Chainlink (LINK) has recently seen a price surge, becoming the focus of the crypto market and sparking discussions and attention from investors. This spike is not coincidental but rather the result of multiple factors working together. Let’s delve into the driving forces behind this and explore how Chainlink stands out in the complex crypto market.

Strategic Partnerships: How Traditional Financial Giants Endorse Chainlink?

The rise of Chainlink is not merely a result of market speculation but is significantly driven by deep collaborations with traditional financial institutions. Notably, the partnership with the global interbank payment network SWIFT is a game-changer. The collaboration aims to promote cross-border payments and asset tokenization, creating important application scenarios for Chainlink.

Imagine the endorsement from traditional financial giants like SWIFT; it not only boosts investor confidence in Chainlink's technology and business prospects but also greatly enhances its market position. As a decentralized oracle technology, Chainlink's primary value lies in building a trustworthy "bridge" between blockchain and the real world. This unique positioning is vividly reflected in its collaboration with SWIFT.

Additionally, the partnership with Vodafone is also noteworthy. Vodafone plans to integrate its digital asset division into the Chainlink network and operate as a node operator. This not only recognizes Chainlink's technological capabilities but also marks a significant step for traditional enterprises into the blockchain space. The market confidence generated by such collaborations is undoubtedly a key driver of LINK's price increase.

Local Staking Upgrade: Technological Innovation Ignites Investor Enthusiasm

If partnerships are the "external" drivers attracting market attention to Chainlink, then technological upgrades represent its powerful "core." The introduction of the local staking upgrade plan injects more technological value into Chainlink. Under the new mechanism, investors can enjoy greater flexibility, enhanced network security, and a dynamic reward system. This not only increases user retention but also fills investors with anticipation for Chainlink's future.

Notably, the initial staking pool was filled in less than three hours, reflecting the high demand and strong recognition from investors for this new feature. For long-term LINK token holders, the staking function not only provides an opportunity for asset appreciation but also enhances trust in network security.

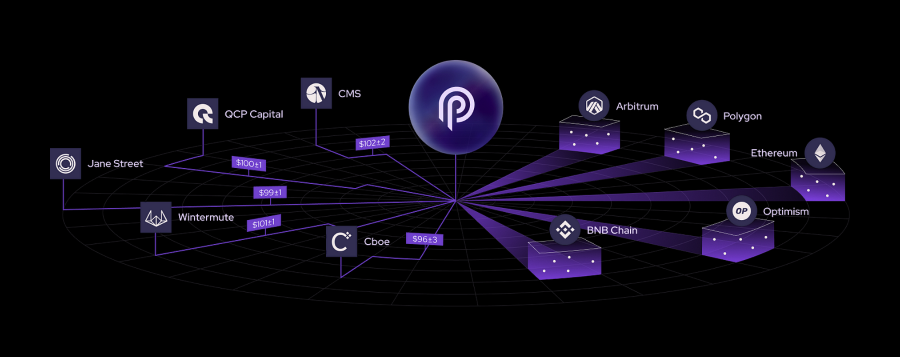

Blockchain Network: Chainlink's Extensive Integration Achieves Market Dominance

Chainlink's success is inseparable from its widespread application within the blockchain ecosystem. Whether it’s Advanced Crypto Strategies DAO or emerging projects like Equilibria, they are all utilizing Chainlink's oracle services. This deep integration not only enhances the popularity of its technology but also makes more investors aware of Chainlink's core position in the blockchain industry.

Moreover, Chainlink's service scope is continuously expanding. It not only provides data support for DeFi projects but has also found a place in NFTs, gaming, and even traditional enterprises. It can be said that Chainlink is no longer just a blockchain technology provider but one of the indispensable cornerstones of the entire Web3 ecosystem.

Investor Sentiment: The Market's Stimulant

Market sentiment is a crucial factor in price fluctuations, and Chainlink's recent performance has undoubtedly ignited investor enthusiasm. According to on-chain data, the number of active addresses on the Chainlink network has reached a new high in 11 months. This explosive network activity is often a signal of price increases, instilling confidence in investors about the future.

Interestingly, some hedge funds and large holders have recently begun accumulating LINK tokens in large quantities and transferring them to exchanges. This behavior is often interpreted as a sign of market optimism regarding LINK's future performance. With more mainstream capital entering, Chainlink's price may further rise.

Emergence of Competitors: Pressure and Motivation Coexist

Of course, Chainlink's success does not come without the threat of competitors. For instance, the Pyth network has seen its total value locked (TVL) surge from $98.4 million to $4.7 billion over the past nine months. This rapid growth compels a reevaluation of Pyth's potential and puts some pressure on Chainlink.

However, competition often serves as a catalyst for innovation. To maintain its market leadership, Chainlink is actively optimizing its technology and services. This healthy competition will ultimately drive the development of the entire oracle field, bringing more benefits to investors and users.

The Future of LINK: Can It Continue to Lead the Market?

Ultimately, Chainlink's price surge is the result of a confluence of favorable factors. From strategic partnerships to technological upgrades, and from market sentiment to competitive pressure, each factor is pushing LINK's price upward. However, the future trajectory still depends on its ability to maintain a dual balance of technological innovation and market expansion.

For investors, Chainlink is undoubtedly a project worth watching. Its core position in the blockchain ecosystem, continuously expanding application scenarios, and strong market performance are all reasons for a long-term bullish outlook on LINK. However, market risks cannot be ignored. In the crypto space, dramatic price fluctuations often accompany high rewards and high risks.

In the future, whether Chainlink can continue to lead the market remains to be seen. Nevertheless, this recent price surge has already proven its significant position in the crypto market and provides us with an excellent case study for understanding oracle technology.

Summary

The surge in Chainlink's market performance is the result of a combination of strategic partnerships, technological upgrades, and market sentiment. From the SWIFT collaboration to local staking, from blockchain integration to heightened investor attention, Chainlink is steadily solidifying its market dominance. Despite facing competitive pressure, its strong technological capabilities and extensive network effects may become its greatest assets in continuing to lead the market. Investors need to closely monitor Chainlink's upcoming strategic moves, as this "oracle war" in the crypto market is far from over.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。