Original Author: Chainalysis

Original Translation: 1912212.eth, Foresight News

The cryptocurrency industry has entered a new stage of maturity, driven by a globally increasing adoption rate, ongoing innovation, and a deeper integration with traditional financial systems.

This year, BTC set new all-time highs in March and December, reflecting tremendous demand. Meanwhile, DeFi's position in the global economy is continuously solidifying, with global capital inflows nearing new highs. Additionally, traditional finance (TradFi) is reactivating, with funds flowing into stablecoins and exchange-traded products (ETPs), indicating that cryptocurrencies are quietly fulfilling their promise to reshape global financial infrastructure.

This is not just another market cycle; it is a pivotal moment for cryptocurrency.

Atypical Bull Market

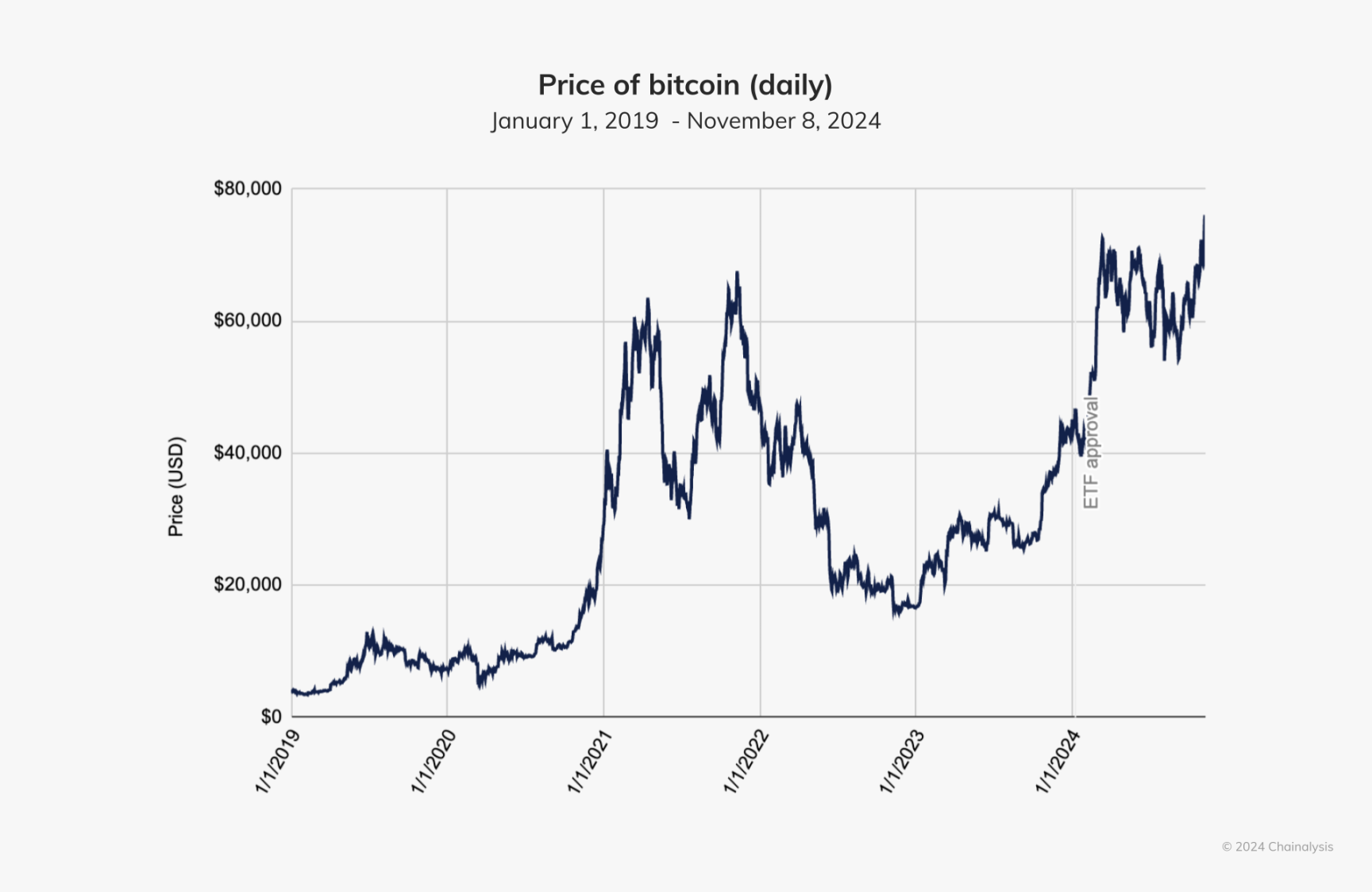

At the end of 2023, BTC began to rise, marking the start of a new upward trend.

