Original Author: BitMEX

Key Highlights

Influenced by Federal Reserve Chairman Powell's hawkish stance on interest rate hikes in 2025 during the latest FOMC meeting, the entire market faced significant sell-offs this week, with Bitcoin dropping below $100,000. The meme coin sector was severely impacted, with several projects experiencing weekly declines of over 30%.

In the trading insights section, we will delve into the innovative stablecoin protocol $USUAL. Thanks to its unique token economic model and real-world yield mechanism, the project has shown strong price performance.

Data Overview

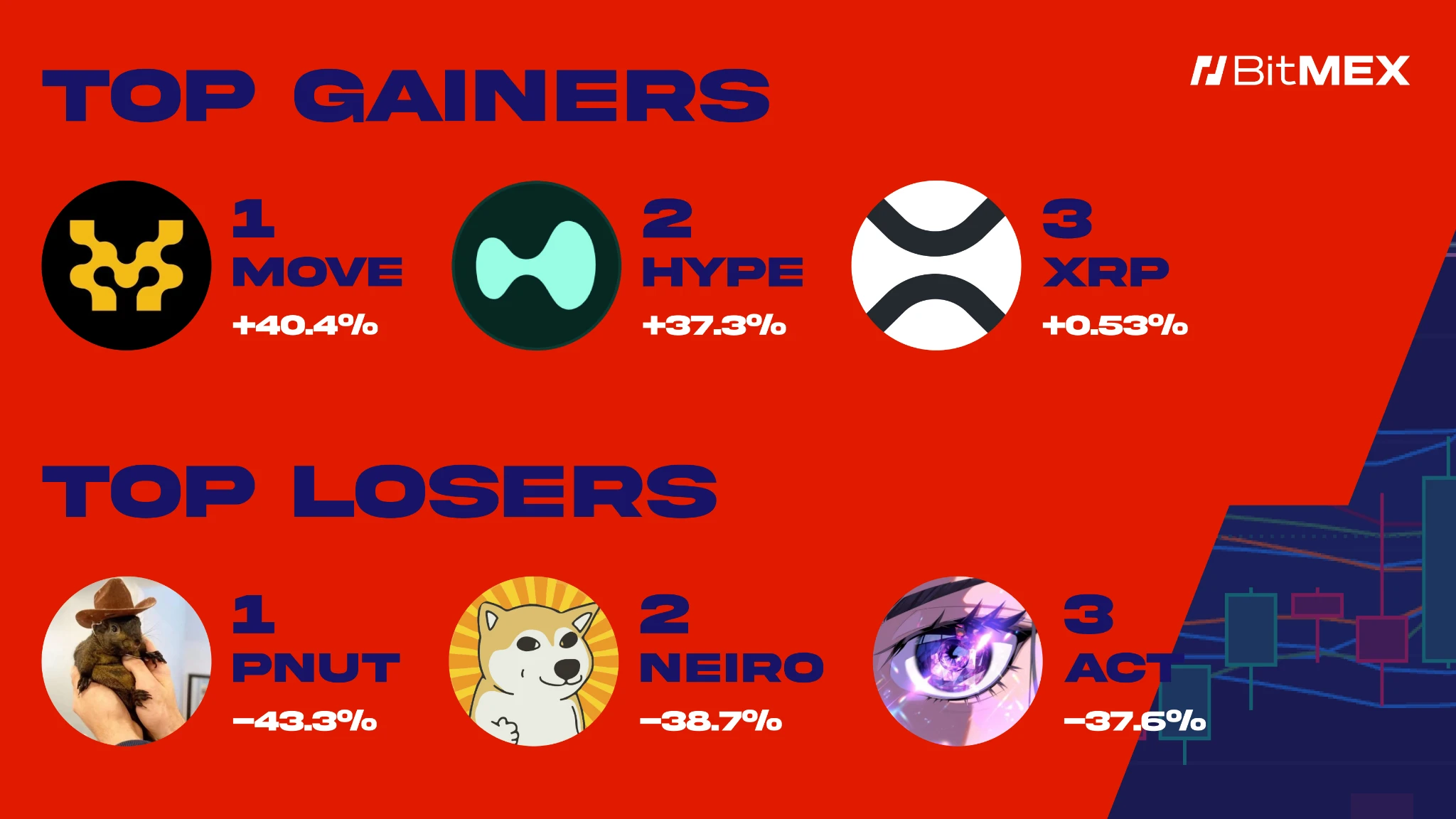

Best Performers This Week

$MOVE (+40.4%): The token price is on a strong upward trend with ample momentum.

$HYPE (+37.3%): DEX trading volume reached an all-time high, continuing its strong performance.

$XRP (+0.53%): Maintained positive returns despite the overall market downturn.

Worst Performers This Week

$PNUT (-43.3%): PNUT is embroiled in legal issues, and the meme coin sector is generally sluggish.

$NEIRO (-38.7%): Experienced a significant drop alongside the weak performance of $DOGE.

$ACT (-37.6%): Notable weekly decline with severe market cap evaporation.

