Recently, both the US stock market and the cryptocurrency market have encountered a "cold wave," drawing strong attention from global investors. This sudden market debacle not only caught many off guard but also further amplified the fragile connections between traditional finance and the crypto space. So, what are the underlying mysteries behind this chain reaction? How should we respond in the future? Let's explore.

The "Emotional Storm" in the US Stock Market: Economic Signals and Policy Shadows Intertwined

The US stock market has once again experienced a "roller coaster" ride, with all three major indices suffering significant losses on December 18. According to AICoin real-time data, the Dow Jones Industrial Average (Dow) plummeted by 2.58%, the Nasdaq Composite Index (Nasdaq) fell by 3.56%, and the S&P 500 Index also faced a decline of 2.95%. What triggered this "emotional storm"? Let's break it down one by one.

1. Economic Data "Stepping on a Landmine," Market Confidence Severely Hit

A series of recently released economic data has undoubtedly added fuel to the fire. The decline in the consumer confidence index and the weak retail sales data directly undermined investors' expectations for economic recovery. Once the market begins to worry about future growth momentum, the selling pressure surges like a tide.

2. Powell's "Suspense" and the Fed's Hawkish Stance

The latest remarks from Federal Reserve Chairman Powell have once again shrouded the market in uncertainty. Although he is set to step down, he has signaled the possibility of adopting more aggressive monetary policies. This hawkish stance has been enough to send market sentiment into a frenzy, as every hint of interest rate hikes or balance sheet reductions can significantly shake the capital markets.

3. Geopolitical Clouds: Friction and Conflict Heighten Market Anxiety

In addition to economic and policy factors, the tense global geopolitical situation has also been fueling market sentiment. The resurgence of US-China trade tensions and the escalation of certain international conflicts have further exacerbated investors' unease. The market is always most sensitive to uncertainty, and when risks soar, risk-averse sentiment naturally takes over.

The "Chain Reaction" in the Crypto Market: Emotional Resonance and Regulatory Storms

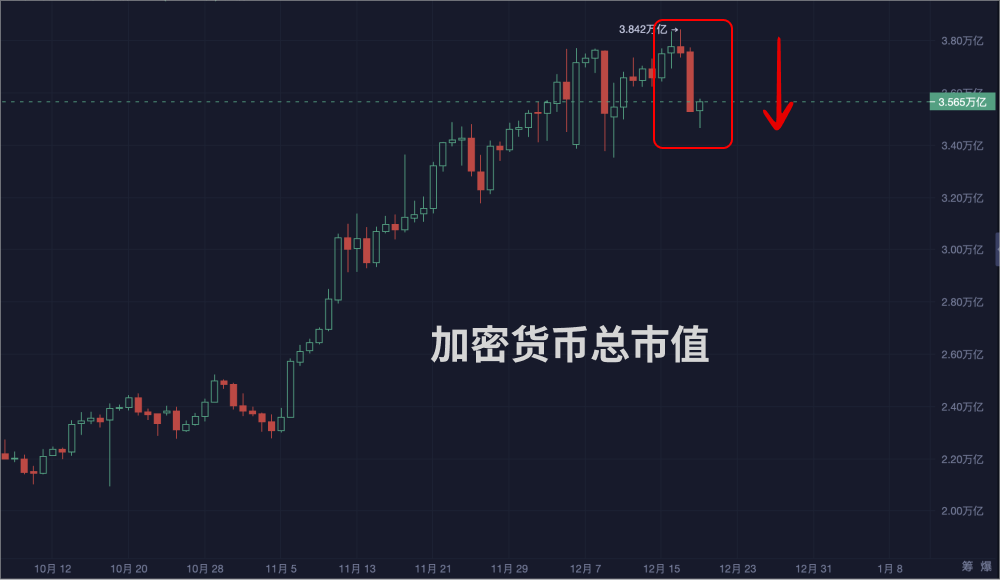

When the traditional financial market sneezes, the cryptocurrency market often catches a cold. The severe fluctuations in the US stock market have also triggered a "chain reaction" in the crypto market. According to AICoin data, as of December 18, the total market capitalization of cryptocurrencies shrank to $3.61 trillion, evaporating $169.532 billion in just 24 hours, a decline of 4.47%. Major assets like Bitcoin and Ethereum were hit hardest, with market shares of 55.88% and 12.73%, respectively. So, why is the crypto market so fragile?

1. "Emotional Contagion": US Stock Decline Triggers Panic Selling

As the ties between traditional financial markets and the cryptocurrency market grow tighter, the transmission effect of emotions becomes increasingly pronounced. This time, the sharp drop in US stocks directly triggered panic selling in the crypto market. Investors' risk-averse sentiment began to spread, and the crypto market, as a high-volatility "risk investment target," naturally found it hard to remain unscathed.

2. Political and Policy Uncertainty as "Hidden Landmines"

Recently, President Trump's inauguration has been viewed as a potential "black swan event" for the crypto market. Former BitMEX CEO Arthur Hayes boldly predicted that Trump might implement unfavorable policies for cryptocurrencies after taking office. This political risk has left investors feeling anxious about the future.

3. Regulatory "Tightening" is Intensifying

The global regulatory landscape for cryptocurrencies is once again tightening, adding more pressure to an already volatile market. For instance, in Hong Kong, four new virtual asset trading platform (VATP) providers have been added, bringing the total number of licensed cryptocurrency exchanges to seven. While such strict regulatory measures may contribute to the healthy development of the market in the long run, they could exacerbate panic in the short term.

The "Breakthrough Path" for the Future: How Can Investors Find Direction Amid the Storm?

When the market is in chaos, what investors need most is calmness and strategy. So, in this dual shock of traditional finance and the crypto market, how can we find a breakthrough path? The following points may provide some inspiration. For reference only, not constituting investment advice.

1. Diversify Investments: "Don't Put All Your Eggs in One Basket"

Whether in stocks or cryptocurrencies, the risk of a single asset is relatively high. Diversifying funds across different asset classes, such as stocks, bonds, gold, and cryptocurrencies, can effectively reduce overall risk. Even if some assets perform poorly, the stability of other assets can serve as a "buffer."

2. Keep a Close Eye on Policy Trends and Plan Ahead

Policy uncertainty is one of the core risks in the current market. Investors need to closely monitor the Federal Reserve's monetary policy direction and the regulatory trends of major countries regarding cryptocurrencies. Anticipating and planning ahead can give you an edge when the market changes suddenly.

3. Long-Termism: Believing in Bitcoin and Quality Assets

Short-term volatility is the norm in the market, but truly valuable assets tend to outperform inflation and market noise in the long run. For "digital gold" like Bitcoin and quality blue-chip stocks, holding them for the long term is often a wiser choice. After all, history has repeatedly proven the "resilience" of the market.

4. Maintain Flexibility: Cash is Also a Good Choice

In periods of heightened market volatility, holding a reasonable cash position can provide more options for future buying opportunities. Don't rush to "buy the dip"; instead, wait for market sentiment to cool further before taking action.

Conclusion: Opportunities and Risks Coexist Amidst Turmoil

The simultaneous decline of the US stock and cryptocurrency markets reflects the complexity of the current global economic and market environment. This "emotional roller coaster," while quickening the heartbeat, also hides numerous opportunities. When facing the storm, the most important thing for investors is to remain calm, formulate scientific strategies, and keep a close watch on the latest market developments. Perhaps it is in such turmoil that discerning investors can find the true "golden pit."

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。