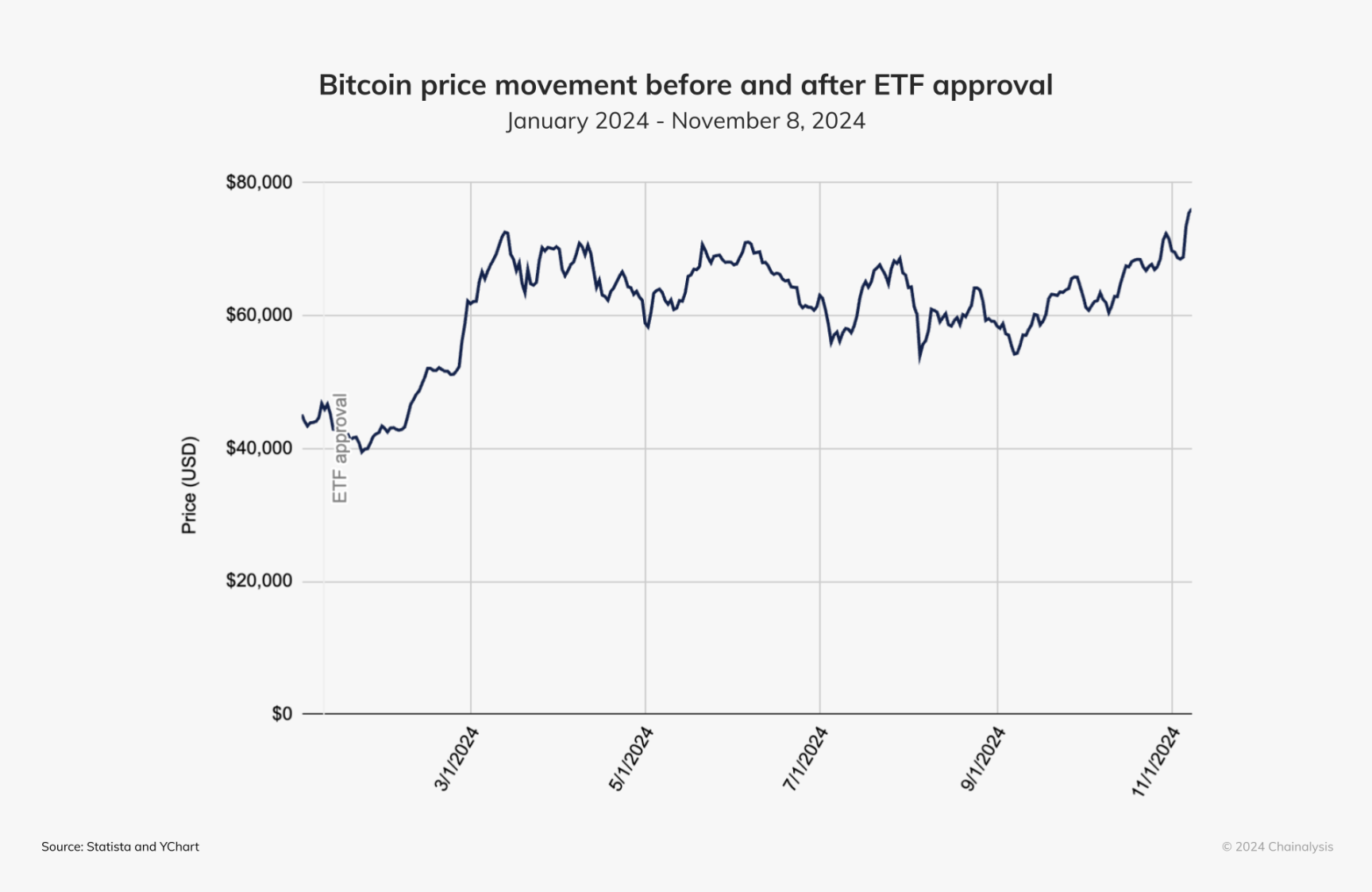

On March 5, 2024, BTC broke through its previous all-time high, rising above $73,000; in December of the same year, it surpassed the $100,000 mark again.

