Table of Contents:

BTC Contract Liquidation Map, Visually Reflecting Risk Control Position;

Altcoin Index Peaks at 88 and Retraces, Aligning with Risk Area Predictions;

Token Large Unlock Data Forecast.

Fundamental Hotspot Interpretation: Focus on CPI Inflation Data.

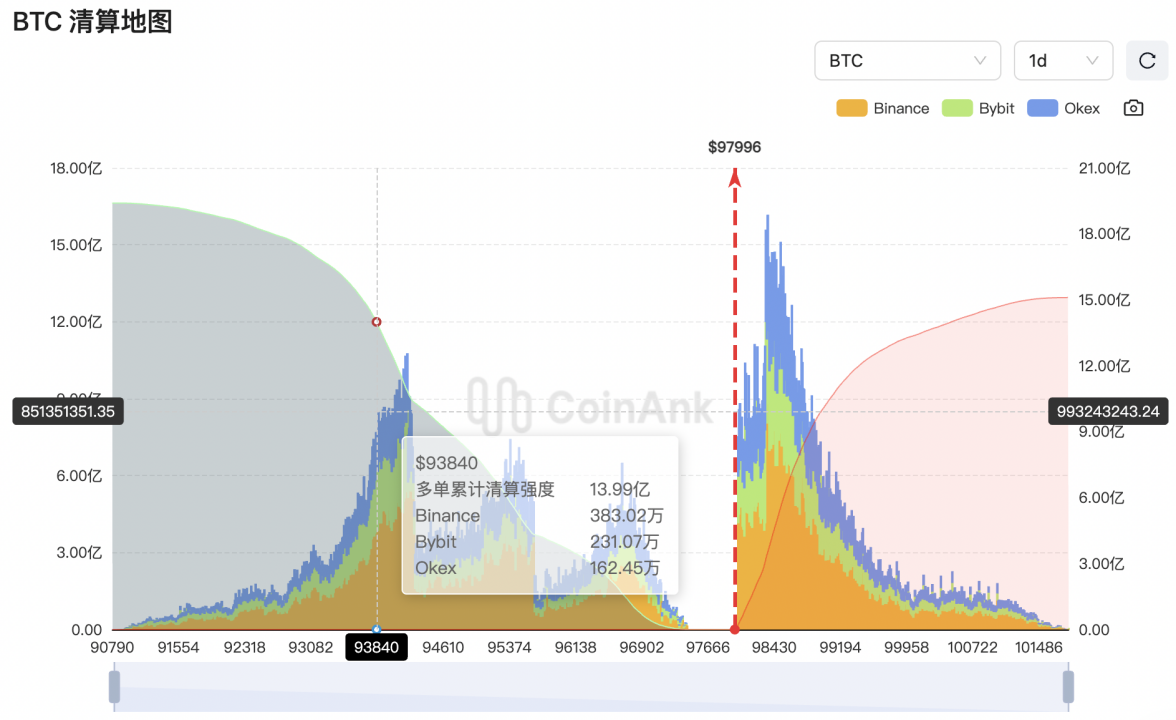

6. BTC Contract Liquidation Map, Visually Reflecting Risk Control Position

According to the latest contract data, if the BTC price breaks above $100,000, there will be $1.332 billion worth of short positions liquidated;

If the BTC price falls below $93,840, there will be $14 worth of long positions liquidated.

