Macroeconomic Interpretation: At 3 AM tonight, the Federal Reserve will announce its interest rate decision and Powell will deliver a speech, with the market holding its breath. BTC has also experienced a pullback during the day, possibly due to bulls taking profits in anticipation of the unknown volatility from the Federal Reserve's meeting.

Today, we will explore the comprehensive impact of the Federal Reserve's interest rate cut decision and Trump's return to the presidency on the cryptocurrency market. We will analyze the macroeconomic effects of the interest rate cut policy, the policy direction of the Trump administration, and the trends in the cryptocurrency market under the combined influence of both.

Global financial markets are focused on the Federal Reserve's interest rate cut decision and the policy changes brought about by Trump's return to the presidency. As the maker of U.S. monetary policy, the Federal Reserve's interest rate cuts often trigger fluctuations in global markets; meanwhile, the Trump administration's clear stance and policy direction towards the cryptocurrency industry may bring unprecedented development opportunities and challenges to the crypto market.

- Macroeconomic Effects of the Federal Reserve's Interest Rate Cut Decision: The Federal Reserve's interest rate cut is typically seen as a supportive measure for economic growth. By lowering borrowing costs, interest rate cuts can stimulate business investment and personal consumption, thereby promoting economic activity. However, this policy also comes with increased liquidity and expectations of a weaker dollar, which may significantly impact the cryptocurrency market. Specifically, the funds flowing from traditional markets (such as bonds and banks) to risk assets (such as stocks and cryptocurrencies) due to interest rate cuts may drive up cryptocurrency prices. However, this also increases market volatility, exposing investors to higher risks.

In the context of a "hawkish rate cut," the Federal Reserve may adjust interest rates more cautiously to respond to the complex and changing economic situation. As indicated by the interest rate cut decision at the end of 2024, although the Federal Reserve continues to cut rates, the pace of cuts may slow, which will have significant implications for market expectations.

- Trump Administration's Policy Direction on Cryptocurrency: During the 2024 campaign, Trump clearly expressed support for the development of the cryptocurrency industry and called for a relaxation of regulations on cryptocurrencies. This policy direction stands in stark contrast to the regulatory tightening during the Biden administration. The Trump administration may further promote the legalization and standardization of the cryptocurrency industry through measures such as establishing a "Cryptocurrency Advisory Committee" and considering Bitcoin as a strategic reserve asset. At the same time, the Trump administration's crackdown on the digital dollar may provide more opportunities for cryptocurrencies in the international payment sector.

These policy directions from the Trump administration are expected to bring more policy dividends and market opportunities to the cryptocurrency market. However, they also come with regulatory uncertainties that may pose challenges to the stable development of the market.

- Impact of the Federal Reserve's Interest Rate Cut and Trump’s Policies on the Cryptocurrency Market: Under the dual influence of the Federal Reserve's interest rate cuts and Trump's policies, the cryptocurrency market faces complex opportunities and challenges. On one hand, the increased liquidity and expectations of a weaker dollar brought about by interest rate cuts may drive up cryptocurrency prices, attracting more investors into the market. On the other hand, the Trump administration's support for cryptocurrencies may further accelerate the industry's compliance and internationalization processes, providing more development opportunities in cryptocurrency payments and cross-border payment sectors.

However, it is worth noting that these factors may also exacerbate market volatility and uncertainty. The influx of funds due to interest rate cuts may inflate market bubbles, while regulatory uncertainties may trigger severe market fluctuations. Therefore, while investors enjoy the policy dividends, they also need to be vigilant about potential market risks.

- Conclusion:

The Federal Reserve's interest rate cuts and Trump's return to the presidency have profound impacts on the cryptocurrency market. Stimulated by the interest rate cut policy, the cryptocurrency market may see more capital inflows and opportunities for price increases; while the Trump administration's support for cryptocurrencies may bring more policy dividends and market opportunities to the industry. However, investors need to maintain a cautious attitude while seizing these opportunities, paying attention to market volatility and potential risks. In the future, how the cryptocurrency market responds to these challenges and seizes opportunities is worth our continued attention and in-depth discussion.

BTC Data:

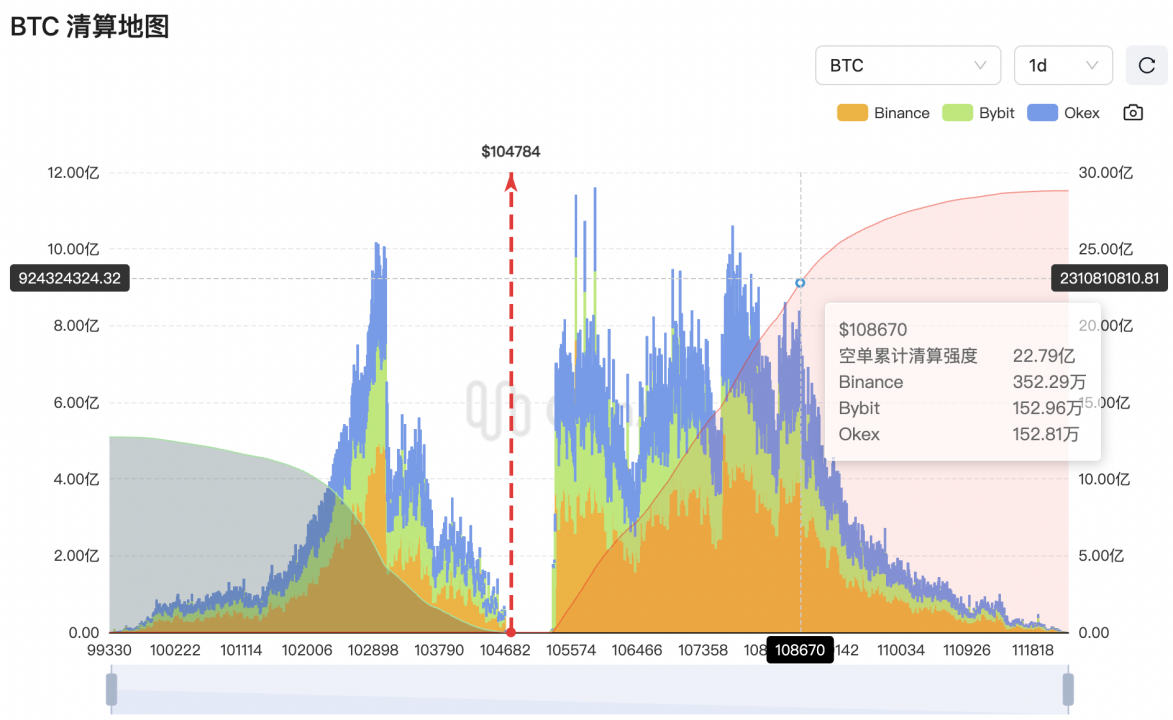

The liquidation map shows that if the market reaches a new high of $108,670, approximately $2.279 billion worth of short positions will be liquidated; if the market drops to around the weekend low of $100,600, approximately $1.215 billion worth of long positions will be liquidated. These can serve as reference points for the main force's risk control positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。