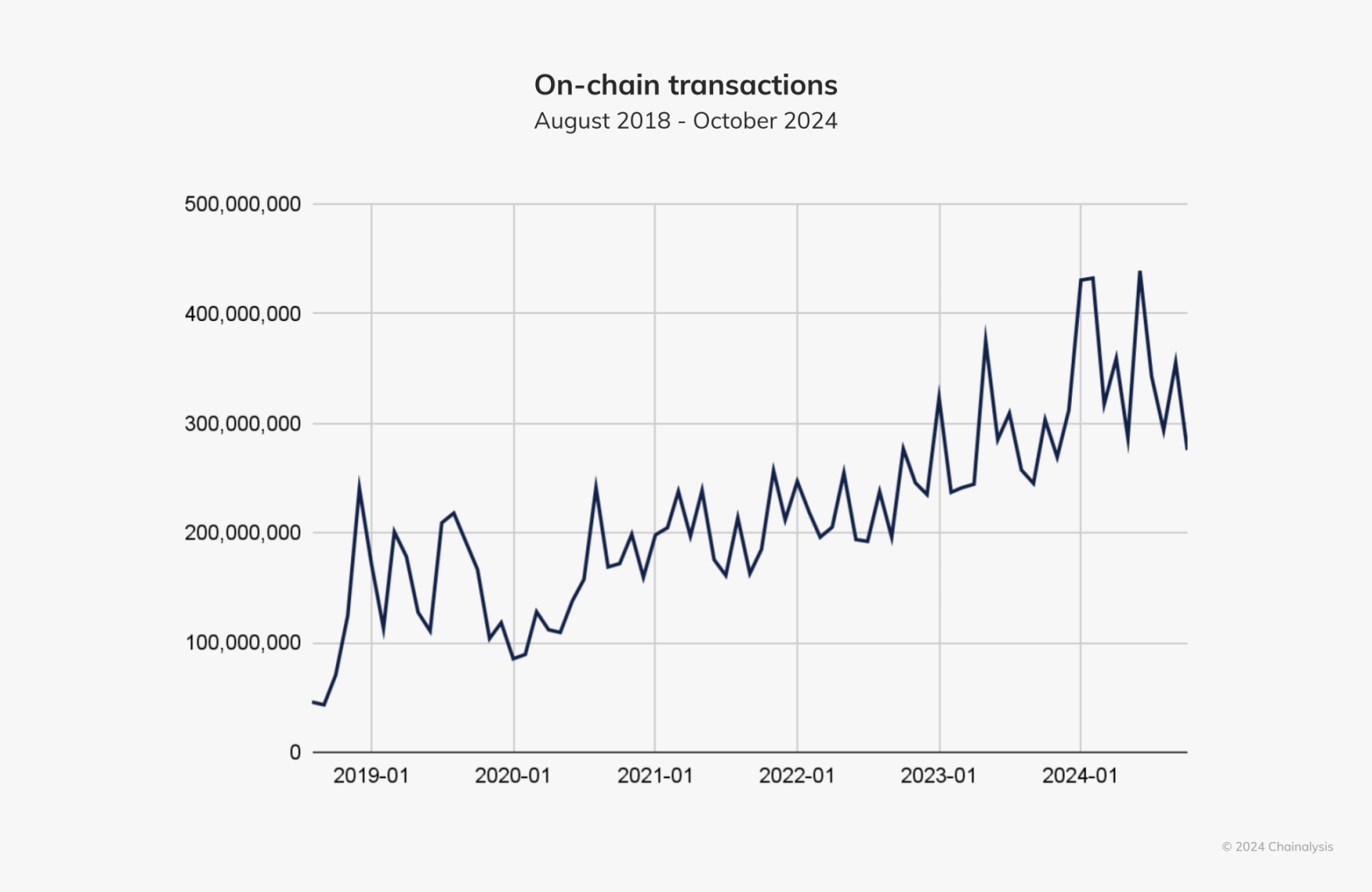

Moreover, the transfer activity of all digital assets has exceeded the historical highs of late 2020 and 2021, indicating that the activity level of this market cycle far exceeds that of the last bull market.

