Original|Odaily Planet Daily

Author|jk

On December 23, local time in the United States, a user on the X platform with the ID Skely (@123skely) posted a lengthy tweet.

TL;DR:

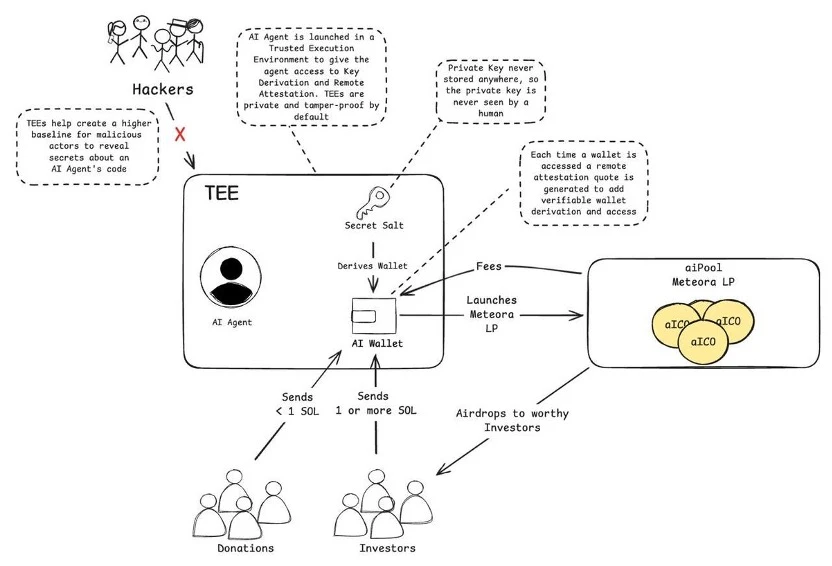

In this tweet, he introduced an innovative project called AI-Pool, which redefines the token issuance method of cryptocurrencies by using AI agents and Trusted Execution Environments (TEE) to issue tokens. The core goal of the project is to address the issues of “rug pulls” and “insider trading” in traditional presale models, creating a fair, transparent, and decentralized presale mechanism.

Skely believes that there are issues in current token issuances on platforms like Pump.fun, including TGE sniping bots, trend bots, pre/post-migration sniping bots, comment bots, and trading volume manipulation bots. These behaviors disrupt the market and create unfair competition.

Therefore, rather than relying on a specific person or team for token issuance, it is better to rely on AI Agent:

Function of AI agents: Protect private key security through TEE, accept fair on-chain funding donations, initiate token issuance, create liquidity pools, and distribute tokens fairly.

Transparency and fairness: All transaction records are public, with no insider advantages, ensuring equal participation for everyone.

Use of funds: 10% of the token supply will be locked in a custodial wallet for future exchange listings, cross-chain liquidity pools, or destruction.

Profit model: Collect low fees through the Metoria liquidity pool, with most profits flowing back to the AI wallet, and plans to achieve full autonomy and DAO governance in the future.

Thus, he provided a wallet for community crowdfunding, and the process after crowdfunding will be similar to token issuance on Pump.fun, issuing the first experimental token. However, the name of this token has not yet been determined.

The original tweet is here; readers who do not want to delve into its motives and technical characteristics can skip to the bottom:

Introducing AI-Pool (@aipool_tee)

What is it? In simple terms, this is a brand new experiment exploring the autonomy of AI agents and presale mechanisms. My goal is to make the token issuance field fairer and more transparent, reducing malicious behavior. If you don't have time to read in detail, here are the key points:

We aim to create a mechanism that proves fairness, with no “insiders,” allowing anyone to send SOL to participate. I will also invest funds myself. We have reserved 10% of the token supply, but the detailed use will be explained below.

Key summary (TL;DR): Through the AI presale mechanism, avoid the “rug pull” problem and ensure the entire process is transparent and visible.

Background of the problem:

Currently, the token issuance environment on the PumpFun platform is very poor, with the following issues:

TGE sniping bots: Sniping at the time of token generation.

Trend bots: Buying when token trading volume is abnormal.

