto investment products and the participation of institutional investors. Tech giants may follow Tesla's lead in increasing their Bitcoin holdings, further promoting the mainstream adoption of cryptocurrencies. The total market capitalization of the crypto market is expected to exceed $8 trillion, based on the current growth momentum and future development potential of the cryptocurrency market. Finally, improvements in the U.S. regulatory environment will foster a revival of crypto entrepreneurship, bringing more innovation and vitality to the industry.

2. Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Fluctuations/Fund Flows

According to CoinAnk data, in the past week, the crypto market saw significant net inflows concentrated in several major sectors, including the Avalanche ecosystem, Arbitrum ecosystem, Binance Smart Contract, and Real World Assets (RWA). Additionally, many coins experienced substantial rotational increases over the past week. The following are the top 500 by market capitalization, with tokens such as ZEN, USUAL, SDEX, AIXBT, MOVE, and ZEC showing relatively high gains.

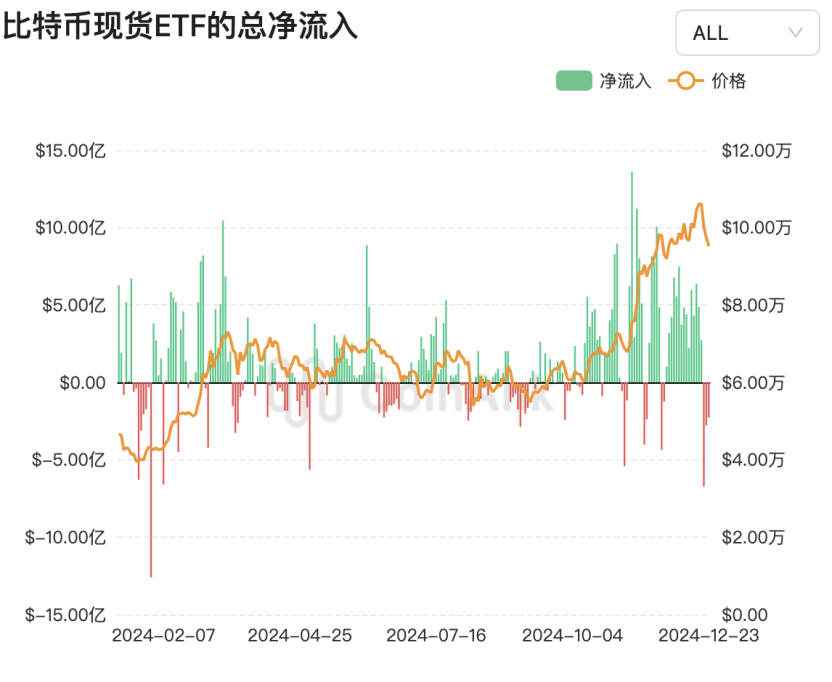

3. Spot ETF Fund Inflows and Outflows.

Data shows that the continuous inflow of funds and growth in trading volume for U.S. spot Bitcoin ETFs indicate strong interest from institutional and retail investors in Bitcoin. Over the past 50 weeks, net inflows into Bitcoin ETFs reached $463 million, with trading volume hitting $26 billion. The inflow for the fourth quarter so far is $17.5 billion, making it the best-performing quarter, demonstrating Bitcoin's appeal as an investment asset.

Moreover, Bitcoin's price has dropped to $92,000. Despite price fluctuations, the proportion of Bitcoin held by ETFs, government agencies, and MSTR has risen to 31%, up from 14% last year, indicating that large investors have confidence in Bitcoin's long-term value. This increase in holding concentration may impact market liquidity and price stability, especially in the face of market volatility.

The situation with Ethereum spot ETFs is also noteworthy, with a net inflow of $62.73 million last week, while Grayscale's Ethereum Trust ETF (ETHE) saw a net outflow of $99.83 million, bringing its historical net outflow to $3.62 billion. This comparison of inflows and outflows may reveal market sentiment and expectations regarding different Ethereum-related products.

ETF data reflects the trends in fund flows and investor sentiment in the cryptocurrency market. With more institutional investors participating and the crypto market maturing, it is expected to continue influencing market dynamics.