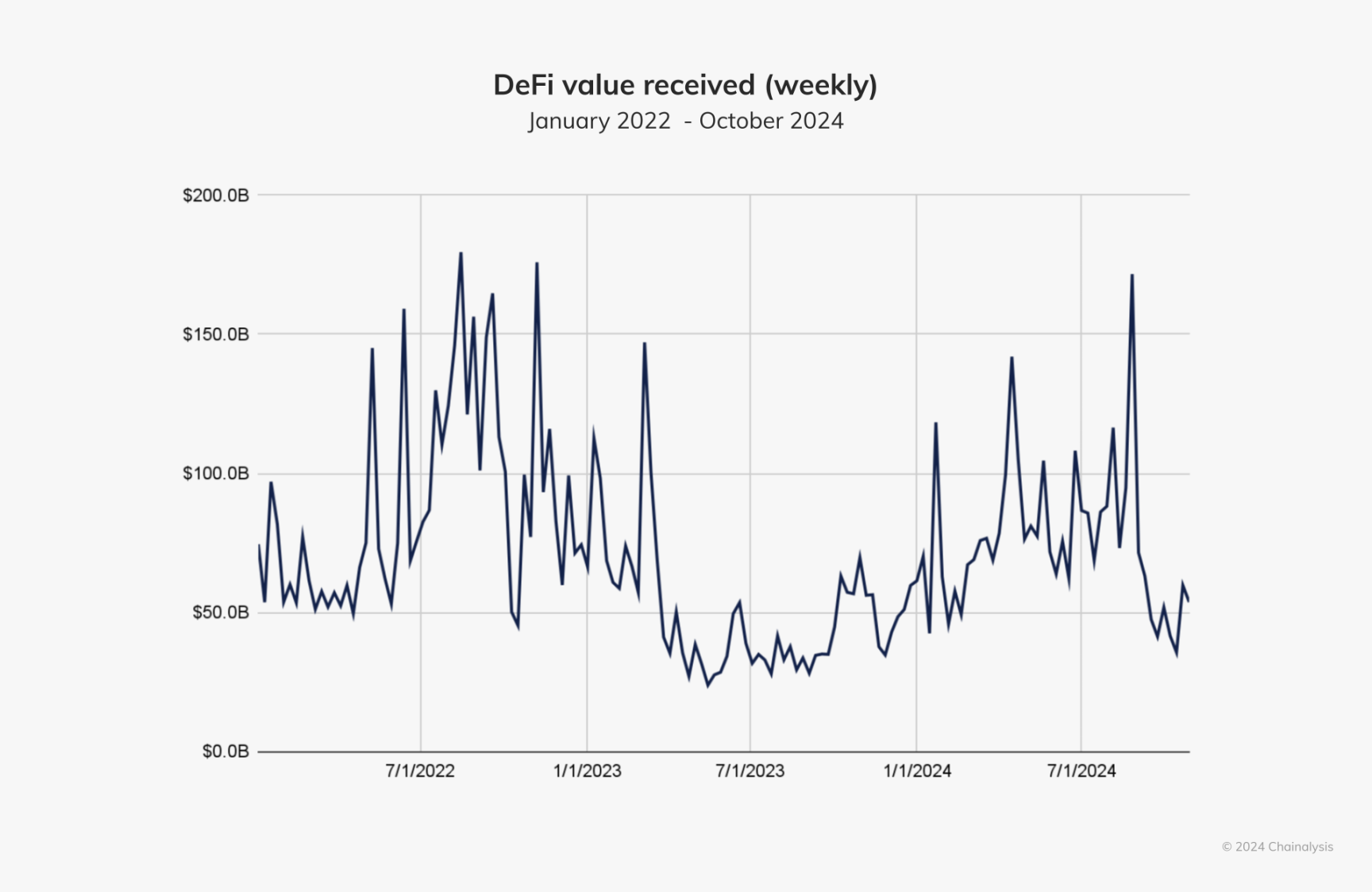

From the end of 2023 to the beginning of 2024, DeFi began to show signs of recovery, with activity levels reaching previous historical highs, as shown below.

Current asset prices and DeFi activity are not the only indicators of market adaptability and resilience—global adoption of stablecoins, explosive interest in traditional finance (TradFi), and the rise of services targeting new application scenarios such as tokenization (as described below) all indicate that cryptocurrencies are being more widely accepted and integrated into the global economy.

Global Usability Drives the Rise of Stablecoins

Stablecoins are typically pegged to the US dollar or other fiat currencies at a 1:1 ratio, combining the efficiency, security, and transparency of cryptocurrencies while avoiding the volatility risks common in other crypto markets.