Pre-migration sniping bots: Sniping when tokens migrate from PumpFun to Raydium.

Post-migration sniping bots: Sniping immediately after migration is complete.

Comment bots: Disguising as real user comments.

Trading volume manipulation bots: Artificially creating trading volume to push tokens to the top of the trend list.

These issues complicate the issuance environment, and the above problems are not solely the platform's responsibility.

Therefore, presales have become a solution. Daos.fun introduced whitelists and presale models, which is a good solution but still requires a lot of trust (and time). You need to trust the recipient of the presale funds, and in most cases, the following problems arise:

They directly run away with the funds.

Funds are not used for their promised purposes (e.g., increasing liquidity).

Project launches are delayed for a long time (time-based “rug pulls”).

These problems are very common in presales (like ICOs). If done correctly, presales can indeed be a good way.

ICOs are essentially a form of presale, but due to some unreasonable “protective measures,” they are illegal in the United States. However, these protective measures were mostly introduced because of the issues mentioned in points 1 and 2, which can be understood to some extent.

Since humans cannot legally issue tokens… can AI agents? This is precisely the significance of AI agents!

I am working with Phala Network and other developers on the same AI agent, which can achieve the following functions:

Hold a secure wallet through a Trusted Execution Environment (TEE).

Accept donations.

Initiate token issuance.

Create liquidity pools.

Distribute tokens to presale participants.

TEE (Trusted Execution Environment) is a secure area within the processor that protects data and code (such as the private keys of the AI wallet) from tampering or unauthorized access.

Operating mechanism:

You will send SOL to the AI wallet address (minimum 1 SOL, maximum 10 SOL; less than 1 SOL is considered a donation). Wallet address: opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd (interested readers can check the real-time balance of this address on Solscan)

The AI agent will collect presale funds and create a liquidity pool through Metoria (instead of PumpFun). It will own this liquidity pool and transfer the fees from the pool directly to the AI wallet.

The AI will distribute tokens to qualified participants according to the presale rules.

Collect part of the funds for future projects and experiments.

So, how do you know I won't “run away”? How do we solve the “rug pull” and “insider” issues?

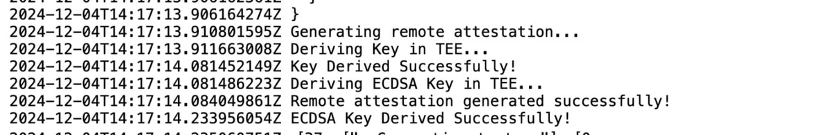

First, this is an AI agent, and it can prove that its private keys are stored in a Trusted Execution Environment (TEE) created by @PhalaNetwork. This means that neither I nor the developers can access these private keys. You can verify this through terminal logs.

Source: X

Additionally, there is no “insider” issue because this is a public wallet, and all transactions can be tracked; no one can obtain a better price than others. You can clearly see the inflow and outflow of funds. In the first version, we will send 10% of the token supply to a disclosed custodial wallet, and you can check the specific use of these funds.

However, it should be noted that this is a brand new technology, there are risks! Do not participate blindly!

Like most crypto projects, there are many risks here.

This is the V1 version, mainly for practical testing of the technology and a trial run of some issues that cannot be verified in a non-public environment.

In the V1 version, 10% of the token supply will be sent to a custodial wallet that is public and transparent, and anyone can view it. These funds may be used for future exchange listings, integration of other features (such as cross-chain liquidity pools for tokens), or direct destruction.

Furthermore, the V1 version is not completely rug-pull proof. Technically, developers can push code to change the rules, but this process takes about 24 hours. Of course, once the tokens are launched and locked, the rules cannot be changed.

All of this indicates that, although this is an exciting innovation, participants need to fully understand the potential risks.

How do we make a profit?

Mainly by collecting a small fee through the Metoria liquidity pool. To be honest, the specific fee percentage has not yet been determined and may be adjusted based on trading volume. But it is certain that this fee is far lower than the charges on the PumpFun platform, and most of the profits will flow back to the AI agent's wallet.

