Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

Recently launched MOVE and ME have showcased the enthusiasm of the crowd and the ferocity of new coins in a bull market. Looking back, for example, the new coin OL on OKX left a deep impression, surging high at the opening, briefly correcting, and then continuing to rise in a "bulldozer" manner.

So, does the strategy for new coins change in a bull market, meaning there’s no need to sell early at the opening? Odaily will review several new coins launched on recent exchanges in this article to attempt to answer this question.

Basic Situation Description

This article selects new coins launched on Binance, OKX, Bybit, and those launched across the network, limited to the last two months.

Network-wide launches include MOVE and ME;

Binance includes SCR, USUAL (pre-market);

OKX includes MAJOR, MORPHO, MEMEFI, OL, and X (in fact, many were launched simultaneously but do not include Binance, etc.);

Bybit selected MOZ (Lumoz) and XION.

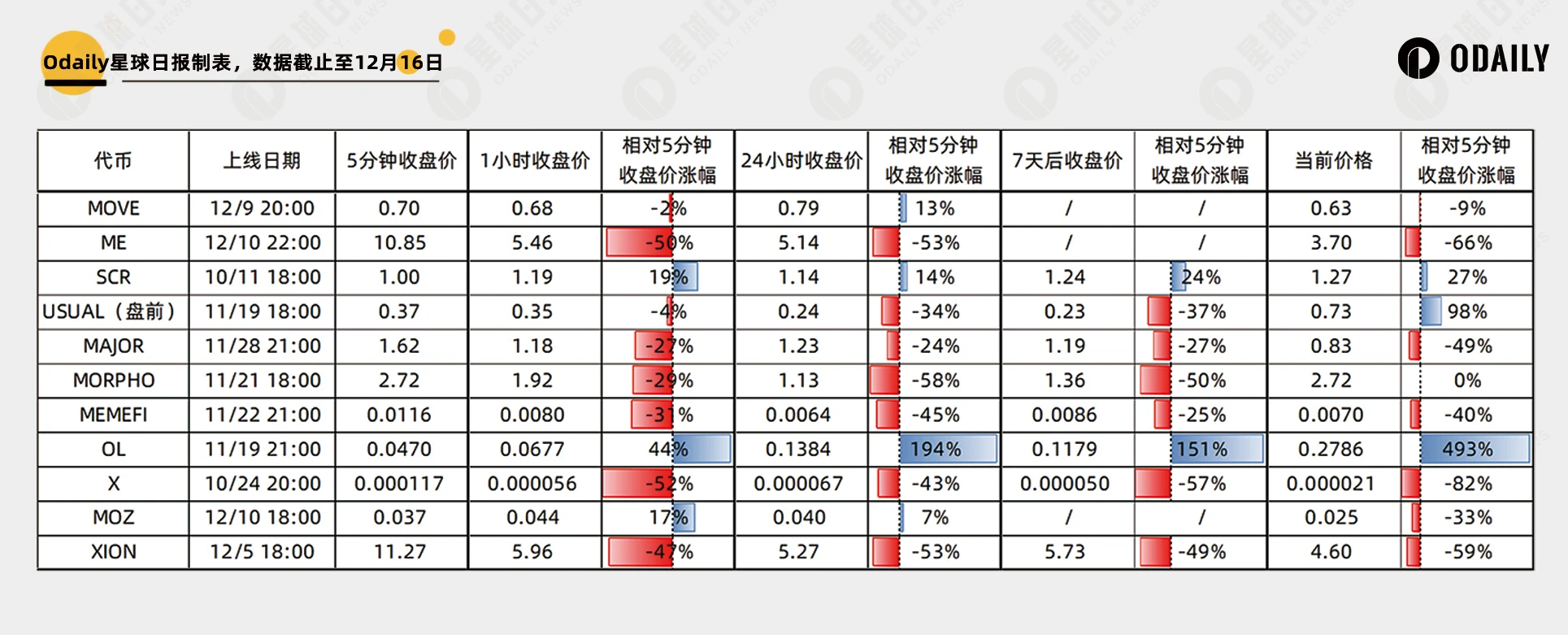

In terms of time, the closing prices of the above tokens were recorded at 5 minutes, 1 hour, 24 hours, 7 days, and the current price (as of December 16, 3 PM Beijing time).

Then, the price changes of each token were compared, such as the percentage change of the 1-hour closing price relative to the 5-minute closing price, to determine whether it was a "high point at opening."

Is the Opening Still a High Point?