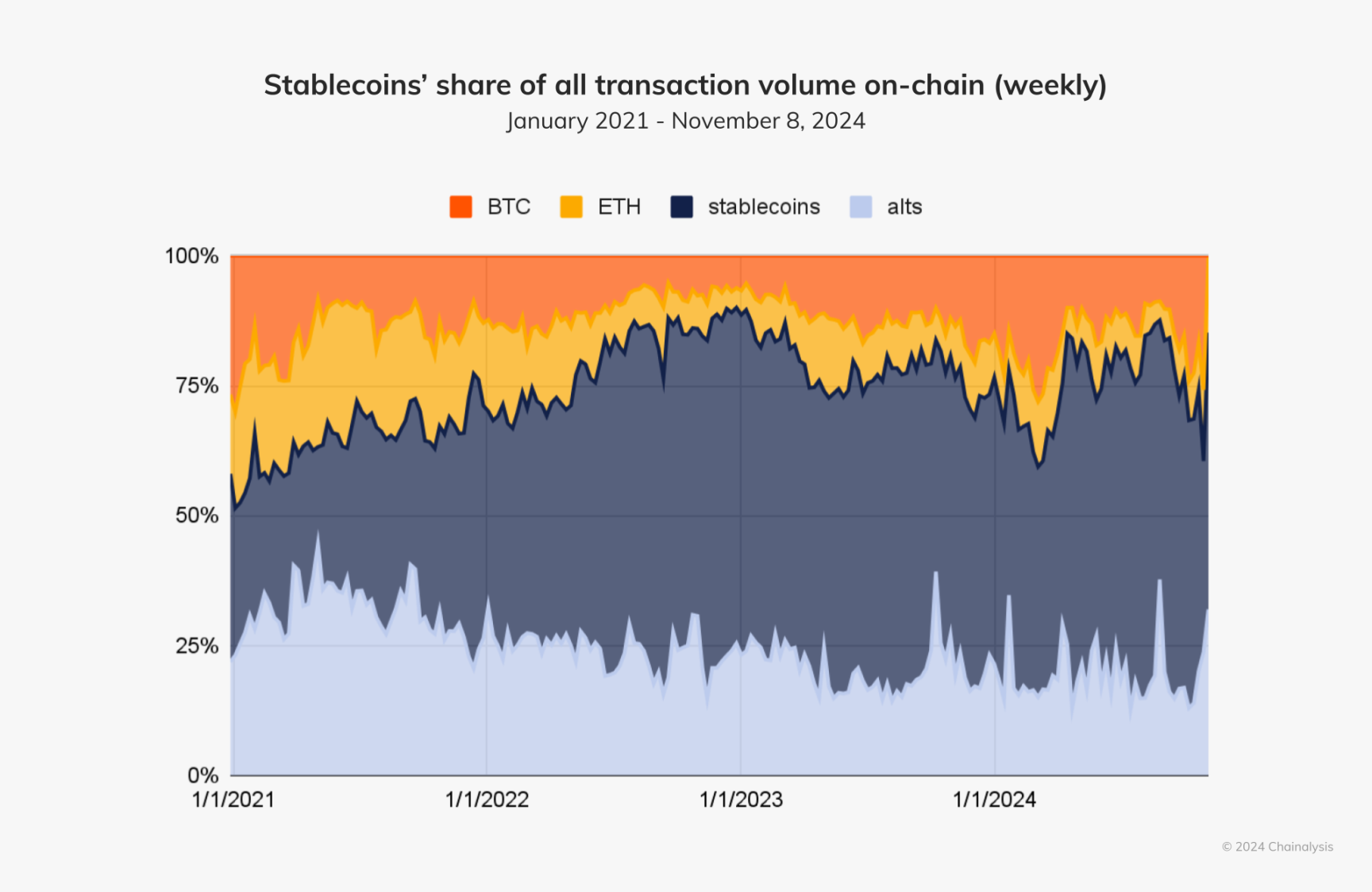

Although major cryptocurrencies like BTC and ETH often make headlines and provide returns that stablecoins cannot match, stablecoins have surpassed other types of cryptocurrencies in terms of adoption rates. In recent months, the on-chain transaction volume of stablecoins has accounted for over half, even reaching 75%.

By providing stability in US dollars to anyone with an internet connection, stablecoins offer a crucial solution for residents of countries facing currency volatility, serving both to protect savings and facilitate business transactions.

The increasingly prominent position of stablecoins in overall trading activity indicates that this asset class has achieved a high level of usability among crypto users.

Bitcoin and Ether ETPs Mark Historic Integration of Cryptocurrency and Traditional Finance

In 2024, traditional finance (TradFi) reached a historic milestone in validating cryptocurrency, with the US market launching spot Bitcoin exchange-traded products (ETPs) further enhancing institutional investor interest. Exchange-traded funds (ETFs)—the most popular form of ETP—have attracted significant interest from both retail and institutional investors.

With the launch of cryptocurrency ETFs, the entire market experienced a surge based on this, as these funds provide regulated mainstream investment tools that can access cryptocurrencies, typically attracting investors who may be hesitant about the complexities and security issues of directly using traditional crypto trading platforms.

