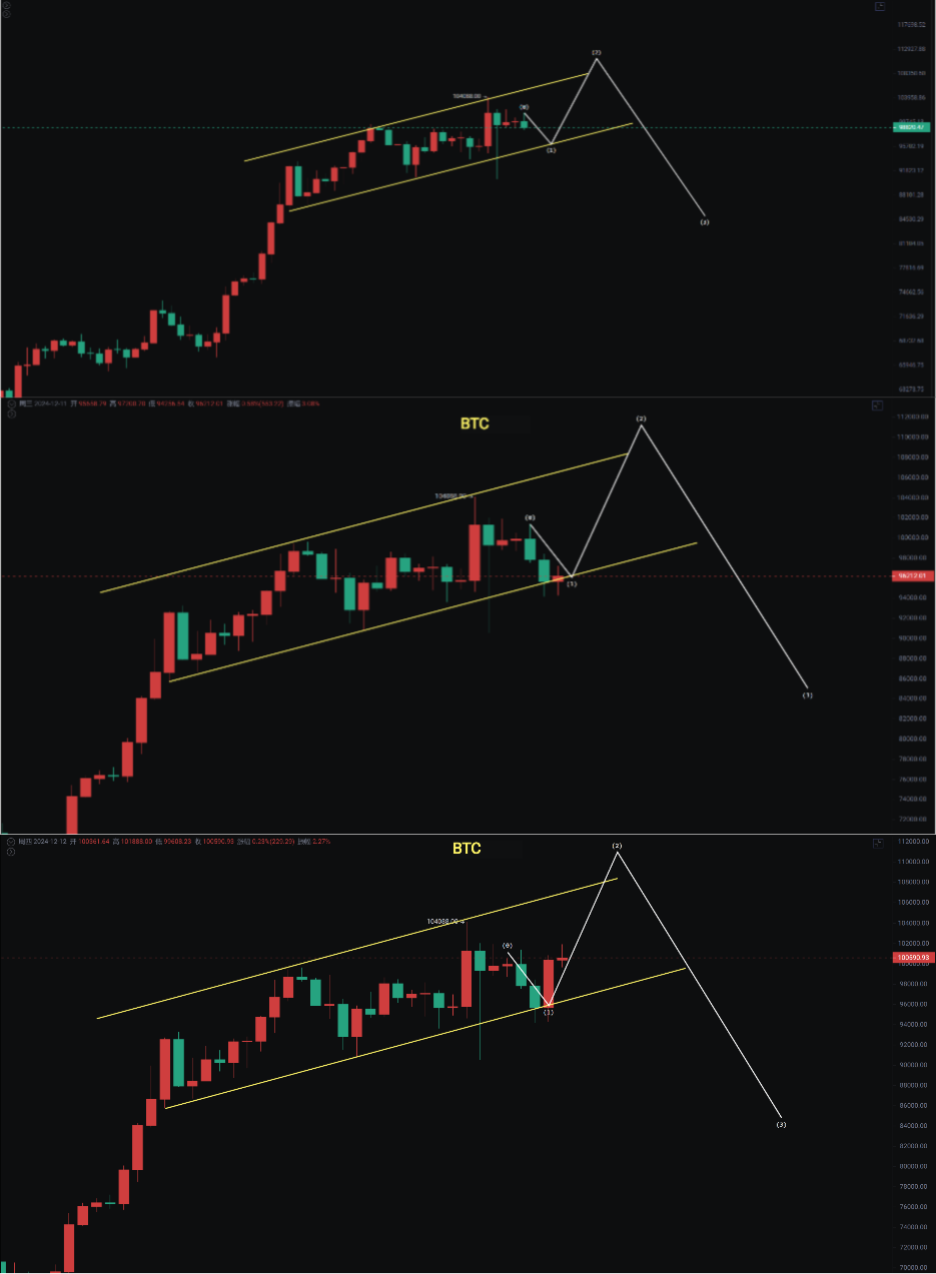

On the 9th, we analyzed that the second rebound at 101898 would face pressure and would test the support at the bottom of the rising channel and the pin bar for a second exploration. Yesterday, the market rebounded by more than 7000 points, again touching the pressure at 101888. After the pin bar at 3509, Ethereum rebounded by 430 points and returned to the internal rising trend.

Two major news items: Google has released the quantum computing chip "Willow," and many people are concerned about its impact or threat to Bitcoin. To crack Bitcoin's encryption algorithm, a quantum computer with about 13 million qubits would need to complete the decryption in 24 hours, while the Willow chip only has 105 qubits, so there is still a long way to go.

Moreover, cryptocurrencies are becoming increasingly mainstream, with more countries and regions adopting ETFs, especially since BlackRock and other consortiums have taken the plunge, which must have its reasons. Technology will certainly continue to innovate, and encryption will also keep evolving. It is possible that BTC will upgrade to have quantum resistance, but this is not something we small investors need to worry about in the short term, at least not for the next ten to twenty years.

Also, after waiting for more than half a year, OpenAI has launched the game-changer Sora, which went live, causing the website to crash due to high traffic. Ultraman urgently closed user registration, but the response has been average and not as stunning as expected, yet this does not affect the hype around the AI sector.

Bitcoin

Bitcoin surged by more than 7000 points yesterday. This wave was perfectly predicted, and we reminded multiple altcoins to buy the dip, resulting in very good profits. The pin bar rebound at the bottom of the rising channel has now touched the pressure at 101888, remaining below during the day.

The daily BOLL is showing signs of opening, with the price line touching the middle BOLL and facing pressure. The MACD histogram is shortening, and if the fast and slow lines can cross above, there is still a chance for a rebound. Pay attention to whether the RSI can break through.

Summary: Overall, it looks like a volatile upward trend. Currently, it is testing the pressure at the 102000 level; if it breaks through, there is a chance to continue making new highs. As for the subsequent movement, if it rises to 107000—113000 and then falls, caution is needed, as the upward momentum during this period has somewhat been exhausted.

Support: Pressure:

Ethereum

Although it dropped by more than ten points a couple of days ago and broke the rising channel, it fell below the MA20 and then recovered. Today, the price line has once again returned to the trend, and the market continues to look bullish.

As of the time of writing, the price has touched below the previous M head, and there is short-term pressure here. It was previously mentioned that it would test the pressure at the previous high of 4093 two to three times. In this wave, we also reminded to enter on the right side at 3509 during the two pin bars, which has yielded good results.

Support: Pressure:

SOL

As expected, the daily descending channel operated, touching the lower channel for a rebound the day before yesterday. Currently, we are looking to see if it can break through the upper channel.

Support: Pressure:

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

The article is time-sensitive and for reference only, with real-time updates.

Focusing on K-line technical research, we aim to win global investment opportunities. Official account: Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。