Original | Odaily Planet Daily

Author | jk

With the rise of narratives surrounding the U.S. and Trump since his election victory and Bitcoin surpassing the $100,000 mark, the market's attention is focused on World Liberty Financial (WLFI), which has strong ties to his family. Since its launch in September 2023, WLFI has quickly garnered widespread market attention due to its unique narrative and large-scale capital operations. Particularly during December, WLFI made significant purchases of nearly $45 million in crypto assets, leading to much speculation in the market. Investors and analysts are trying to answer a key question: What tokens might WLFI continue to buy in the future?

Background Information

World Liberty Financial (WLFI) officially launched in September 2023, claiming to be a DeFi platform characterized by its reliance on its relationship with the Trump family and strong Trump-like values such as "Be Defiant." On WLFI's official website, Trump is listed as the "Chief Crypto Advocate," while his sons Donald Trump Jr., Eric Trump, and Barron Trump hold the title of "Ambassador."

WLFI's website. Source: WLFI official website

It is important to note that on the official website, WLFI legally avoids any connection with the Trump family. The project claims to be the "only DeFi platform inspired by Trump," and the titles of advocates and ambassadors cannot be considered real management positions. Moreover, there is a small print at the bottom of the website:

Donald J. Trump, any family members, or any directors, officers, or employees of the Trump Organization, DT Marks DEFI LLC, or their respective affiliates are not management, directors, founders, or employees of World Liberty Financial (WLFI) or its affiliates. The ownership, management, or operation of World Liberty Financial, Inc., its affiliates, or the World Liberty Financial platform does not belong to Trump, any family members, the Trump Organization, DT Marks DEFI LLC, or their respective directors, officers, employees, affiliates, or principal persons.

The use and sale of the $WLFI token and the World Liberty Financial platform are provided solely by World Liberty Financial or its affiliates. DT Marks DEFI, LLC and its affiliates (including Donald J. Trump) have received or may receive approximately 2.25 billion tokens from World Liberty Financial, and are entitled to receive 75% of the net agreement revenue under a service agreement. The definition of this agreement revenue includes income from any source, minus agreed reserves, fees, and other amounts, the specific amounts of which cannot yet be determined.

World Liberty Financial and its $WLFI token are not political in nature, nor are they part of any political campaign.

In summary, the project is openly telling everyone: "We have numerous connections with the Trump family, but legally, there is no connection." This sounds rather irresponsible.

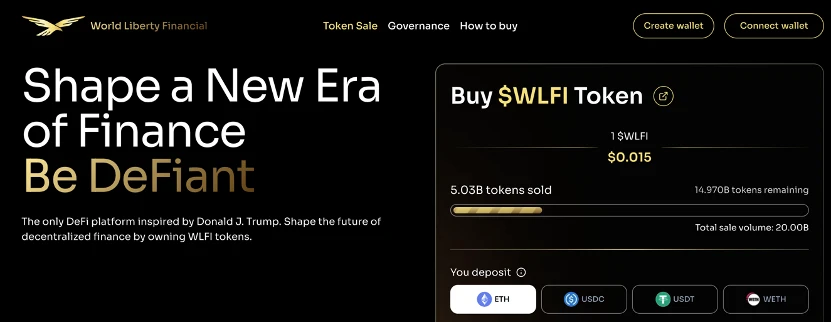

It is no wonder that almost no one is buying WLFI tokens: currently, the project’s official website shows that out of a total of 20 billion tokens, only a quarter of the sales target has been completed since its launch, even in such a bullish market.

Token sales target only reached 5 billion. Source: WLFI official website

However, this does not prevent the assets purchased by this project from becoming a market trend to some extent; after all, "willing to invest in the Trump family" and "what assets has the Trump family invested in? Can I follow suit?" are two completely different matters. In the latter case, as the crypto advocate, Trump's appeal is unprecedented.

Large-scale Crypto Asset Purchases

Odaily previously reported, according to Spot On Chain monitoring, WLFI has made significant purchases of various mainstream and emerging crypto assets since November 2023 through a major wallet address.

