Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

Last Saturday, the token Farm, born from Hypurr Fun, surged to a market cap of $20 million after being listed on the Hyperliquid spot market. As HYPE maintains a "bulldozer" style increase, the success of Farm has attracted many users to the Hypurr Fun ecosystem. As an order book DEX, Hyperliquid's token listing process differs from the permissionless forms of platforms like Raydium. How does the pump.fun-like platform Hypurr integrate with it? What are the specific rules and trading processes behind it? Odaily will clarify and interpret these in this article.

Essential Knowledge: Hyperliquid Spot Token Auction

According to the official documentation, HIP1 is a token standard with a supply cap (FT), which is the form of most tokens in Hyperliquid. In HIP1 tokens, the Dev can define multiple parameters, among which the most critical include maximum supply, initial supply, and Dev retention amount.

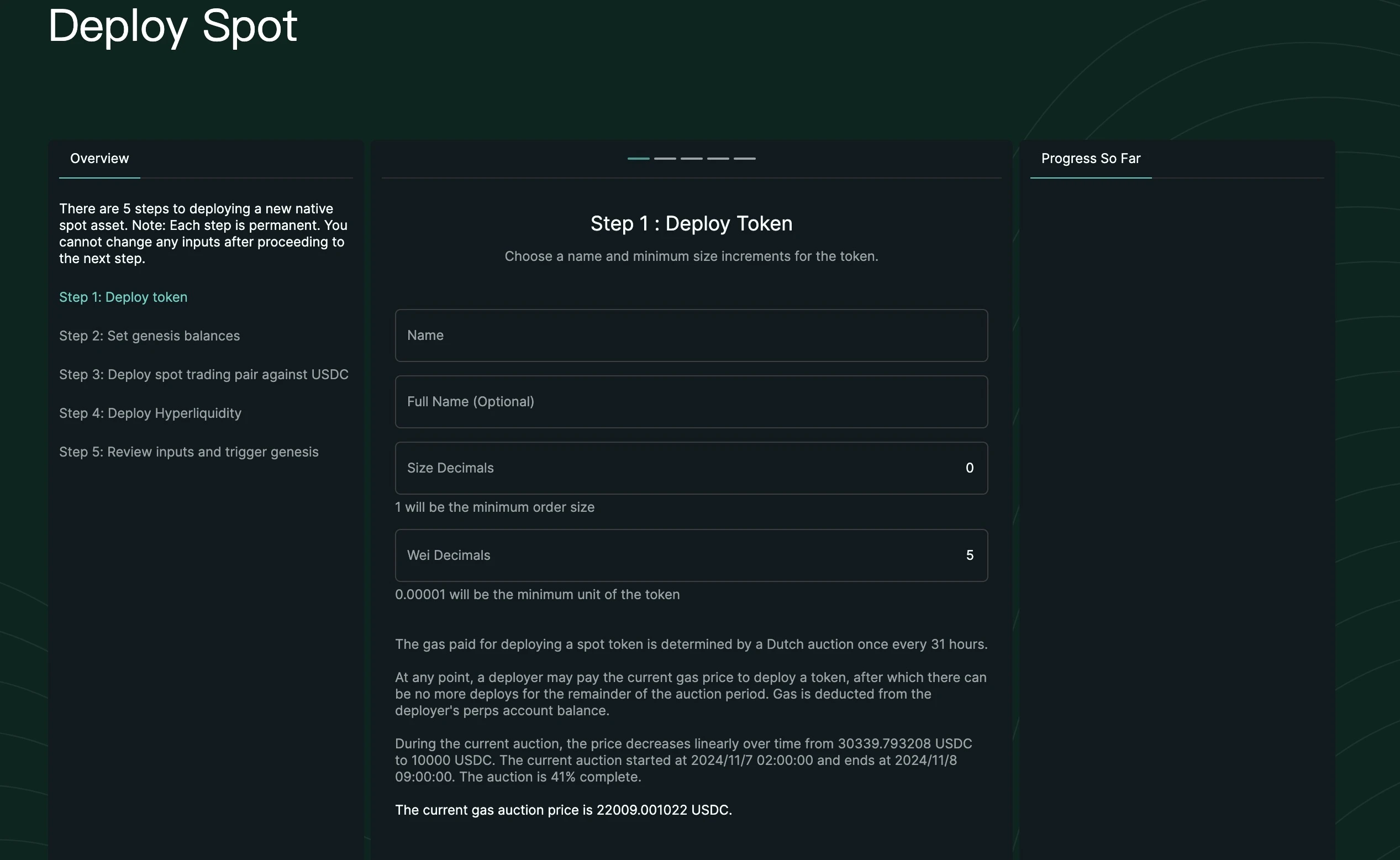

The token listing process on Hyperliquid is a Dutch auction lasting 31 hours, during which the token deployment fee will linearly decrease from the initial price to $10,000 stablecoin (USDC) until a token is bid and goes live on the Hyperliquid spot market. If the last auction fails, the initial price will revert to $10,000 stablecoin; otherwise, the starting price for the auction will be double the last price.

