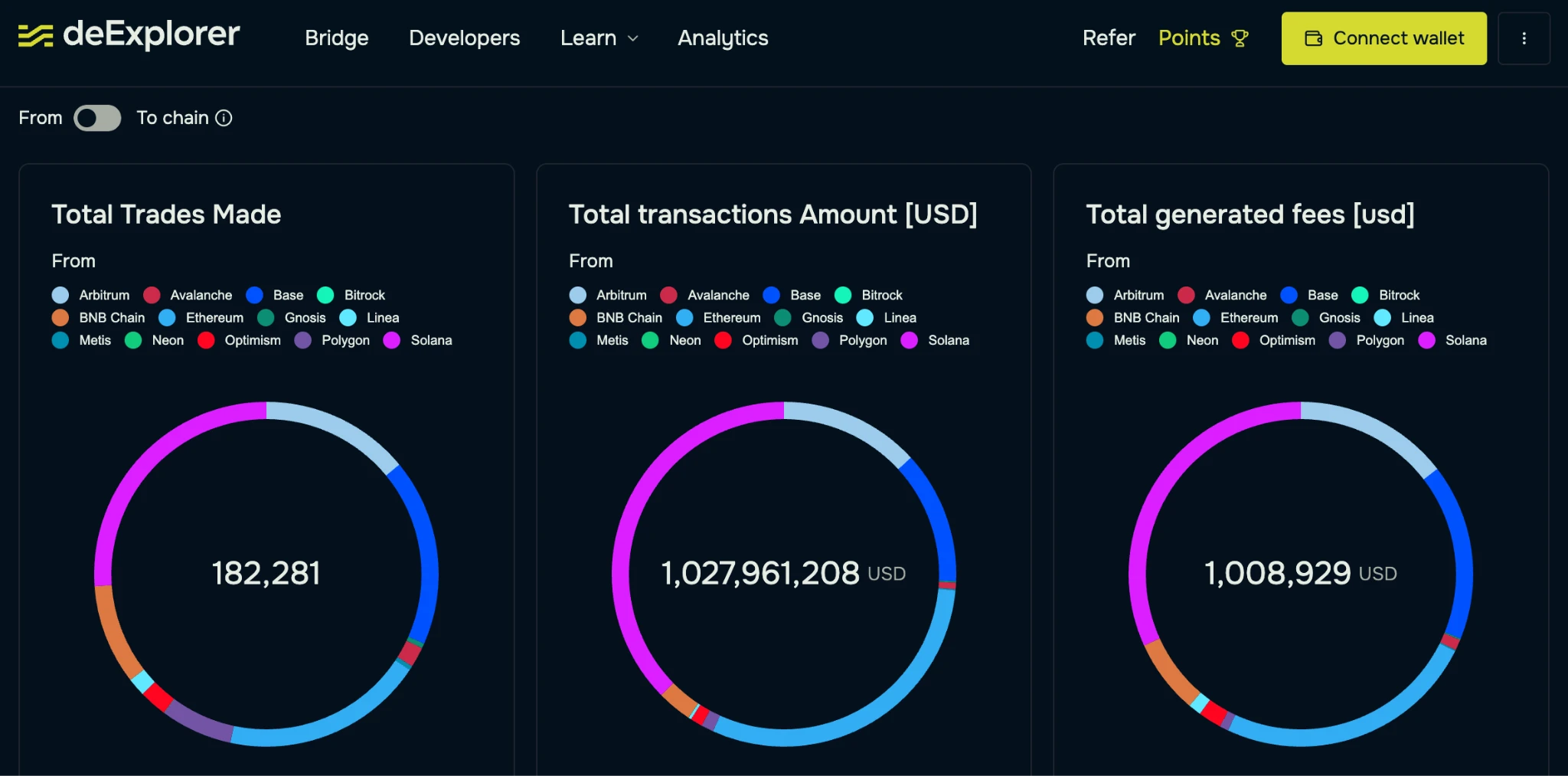

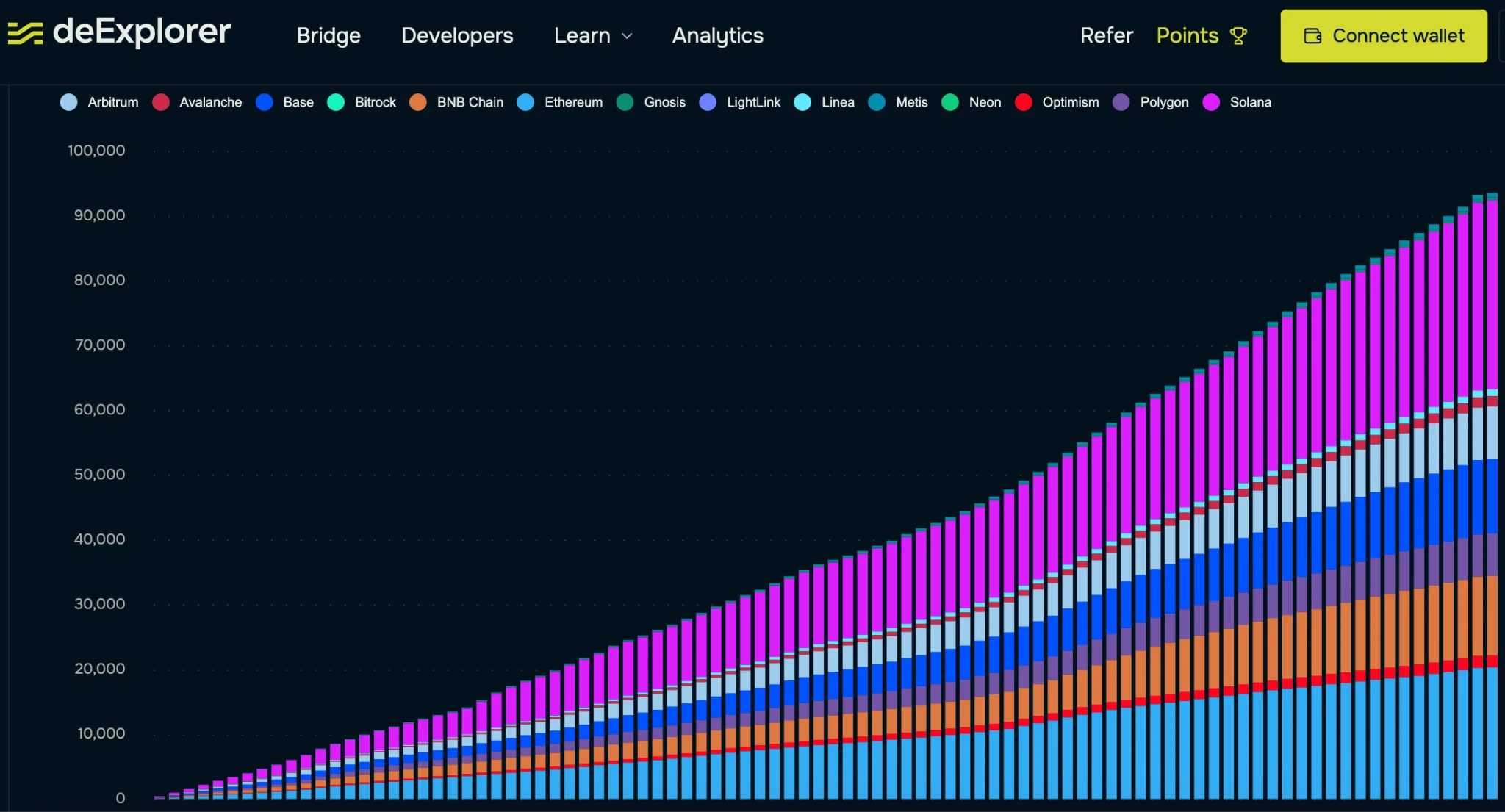

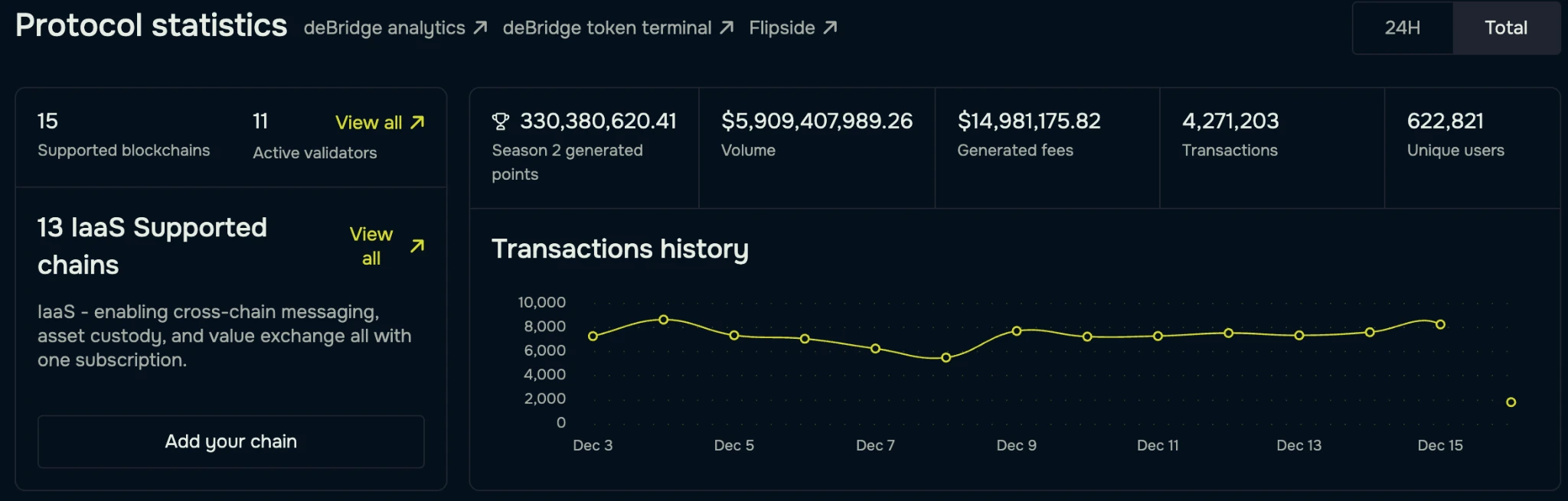

According to on-chain data, the deBridge cross-chain protocol has a total settlement amount of approximately $5.9 billion, with an average daily cross-chain settlement of about $40 million. In 100 days, it has gained 100,000 new users, and the protocol's revenue is around $15 million. In the past thirty days, the cross-chain settlement amount exceeded $1 billion, and the cross-chain transaction fees surpassed $1 million, making it the top-ranked cross-chain bridge in terms of fee income. Additionally, 90% of large cross-chain funds on Solana are transferred using deBridge.

Data source: https://app.debridge.finance/analytics

Consolidation of Market Leadership

First in Cross-Chain Fee Revenue

In the past 30 days, deBridge's cross-chain fee revenue exceeded $1 million, indicating that it has become the preferred protocol for users and institutions transferring assets across chains. deBridge offers efficient, secure, and attractive cross-chain services. In a competitive market, users are willing to pay higher fees for quality services, ensuring the liquidity and security of funds. The sustainability of revenue will provide financial support for further R&D, market expansion, and ecological cooperation.