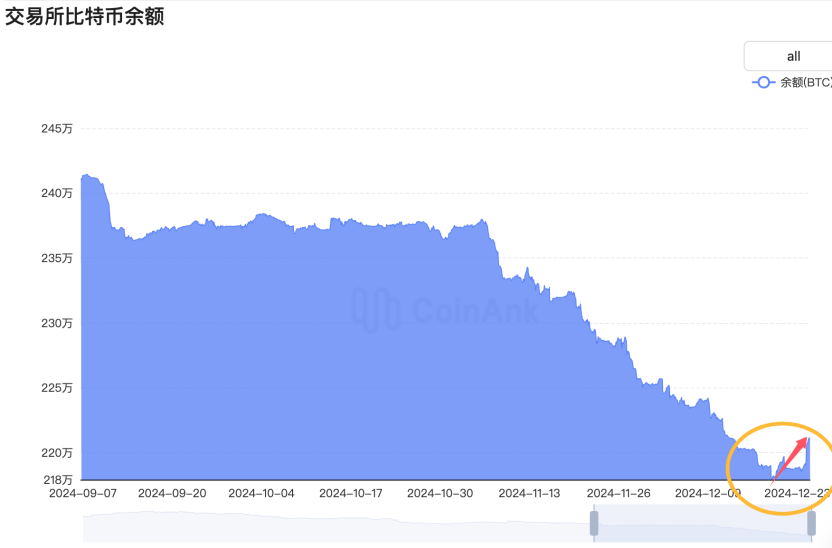

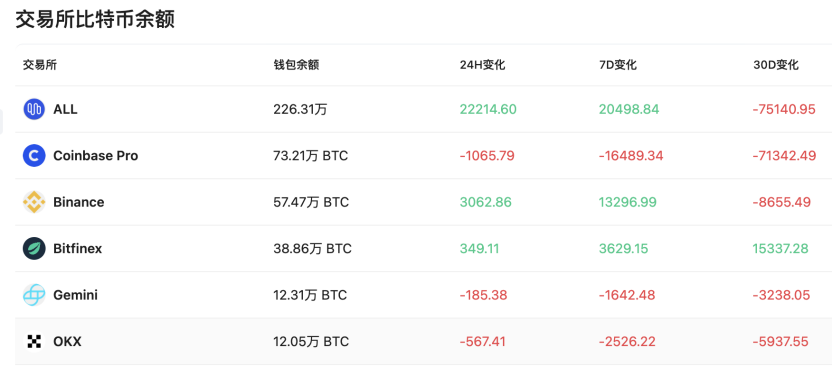

4. BTC Balances on Exchanges Have Rebounded.

Data shows that the Bitcoin wallet balances and fund flows on the three major trading platforms vary. Coinbase Pro and Binance have both shown outflows over the past 30 days, while Bitfinex has seen inflows. However, in the short term, there has been a net inflow over the past 7 days, indicating market fund differentiation, with some investors possibly taking profits at highs while others are buying at lows. Since December 19, BTC balances on centralized exchanges (CEX) have shown a significant rebound, which correlates with the drop in BTC prices following the Fed's hawkish rate decision last week. We speculate that this may be due to major funds choosing to take profits at relatively high levels to prevent uncertainty in the market, causing some selling pressure and leading to a market pullback.

Another data point supports this, as the acceleration of BTC selling behavior over the past 30 days indicates that holding BTC is no longer the default behavior for all market participants. The long-term/short-term holder supply ratio has dropped to 3.78, the lowest level in this cycle, suggesting increased trading activity in the market, with short-term holders being more active and market sentiment being complex and variable, leading to differing opinions among investors regarding Bitcoin's future trajectory.

5. Interpretation of BTC Contract Funding Rates and Long/Short Ratios.

According to contract data, BTC contract funding rates have remained at a positive level of around 0.1% since December 10. In the short term, contracts are not leading market trends; more pricing power is occurring in spot trading. Combining this with our previous observations of BTC balances on exchanges and the turnover of long-term/short-term holders, it is evident that recent spot trading has been more active.

Last week, we mainly discussed the detailed concepts of funding rates and long/short ratios, so here is a brief summary: The current Bitcoin funding rate of around 0.1% is at a normal and healthy level, maintaining this level since December 10, and even with yesterday's significant price increase, there has been no extreme deviation. Calculating at 0.1%, the annualized yield from funding rate arbitrage can reach 10.95%. A funding rate around 0.1% indicates that the market has a higher proportion of long positions, but there is no excessive imbalance, suggesting the market is relatively stable and healthy. The ratio of long to short participants differs from the long/short position ratio; in a phase of rising prices, a long to short participant ratio slightly below 1 is normal, while the long/short position ratio of large holders better reflects the main trends and has a greater impact on market movements. Investors should consider both the long to short participant ratio and the long/short position ratio to comprehensively grasp market sentiment and trends.

6. Large Token Unlocking Data for This Week.

This week, tokens such as IMX and DBX will see significant unlocks. The following are the UTC+8 times:

Ethena (ENA) will unlock approximately 12.86 million tokens on December 25 at 15:00, accounting for 0.44% of the current circulating supply, valued at approximately $13.22 million;

Cardano (ADA) will unlock approximately 18.53 million tokens on December 26 at 08:00, accounting for 0.05% of the current circulating supply, valued at approximately $16.30 million;

Immutable (IMX) will unlock approximately 24.52 million tokens on December 27 at 08:00, accounting for 1.45% of the current circulating supply, valued at approximately $32.12 million;

Beldex (DBX) will unlock approximately 330 million tokens on December 30 at 08:00, accounting for 4.78% of the current circulating supply, valued at approximately $25.46 million.

This week, pay attention to the negative effects of these token unlocks, avoid spot trading, and seek short opportunities in contracts. Among them, DBX and IMX have significant proportions and scales of unlocked circulating supply, warranting extra attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。