For example, as of the last auction at the time of writing, the winner was MON, with a winning bid of $487,936, so the starting price for the next auction will be $975,873, and it will continue to decrease over time.

The Pump of the Hyperliquid Ecosystem

In response to Hyperliquid's token auction mechanism, Hypurr Fun was born, which effectively establishes a "crowdfunding" platform where participating users invest funds and then compete for spots in the Hyperliquid spot token listings (referred to as Spot Deployment in Hyperliquid).

Token Information Query Platform

Through the web version, users can query Hypurr token information and trading conditions, including project descriptions, token prices, market caps, trading volumes, and other basic information.

Users can also obtain new token information via the Telegram channel, following the path Hypurr Official Bot → Prelaunch market channel → Launch Alert sub-channel, allowing for more real-time updates on newly added tokens without needing to refresh the webpage.

Additionally, the Hyperliquid News account on the X platform provides related information, but it is uncertain whether it is an officially supported account, so it is recommended to obtain information from it without conducting any trading operations through that account.

Trading Methods

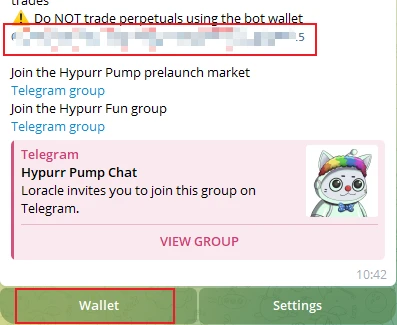

Currently, Hypurr Fun only supports purchases through the Telegram Bot. After entering the Bot, a pop-up message will provide a wallet address, and more information can be obtained through the Wallet module. Currently, it only supports transfers and deposits from Hyperliquid L1 or Arbitrum, and it is important to note that only native USDC deposits are supported (USDC.e is not supported).

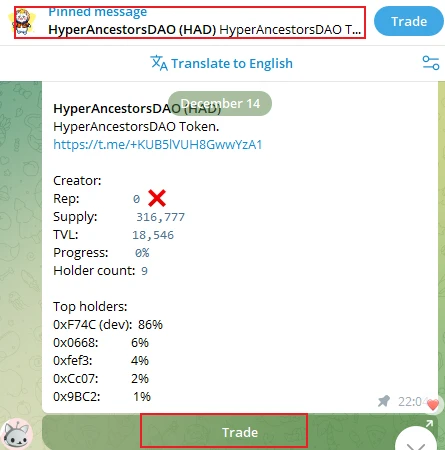

Purchasing tokens is quite unique; the most common method is to jump from the web version to the token channel, then navigate to the Trade interface through the pinned message (the author has not found a direct way to search for tokens from Telegram).

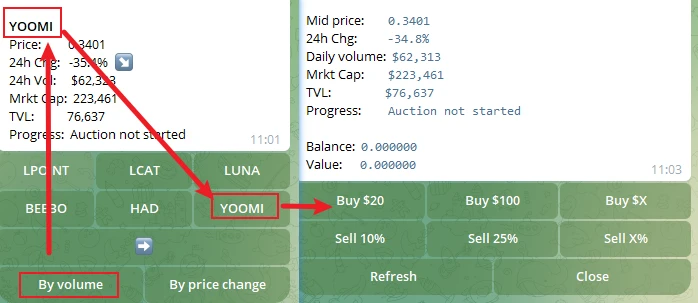

Another method is to purchase through the Telegram homepage using either “/launches” (which can sort by trading volume or price) or “/chat.” The former is an official data filtering tool, allowing users to directly select the purchase quantity. The latter is a public chat channel where popular tokens can be discovered, and transactions can also be made through clickable links.

Personal Opinion: Primitive and Rising Period

From the author's subjective experience, Hypurr is still in its early stages and is continuously rising, thus there may be many "gold mining" opportunities.

The tools available are clearly very underdeveloped compared to other mature pump ecosystems. Additionally, the information is currently incomplete; for example, the rules for spot token listings (as shown in the first image of this article) are very difficult to find specific locations and information. Although several KOLs have mentioned these listing rules, no one has provided specific sources of information; currently, only one image has been seen.

In terms of popularity, Farm set a record for the highest listing fee at $180,000, followed by SOVRN, which set a record of $260,000 yesterday, and today, at the time of writing, MON has directly surpassed $480,000, indicating that the popularity is increasingly rising.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。