Main Channel for Large Cross-Chain Funds on Solana

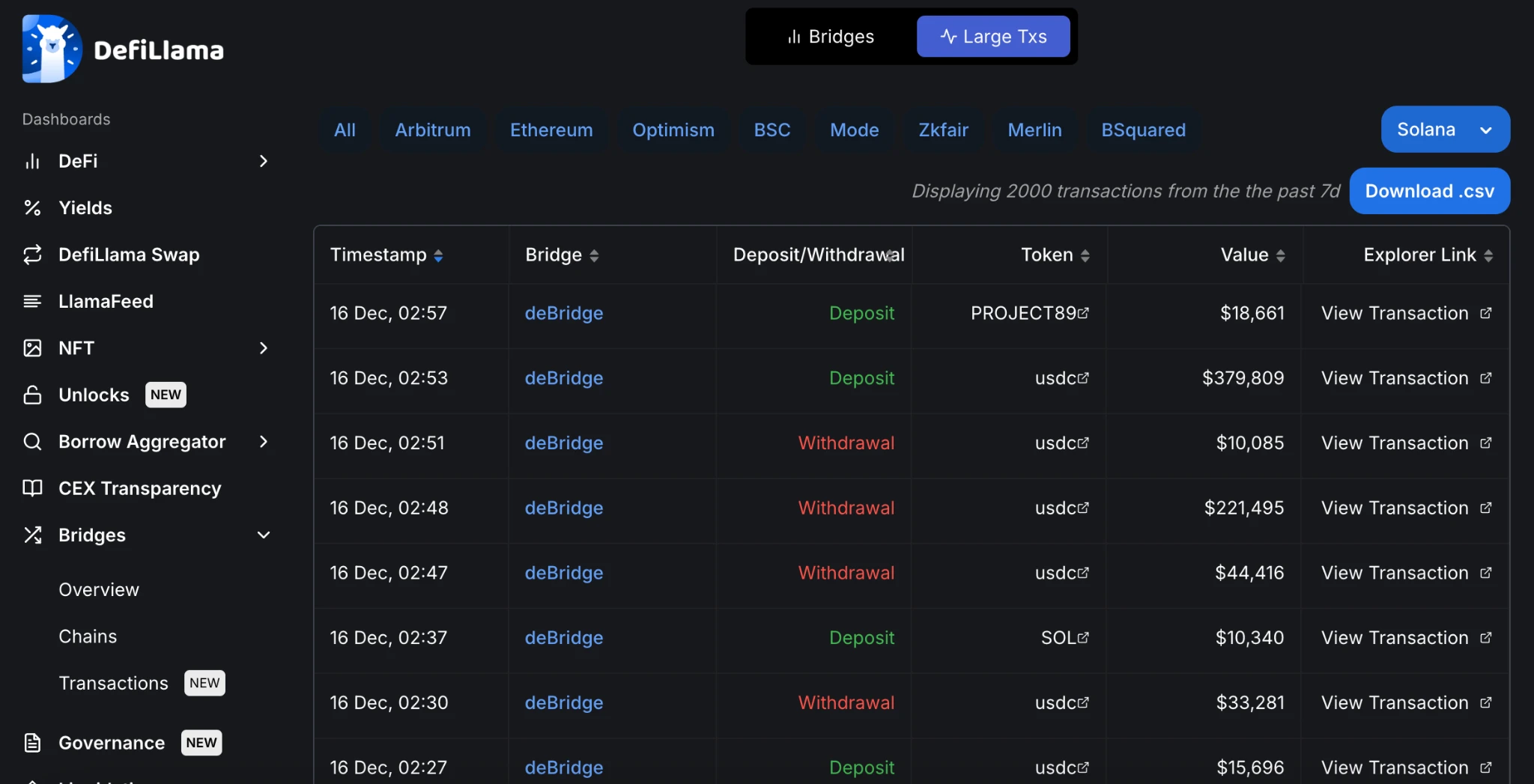

90% of large cross-chain funds on Solana are completed through deBridge, indicating that its technical capabilities have gained the trust of high-value trading users. This trend highlights deBridge's irreplaceable role in the Solana ecosystem, especially in its competitive advantage in serving high-net-worth users and institutions. It also proves the protocol's stability, security, and efficiency in handling large transactions.

