Original Author: BitMEX

Welcome back to our periodic options strategy series. Today, we will share a unique trading opportunity brought about by significant differences in the Bitcoin options market.

Currently, the implied volatility (IV) of Bitcoin call options is soaring, while put options seem undervalued.

In this article, we will analyze this IV skew phenomenon and propose a strategy that could profit from the rise in put option IV. Given the current market's strong bias towards call options, we believe this contrarian strategy could be particularly rewarding!

Let’s start the analysis.

Bitcoin Implied Volatility (IV) Skew Analysis

As shown in the above BitMEX options table for BTC options expiring on January 31, 2025, the IV skew between call and put options is approximately 25%, with call options having significantly higher IV.

This indicates strong demand for call options in the market, reflecting bullish market sentiment or a hedge against upside risk. This significant skew highlights a supply-demand imbalance, making put options relatively cheaper and creating potential opportunities for volatility trading strategies.

Considering a Ratio Put Spread Strategy

If you believe that BTC put options will become more expensive and/or that BTC prices will experience a significant adjustment within the next two months, we suggest considering a ratio put spread strategy.

This trading strategy aims to capitalize on multiple market dynamics:

Profit from the potential rise in IV, particularly in out-of-the-money put options. Due to the skew, these options currently have lower premiums, meaning their value will increase more rapidly during a volatility spike (especially during market sell-offs).

It also provides a smart directional trade with limited downside risk, allowing traders to benefit from any significant drop in BTC below $82,000. To effectively manage risk, this structure includes selling one at-the-money put option, which helps offset the cost of buying two out-of-the-money put options, thereby reducing the net debit and limiting upfront risk.

How to Implement Your Market View

Trading Strategy:

Sell 1 BTC $96,000 at-the-money put option expiring on January 31, 2025.

Buy 2 BTC $90,000 out-of-the-money put options expiring on January 31, 2025.

Scenario and Profit Analysis

This trade can profit in two ways. First, through a spike in IV before expiration—ideally occurring early to minimize the negative impact of time decay (the reduction in option value as expiration approaches). Second, through a significant drop in BTC price, turning our 2 out-of-the-money put options into in-the-money options and generating profit.

Scenario Analysis:

IV Rise: The trade benefits from the rise in IV of put options, particularly the out-of-the-money strike price.

BTC Sharp Decline: A significant downward price movement amplifies the value of the $90,000 put options, while the $96,000 put option offsets costs.

IV Decline: The trade suffers when the IV of put options declines, especially if the out-of-the-money strike price experiences greater IV compression.

BTC Strong Rally: A significant upward price movement would harm the trade as it reduces the value of both put options.

Scenario 1: IV Never Spikes During the Trade

If IV never spikes during the trade, the only way for the strategy to profit is through a significant drop in Bitcoin.

Scenario 2: IV Spike Occurs

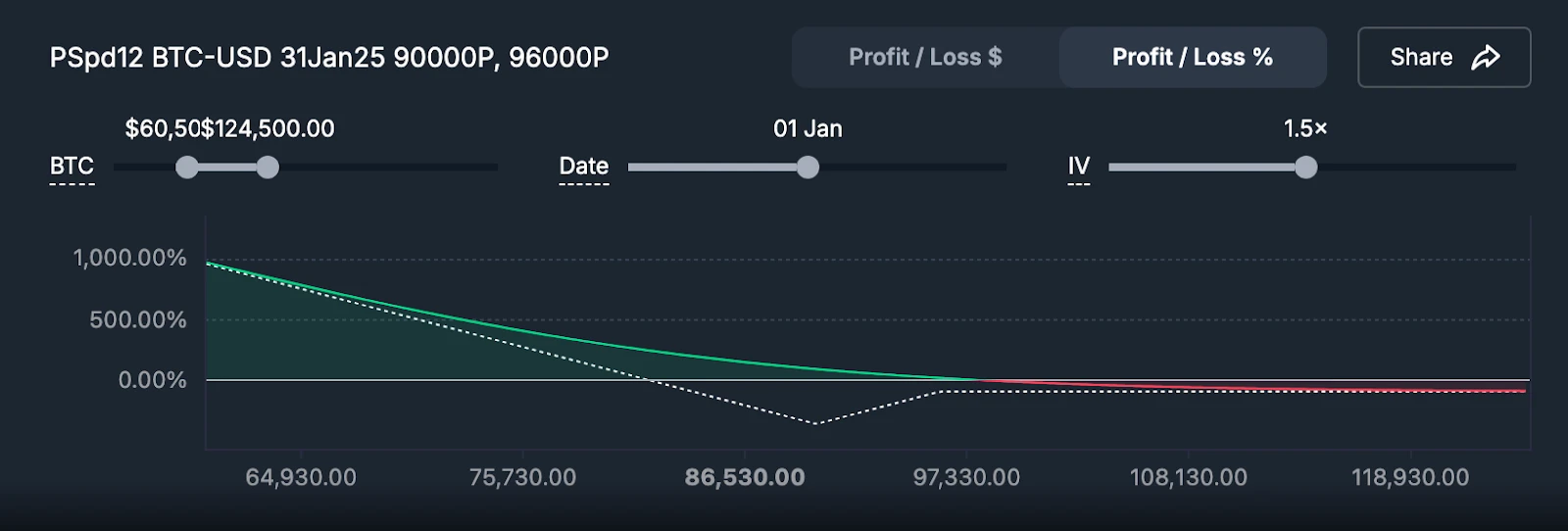

If IV can spike by 50% in the mid-term before the options expire, as long as BTC trades below $97,000 and we can close the position, we can achieve a nice profit. You can use BitMEX's strategy simulator to model the different impacts of time decay and IV spikes on your profits.

Risks and Considerations

1. Maximum Loss:

If Bitcoin's trading price is $90,000 on expiration day, the trade will incur maximum loss.

2. Skew Compression:

If the IV skew narrows (for example, if the IV of out-of-the-money put options declines further relative to at-the-money IV), the trade may lose its edge.

3. Directional Risk:

A moderate decline (for example, $92,000-$93,000) may lead to partial losses, as the loss on the sold at-the-money put option exceeds the gains from the bought out-of-the-money put options.

4. Time Decay:

Time decay is unfavorable for the bought out-of-the-money put options, requiring sufficient IV rise or price movement to overcome this drag.

Summary

This ratio put spread strategy leverages the current IV skew, providing a structured way to profit from rising Bitcoin volatility and potential declines. It is an attractive strategy for traders expecting increased uncertainty or bearish price movements while wanting to limit upfront costs and downside risk. However, to optimize profitability and reduce risk, close monitoring of IV and price movements is essential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。