Original Author: BitMEX

Welcome back to our weekly options trading strategy analysis. In this issue, we will explore an interesting arbitrage opportunity involving BitMEX's options market and the prediction platform Polymarket, by combining a buy spread strategy with positions in the prediction market for arbitrage.

Market Conditions

Current market conditions present an attractive arbitrage opportunity:

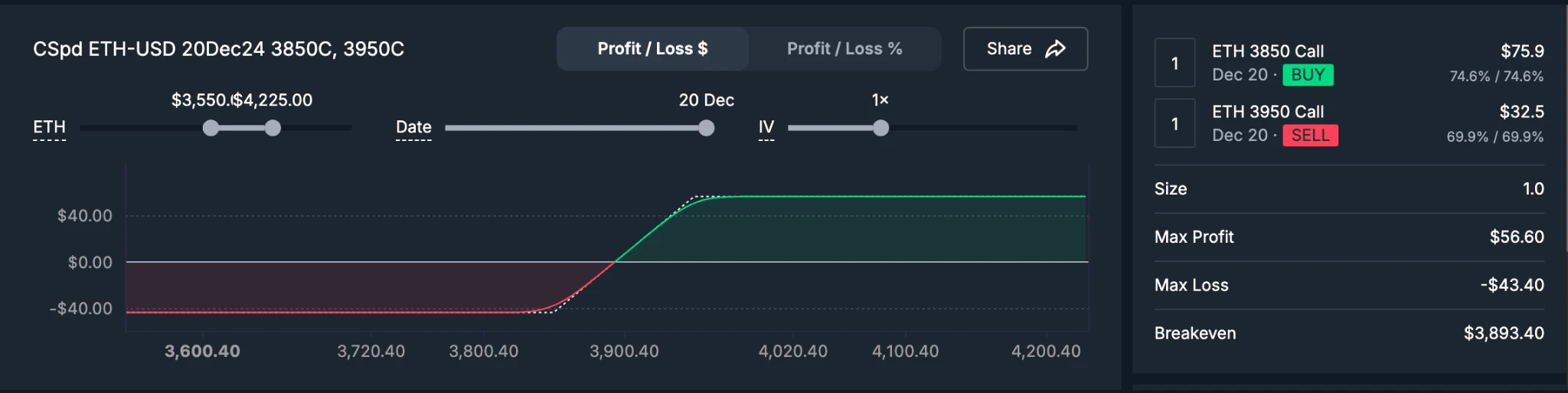

BitMEX Options Market (expires December 20):