100,000 New Users in 100 Days

Attracting 100,000 new users in a short period reflects deBridge's significant success in user experience, product promotion, and market strategy. As the user base grows, the overall transaction volume and activity of the protocol will further increase, with more participants driving the self-circulation development of the ecosystem.

Sustainability of Protocol Revenue and Business Model

Protocol Revenue Reaches $15 Million

In the cross-chain field, it is rare to see cross-chain protocols achieving stable and high revenue. Outstanding Profitability: Compared to projects that rely solely on financing and token issuance, deBridge's revenue growth demonstrates the uniqueness and sustainability of its business model. Premium from Technological Innovation: The fee model has been recognized by the market, with users willing to pay transaction fees in exchange for high-quality cross-chain services. Future Expansion Potential: The accumulation of revenue can support the protocol in further technological innovation and marketing.

Stable Growth of Transaction Volume and Market Demand

Cross-Chain Settlement Amount Reaches $5.9 Billion, Average Daily $40 Million

The stable growth of the average daily settlement amount indicates that deBridge has become one of the core infrastructures for cross-chain asset liquidity. As the share of the crypto market continues to grow, more users and institutions require efficient cross-chain tools, and deBridge fills this critical market need. While supporting such large-scale transactions, the protocol maintains stable operation, further enhancing user trust.

Over $1 Billion in Cross-Chain Settlements in the Past 30 Days

The recent increase in transaction volume indicates a sustained rise in market demand for cross-chain technology, with deBridge becoming a beneficiary and driver of this growth: new users are actively using the protocol, increasing its actual utilization rate.

Core Competitive Advantage of 0-TVL

With its core competitive advantage of 0-TVL for rapid cross-chain transactions, deBridge may have attracted more users from competitors, further consolidating its market share. 0-TVL means no risk of fund custody, avoiding becoming a target for attacks. Higher capital efficiency enhances the liquidity of user assets, and a decentralized verification network ensures transaction security and transparency. It avoids economic risks related to TVL. In the long run, the 0-TVL model will further enhance deBridge's market competitiveness in the cross-chain ecosystem while providing new ideas for the security and sustainable development of the entire industry.

Future Potential Behind Growth Data

The growth data of deBridge not only reflects its own success but also highlights the mainstreaming of cross-chain transactions. The significant flow of funds across chains indicates that the blockchain ecosystem is moving towards a multi-chain coexistence pattern, with a notable increase in the demand for cross-chain bridges as key infrastructure.