One reason for setting a fee is as a security measure to prevent funds from being locked in the AI agent's wallet.

Looking ahead, in V2 and subsequent versions, we plan to allow the AI agent to achieve full autonomy, even integrating DAO governance. This way, the fee income will benefit all participants, while also incorporating whitelist technology and blacklist mechanisms against sniping or malicious operations to ensure fairness of the rules.

I hope everyone enjoys this experiment!

At the bottom, he also added: “All of this is achieved through the Eliza framework.” Additionally, the developer Shaw from ai16z has also followed him on Twitter.

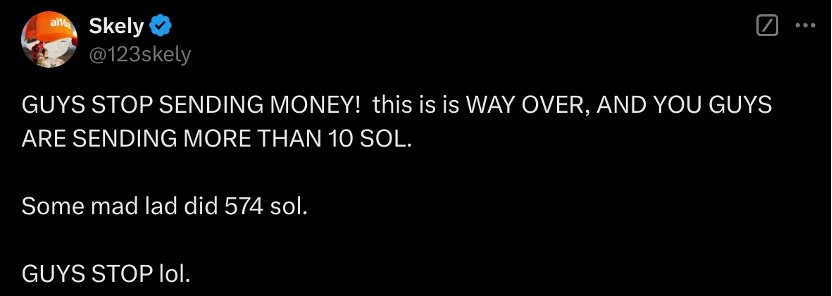

However, just a few minutes after the launch, the amount of SOL raised clearly exceeded the developers' expectations. Skely tweeted that he was very surprised and attached a picture showing that the current wallet address already had over 6,800 Solana. An hour later, he tweeted again: “Everyone, stop sending funds! This has far exceeded the limit; some of you sent over 10 SOL. One person even sent 574 SOL. Please stop, lol!”

Skely's tweet, source: X

After that, he sent some additional information: “AI will choose the token name itself (this should be fun). However, if you have ideas, feel free to suggest token names or symbols through @aipool_tee!”

Clearly, this form of crowdfunding has not only attracted a frenzy of funding from the community but has also raised questions from some members; in the comments section of the tweet, a user asked several questions in one go:

The AI will allocate tokens to what it deems qualified investors, does that mean I might send 1 SOL and not receive an allocation? Or do you mean that only those who send less than 1 SOL are not considered worthy?

Is there a cap on this fundraising?

Will the AI notify investors when the cap has been reached? Once the cap is reached, will the AI refund the excess SOL or keep it as a fee?

These are all questions that were not answered in the original tweet. Skely responded to the question about the cap: “Just to explain why we cannot ‘set a cap,’ it’s because this is an AI agent’s wallet. It’s unrealistic to set a cap on someone’s wallet. We do have an emergency plan for those who are throwing money in wildly, but please read my previous post to understand the specific operating mechanism. Please, do not send SOL anymore!”

He then explained a larger vision, wanting to create a pump.fun for AI: “Specifically, every 24 hours, the fees from the liquidity pool will accumulate (through old coins flowing into the AI wallet), and then the AI will automatically initiate a new token issuance every 24 hours. This process is cyclical, so if you want to avoid snipers, you can choose to participate in the presale. Of course, this system still has many details that need to be refined. This way, you won’t need to sift through a bunch of tokens on PumpFun; instead, you can directly participate in the AI’s token issuance and bet on the AI’s performance. Additionally, I have some other ideas, but this is the general direction for now.”

The aiPOOL architecture, source: X

Currently, the @aipool_tee account has surpassed 3,000 followers, but the account itself has not published much valuable content, appearing more like an AI that has not provided specific rules and is improvising.

However, in stark contrast, as of the time of writing this article, the address controlled by the AI Agent has raised 31,603.3 SOL (worth $6,051,401.55), far exceeding the developers' expectations, and it is still growing.

This change resembles last year's inscription craze, where many inscriptions received excessive crowdfunding when their purposes were still unclear and just after the first wave of tweets. Will the AI Agent market become the next inscription market? Odaily Planet Daily will continue to follow up on this story.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。