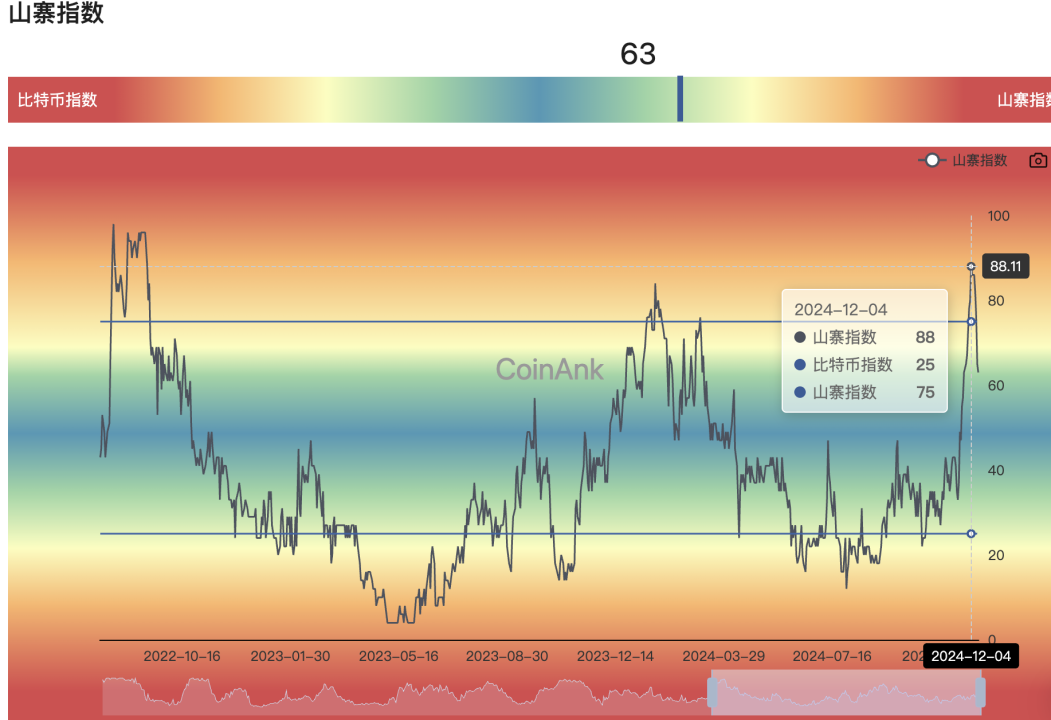

7. Altcoin Index Peaks at 88 and Retraces, Aligning with Risk Area Predictions.

Currently, the latest value of the altcoin index is around 63. In last week's research report, we mentioned, "When the altcoin index exceeds 80, we need to pay attention as it approaches the risk area, with the last high point being 85." Two weeks ago, we noted, "In the short term, it is in a healthy state, but if it exceeds 85 in the future, caution is needed." This round peaked at 88 before retracing, aligning with our risk area predictions. The overall crypto market adjusted as expected on Monday evening; although BTC did not create a new low for the phase, the significant drop in altcoins contributed to the overall liquidation scale far exceeding that of the 312 period.

Most sectors in the crypto market retraced, with declines of over 10%. The Layer 1, Layer 2, Meme, RWA, and DeFi sectors led the decline, while BTC, ETH, and CeFi sectors were relatively resilient.

8. Token Large Unlock Data Forecast:

This week, APT, STRK, and SEI will experience a large one-time token unlock, releasing a total value of over $200 million, including:

Aptos (APT) will unlock 11.31 million tokens at 0:00 on December 12, valued at approximately $163 million, accounting for 2.11% of the circulating supply;

Starknet (STRK) will unlock 64 million tokens at 8:00 on December 15, valued at approximately $49.51 million, accounting for 2.83% of the circulating supply;

Sei (SEI) will unlock 55.56 million tokens at 20:00 on December 15, valued at approximately $38.24 million, accounting for 1.39% of the circulating supply;

Cardano (ADA) will unlock 18.53 million tokens at 8:00 on December 11, valued at approximately $22.05 million, accounting for 0.05% of the circulating supply.

This week, pay attention to the negative effects brought by these token unlocks, avoid spot trading, and seek short opportunities in contracts. Among them, APT's unlock volume and proportion of circulating supply are relatively large, so pay extra attention.

- Hotspot Interpretation: Focus on CPI Inflation Data

The U.S. is about to release significant inflation data tonight. As an important indicator of the price level of consumer goods and services, changes in CPI have far-reaching impacts on investors, consumers, and policymakers, affecting the dollar, gold, U.S. stocks, and the crypto market.

This CPI data is highly anticipated as it is the last major inflation data before the Federal Reserve's final interest rate meeting in 2024. The market generally expects the inflation rate for November to rebound from last month's 2.6% to 2.7%, while core CPI is expected to remain in the range of 3.2% to 3.3%. Recent market performance shows a significant rise in gold prices, reflecting investors' concerns about geopolitical instability and inflationary pressures. Meanwhile, the U.S. stock market has seen declines, with investors maintaining a cautious stance ahead of the inflation data release.

Changes in CPI data have significant implications for the Federal Reserve's monetary policy. If CPI data unexpectedly rises, it may prompt the Fed to pause interest rate cuts earlier or even reverse previous easing policies. This is because high inflation erodes the purchasing power of money, posing threats to economic growth and social stability. Therefore, the Fed needs to closely monitor CPI trends and adjust monetary policy accordingly. Additionally, CPI data has broad implications for the global economy. High inflation may lead to increased import costs, subsequently raising production costs and consumer prices, putting pressure on the global economy. Conversely, if CPI data is stable or below expectations, it may help alleviate market concerns about inflation and boost investor confidence.

CPI data also significantly impacts the crypto market. On one hand, if rising CPI data triggers adjustments in Fed policy, it may lead to a decrease in investor risk appetite, thereby putting pressure on the crypto market. On the other hand, if CPI data meets or falls below expectations, it may boost investor sentiment and drive the crypto market upward. It is important to note that the crypto market is influenced by various factors, including market sentiment, regulatory policies, technological innovations, and its own narrative logic. While we focus on the data, we should also pay attention to the industry itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。