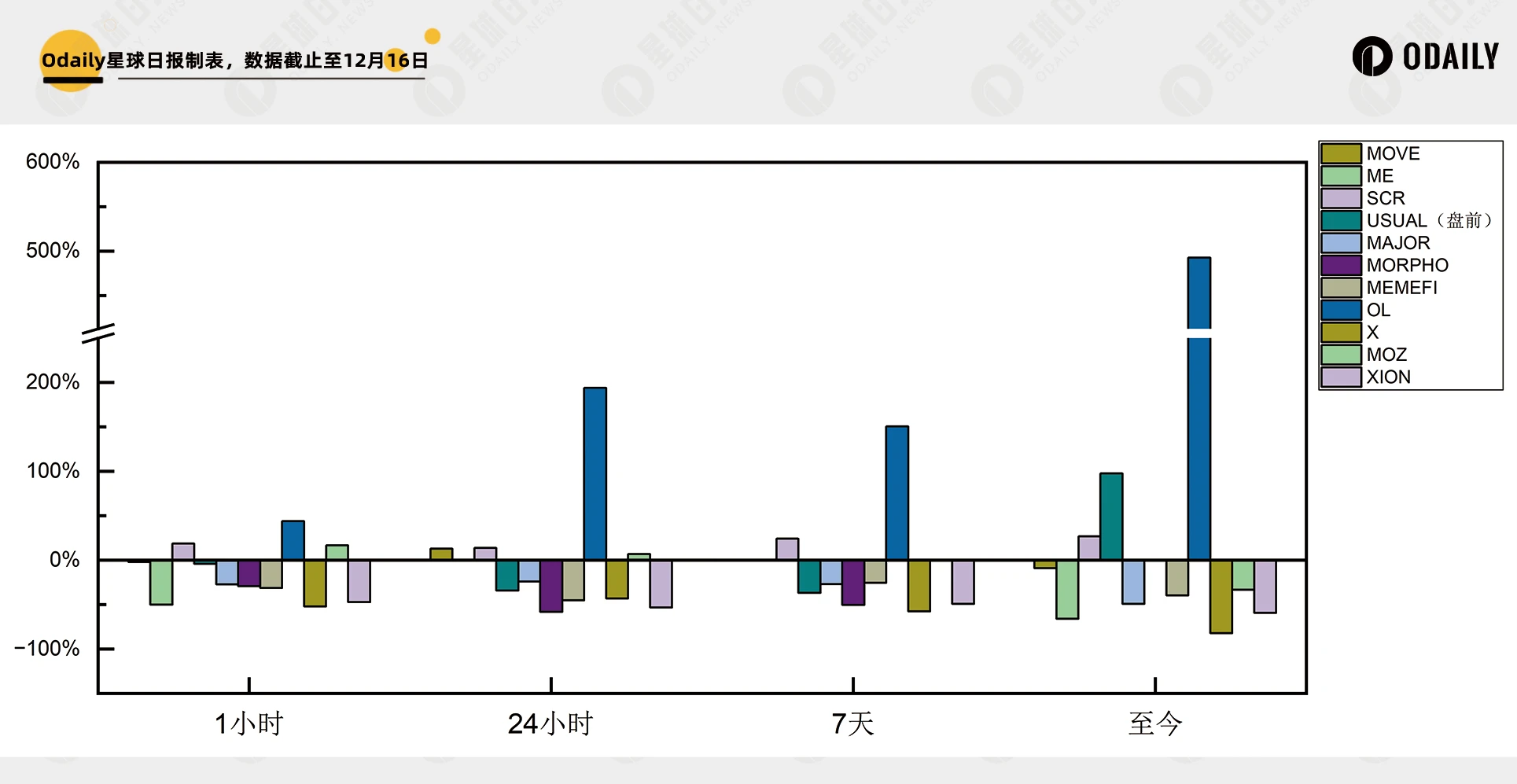

The price change data for each token is shown in the figure below. The average drop of the 1-hour closing price relative to the 5-minute closing price is 14%, while the average drop of the 24-hour closing price is 7%.

It can be seen that in the short term, the opening 5 minutes is still a high point, and if tokens can be obtained within that time frame, selling is still recommended.

There are eight tokens that have been online for 7 days, and these tokens have an average drop of 8.7% in the 7-day closing price relative to the 5-minute closing price, indicating that the mid-term situation remains unchanged, and the opening is still a high point.

Will the situation change if we extend the time frame?

The average increase of the current price relative to the 5-minute closing price for the 11 tokens has reached 25%, but excluding OL, it turns into an average drop of 21%, with the decline further expanding.

Opening is Still the Peak

In summary, for most tokens, the opening is still likely to be the highest point, and the bull market may bring higher opening prices rather than long-term increases. Moreover, one or two months is insufficient to dissipate the overly enthusiastic prices caused by the opening. According to statistical patterns, it is still recommended to sell if tokens can be obtained within 5 minutes.

Binance New Coin VANA Price Estimate

Based on the past 21 periods of Binance Launchpool data, we estimate VANA's price to be 15.9 USDT, corresponding to an FDV of 1.911 billion USD and an initial circulating market value of 479 million USD.

The calculation is as follows: the average annualized return over the past 21 periods is 96%, assuming this period is also 96%; then, based on the average amount of BNB invested in the past 21 periods and the BNB price of 726 USDT, we can determine that to achieve the same annualized return, VANA's price needs to reach:

16973725 × 726 ÷ 4080000 × 2 ÷ 365 × 96% = 15.93

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。