$3,850 Call Option: Price for 1 contract is $75.9

$3,950 Call Option: Selling price for 1 contract is $32.5

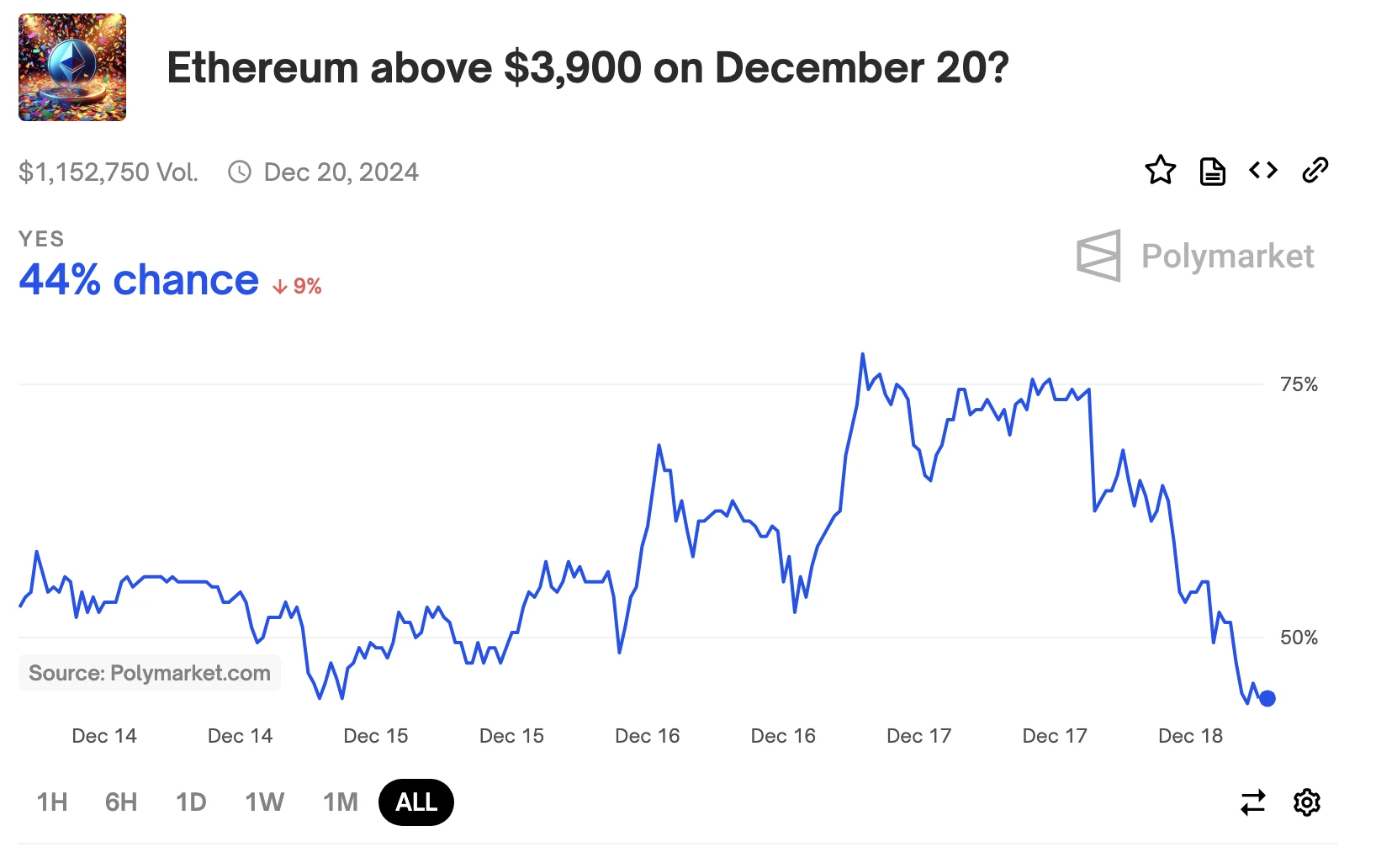

Polymarket (expires December 20):

The "No" contract price for ETH being above $3,900 on December 20 is 57 cents.

A $25 position, if successful, is expected to yield $44.98 in profit (return rate of 75.4%).

Arbitrage Strategy

This strategy combines BitMEX options and Polymarket positions. Here’s a detailed breakdown of the strategy:

BitMEX Spread Options:

Buy 1 ETH 20Dec $3850 Call Option

Sell 1 ETH 20Dec $3950 Call Option

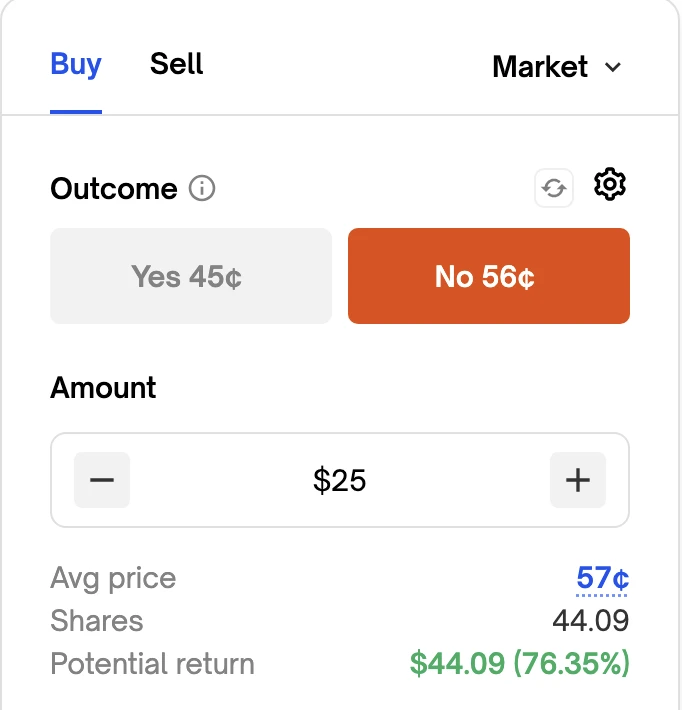

Polymarket Position:

Buy a $25 "No" contract, purchasing the contract for ETH being below $3,900 at 46 cents.

Potential Return: If ETH remains below $3,900 on December 20, the expected return is $44.09.

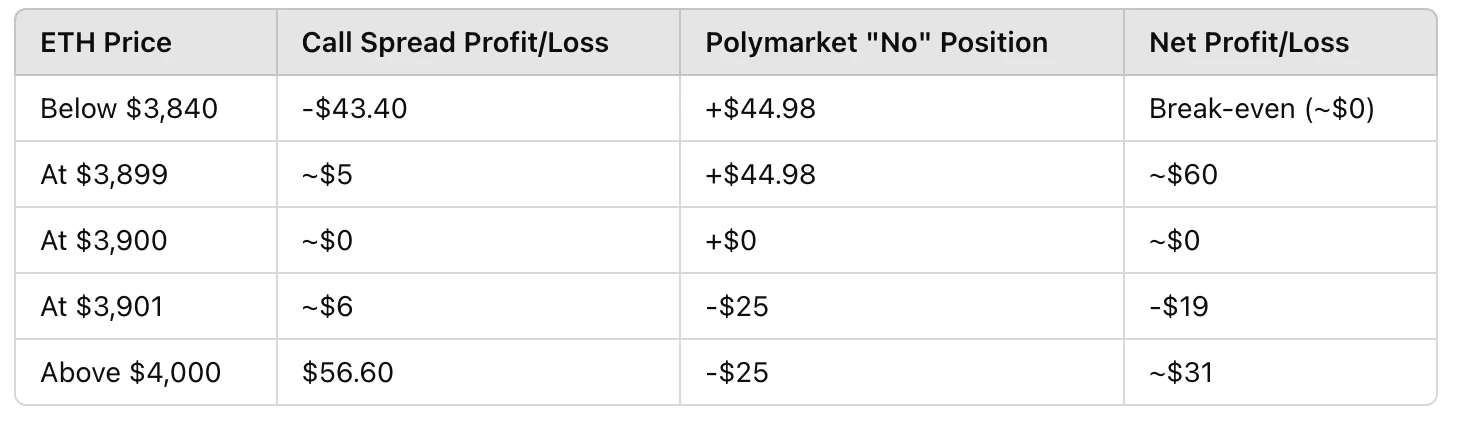

Profit Scenarios

Risk Considerations

Calendar Risk: BitMEX options expire at 08:00 UTC on December 20, while the Polymarket position settles at 12:00 ET (noon) on December 20. Due to the 4-hour gap between the two, close monitoring of price fluctuations is necessary as they may impact profitability.

Liquidity Risk: Ensure that both markets have sufficient liquidity. Pay attention to bid-ask spreads and execution costs, as these factors may affect the final profit calculations.

Market Volatility: High volatility may impact the premiums of options. Monitor changes in implied volatility and adjust position sizes according to market conditions.

Summary

This strategy offers an interesting arbitrage method that combines BitMEX options and Polymarket positions. By using a spread on options, we create a strategy with multiple profit scenarios and clear risk parameters.

Given the current market pricing, this arbitrage opportunity appears particularly attractive. However, as always, careful position adjustments and risk management are crucial. It is important to closely monitor the dynamics of both markets and be prepared to adjust positions as market conditions change to maximize profits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。