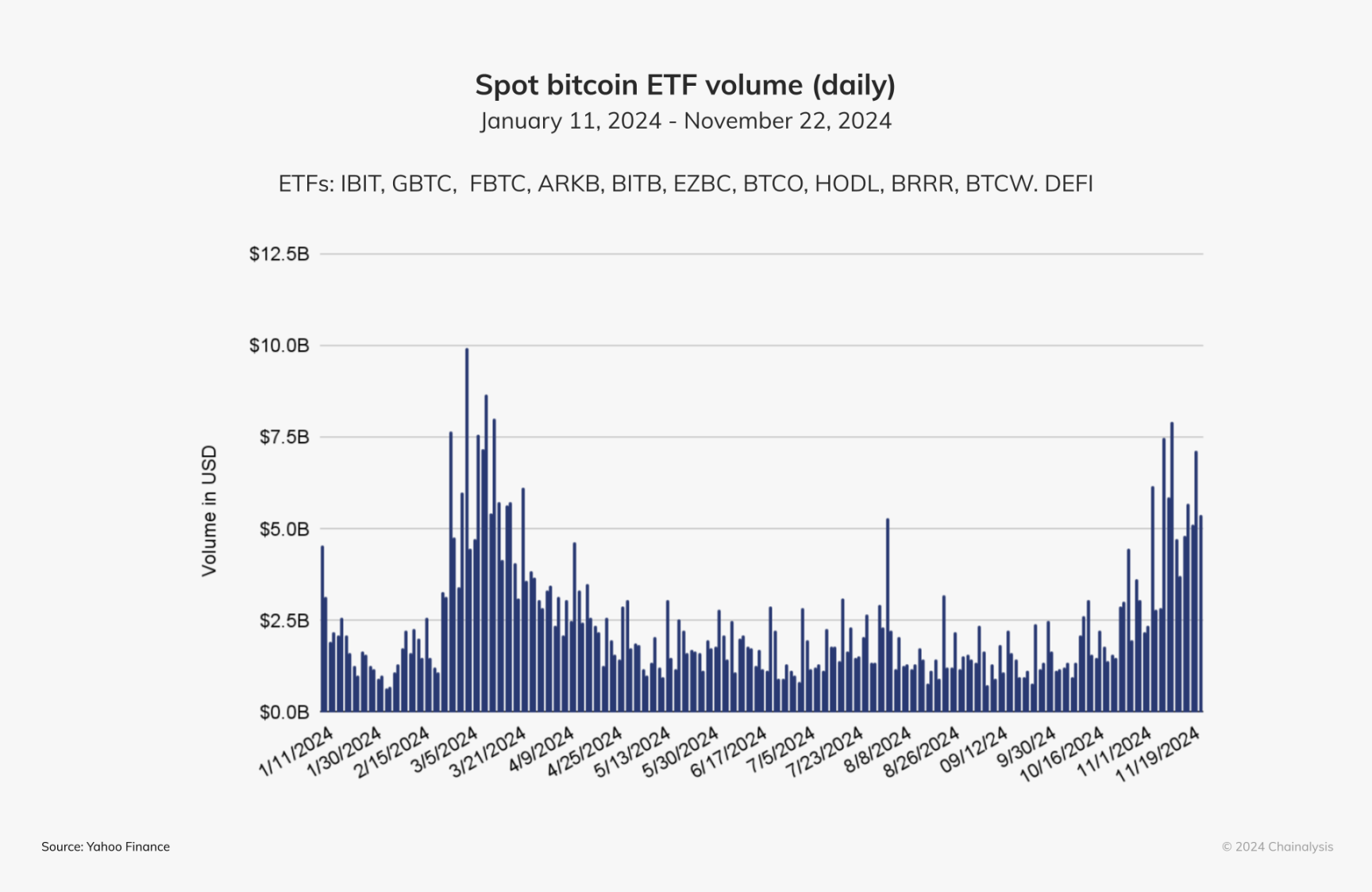

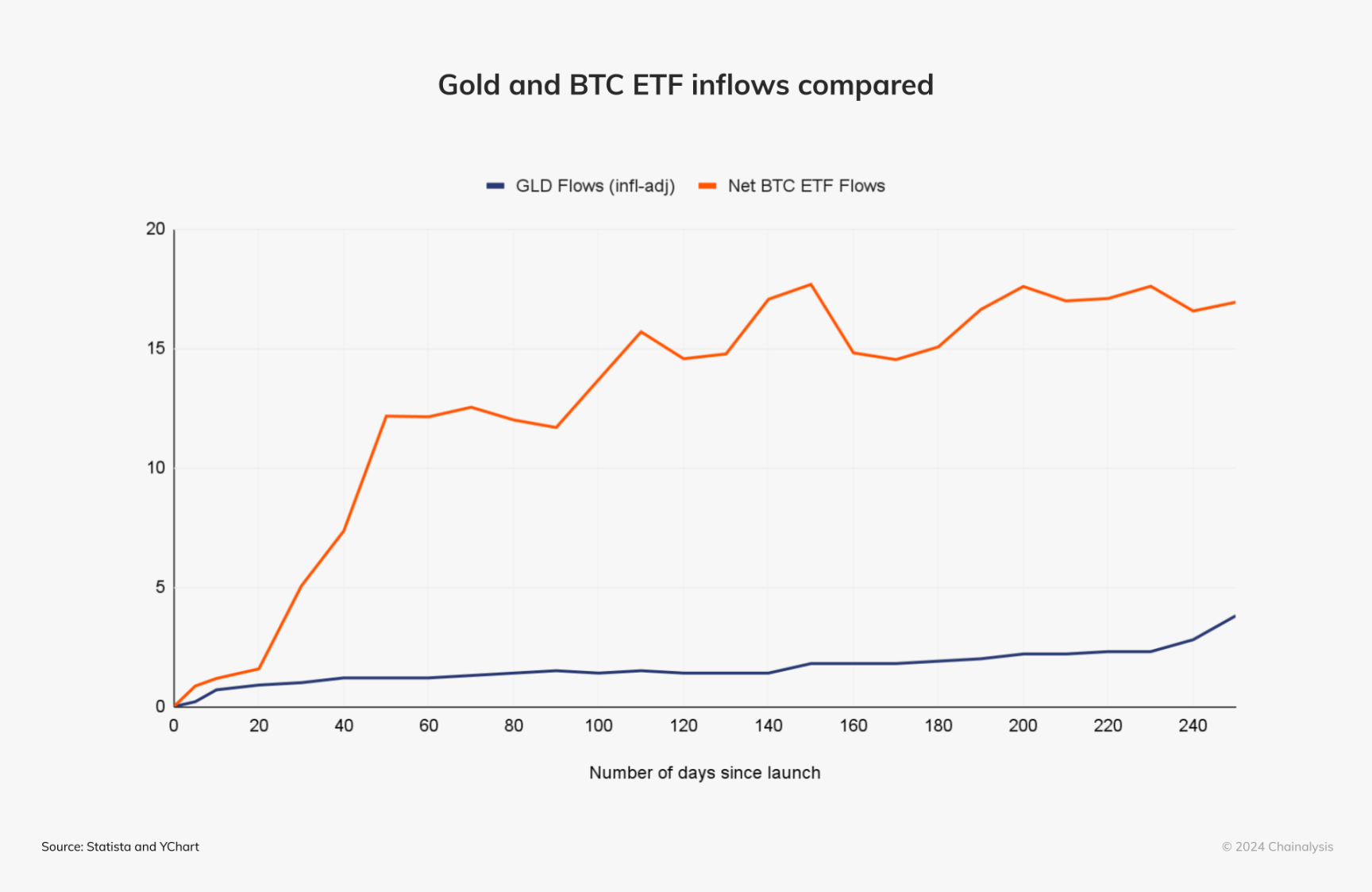

The daily trading volume of Bitcoin ETFs surged, approaching $10 billion per day in March. The inflows into Bitcoin ETFs also surpassed the net inflows of gold ETFs launched in 2005 (adjusted for inflation), as shown in the following chart, making it the fastest-growing ETF in history.

On January 10, 2024, after the news of Bitcoin ETF approval broke, the price of Bitcoin began to rise rapidly and soon started trading.

By providing easier access to cryptocurrencies through traditional trading platforms, ETPs can unlock new sources of demand for the underlying assets, which seems to be one of the key factors driving the recent price increase of Bitcoin (BTC).