The assets purchased include:

ETH: Total of $30 million, purchasing 8,105 ETH at an average price of $3,701 per coin;

cbBTC: Total of $10 million, purchasing 102.9 cbBTC at an average price of $97,181 per coin; (later switched to WBTC)

LINK: Total of $2 million, purchasing 78,387 LINK at an average price of $25.51 per coin;

AAVE: Total of $1.91 million, purchasing 5,886 AAVE at an average price of $324.4 per coin;

ENA: Total of $750,000, purchasing 741,687 ENA at an average price of $1.011 per coin;

ONDO: Total of $250,000, purchasing 134,216 ONDO at an average price of $1.86 per coin.

Odaily later reported, World Liberty Financial announced a partnership with Ethena Labs, with both parties seeking long-term collaboration, starting with Ethena's revenue token sUSDe.

It can be seen that even after several pullbacks following the breakthrough of $100,000 and the significant drop influenced by the Fed's hawkish rate cut news, as of December 19, the six tokens purchased by WLFI still maintained gains within their 30-day trend: Bitcoin and Ethereum increased by 10% and 15%, respectively, Chainlink by 65.1%, Aave by 103.9%, Ethena by 89.4%, and Ondo by 85.1%. This means that WLFI's purchase targets have indeed become a market trend during the rise, allowing them to maintain 30-day gains despite significant pullbacks.

So, what tokens might WLFI potentially buy next?

Potential Next Assets for WLFI

We can speculate based on three dimensions:

Investment Assets from Polychain

On the official website, Luke Pearson from Polychain has become one of WLFI's advisors (other advisors and team members' information can be found in this article: Who are the decision-makers behind the Trump project WLFI that is making large crypto asset purchases?). There is a considerable possibility that the purchased tokens will come from Polychain's investment portfolio. According to Rootdata, we can see that not every project in the Polychain investment portfolio has issued tokens, and even fewer can be considered seasoned DeFi projects.

DeFi Assets in the Top 100 by Market Cap on Coingecko

At the same time, the assets previously purchased by WLFI are all within the top 100 list by market cap on Coingecko, likely due to considerations of volatility and pullbacks. Additionally, regarding WLFI's collaboration with Ethena, its token purchases may also carry subsequent collaboration considerations; using the purchasing heat and influence to collaborate with larger DeFi projects in the market, thereby enhancing WLFI's brand value as a DeFi protocol.

Listed Assets on COWSwap (Less Impact)

WLFI uses the decentralized trading platform CowSwap, which is also one of the more popular DEXs today, with products including AMM, etc. On the CowSwap interface, it can be found that there are a total of 374 assets verified by CowSwap that do not require manual contract input if the network is set to Ethereum, making it the largest range to choose from. CowSwap does not support many networks; besides Ethereum, it only supports Gnosis, Base, Arbitrum One, and the Sepolia testnet. Other purchases by WLFI are also likely to occur on CowSwap, so the possibility for DeFi projects on Solana is relatively low. Of course, this factor has a relatively small impact, as WLFI can completely purchase, manually buy, or OTC buy assets from other projects through other platforms that support Solana.

So, what tokens can we identify based on these considerations?

Simultaneously considering Polychain's investment projects/CowSwap listed assets/and Coingecko's top 100 by market cap:

Maker (MKR), recently rebranded as SKY

Uniswap (UNI)

DYDX (currently ranked 113 by market cap, not far off)

Additionally, if we consider projects that are not in Polychain's investment portfolio but have high brand value, we can include the following four tokens: Lido, Pendle, Eigen, and Curve. These projects also have some "American attributes," making collaboration possible. If we expand the market cap further, then 1inch and Morpho also have a small possibility.

In summary, WLFI's investment strategy shows a certain level of strategic thinking and demonstrates strong capital operation capabilities. In the future, WLFI's purchase targets may continue to focus on high-quality DeFi assets within the top 100 by market cap, and this recent significant pullback may also become the best window for buying. During Trump's upcoming term, WLFI's buying actions may provide important signals for investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。