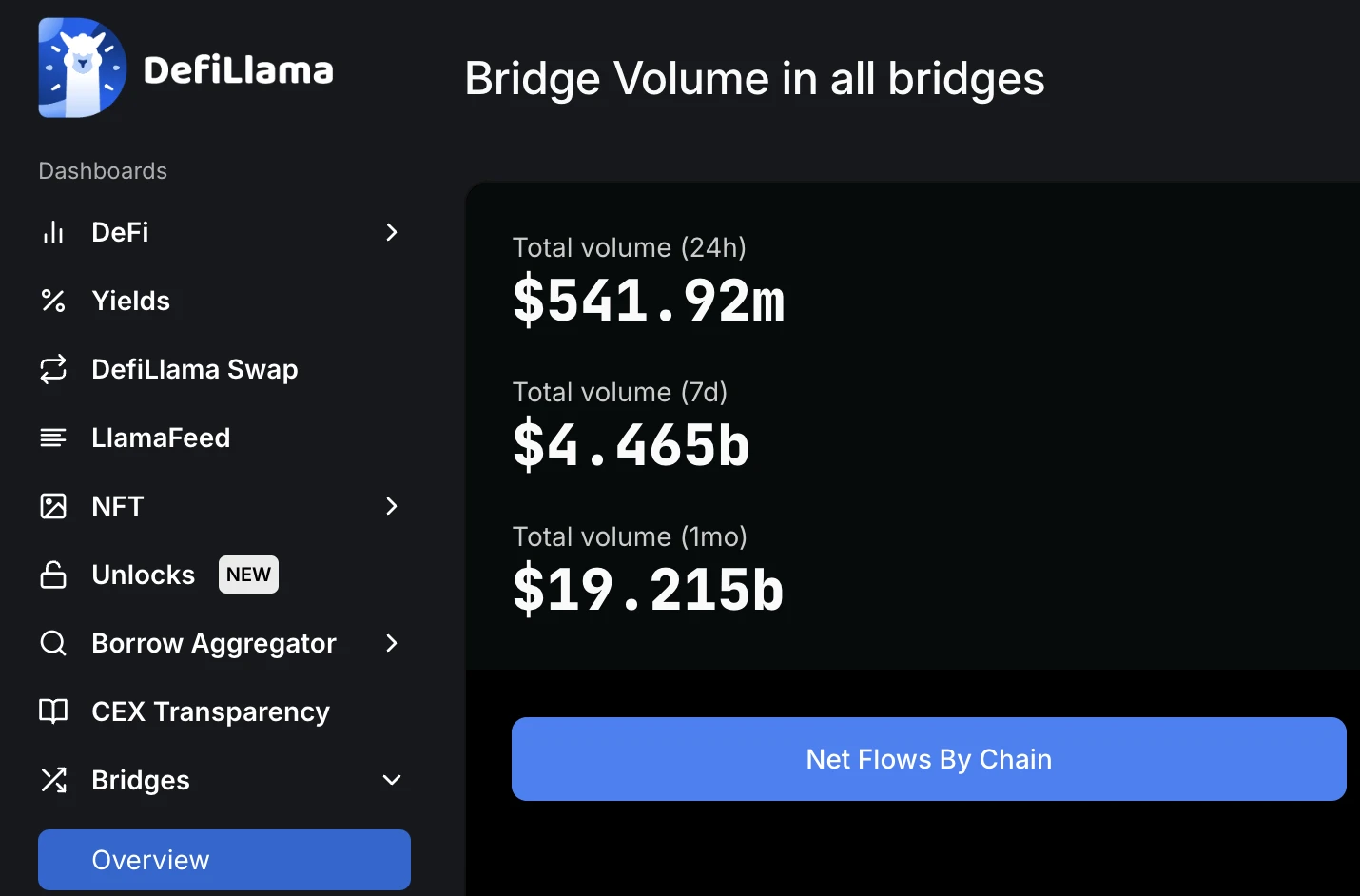

According to on-chain data platform DefiLlama, the total transaction settlement amount for all cross-chain protocols in the past 30 days was approximately $20 billion, with over $4 billion settled in the last 7 days. The demand for cross-chain solutions among DeFi users is rapidly increasing, and the stable growth of cross-chain bridges is undoubtedly linked to their core competitiveness. Maintaining a leading competitive edge will be a long-term topic.

Expansion of Ecological Cooperation and Cross-Chain Application Scenarios

deBridge is further expanding its ecosystem through partnerships with more public chains, protocols, and decentralized applications. This will bring more transaction volume and user base. deBridge Launches OP Horizon, a growth plan for users and projects within the deBridge ecosystem, was previously launched as Arbtium Horizon a few months ago. With the support of the Optimism Foundation, 150,000 OP grants are being distributed to refund users' fees and gas costs, providing liquidity for the Optimism ecosystem.

Value Empowerment of DBR Token

The growth in protocol revenue and the expansion of the user base will provide more practical support for the value of the DBR token, bringing long-term returns to investors and the community. According to the official tweet from the deBridge Foundation, DBR, as a core component of the deBridge DAO, will play an important role in voting governance, staking, protocol fee sharing, and fee reductions for token holders in the future.

The next step for deBridge is to support more cross-chain networks and Bitcoin networks, integrating more liquidity fragments to achieve seamless interoperability earlier. In addition to the development of programmable cross-chain and chain abstraction, account abstraction, the team will also explore more technological innovations to bring more possibilities to the DeFi field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。