While it is difficult to precisely define the specific impact of the launch of Bitcoin ETPs in the US, it is widely believed that it has boosted market optimism and expanded institutional investors' exposure to Bitcoin. The surge in demand reflects the unique appeal of ETPs among retail and institutional investors, providing a regulated and familiar way to access Bitcoin without the complexities of managing private key wallets.

Tokenization: Real World Assets (RWA) are Growing

The excitement surrounding the large-scale tokenization of real-world assets (RWA) is quietly transforming the landscape of asset management and investment, with many traditional finance (TradFi) giants, such as Franklin Templeton, already establishing a foothold in this market. Reports indicate that Goldman Sachs plans to launch a crypto trading platform focused on tokenization in the next 12 to 18 months.

RWA refers to any asset of value—whether tangible or intangible—whose value derives from outside the blockchain. Through tokenization, the rights to these assets (from real estate and artwork to intellectual property) are represented as tokens on the blockchain. This process not only simplifies the sale and trading of these assets but also enhances their accessibility to a broader audience, creating a more efficient and liquid market. RWA also promises to enhance transparency in investment markets, as all transactions are recorded on-chain.

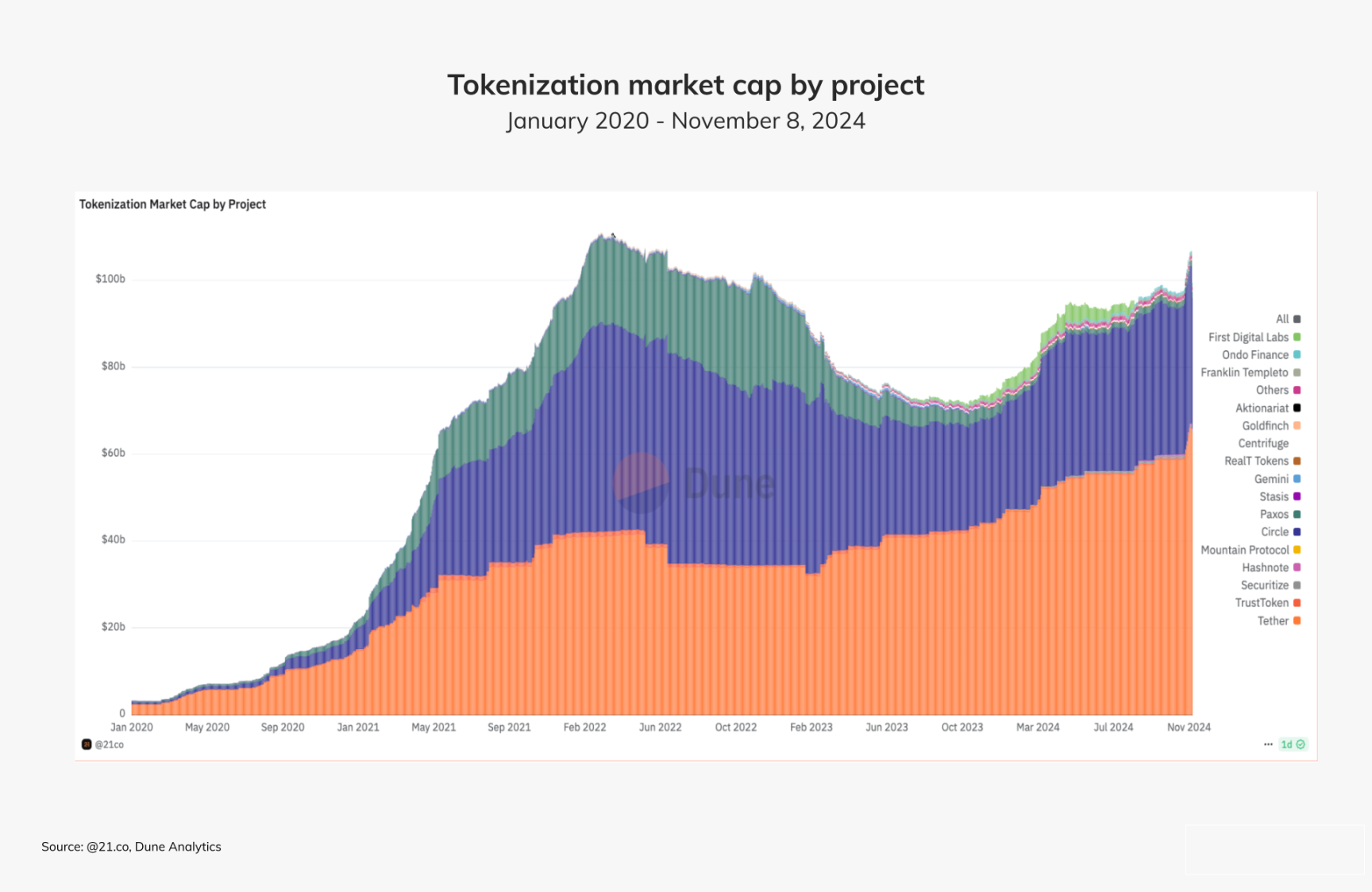

Currently, most RWA projects focus on tokenizing relatively simple and stable financial instruments, such as US Treasury bonds. Lending platforms like Goldfinch and Ondo Finance, which rely on tokenized RWA as their core, have captured a significant share of the RWA market. According to data compiled by asset management firm 21.co, the total market capitalization of tokenized projects has exceeded $100 billion.