This Week's News Highlights

Macroeconomic Dynamics

Weekly net inflow for ETH ETF: +$137.8 million (source)

Weekly net inflow for BTC ETF: +$734.2 million (source)

The scale of U.S.-listed Bitcoin spot ETFs is about to surpass that of gold ETFs (source)

The Federal Reserve's hawkish stance caused Bitcoin to drop to $101,000, with significant declines in the altcoin market (source)

Hut 8 surpasses Tesla to become the fourth-largest publicly traded company holding over 10,000 Bitcoins (source)

Despite reaching an agreement with the IMF, El Salvador will accelerate its Bitcoin purchases (source)

Project Dynamics

Aptos Labs CEO resigns (source)

Craig Wright receives probation for contempt of court (source)

Solana sets a new record with 66.9 million transactions in a single day, thanks to the Pengu token (source)

21shares registers Polkadot Trust in Delaware in preparation for ETF (source)

Bitget announces strategic collaboration with the Tron blockchain, acquiring $10 million of TRX (source)

Polygon accuses Aave of monopolistic practices in the DeFi space (source)

German regulators demand Worldcoin enhance biometric data privacy measures (source)

Ethena Labs introduces sUSDe as collateral for the Trump-backed WLFI protocol (source)

Trading Insights

Disclaimer: The following content is for reference only and does not constitute investment advice. This is a summary of market news, and we recommend conducting your own research before making any trades. We are not responsible for any trading outcomes and do not guarantee profits.

Why $USUAL is Worth Watching?

Stablecoins play an extremely important role in the crypto world. For many investors and users, stablecoins are not only a trading valuation tool (similar to chips in a casino) but also a means to circumvent fiat currency restrictions and achieve capital preservation. This brings substantial profits to stablecoin issuers.

The $USUAL project aims to break the profit monopoly of traditional centralized stablecoin issuers, distributing the earnings from this pie to the community and token holders. It can be said that $USUAL is launching a "vampiric" challenge against stablecoin giants like USDT and USDC, siphoning off their profits and returning them to users.

Why Was It Initially Overlooked but Became a Dark Horse?

In the early stages of the $USUAL project, the environment was not ideal. The crypto market was at a consensus low, and many well-known KOLs were "harvesting" projects at that time. During this period, an inconspicuous French team claimed to challenge USDT with stablecoin mining, which sounded a bit like a fairy tale at the time, leading many investors to overlook it.

However, the $USUAL team carved out a path in the quiet market environment through deep listening to the community and a steady strategy. Ultimately, it successfully launched on Binance, dramatically changing the project's fate and external perception, becoming an undeniable dark horse in this market cycle.

Core Token Mechanism: $USUAL, $USUALx, $USD0, and $USD0++

1. $USUAL:

As a "mining coin," 90% of newly issued $USUAL is distributed to users holding $USD0++/$USD0, and 10% is given to users staking $USUAL.

The emission of $USUAL is linked to TVL (Total Value Locked): emissions decrease when TVL increases and increase when TVL decreases.

2. $USD0:

- A RWA (Real World Asset-backed) stablecoin similar to USDY, with minted funds invested in low-risk assets like short-term government bonds, providing real yield support for the system.

3. $USD0++:

A token similar to a "bond," encouraging users to lock up their assets long-term and reduce short-term behaviors of "mine and sell."

Offers a higher APY to attract more funds and increase TVL.

4. $USUALx:

Earned by staking $USUAL, allowing users to receive 10% of the new $USUAL emission tax revenue.

A 10% "head tax" must be paid upon unlocking, creating a high APY effect in the short term, thereby guiding more people to stake and hold long-term.

Why Will $USUAL Price Rise? The Formation of the Flywheel Effect

The price increase of $USUAL comes from a positive cycle (flywheel effect):

High APY of $USD0++ attracts funds, increasing TVL.

Growth in TVL strengthens the fundamentals of $USUAL, solidifying the token's value.

The rising price of $USUAL, in turn, supports higher APY, further attracting new funds.

More funds participating leads to another increase in TVL, reinforcing this positive cycle.

When users and large holders are optimistic about future developments, believing that TVL will exceed the current $1 billion, and anticipate that more asset types (not just stablecoins, but possibly including LST, USDe, etc.) can join mining, they are motivated to stock up while TVL is still low, preparing for future growth.

Game Theory and Token Price: 7-Day Waiting Period for New Wallets

The economic model of $USUAL also incorporates some game theory elements, such as new wallets needing to wait 7 days before they can start mining. This means that the real test will come 7 days after the TGE (Token Generation Event). When early users mine and earn rewards while new users are still waiting for their unlock, this timing difference may affect trading behavior and price fluctuations in the secondary market.

In other words, next week (7 days after TGE) will be the true test for $USUAL: Will new participants be willing to wait, hold, and invest more funds? Will early players take profits at this time? This will test the market's consensus and confidence in the project's long-term value.

Risks and Concerns Similar to LUNA

Some may ask: Will $USUAL crash like LUNA?

Although $USD0 and $USD0++ are products that combine stablecoins and "bonds," they are supported by real yield assets and a locking mechanism. There is a certain depth in trading pools like Curve, and there is a path for lossless conversion to USDC.

Unlike LUNA/UST, $USUAL places greater emphasis on real yields and long-term locking, reducing the likelihood of a crash caused by short-term arbitrage mining and selling. However, if the Curve pool becomes unpegged or confidence in the funds wavers, the project may redeem $USUAL, introducing new variables.

The Impact and Outlook of Binance

Listing on Binance has brought $USUAL to a broader stage, attracting more liquidity and attention. For seasoned DeFi players, the innovation of $USUAL may not seem groundbreaking, but the support from a top exchange paves the way for the project's long-term expansion.

In the future, $USUAL may not be limited to RWA stablecoins but could also expand to other types of assets. This means that if the $USUAL model continues to succeed, its TVL ceiling will be significantly raised.

Summary:

$USUAL is built on a complex yet sophisticated economic system centered around stablecoins and real yields, forming a positive cycle through high APY, gradually expanding asset choices, and reasonable incentive mechanisms. Looking ahead, it may continue to expand its application scenarios, attracting more funds and users. However, all of this still needs market validation. The real test will come 7 days after the new wallet mining unlock—whether it can maintain capital inflow and market consensus will determine if $USUAL continues to soar or gradually recedes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。