Although still in its early stages, the increasingly important position of RWA is a crucial step toward the future, where most value transfers will occur on the blockchain, facilitating a unified, open, and frictionless global market.

What Maturity in the Cryptocurrency Industry May Mean for Organizations

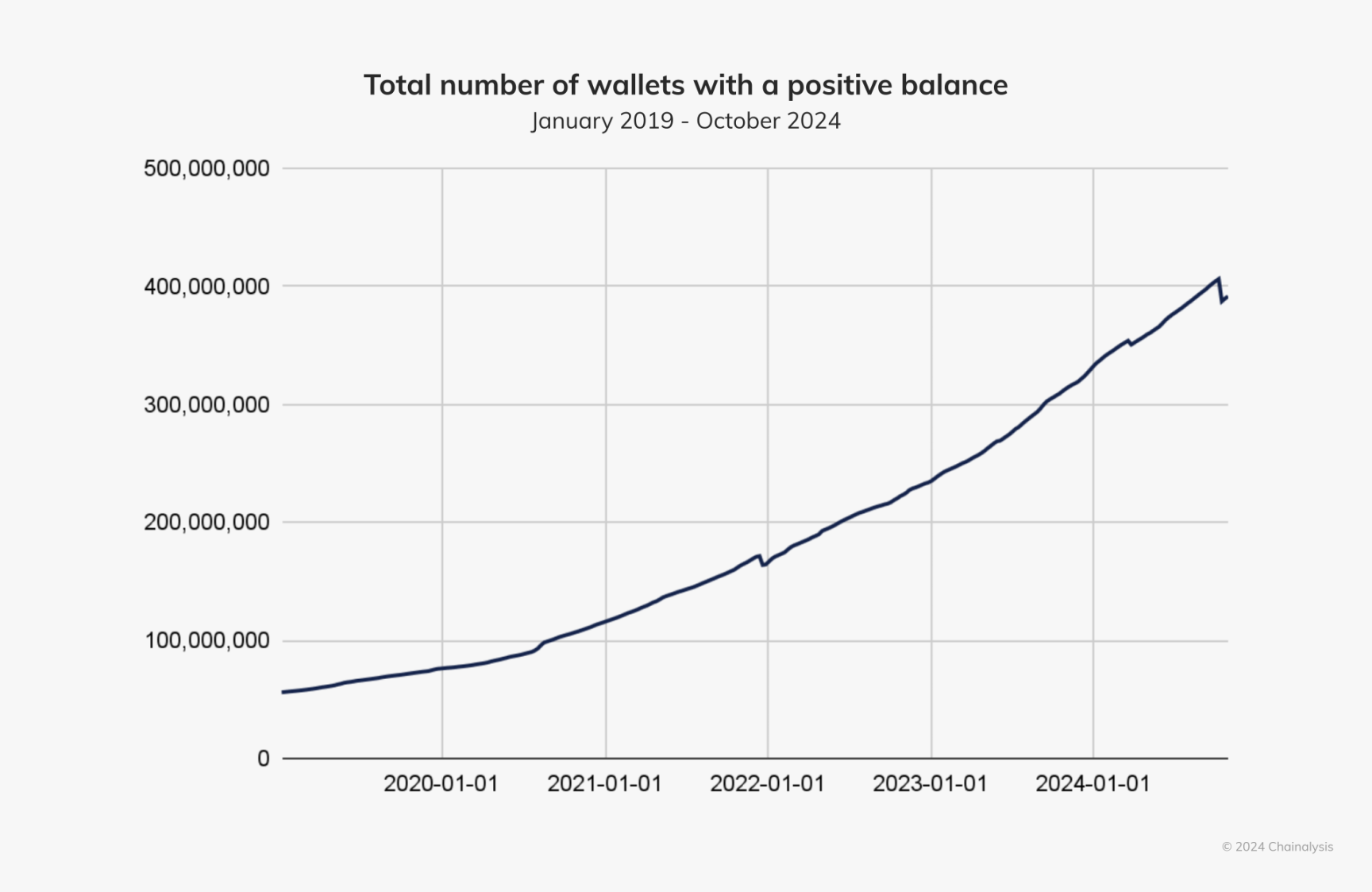

As we examine the progress of the crypto ecosystem, it is evident that we are experiencing a significant shift in perception and usage. While the cryptocurrency market may undergo volatility and prolonged bear cycles, one trend remains consistent: the linear growth of wallets with positive balances, which continues to rise. Currently, over 400 million wallets hold cryptocurrencies.

Although one wallet does not mean only one user, as institutions and individuals can manage multiple wallets, the large number of growing wallets indicates that cryptocurrency adoption is steadily increasing.

As the influence of cryptocurrency continues to expand, it becomes increasingly important to measure the criteria for success in this new paradigm. For organizations, adapting to on-chain realities is not just about keeping pace with technological advancements—it also requires a thorough reassessment of operational models to leverage the unique opportunities presented by blockchain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。